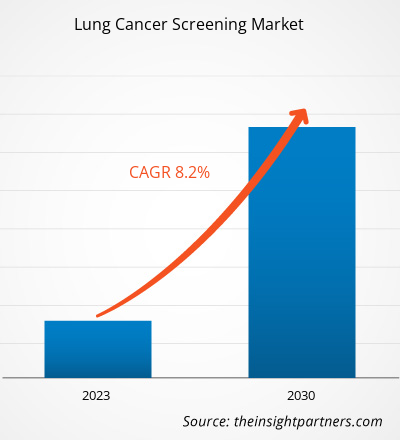

[Research Report] The lung cancer screening market size is projected to reach US$ 4,363.95 million by 2030 from US$ 2,326.5 million in 2022. It is expected to register a CAGR of 8.2% from 2022 to 2030.

Analyst Perspective:

The rising incidence of lung cancer and increasing government support drive the lung cancer screening market expansion. With the high pervasiveness of lung cancer, the awareness of the disease and the associated treatment are also rising. Additionally, government initiatives provide better and more affordable screening and favorable reimbursement policies, which are expected to boost the lung cancer screening market growth. The lung cancer screening market key players are focusing on strategic initiatives by collaborations to expand their geographic reach and enhance capacities to cater to a large customer base. For instance, in November 2021, GE Healthcare and Optellum collaborated to advance precision diagnosis and treatment of lung cancer. Together, the companies seek to address one of the largest challenges in diagnosing lung cancer, helping providers determine the malignancy of a lung nodule: a suspicious lesion that may be benign or cancerous.

Lung Cancer Screening Market - Market Overview:

Lung cancer screening is a process used to detect lung cancer in otherwise healthy people with a high risk of lung cancer. Lung cancer screening is recommended for older adults who are long time smokers and who do not have any signs or symptoms of lung cancer. Doctors use a LDCT scan of the lungs to look for lung cancer. If lung cancer is detected early, it is more likely to be cured with treatment.

The lung cancer screening market is segmented into technology, cancer type, age group, and end user. The report offers insights and in-depth analysis of the global lung cancer screening emphasizing on parameters such as market trends, technological advancements, market dynamics, and competitive landscape analysis of leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lung Cancer Screening Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Incidence of Lung Cancer Drives Lung Cancer Screening Market

Lung cancer is among the main causes of mortality across the world. Lung cancer screening is a critical component of cancer prevention approaches. The prognosis for lung cancer patients is better when the disease is diagnosed early, so people at high risk of lung cancer are encouraged to undergo routine testing to detect the formation of cancerous growth in their lungs. According to estimates by the American Cancer Society for lung cancer in the US for 2023, about 238,340 new lung cancer cases were registered; of these, 120,790 in women and 117,550 in men were reported. Also, according to the National Center for Biotechnology Information (NCBI), each year, ~41,000 new diagnoses of lung cancers and 34,000 deaths are recorded in Italy.

As per the Cancer Australia 2023 report, ~14,529 new lung cancer cases were diagnosed in 2022; among these, 7,707 were males and 6,822 were females. Nearly 9% of registered new cancer cases were diagnosed in 2022, with an estimated 8,664 total deaths due to lung cancer.

Thus, the rising incidence of lung cancer worldwide is contributing to the initiation of lung cancer screening programs, which is, in turn, driving the lung cancer screening market growth.

Lung Cancer Screening Market - Segmental Analysis:

Based on cancer type, the lung cancer screening market is bifurcated into non-small cell lung cancer (NSCLC) and small cell lung cancer. The NSCLC segment accounted for a larger market share in 2022 and is expected to grow at a CAGR of 8.0% during the forecast period. The market position of this segment is due to the rising cases of NSCLC across the world. NSCLC develops more slowly than small cell lung cancer. It usually spreads to other parts of the patient's body by the time it is diagnosed. Therefore, early diagnosis and treatment are crucial. According to National Foundation for Cancer Research, NSCLC accounts for nearly 9 out of every 10 diagnoses. As per the same source, large-cell undifferentiated carcinoma lung cancer accounts for ~10–15% of all NSCLC diagnoses.

Lung Cancer Screening Market - Regional Analysis:

The increasing prevalence of lung cancer has made its screening extremely important for early detection. Lung cancer screening is suggested for older adults who are long-time smokers and do not have any symptoms related to lung cancer. Physicians use a low-dose computerized tomography (LDCT) scan or X-ray for screening.

