Malaria Treatment Market Dynamics and Trends by 2030

Malaria Treatment Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Treatment (Generic Drug, Originators, Vaccines, and Others), Route of Administration (Oral and Parenteral), and Distribution Channel (Direct Tender, Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Nov 2023

- Report Code : TIPRE00018229

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 320

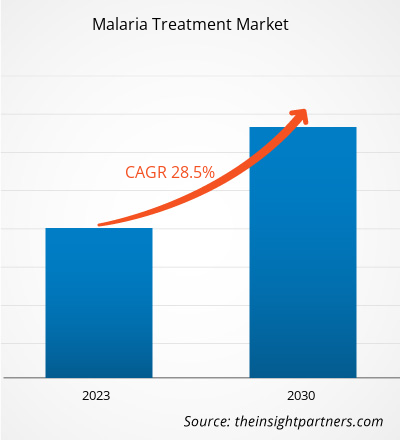

[Research Report] The malaria treatment market was valued at US$ 3,296.98 million in 2022 and is expected to reach US$ 24,487.73 million by 2030; it is estimated to grow at a CAGR of 28.5% from 2022 to 2030.

Market Insights and Analyst View:

Malaria is a life-threatening infectious disease caused by the Plasmodium parasite. The market for malaria treatment is growing due to the high prevalence of malaria in low-income countries and global malaria elimination programs initiated by international and national organizations. Also, the increasing launch of advanced diagnostic tools and rising research activities to provide effective therapeutics are driving the growth of the malaria treatment market. Over the two peak years of the pandemic (2020–2021), COVID-related disruptions led to more than 13 million malaria cases and 63,000 associated deaths. The WHO African Region continues to hold a disproportionately huge share of the global malaria burden. In 2021, Africa was home to approximately 95% of all malaria cases and 96% of deaths. Furthermore, children under 5 years of age accounted for ~80% of all malaria deaths in the region. According to the same source, Nigeria, Democratic Republic of the Congo, the United Republic of Tanzania, and Niger accounted for over half of all malaria deaths worldwide.

Growth Drivers and Challenges:

Malaria, one of the acute febrile illnesses, is caused by plasmodium parasites and spreads through the infected female Anopheles mosquitoes. Five parasite species in humans mainly cause malaria, and two of these species—Plasmodium falciparum and P. vivax—are considered the greatest threat to human health. Also, P. falciparum is the deadliest malarial parasite, and it is most widely spread across the African continent. Further, P. vivax is the dominant malarial parasite in most countries outside of sub-Saharan Africa. According to the latest World Malaria Report (WMR) 2020 from the World Health Organization (WHO), 241 million cases of malaria were reported in the world, in comparison to 227 million cases that were logged in 2019. According to the same source, the number of deaths caused due to malaria has an annual rise of 69,000 deaths. Approximately two-thirds of these deaths, i.e., 47,000, were caused by disruptions in healthcare services during the COVID-19 outbreak; the remaining one-third of deaths, i.e., 22,000 reflected a recent change in the WHO’s methodology for calculating malaria mortality (irrespective of COVID-19 disruptions). Thus, the rising prevalence of malaria in different regions across the globe boosts the malaria treatment market growth.

The occurrence of antimalarial drug resistance can be due to the growing availability and use of counterfeit drugs, overuse of certain medications for prevention, incomplete treatment of active infections, and the parasite's adaptability at the genetic and metabolic levels, among others. The elevated usage of counterfeit antimalarial drugs is a primary concern faced by healthcare sectors worldwide. Counterfeit antimalarial drugs are prominently used in most African countries due to high medical costs. People also opt for counterfeits to receive treatments at lower costs, while a few countries lack reasonable quality control and verification processes, which ease access to these counterfeit drugs. According to the Journal of Vector-Borne Diseases 2020, counterfeit antimalarial drugs not only resulted in an economic loss but also decreased the efficacy of treatment, thereby resulting in the loss of faith in the healthcare system and increasing the chances of drug resistance in the parasites.

Thus, the surging dominance of counterfeit antimalarial drugs is hindering the growth of the malaria treatment market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMalaria Treatment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

Based on treatment, the malaria treatment market is segmented into generic drugs, originators, vaccines, and others. Based on route of administration, the malaria treatment market is divided into oral and parenteral. Based on distribution channel, the malaria treatment market is segmented into direct tender, hospital pharmacies, retail pharmacies, online pharmacies, and others. By geography, the malaria treatment market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, the UAE, South Africa, Kenya, Tanzania, Rwanda, Nigeria, Ghana, Uganda, Angola, Cameroon, Senegal, Zambia, and Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on treatment, the malaria treatment market is segmented into generic drugs, originators, vaccines, and others. In 2022, the vaccines segment held the largest share of the market. Also, the segment is expected to record the highest CAGR during the forecast period. Vaccines provide active acquired immunity against particular infectious diseases. The market for malaria vaccines is growing at a significant growth rate owing to increasing research and development activities and an increasing pipeline of vaccine candidates. The only approved malaria vaccine is RTS,S vaccine developed by GlaxoSmithKline to prevent the Plasmodium falciparum malaria parasite from entering the liver. It requires four injections and is being provided to young children through national immunization programs in sub-Saharan African countries. The vaccine is being given as part of a pilot introduction that began in 2019. International and local cooperation has been integral in the development of the vaccine, and by the end of the pilot roll-out in 2024; funding for RTS,S is estimated to exceed US$ 1 billion, out of which US$ 700 million will be provided by GSK, which has donated 10 million doses for the pilot.

