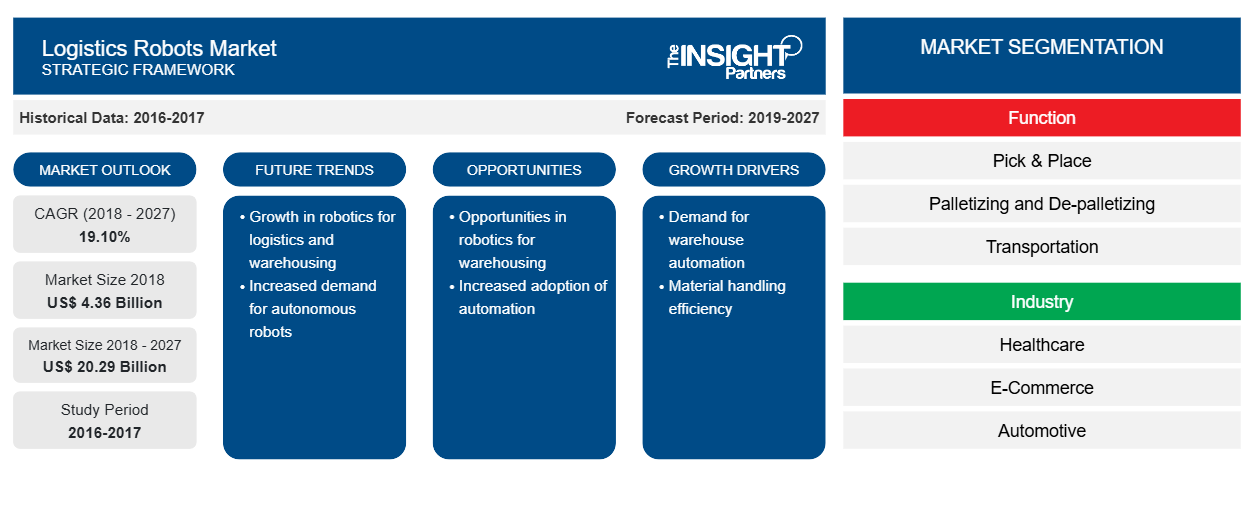

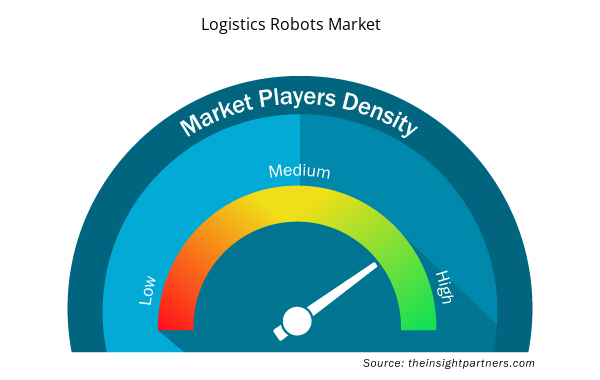

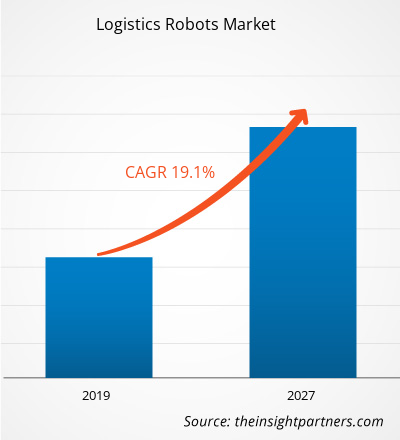

The logistics robots market was valued at US$ 4,356.2 million in 2018 and is expected to grow at a CAGR of 19.10% from 2019 to 2027 to reach US$ 20,293.4 million by 2027.

The increase in the number of logistics and warehousing companies that are robustly focusing on incorporating robots to gain the benefits of enhanced efficiency, speed, and augmented profits to remain competitive in a market. The adoption of advanced technology such as robotic warehousing and logistics technologies are growing in order to enhance the operation efficiency at affordable price. The global logistics robots market is driven by factors such as a growing percentage of aging population globally leading towards labour shortage and augmenting supply chain networks globally, but high capital investment for the deployment of logistics robots is anticipated to restrain the market growth of the logistics robots market during the forecast period. However, rising warehouse automation and well-established market in APAC and European countries are likely to deliver substantial growth opportunities to improve market share for industry players in the near future.

