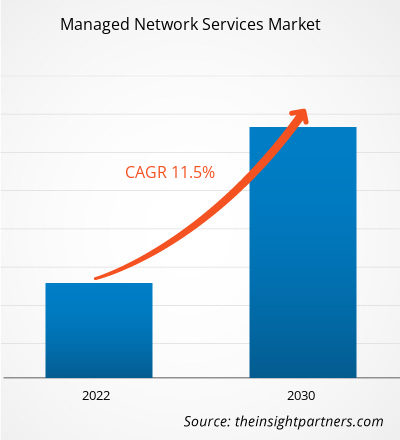

The managed network services market is projected to reach US$ 143.4 billion by 2030 from US$ 60.9 billion in 2022, with an estimated CAGR of 11.5% from 2023 to 2030. The growing interest in SD-WAN and SASE is likely to remain a key trend in the market.

Managed Network Services Market Analysis

The growing demand for digital transformation in various enterprises is likely to boost the managed network services market growth. Businesses are rapidly embracing significant network technologies to support business initiatives and gain a competitive advantage. Managed network services are a major contributor to a robust IT infrastructure. The growing emphasis of organizations on creating a digital workplace with minimum network downtimes has become a major driving factor for product demand. Furthermore, the growing advancements in artificial intelligence technology and high penetration of mobility will further accelerate the growth of the managed network services market. The managed network services offer significant scope for SMEs to grow and realize business goals. IT spending among SMEs is predicted to increase significantly, as SMEs are under constant pressure to expand by implementing innovative and enhanced IT services. The US government had proposed an IT budget of US$ 109.4 billion for 2022. Thus, increasing demand for managed network services among SMEs and a rise in IT spending are the key factors propelling the market growth.

Managed Network Services Market Overview

Managed network services are networking applications, functions, and services that are remotely operated, monitored, and maintained by a third-party service provider or managed service provider (MSP). It mostly includes monitoring and maintaining equipment and remote monitoring and management of servers, IT systems management, network monitoring, and other support services. Small and medium-sized enterprises (SMEs), nonprofits, and government agencies are procuring managed network services to perform regular management services. An increase in the population of random traffic, data volumes, bandwidth requirements, and proliferation of IoT and cloud emerge as the various driving factors for the growth of the managed network services market. Further, growing advancements in big data analytics technology, rising adoption of cloud-based solutions and services by small and medium-scale organizations, and growing focus on reducing deployment costs and downtime are the key factors attributable to the managed network services market growth. The growing adoption of cloud-based solutions since the onset of the COVID-19 pandemic is anticipated to boost market growth over the coming years. As per the IBEF, end-user spending on public cloud services in India is expected to reach US$ 7.3 billion in 2022, an increase of 29.6% from 2021. Thus, such growth prospects in cloud adoption are fueling the market growth over the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Managed Network Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Managed Network Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Managed Network Services Market Drivers and Opportunities

Rising Digital Transformation to Favor Market

Digital transformation uses technologies to create new or modify existing business processes and customer experiences to meet the ever-changing business environment. Digital transformation has common goals, such as improving efficiency, adding value, and promoting innovation. As companies are increasingly adopting digital transformation to deliver better customer experiences and compete more effectively, there is a growing need for services that support such modernization of information technology (IT) within different enterprises. Additionally, while companies seek to adopt digital transformation, the availability of skilled personnel and the cost of retaining them become hindrances for most enterprises. Managed network service providers, often termed managed service providers (MSPs), strongly aid in overcoming such hindrances. Enterprises can easily avail of their digital transformation service without the requirement of managing or maintaining an IT department within their enterprise. Hence, the rising adoption of digital transformation is strongly aiding the managed network services market growth.

Increasing Strategic Decisions by Key Market Players

The key players operating in the managed network services market were increasingly engaging themselves in various strategic decisions such as product launches, partnerships, acquisitions, collaboration and others in order to meet the increasing demand and stay competitive in the market. For instance, in February 2023, Huawei announced the launch of a digital managed network solution to boost new growth for carriers' B2B services. This solution provides digital managed network capabilities and rich product portfolios, helping carriers transform from ISPs to MSPs. In July 2023, Netskope announced a new partnership with Wipro Limited to deliver robust cloud-native Managed secure access service edge (SASE) and managed zero trust network access (ZTNA) services to Wipro’s extensive global enterprise client portfolio.

Managed Network Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the managed network services market analysis are type, deployment, organization size and end use vertical.

- Based on the type, the managed network services market is divided into managed LAN, managed network security, managed monitoring, managed VPN, managed WAN and managed Wi-Fi. The software segment will hold a significant market share in 2022.

- By deployment, the market is segmented into cloud and on-premise. The cloud segment is expected to hold a significant market share in 2022.