According to an article titled “Lung Cancer in Germany,” published in the Journal of Thoracic Oncology, in June 2022, cancer is among the second most frequent cause of death in Germany, accounting for 25% of all deaths. In men, lung cancer ranks second after cardiovascular disease, accounting for 6.5% of all-cause mortality. With an age-standardized incidence rate of 52.1 and 32.7 and (per 100,000) in men and women, respectively, lung cancer ranks second in men and third in women (accounting for 13.3% and 9.4% of all newly diagnosed cancers, respectively). The average age of cancer diagnosis is 70 years (men) and 69 years (women); 52% of all patients present with stage IV. The incidence rates in women and men have converged since the 1990s because of long-term changes in smoking habits. Currently, every fourth man (27.0%) and every fifth woman (20.8%) in Germany smokes regularly.

The German National Cancer Plan designates organ cancer centers (lung cancer centers), oncology centers, and comprehensive cancer centers to offer general oncologic care in Germany. As of 2020, 64 lung cancer centers at 79 institutions were certified nationwide. Further, the implementation of lung cancer screening in the German healthcare system is expected in the upcoming years. For example, the HANSE, a lung check study, is primarily intended as a pilot program to provide evidence that a holistic and effective lung cancer screening program can be implemented and integrated into the current infrastructure of certified lung cancer centers in Germany. The HANSE investigates the feasibility of controlled lung cancer screening, screening for relevant cardiac and pulmonary comorbidities, and assessing potential predictive biomarkers in 5,000 high-risk candidates in the Northern German region. The screening is facilitated by a mobile CT truck rotating among three approved lung cancer centers. In addition, Germany is participating with two sites in the European “4 in the Lung Run–Study,” a prospective trial that is investigating several innovative modifications of screening, including personalized recruitment approaches, individualized screening intervals, improved radiological criteria, and others.

Thus, with rising lung cancer incidences in Germany and the implementation of lung cancer screening in the German healthcare system, the market for lung cancer screening is expected to grow.

Lung Cancer Screening Market - Key Player Analysis:

The lung cancer screening market analysis involved the study of players such as Intelerad Medical Systems Incorporated; Nuance Communications Inc; GE HealthCare Technologies Inc; Medtronic Plc; Canon Medical Systems Corp; Koninklijke Philips NV; Siemens AG; Aetna Inc; bioAffinity Technologies, Inc.; and LungLife AI, Inc. Among the players in the lung cancer screening market, Siemens AG and Medtronic Plc are the top two players owing to the diversified product portfolio offered.

Lung Cancer Screening Market Regional InsightsThe regional trends and factors influencing the Lung Cancer Screening Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Lung Cancer Screening Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Lung Cancer Screening Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.33 Billion |

| Market Size by 2030 | US$ 4.36 Billion |

| Global CAGR (2022 - 2030) | 8.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Cancer Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Lung Cancer Screening Market Players Density: Understanding Its Impact on Business Dynamics

The Lung Cancer Screening Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Lung Cancer Screening Market top key players overview

Lung Cancer Screening Market - Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the lung cancer screening market. A few recent key market developments are listed below:

- In June 2022, Royal Philips teamed up with Biodesix, Inc. to incorporate the results of Biodesix’s Nodify Lung blood-based lung nodule risk assessment testing into Philips Lung Cancer Orchestrator lung cancer patient management system.

- In August 2022, Intelerad Medical Systems acquired PenRad Technologies, Inc., a software provider for enhancing breast imaging and lung screening productivity. The acquisition has expanded Intelerad’s product offerings for mammography and lung analytics, optimizing workflow for radiologists and boosting patient health outcomes.

- In May 2021, Genetron Holdings Limited partnered with Siemens Healthineers at the China Medical Equipment Fair. This partnership promoted the large-scale application of Genetron’s S5 platform and lung cancer 8-gene IVD assay in Chinese hospitals and provided NSCLC patients with efficient and accurate personalized diagnosis and treatment guidance.

Frequently Asked Questions

What are the driving factors for the Lung cancer screening market across the globe?

What are the opportunities for lung cancer screening market entrants?

Which is the most influencing segment growing in the lung cancer screening market report?

What is Lung cancer screening?

Who are the major players in the lung cancer screening market?

What are the key trends in the lung cancer screening market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For