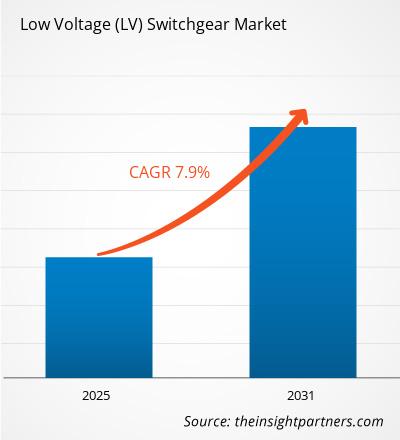

The Low Voltage (LV) Switchgear Market size is projected to reach US$ 87.88 billion by 2031 from US$ 47.83 billion in 2023. The market is expected to register a CAGR of 7.9% during 2023–2031. The rising adoption of renewable energy is likely to remain a key trend in the market.

Low Voltage (LV) Switchgear Market Analysis

- The low voltage switchgear market has witnessed significant growth in recent years, driven by the evolution of Industry 4.0 and growing investment in smart city projects. Aging electricity distribution infrastructure is the primary driving factor behind the growth of the low voltage switchgear market worldwide.

- Aging infrastructure is prone to hazardous breakdowns, which need new switchgear to ensure the reliability of power supply by reducing disruptions and downtime in operations. The increasing burden on electrical infrastructure creates the need for either refurbishment or replacement of electrical equipment to ensure uninterrupted power supply within the operating area.

- As per the Department of Energy Report, the US is replacing its existing grid infrastructure with a highly modern and automated grid, which provides an opportunity for the utility sector to develop automation-equipped low voltage switchgear that allows remote monitoring, real-time status checks and provide immediate response to issues in the operations. The development of existing infrastructure is driving the market.

Low Voltage (LV) Switchgear Market Overview

- Low voltage (LV) switchgear is a three-phase power distribution equipment designed to safely, reliably, and efficiently supply electric power. It is typically used for circuit protection and power distribution in the low voltage system. This switchgear is commonly used in residential, commercial, and industrial sectors for protecting ma circuits from short circuits and overloads. The demand for low voltage switchgear has rapidly increased in recent years due to rising expenditure in infrastructural expansion.

- Increasing complexities in the grid infrastructure in developing countries raise the deployment of low voltage switchgear in the distribution grid. Moreover, the energy generation mix is undergoing a drastic transformation due to rapid digitalization, diverse electrification programs, smart grid infrastructure, and increasing use of renewable energy sources, driving the market during the forecast period.

- Additionally, low voltage switchgear is already used in numerous smart grid projects, energy generation, and improving safety in power infrastructure and plants worldwide.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Low Voltage (LV) Switchgear Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Low Voltage (LV) Switchgear Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Low Voltage (LV) Switchgear Market Drivers and Opportunities

The Evolution of Industry 4.0

- Low voltage switchgear is crucial for the smart factory and Industry 4.0 for enabling smart manufacturing, advanced automation, and data-driven decision-making activities. The switchgear is essential for power distribution in various components in the smart factory, including motors, control systems, sensors, and machines.

- The switchgear allows precise operations, motor control, and manufacturing processes by starting, stopping, and regulating motor speed. The growth in the smart manufacturing process is driving the market. Switchgear is a primary component of Industry 4.0 and smart manufacturing. It offers the necessary infrastructure to ensure efficient power distribution and automation within modern industrial facilities.

Growing Investment in Smart City Projects

- Rising investment in smart city projects and growing city management initiatives further boost the market growth. For instance, in May 2022, the European Commission announced the participation of 100 climate-neutral and smart cities in the Cities Mission by 2031. The Cities Mission will receive funding of US$378.2 million to start research and innovation paths towards climate neutrality by 2031. These research and innovation actions will address clean mobility, green urban planning, and energy efficiency and offer the possibility of collaborations in synergies with other EU programs.

- Several smart city projects are currently ongoing or being launched to expand the digitalization of cities and urban development through information and communication technologies. Geospatial data is the foundation of urban development planning in smart city projects. It includes accurate, reliable, remote monitoring, safety, and efficient energy distribution within the urban areas. Smart city infrastructure is highly reliable on uninterrupted power supply, increasing the demand for low voltage switchgear to prevent downtime.

- For instance, in October 2022, Azerbaijan’s President Ilham Aliyev partnered with EKM Global Consulting GMBH for digital infrastructure smart solutions to transform into a smart country. The country’s smart city project aims to adopt efficient switchgear for reducing energy consumption and greenhouse gas emissions. Growing urbanization shifts the government's focus to support smart ways of managing complexity, increasing efficiency, analyzing & integrating infrastructure, and improving standards of living in the country.

Low Voltage (LV) Switchgear Market Report Segmentation Analysis

The key segments that contributed to the derivation of the Low Voltage (LV) Switchgear Market analysis are protection, product, rated current, voltage rating, current, installation, application, and end-users.

- Based on protection, the Low Voltage (LV) Switchgear Market is divided into circuit breakers and fuse. The circuit breakers segment is further divided into ACB, MCCB, МСВ, MSP, and МРСВ.

- On the basis of product, the market is divided into fixed mounting, plug-in, and withdrawable unit.