- In terms of organization size, the market is segmented into large enterprises and SMEs. The large enterprises segment is expected to hold a significant market share in 2022.

- In terms of end-use vertical, the market is segmented into BFSI, government, IT & telecommunication, manufacturing, media & entertainment, retail & e-commerce, and others. The segment is expected to hold a significant market share in 2022.

Managed Network Services Market Share Analysis by Geography

The geographic scope of the managed network services market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America Managed Network Services Market is segmented into the US, Canada, and Mexico. Managed network services (MNS) offer potential opportunities to small and medium enterprises (SMEs) to grow and achieve business goals. IT spending among SMEs is predicted to increase because SMEs are expanding their businesses by implementing innovative and enhanced IT services. The rise in IT spending by SMEs is expected to fuel the demand for managed service providers (MSPs) as SMEs are adopting automated services, cloud, and advanced digital technologies. The MNS providers are opening new opportunities for SMEs to remain competitive, expand, and grow their businesses. Moreover, the current business environment has increased the demand for accelerated digital transformation, with SMEs needing more IT assistance than ever. With limited resources, SMEs need safe and reliable solutions and a technology partner for maintaining business continuity and connections with colleagues and customers. Cisco Systems, Inc., a US-based company, provides a series of simple, affordable, and reliable cloud-based IT solutions to help SMEs transform their businesses to operate more effectively in digital workplaces.

Managed Network Services Market Regional Insights

The regional trends and factors influencing the Managed Network Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Managed Network Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Managed Network Services Market

Managed Network Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 60.9 Billion |

| Market Size by 2030 | US$ 143.4 Billion |

| Global CAGR (2023 - 2030) | 11.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

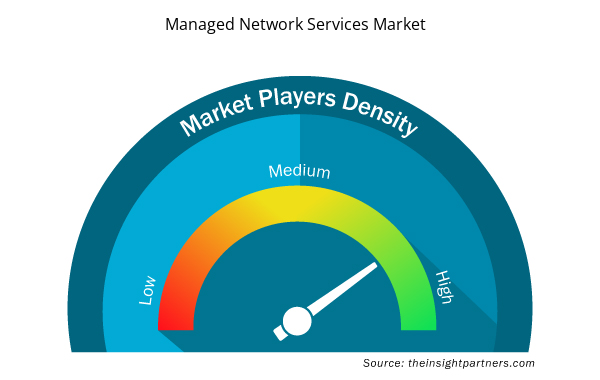

Managed Network Services Market Players Density: Understanding Its Impact on Business Dynamics

The Managed Network Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Managed Network Services Market are:

- Accenture

- Cisco Systems, Inc.

- Cognizant

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Kyndryl Holdings, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Managed Network Services Market top key players overview

Managed Network Services Market News and Recent Developments

The managed network services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the managed network services market are listed below:

- HCLTech has announced a strategic global partnership with Verizon Business to become its primary managed network services (MNS) collaborator in all networking deployments for global enterprise customers. (Source: HCLTech, Press Release, August 2023)

- Vodafone and Accenture entered into a partnership to provide managed security services to small to medium-sized enterprises (SMEs) in Germany. The services will help SMEs be more resilient to cyber threats, providing leading cybersecurity talent and industry expertise to organizations that do not have the capacity, time, or resources to keep up with this rapidly evolving space. (Source: Vodafone, Press Release, March 2022)

Managed Network Services Market Report Coverage and Deliverables

The “Managed Network Services Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Managed network services market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Managed network services market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Managed network services market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the managed network services market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Deployment, Organization Size, and End-Use Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The leading players operating in the managed network services market are Accenture; Cisco Systems, Inc.; Cognizant; Fujitsu Limited; Huawei Technologies Co., Ltd.; Kyndryl Holdings, Inc.; NTT Limited; Tata Consultancy Services Limited; Verizon; and HCL Technologies.

North America is expected to dominate the managed network services market with the highest market share in 2022.

The managed network services market size is projected to reach US$ 143.4 billion by 2030.

The global managed network services market is expected to grow at a CAGR of 11.5% during the forecast period 2022 - 2030.

The growing interest in SD-WAN and SASE is anticipated to play a significant role in the global managed network services market in the coming years.

Rising digital transformation and growing demand for reducing administration and maintenance expenditure are the major factors driving the managed network services market.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Managed Network Services Market

- Accenture Plc

- Cisco Systems Inc

- Cognizant Technology Solutions Corp

- Fujitsu Ltd

- Huawei Investment & Holding Co Ltd

- Kyndryl Holdings Inc

- NTT Ltd

- Tata Consultancy Services Ltd

- Verizon Communications Inc

- HCL Technologies Ltd

Get Free Sample For

Get Free Sample For