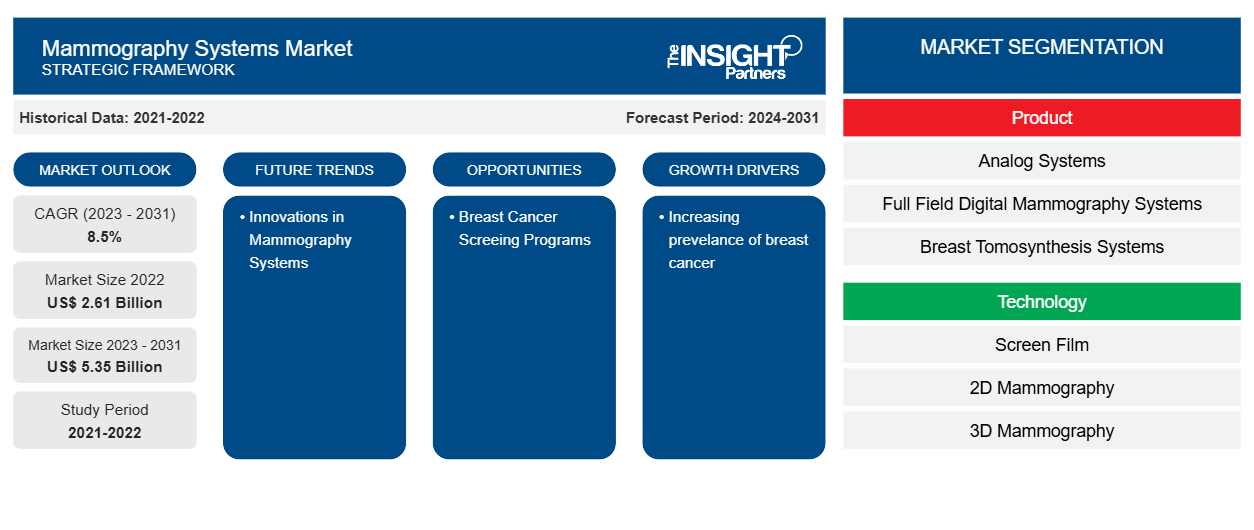

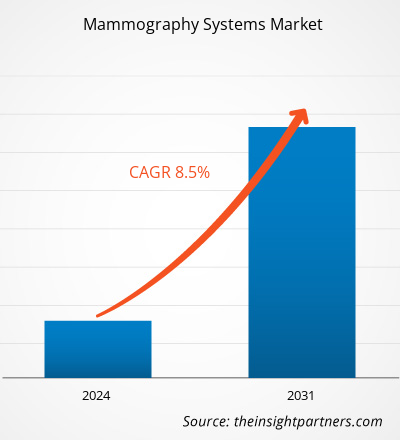

The Mammography Systems Market size is projected to reach US$ 5.35 billion by 2031 from US$ 2.61 billion in 2022. The market is expected to register a CAGR of 8.5% in 2023–2031. Increasing innovation in mammography systems and collaboration among market players led to new product launches that are likely to remain key Mammography Systems Market trends.

Mammography Systems Market Analysis

The prevalence of breast cancer is growing worldwide and has resulted in increased demand for mammography systems for diagnosis. A few of the common symptoms of breast cancer are the appearance of inverted nipples, changes in breast shape, development of lumps in the breast, a red or scaly patch of skin, or sore nipples. As per the Breast Cancer Organization report, 2023, breast cancer accounts for 12.5% of total cancer cases reported globally. Additionally, every year ~30% of newly diagnosed cancer among women are breast cancer. As per the same source, there were 2,800 new breast cancer are expected to be diagnosed in men during 2023. Therefore, the globally increasing prevalence of breast cancer among a large population is expected to generate demand for diagnosis and treatment which in turn support the growth of the mammography systems market.

Mammography Systems Market Overview

Breast cancer is one of the most common cancers affecting a large population globally. The increasing prevalence and incidence of breast cancer have increased the demand for accurate diagnosis and effective treatment options. The increasing prevalence of cancer has increased the research activities funds, and grants to increase the diagnosis rate globally to provide timely treatment. Moreover, there are various market players operating in the global market focusing on the development of advanced diagnostic systems which led to increased product launches and collaborations which in turn contributed to the growth of the mammography systems market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mammography Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mammography Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mammography Systems Market Drivers and Opportunities

Increasing Public-Private Investments, Grants, and Funds to Favor Market

In the last few years, there has been an increase in investments in research activities focused on the early detection of breast cancer. For instance, in May 2023, the Victorian Medical Acceleration Fund grant helped BreastScreen Victoria to develop facilities and carry out research activities for the use of artificial intelligence (AI) in reading mammograms.

The Society of Breast Imaging in the US focuses on minimizing the impact of breast cancer and saving lives of the patients. It has a Research & Education Fund program that aims at providing funds to support the research and education for breast imaging. Further, in the UK, the government promises to invest an extra USD 12.49 million to provide 29 new breast cancer screening centers and approximately 70 lifesaving developments for the treatment and diagnosis of breast cancer.

Thus, increasing public-private investments, grants, and funds provides growth impetus to the mammography systems market.

