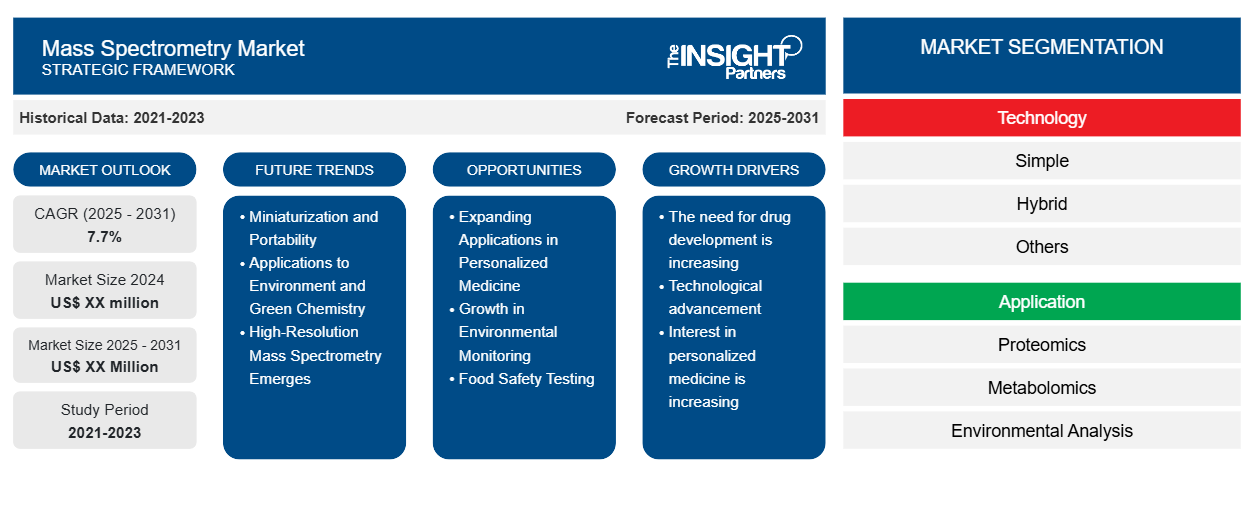

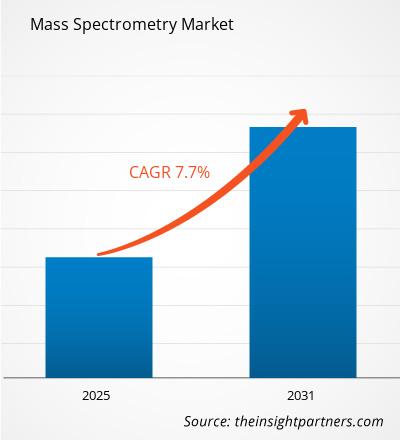

The Mass Spectrometry Market is expected to register a CAGR of 7.7% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Technology [Simple (Ion Trap, Quadrupole, Time Of Flight, and Others), Hybrid (Triple Quadrupole, Quadrupole TOF, and Fourier Transform Mass Spectroscopy), and Others]. Also, the report is segmented based on Application (Proteomics, Metabolomics, Environmental Analysis, Pharmaceutical Analysis, Forensic Applications, Clinical Applications, and Others), Further, the report is segmented on the basis of End Users (Pharmaceutical and Biotechnology Companies, Research Labs and Academic Institutes, Environment Testing Labs, Food And Beverage Industry, Forensic Labs, and Others). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments.

Purpose of the Report

The report Mass Spectrometry Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Mass Spectrometry Market Segmentation

Technology

- Simple

- Hybrid

- Others

Application

- Proteomics

- Metabolomics

- Environmental Analysis

- Pharmaceutical Analysis

- Forensic Applications

- Clinical Applications

- Others

End Users

- Pharmaceutical and Biotechnology Companies

- Research Labs and Academic Institutes

- Environment Testing Labs

- Food And Beverage Industry

- Forensic Labs

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mass Spectrometry Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mass Spectrometry Market Growth Drivers

- The need for drug development is increasing: An upsurge in mass spectrometer market demand is founded by development in the pharmaceutical field and pharmaceutical research market. Mass spectrometry enables screening of drug efficacy and safety of complex biological samples. Since new treatments target the pharmaceutical sector, it makes it worse with such stringent regulatory requirements involved in drug approval. With new analysis required for research and quality control.

- Technological advancement: Technological advancements in the mass spectrometry market have a significant impact on the market growth. Improvements such as high-resolution mass spectrometry and miniaturization of coupled mass spectrometers will improve sensitivity and accuracy. and can analyse complex samples at a greater level of detail. These improvements have led to many applications in areas such as proteomics and environmental studies.

- Interest in personalized medicine is increasing: This forms the basis of the mass spectrometer market's movement towards personalized medicine. Health data indicates that personal health care plans are going up. Mass spectrometry thus provides critical information about the metabolic profile. Thus, biomarkers and drug interactions enable doctors to treat patients according to their specific needs. The above has therefore created a need for advanced analytical methods in clinical research settings.

Mass Spectrometry Market Future Trends

- Miniaturization and Portability: The major trend in the mass spectrometry market at present is miniaturization and portability. Advances in microfabrication and nanotechnology are driving compact, user-friendly mass spectrometers to field-deployment applications. Portability is facilitating on-site analysis in environmental monitoring, food safety, and clinical diagnostics, which makes on-site, real-time data collection more possible with mass spectrometry.