- Based on rated current, the market is divided into ≤1000 ampere, >1000 ampere to ≤5000 ampere, and >5000 ampere.

- On the basis of voltage rating, the market is divided into ≤250 volts, >250 volts to ≤750 volts, and >750 volts.

- Based on current, the market is divided into AC and DC.

- On the basis of installation, the market is divided into indoor and outdoor.

- Based on application, the market is divided into substation, distribution, power factor correction, sub distribution, motor control, and others.

- Based on end-users, the market is divided into residential, commercial, and industrial.

Low Voltage (LV) Switchgear Market Share Analysis by Geography

- The Low Voltage (LV) Switchgear Market report comprises a detailed analysis of five major geographic regions, which includes current and historical market size and forecasts for 2021 to 2031, covering North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South & Central America.

- Each region is further sub-segmented into respective countries. This report provides analysis and forecasts of 18+ countries, covering Low Voltage (LV) Switchgear Market dynamics such as drivers, trends, and opportunities that are impacting the markets at the regional level.

- Also, the report covers PEST analysis, which involves the study of major factors that influence the Low Voltage (LV) Switchgear Market in these regions.

Low Voltage (LV) Switchgear Market Regional Insights

The regional trends and factors influencing the Low Voltage (LV) Switchgear Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Low Voltage (LV) Switchgear Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Low Voltage (LV) Switchgear Market

Low Voltage (LV) Switchgear Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 51.61 Billion |

| Market Size by 2031 | US$ 87.88 Billion |

| Global CAGR (2025 - 2031) | 7.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Protection

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

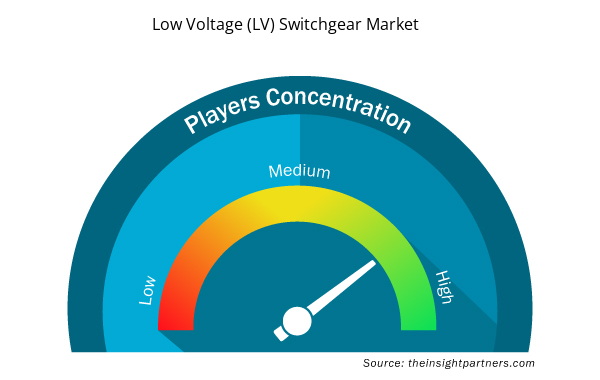

Low Voltage (LV) Switchgear Market Players Density: Understanding Its Impact on Business Dynamics

The Low Voltage (LV) Switchgear Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Low Voltage (LV) Switchgear Market are:

- Siemens AG

- ABB Ltd

- General Electric Co

- Hitachi Ltd

- Eaton Corp Plc

- Powell Industries, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Low Voltage (LV) Switchgear Market top key players overview

Low Voltage (LV) Switchgear Market News and Recent Developments

The Low Voltage (LV) Switchgear Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Low Voltage (LV) Switchgear Market are listed below:

- ABB, a global leader in energy efficiency and technology, has launched its game-changing newest product, SEN Plus switchgear, in Riyadh, Saudi Arabia. The event engaged an audience of End-users, contractors, panel builders, and consultants, plus featured dedicated technical presentations highlighting ABB low voltage platform offerings for dedicated segments. (Source: ABB, Company Website, December 2023)

- UK Power Networks, which provides power to 8.3 million homes and businesses, has commissioned ABB to supply the world’s first 36 kV medium-voltage double busbar AirPlus Gas Insulated Switchgear (GIS). It features AirPlus gas, which acts as an insulator between the electrical contacts with almost zero global warming impact. As part of its Environmental Action Plan to pass on a sustainable planet for future generations, the UK’s biggest electricity distributor, UK Power Networks, has announced plans to use AirPlus, ABB’s innovative sustainable alternative to SF6 switchgear, at its substation in Kent. (Source: ABB, Company Website, January 2022).

Low Voltage (LV) Switchgear Market Report Coverage and Deliverables

The “Low Voltage (LV) Switchgear Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Low Voltage (LV) Switchgear Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Low Voltage (LV) Switchgear Market trends as well as market dynamics such as drivers, restraints, and key opportunities.

- Detailed PEST/Porter’s Five Forces and SWOT analysis.

- Low Voltage (LV) Switchgear Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Low Voltage (LV) Switchgear Market.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global Low Voltage (LV) Switchgear Market is expected to grow at a CAGR of 7.9% during the forecast period 2023 - 2031.

The evolution of Industry 4.0 is one of the major factors driving the Low Voltage (LV) Switchgear Market.

The rising adoption of renewable energy is anticipated to play a significant role in the global Low Voltage (LV) Switchgear Market in the coming years.

The leading players operating in the Low Voltage (LV) Switchgear Market are Siemens AG, ABB Ltd, General Electric Co, Hitachi Ltd, Eaton Corp Plc, Powell Industries, Inc., Hyundai Corp, Lucy Group Ltd., CHINT Group, and Fuji Electric Co Ltd.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- Siemens AG

- ABB Ltd

- General Electric Co

- Hitachi Ltd

- Eaton Corp Plc

- Powell Industries, Inc.

- Hyundai Corp

- Lucy Group Ltd.

- CHINT Group

- Fuji Electric Co Ltd

Get Free Sample For

Get Free Sample For