The malaria treatment market, by route of administration, is bifurcated into oral and parenteral. In 2022, the oral segment held a larger share of the market. However, the parenteral segment is anticipated to record a higher CAGR during the forecast period. Oral drug delivery is the most preferred and suitable route of drug administration as it offers high patient compliance, noninvasiveness, least sterility constraints, cost-effectiveness, and flexibility in the design of dosage form and ease in the manufacturing process. Benefits such as ease of administration and long-term cost efficiency are major factors fueling the adoption of oral drugs. The low manufacturing cost of tablets, capsules, and other orally administered drugs is also a key driving factor for the malaria treatment market growth. A few of the available anti-malarial drugs are quinine, quinidine, chloroquine, amodiaquine, tafenoquine proguanil, chlorproguanil, and artemisinin. The ACTs and the combination therapies are being used for the treatment of uncomplicated malaria caused by the P. falciparum parasite. ACTs are the most effective antimalarial medicines that are currently available in the market.

By distribution channel, the malaria treatment market is categorized into direct tender, hospital pharmacies, retail pharmacies, online pharmacies, and others. In 2022, the direct tender segment held the largest share of the market. In addition, the same segment is also expected to record the highest CAGR during the forecast period. A tender is an offer to do specific duties or provide items for a fixed amount. In the first step of this tender procedure, contractors will be asked to submit sealed bids for construction or to offer particularly planned services or products within a specific time limit. The e-tendering procedure in India is designed to ensure that work for the government or a specific client is completed in a timely manner. A few places, for example, may have specific procurement regulations that dictate the way decisions are made and which tenders are accepted. For instance, the All India Institute of Medical Sciences, Managing Director, Bihar Medical Services and Infrastructure Corporation Limited (Government of Bihar), Patna (AIIMS Patna) invites bids from reputed, experienced, and financially established companies/firms/agencies for malaria testing kits and drugs for different healthcare facilities in India.

Regional Analysis:

Based on geography, the malaria treatment market is categorized into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The market in North America has been analyzed with a prime focus on three major countries—the US, Canada, and Mexico. The Middle East & Africa held the largest share of the malaria treatment market in 2022. Rising disposable income, growing demand for targeted nutrition, and rising awareness regarding malaria treatment and supplements are a few of the prominent factors propelling the market growth.

The malaria treatment market in Nigeria holds the largest market share, and Saudi Arabia is the fastest-growing market during the forecast period. According to the Severe Malaria Observatory report, malaria is significantly prominent across Nigeria, and ~97% of the population is at a high risk of suffering from malaria. Further, according to the 2021 World Malaria Report, Nigeria recorded the highest number of malaria cases, with the highest number of deaths, i.e., ~32% of global malaria deaths were recorded in the country in 2020. To overcome such a high prevalence of malaria, Nigeria's collaboration with the National Malaria Elimination Program (NMEP) started the High Burden High Impact (HBHI) approach with technical support from the WHO.

Malaria Treatment Market Opportunity:

Growing Strategic Initiatives by Market Players

A few major players operating in the malaria treatment market are increasingly focusing on the adoption of various strategies such as product innovations, launches, and approvals; R&D investments; and mergers and acquisitions in order to remain competitive. A few of these initiatives are mentioned below:

- In March 2022, tafenoquine, a novel drug used to treat a specific strain of malaria, was licensed in Australia by Medicines for Malaria Venture (MMV), which codeveloped the drug with GlaxoSmithKline (GSK) for children and adolescents. The drug is combined with the widely used antimalarial drug—chloroquine.

- In December 2021, Zydus Cadila announced the plan to develop its antimalarial drug ZY19489 with Medicines for Malaria Venture, which received US FDA approval. According to the company, the Phase I trial of ZY19489 demonstrated a long half-life and the potential for a single-dose cure for malaria. In a separate malaria challenge trial, strong antimalarial activity was displayed after a single oral dose of ZY19489.

Therefore, the abovementioned strategic initiatives by the market players are expected to provide growth opportunities for the malaria treatment market in the coming years.

Malaria Treatment Market Regional InsightsThe regional trends and factors influencing the Malaria Treatment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Malaria Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Malaria Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.3 Billion |

| Market Size by 2030 | US$ 24.49 Billion |

| Global CAGR (2022 - 2030) | 28.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Treatment

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Malaria Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Malaria Treatment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Malaria Treatment Market top key players overview

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global malaria treatment market are Cipla Ltd, Sun Pharmaceutical Industries Ltd, Sanofi SA, GSK Plc, Novartis AG, Pfizer Inc, Emmaus Life Sciences Inc, AdvaCare Pharma USA LLC, VLP Therapeutics LLC, Lupin Ltd, and Teva Pharmaceutical Industries Ltd. These companies focus on the development of new technologies, advancements in existing products, and expansion of geographic footprint to meet the growing consumer demand worldwide and expand their product range in specialty portfolios. Companies operating in the global malaria treatment market are implementing various inorganic and organic strategies. A few of them are mentioned below:

- In November 2022, Novartis and Medicines for Malaria Venture (MMV) announced its decision to move to a Phase 3 study for a novel non-artemisinin combination to treat uncomplicated malaria. This novel combination also contains an optimized formulation of lumefantrine, which allows it to be given once daily instead of the usual twice-daily administration.

- In October 2021, GlaxoSmithKline (GSK) plc welcomed WHO recommendation for the broader deployment of GSK’s RTS,S malaria vaccine to reduce childhood illness and deaths from malaria in children (living in sub-Saharan Africa and other regions with moderate to high transmission). RTS,S is the first and only malaria vaccine to have been shown in pivotal long-term clinical trials to significantly reduce malaria in children. The vaccine is the result of over 30 years of research led by GSK, with PATH and other partners.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For