- Applications to Environment and Green Chemistry: As environmental awareness is increasing worldwide, the applications of mass spectrometry in green chemistry also grow. Techniques for ascertaining the levels of pollutants and trace contaminants in water sources or environmental health monitoring are under development. What is significant is that massive and increasing demands for sustaining compliance with environmental standards should reinforce this position of mass spectrometry in one of the tools useful for assessment of ecological impacts.

- High-Resolution Mass Spectrometry Emerges: A trend seen in the mass spectrometry market is higher demand for high-resolution mass spectrometry (HRMS) systems. The latest-generation instruments deliver unprecedented resolution in molecular analysis, enabling researchers to identify complex mixtures with great accuracy. Of interest, HRMS is increasingly applied in proteomics and metabolomics as well as in pharmaceutical development, where detailed molecular insight is crucial for product development. Coupled with significant effort to measure subtle differences in isotopic patterns and the resolution of closely related compounds, it is driving innovation and expanding applications, especially in biomarker discovery and environmental analysis.

Mass Spectrometry Market Opportunities

- Expanding Applications in Personalized Medicine: The mass spectrometry market holds enormous opportunities for personalized medicine. Detailed analysis of biomolecules can help identify unique biomarkers for each individual, and hence assist in therapies tailored to the needs of a patient. As healthcare is moving increasingly towards individual treatments, demands for precise analytical techniques are on the rise, and thus, mass spectrometry will play a very important role in developing personal therapies and monitoring responses of patients.

- Growth in Environmental Monitoring: The heightened regulatory scrutiny and growing awareness of pollutants have further created new avenues for mass spectrometry in environmental monitoring. In the assessment of environmental health, trace levels of contaminants in air, water, or soil can be detected with the help of mass spectrometry. Increased expectations regarding sustainability from governments and other organizations create a new market for analytical solutions that are strong enough to meet such expectations and, therefore, will continue to present mass spectrometry applications with opportunities.

- Food Safety Testing: Increasing consumer awareness with regard to food quality and safety will give a boost to the demand for mass spectrometry in food safety testing. The technology allows for rapid and accurate detection of contaminants, additives, and nutritional profiles. Assurance of food safety and authenticity, along with strict regulations put on the food supply chain and their demand for its transparent delivery will increase drastically, boosting demand in that market segment.

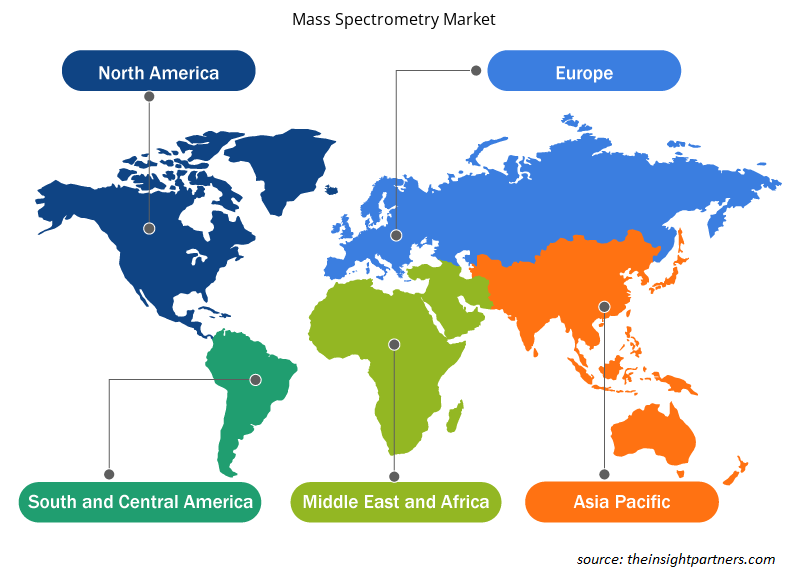

Mass Spectrometry Market Regional Insights

The regional trends and factors influencing the Mass Spectrometry Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mass Spectrometry Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mass Spectrometry Market

Mass Spectrometry Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Mass Spectrometry Market Players Density: Understanding Its Impact on Business Dynamics

The Mass Spectrometry Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mass Spectrometry Market are:

- AB Sciex Pte. Ltd.

- Bio-Rad Laboratories

- Bruker

- JEOL Ltd.

- Kore Technology Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mass Spectrometry Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Mass Spectrometry Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Mass Spectrometry Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Application, and End Users

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific region is the fastest growing in the market

2021 to 2022- are the historic year, 2023 - base year, 2024 to 2031- are the forecast year

Bio-Rad Laboratories, Bruker, and AB Scitex Pt. Ltd accounted for major market shares in the year 2023

The Mass Spectrometry Market is estimated to witness a CAGR of 7.7% from 2023 to 2031

North America region accounted for the accounted for the highest market share

The report can be delivered in PDF/Word format, we can also share excel data sheet based on request.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. AB Sciex Pte. Ltd.

2. Bio-Rad Laboratories

3. Bruker

4. JEOL Ltd.

5. Kore Technology Limited

6. LECO Corporation

7. MKS Instruments

8. PerkinElmer Inc.

9. Rigaku Corporation

10. Thermo Fisher Scientific

Get Free Sample For

Get Free Sample For