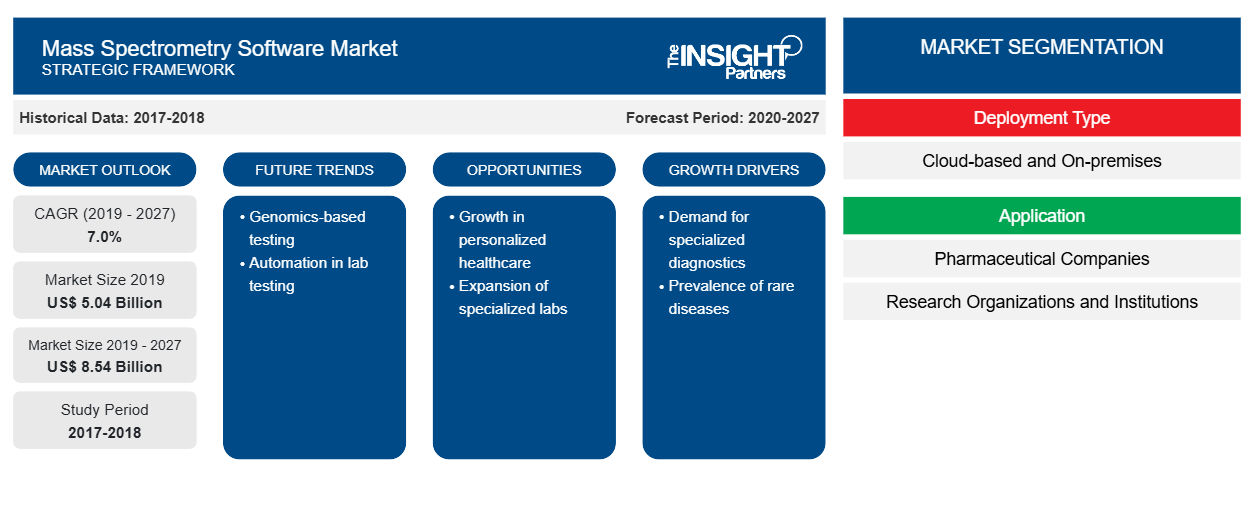

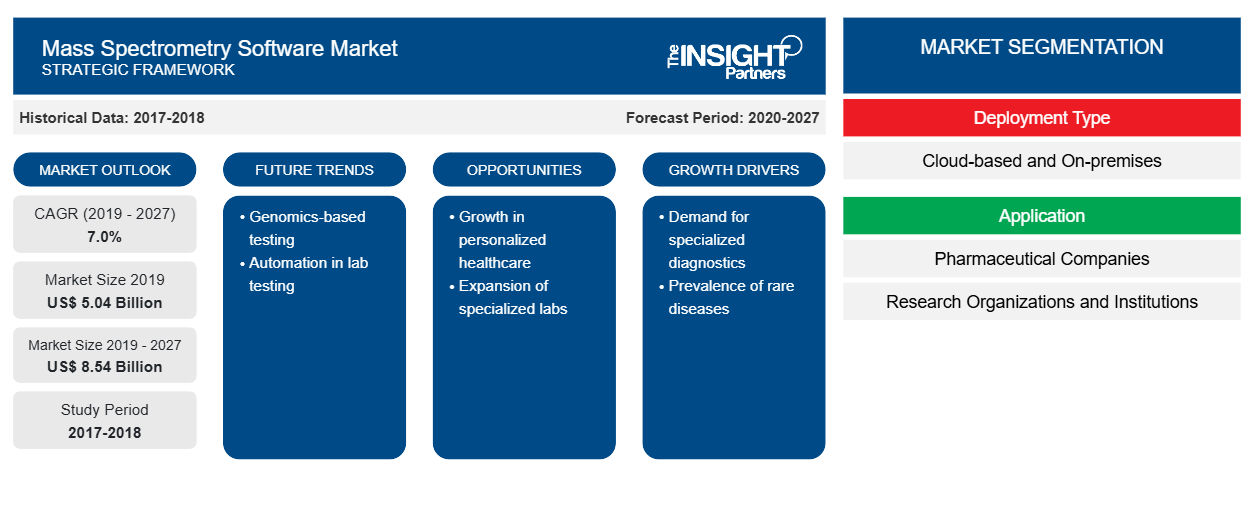

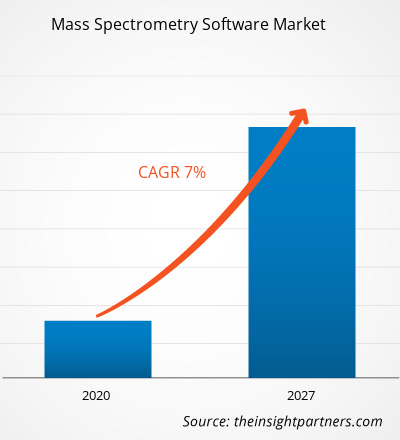

The mass spectrometry software market was valued at US$ 5,037.56 million in 2019 and is projected to reach US$ 8,541.36 million by 2027; it is expected to grow at a CAGR of 7.0% from 2020 to 2027.