Market Insights

Growing Percentage of Aging Population Globally Leading towards Labour Shortage

The growing percentage of aging population across the globe is one of the major factor for the reduction of labors across various industries. Each country across the world is witnessing an upsurge in the number of elderly people in their community. Population aging has become one of the substantial factor for the social transformations in the 21st century across all sectors, which embraces labor as well as financial markets. Though, various countries such as Italy, Japan, and many more are the countries which listed the maximum number of the aging population proportion, by considering a substantial percentage of their population over 65 years. According to WHO, ~ 2 Mn people around the world are expected to be above 60 years old by the year 2050, which is accounted for the triple of what it was in 2000. The upsurge in the number of aging population accounted for the labor shortage. The implementation of logistics robot across several industries plays an important role, as it reduces the overall cost of the process, increasing productivity, enhancing safety, and reduce human error. The rapid technology advancements across warehouse globally, is focusing on the requirement related to the difficulties faced by supply chain process and assuring that the technology used associated with the business objectives. The implementation of robots across different units, functions, and stages in product lifecycles have been a key challenge faced by warehouses today on their growth path, which would, in turn, boost the logistics robots market in the near future.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Logistics Robots Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Logistics Robots Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Robot Type Insights

The collaborative mobile robots segment captured the largest share in the global logistics robots market. They are being deployed across various industries for performing a number of tasks such as packaging, machine tending, and material handling, as these cobots are proficient enough to handle heavy-duty as well as light operations. They are highly accurate, flexible, and precise. Further, cobots are easy to maintain and are more accessible to reconfigure and reprogram. These robots can also handle sensitive work; moreover, they adjust themselves according to the inconsistencies occurring during manufacturing processes. Cobots are capable of gathering critical metrics for providing onboard analysis, along with reports, to simplify the decision-making process drives the overall logistics robots market.

Function Insights

The transportation segment captured the largest share in the global logistics robots market. the goods are palletized, and there is a slight variation in several product shapes and sizes, which has required the automation for loading and unloading of these goods. The 3D laser vision is integrated with the new robotic software, which aids users with a visibility of different products in containers, determine the ideal loading/unloading sequence, and carry out the process with a high accuracy. Logistic robotics is employed for moving target rack, draw and lift up basket, stretch the fork on shelf, and return the target position drives the overall logistics robots market.

Industry Insights

The outsourced logistics segment captured the largest share in the global logistics robots market. These logistics service providers are offering various services, which include warehousing, inventory management, transportation, distribution, order fulfillment, and freight consolidation. The ever-increasing demand for timely delivery management as well as shipping cost reduction, enhancing the focus on keeping the record of material in stock, and core business & reduction on the company’s assets that is anticipated to drive the market for logistics robots during the forecast period.

Several market initiative strategy is commonly adopted by companies to expand their footprint worldwide and meet the growing demand. This strategy is mostly observed in Europe and APAC. The players present in the logistics robots market adopt the strategy of expansion and investment in research and development to enlarge customer base across the world, which also permits the players to maintain their brand name globally.