Breast Cancer Screening Programs – An Opportunity in Mammography Systems Market

The growing implementation of preventive healthcare and disease diagnosis programs creates lucrative growth opportunities for the mammography systems market players. For instance, all provinces in Canada have breast cancer screening programs for women with 50–74 years of age. The Provincial Health Services Authority of British Columbia has a breast cancer screening program to offers simple, inexpensive tests to large population base; the program mainly aims toward the early diagnosis of breast cancer.

Additionally, in November 2023, FUJIFILM India launched an On-Ground Breast Cancer Screening and Awareness Campaign on National Cancer Awareness Day to promote early breast cancer detection. Fujifilm India pledges to carry out this initiative in 19 cities in collaboration with 35 cutting-edge diagnostic centers equipped with advanced mammography systems.

Mammography Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Mammography Systems Market analysis are product, technology, and end user.

- Based on product, the Mammography Systems Market is segmented into full-field digital mammography systems, breast tomosynthesis systems, and analog systems. The full-field digital mammography systems segment held a larger market share in 2023.

- By technology, the market is segmented into screen film, 2D mammography, 3D mammography, and others. The 2D mammography technology segment held the largest share of the market in 2023.

- In terms of end user, the market is segmented into hospitals, ambulatory surgical centers and others. The other segment dominated the market in 2023.

Mammography Systems Market Share Analysis by Geography

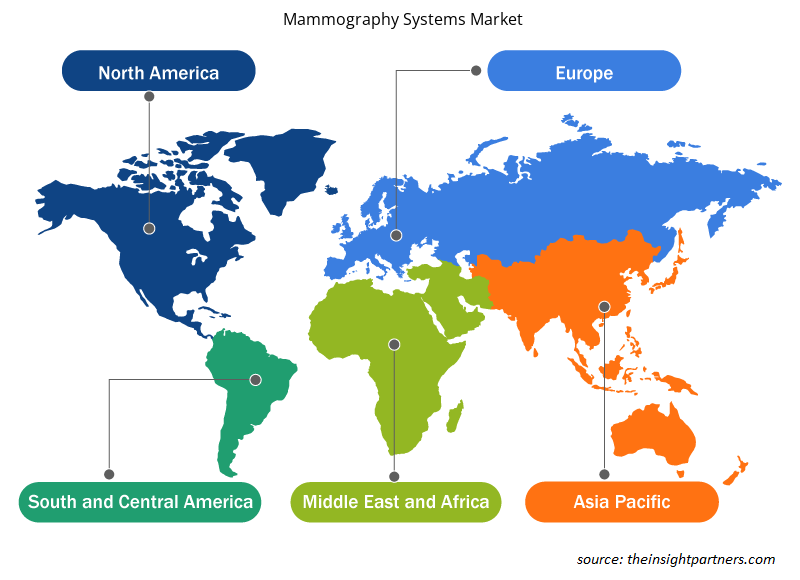

The geographic scope of the Mammography Systems Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the Mammography Systems Market owing to the Increasing adoption of advanced medical devices, technological advancements and the rising prevalence of breast cancer are projected to accelerate the growth of the mammography systems market. The US held the largest market share in 2023 owing to the increasing adoption of advanced medical device technologies, growing digitalization of medical devices, increasing emphasis on improving treatment outcomes and increasing prevalence of breast cancer. The increasing prevalence of breast cancer in the US is likely to demand mammography systems. As per the breast cancer statistics by the Breast Cancer Organization, breast cancer accounts for 12.5% of all new annual cancer cases worldwide. Additionally, there were ~297,790 new cases of invasive breast cancer are expected to be diagnosed among women along with 55,720 new cases of DCIS in the US during 2023. Moreover, Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Mammography Systems Market Regional Insights

Mammography Systems Market Regional Insights

The regional trends and factors influencing the Mammography Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mammography Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mammography Systems Market

Mammography Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.61 Billion |

| Market Size by 2031 | US$ 5.35 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Mammography Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Mammography Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mammography Systems Market are:

- Carestream Health Inc.

- General Electric Company

- Hologic, Inc.

- Koninklijke Philips N.V.

- PLANMED OY

- Fujifilm Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mammography Systems Market top key players overview

Mammography Systems Market News and Recent Developments

The Mammography Systems Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for mammography systems and strategies:

- The company launched Mammomat B.brilliant, a new mammography system with wide-angle tomosynthesis. In tomosynsthesis, the tube moves around the breast at a wide 50° angle, which is the largest angle available on the market making it excellent tool for mammography. (Source: Siemens Healthineers AG, Press Release, 2023)

- The company launched all-in-one platform of artificial intelligence (AI) apps to support clinicians with breast cancer detection and improved workflow productivity called MyBreastAI Suite. With this initial release, MyBreastAI Suite integrates three AI applications from iCAD including ProFound AI for DBT, SecondLook for 2D Mammography and PowerLook Density Assessment to help support early detection and improve patient outcomes, as well as help radiology departments improve operational productivity. (Source: GE HealthCare, Press Release, 2023)

- The company launched new “Harmony” version of its Amulet Innovality mammography system. The “Harmony” version brings together improved diagnostic performance with new design themes to embellish and illuminate your mammography suite, creating an environment to put patients at ease. (Source: HiE, Newsletter, 2021)

Mammography Systems Market Report Coverage and Deliverables

The “Mammography Systems Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Technology, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For