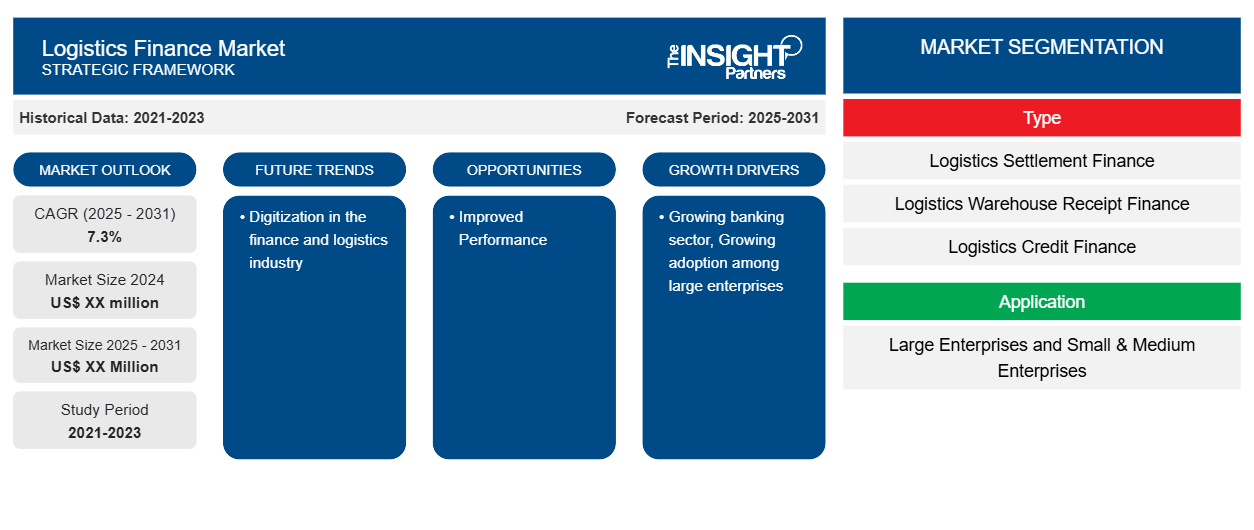

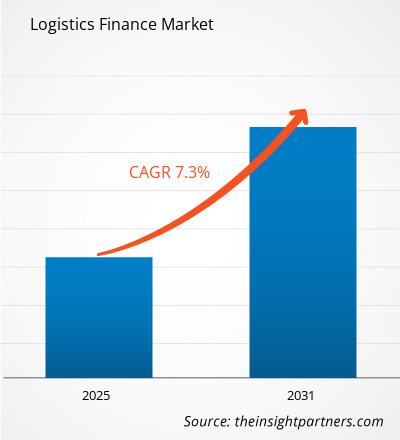

The logistics finance market is expected to expand at a CAGR of 7.3% from 2025 to 2031. Digitization in the finance and logistics industry is likely to be a key trend in the market.

Logistics Finance Market Analysis

In the context of rapid social growth, a logistics financial model that can meet the financing demands of small and medium-sized businesses while also providing high profits is widely adopted in all parts of the logistics finance industry. Logistics finance is a novel financing model that may successfully integrate logistics enterprises, financial organizations, and financing institutions for mutual gain. The ambiguity of financial information and the motivation of each business service object to chase high profits in a short period has led to credit risks in the development of logistical and financial services.

Logistics Finance Market Industry Overview

Historically, finance and logistics have been two different and independent functions. While logistics wants to keep inventory in order to better serve consumers, finance wants to free up capital that has become stranded in inventory. Logistics financing is the transfer of goods and monies to consumers by third-party logistics providers and financial institutions as part of the supply chain management process in order to perform financial transactions. There are many different forms of logistics to suit the demands of those sending and receiving goods, as well as the type of goods.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Logistics Finance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Logistics Finance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Logistics Finance Market Driver and Opportunities

Increasing Adoption Among Large Enterprises to Favor Market Growth

Finance can provide valuable advice on how to reduce logistics costs and make the supply chain more cost-effective, demonstrating how finance and logistics complement one another. Significant cost savings can also be gained through appropriately designed financial flows throughout the chain. All of these factors are expected to drive the adoption of financial logistics among large firms during the forecast period.