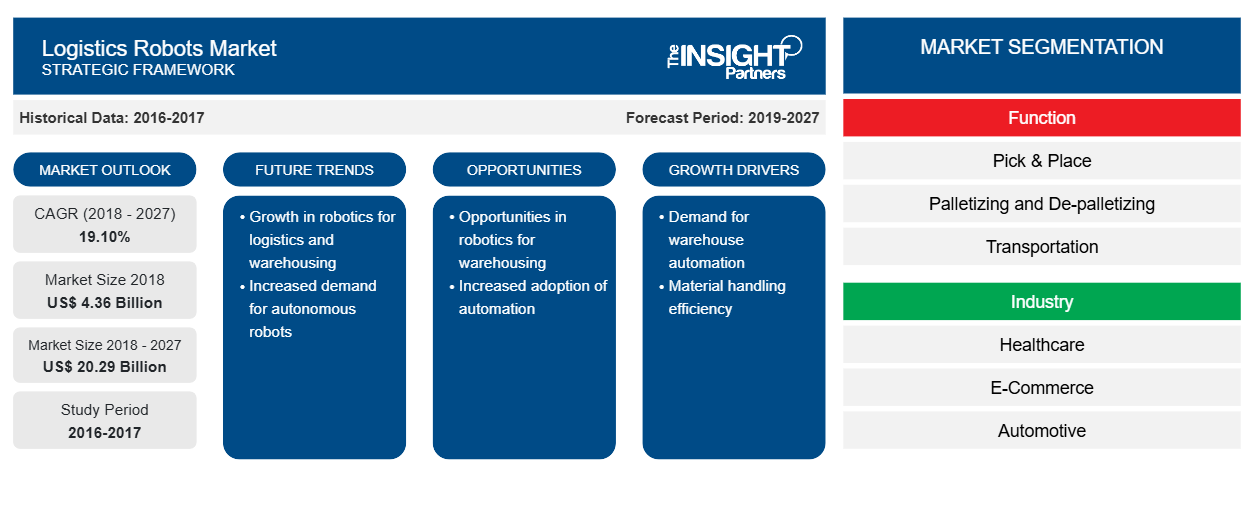

Logistics Robots Market Regional Insights

The regional trends and factors influencing the Logistics Robots Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Logistics Robots Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Logistics Robots Market

Logistics Robots Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 4.36 Billion |

| Market Size by 2027 | US$ 20.29 Billion |

| Global CAGR (2018 - 2027) | 19.10% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Function

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Logistics Robots Market Players Density: Understanding Its Impact on Business Dynamics

The Logistics Robots Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Logistics Robots Market are:

- AGV International

- Clearpath Robotics

- Daifuku Co. Ltd.

- Fanuc Corporation

- Fetch Robotics Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Logistics Robots Market top key players overview

Logistics Robots Market – By Robot Type

- Robotic Arm

- AGV

- Collaborative Mobile Robots

- Others

Logistics Robots Market – By Function

- Pick & Place

- Palletizing and De-palletizing

- Transportation

- Packaging

Logistics Robots Market – By Industry

- Healthcare

- E-Commerce

- Automotive

- Outsource Logistics

- Retail

- Consumer Goods

- Food and Beverages

- Others

Logistics Robots Market – By Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific

- China

- India

- South Korea

- Japan

- Australia

- Rest of Asia Pacific

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

South America

- Brazil

- Argentina

- Rest of South America

Company Profiles

- AGV International

- Clearpath Robotics

- Daifuku Co. Ltd.

- Fanuc Corporation

- Fetch Robotics Inc.

- Kion Group AG

- KNAPP AG

- Kollmorgen

- KUKA AG

- Toshiba Corporation

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Function ; Industry ; Robot Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Automated guided vehicles (AGVs) are used for consistent as well as predicted transport of materials. AGVs might be serviced through conveyors, forklift trucks, or manual cart transport systems. The transport of bulk materials using AGVs helps minimize efforts required in repetitive transportation of small chunks of materials, with less human intervention. Apart from distribution and manufacturing, AGVs have also become an integral part of other industries, including retail, military, food & beverages, automotive, and healthcare. The deployment of AGVs benefits businesses by reducing the cost of labor required in manual execution of tasks; enhancing safety, accuracy, and productivity of products; and improving the efficiency of work when integrated with the warehouse management/control systems. Improved work efficiencies further helps streamline other processes, such as materials ordering and inventory management.

With the increasing importance of equipment in logistic markets in APAC, especially China and India, robot manufacturers realize that electronics innovations can complement production innovations in gaining a competitive advantage. Japan is a well-developed economy and is one of the most technologically advanced economies across the world. Also, the region has a few significant manufacturers of robots and factory automation systems such as Fanuc, Mitsubishi Electric, and Omron Corp, among others. The Japanese companies widely use automation solutions to maintain their competitive position in the market.

The continuous growth in consumer expectations is likely to drive continued investment for the adoption of logistics robots for performing operational functions in warehouses. Leveraging the modern supply chain technology as well as the Internet of Things (IoT), the focus on the “smart warehouse†concept is growing, which can serve as a hub to enhance the efficiency and speed of the entire supply chain process. The warehouse automation includes wearable wore by workers to sensors, logistics robots, internet-enabled devices, and smart equipment, which profoundly modify the logistics management. Warehouse management is constantly facing more pressures related to supply chain transformation, commoditization, and rising customer expectations. Therefore, the warehouse automation concept is an effective way to enhance efficiencies, reduce operational costs, and scale operations. The warehouse automation performs various activities such as data collection and inventory control, with million-dollar of investments.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Logistics Robots Market

- AGV International

- Clearpath Robotics

- Daifuku Co. Ltd.

- Fanuc Corporation

- Fetch Robotics Inc

- KION GROUP AG

- KNAPP AG

- Kollmorgen

- Kuka AG

- Toshiba Corporation

Get Free Sample For

Get Free Sample For