Improved Performance

A mutual understanding between the financial manager and the supply chain manager can lead to better performance in both roles. The position of the finance professional is evolving from bookkeeper to strategic collaborator with supply chain managers. With finance logistics, the finance team may be of tremendous assistance during the budgeting process, advising on how to use input data and validate it before producing a future budget. Thus, demand for finance logistics for better performance in banking and financial institutions is likely to provide profitable growth prospects during the forecast period.

Logistics Finance Market Report Segmentation Analysis

The key segments that contributed to the derivation of the logistics finance market analysis are type and applications.

- By type, the market is segmented into logistics settlement finance, logistics warehouse receipt finance, and logistics credit finance.

- By application, the market is segmented into large enterprises and small & medium enterprises.

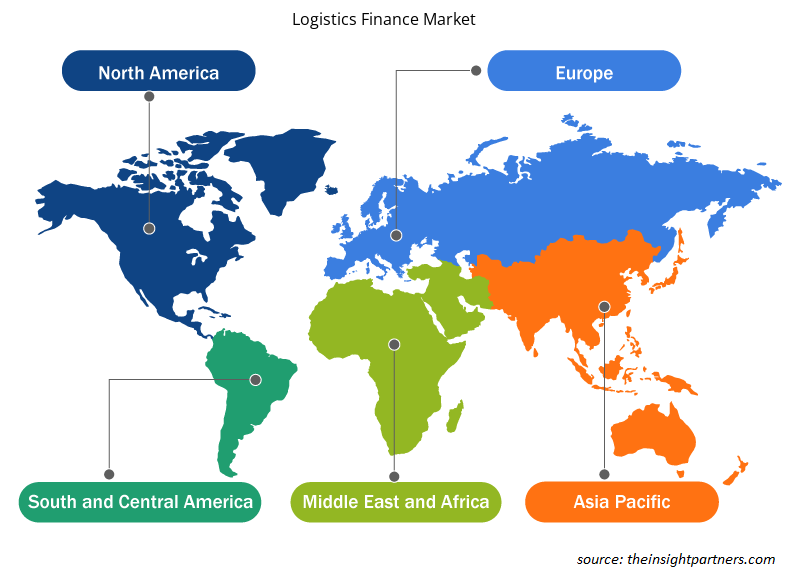

Logistics Finance Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

North America is predicted to have a considerable market share in 2023. This rise might be ascribed to early acceptance of innovative services and the presence of a large number of market players. Furthermore, the Asia-Pacific region is predicted to develop at the fastest CAGR over the projection period. This development may be due to the increasing digitization in the banking and insurance sectors.

Logistics Finance Market Regional Insights

The regional trends and factors influencing the Logistics Finance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Logistics Finance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Logistics Finance Market

Logistics Finance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

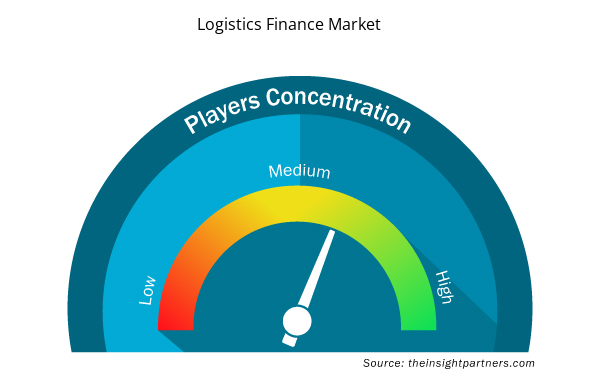

Logistics Finance Market Players Density: Understanding Its Impact on Business Dynamics

The Logistics Finance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Logistics Finance Market are:

- ExlService Holdings, Inc.

- Minions Ventures Pvt Ltd

- Clear Business Finance

- KredX

- PrimaDollar

- Alliance Funding Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Logistics Finance Market top key players overview

Logistics Finance Market Report Coverage & Deliverables

The logistics finance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Logistics Finance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- logistics finance market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- logistics finance market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- logistics finance market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the logistics finance market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are additional 3–5 company profiles and a country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

ExlService Holdings, Inc., Minions Ventures Pvt Ltd, Clear Business Finance, KredX, PrimaDollar, Alliance Funding Group, ProConnect Supply Chain Solutions, and Portman Finance Group are the major market players.

Digitization in the finance and logistics industry is one of the major trends in the market.

The global logistics finance market was estimated to grow at a CAGR of 7.3% during 2023 - 2031.

The growing banking sector and growing adoption among large enterprises are the major factors that drive the global logistics finance market.

Get Free Sample For

Get Free Sample For