Mass spectrometry software helps in collecting various digital instruments and tools that provide several features and benefits for mass spectrometry processes. Mass spectrometry software helps in data analyzing through it specialized tools and help identify protein biomarkers and protein deviations better.

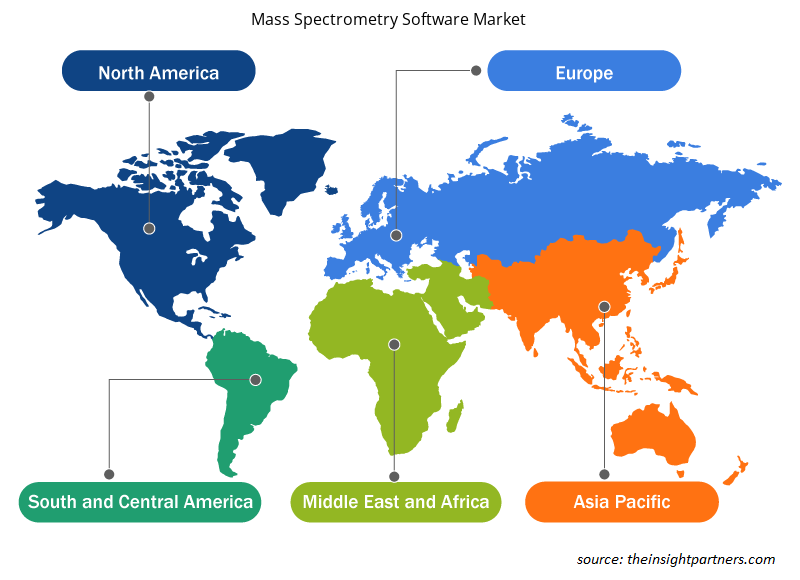

The scope of the mass spectrometry software market includes deployment type, application, and region. The market for mass spectrometry software is analyzed based on regions such as North America, Europe, Asia Pacific, Middle East & Africa, and South and Central America. The report offers insights and in-depth analysis of the mass spectrometry software market emphasizing on various parameters, such as market trends, technological advancements, market dynamics, and competitive landscape analysis of leading market players across the world.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mass Spectrometry Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mass Spectrometry Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Applications of Genomics and Proteomics

Growing advancements in technology have enhanced the genomic and proteomic applications in the biotechnology industry. These applications are majorly dependent on mass spectrometry-based identification and quantification outcomes. The integration of information technology with biotechnology has allowed receiving genome-sequence databases automatically by rapid protein profiling. It offers benefits such as real-time analysis of continuously flowing protein samples that can be used for medical applications.

Growing applications of genomics and proteomics in the medical industry for diagnosing and treating chronic diseases have increased the utilization of mass spectroscopy. Mass spectrometry has enabled the invention of therapeutic techniques to design personalized treatments for diseases, such as cancer, diabetes, and genetic disorders. Various innovations have received support from government organizations worldwide to enhance the research and development in the biotechnology industry. For instance, in 2006, the National Cancer Institute and National Human Genome Research Institute collaborated to lead significant initiatives—such as Cancer Genome Atlas—for the development of personalized medicines for oncology. Under the program, ~47 drugs have been approved by the Food and Drug Administration in 2018, and nearly 20 by the mid of 2019.

Similarly, in 2016, International Cancer Proteogenome Consortium (ICPC) was launched to provide a platform for world's leading cancer and proteogenomics research centers to enhance their research for precision medicine and its challenges for cancer. The ICPC is present in 13 countries comprising 33 institutes and 11 Clinical Proteomic Tumor Analysis Consortium members. Increasing research or application of proteogenome in the medical industry leads to growing demand for automated mass spectroscopy. In addition, the demand for mass spectrometry software is raised by various academic institutes as well as pharmaceutical and biopharmaceutical companies to enhance their research and drug development activities. Thus, increasing genomics and proteomic applications are expected to drive the market during the forecast period.

Deployment Type-Based Insights

Based on deployment type, the mass spectrometry software market is segmented into cloud-based and on-premises. The cloud-based segment held the largest share of the market in 2019. Also, the segment is estimated to register the highest CAGR of in the market during the forecast period due to easy accessibility to data from any place at any time. In addition, it provides high levels of security, scalability, accessibility, affordability, lower energy costs, and fast deployment. This is expected to accelerate the market’s growth.

Application-Based Insights

Based on application, the mass spectrometry software market is segmented into pharmaceutical companies, research organizations and institutions, and others. The pharmaceutical companies segment held the largest share of the market in 2019. The same segment is estimated to register the highest CAGR in the market during the forecast period.

Inorganic strategies, such as partnerships, merger and acquisition, are commonly adopted by companies to cater to changing customer demand across the world, which also permits the players to maintain their brand name globally. The market players operating in the mass spectrometry software market also adopted organic strategies, such as product launch and expansion, to outstretch their footprint and product portfolio worldwide as well as to meet the growing demand.

Mass Spectrometry Software Market Regional Insights

The regional trends and factors influencing the Mass Spectrometry Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mass Spectrometry Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mass Spectrometry Software Market

Mass Spectrometry Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 5.04 Billion |

| Market Size by 2027 | US$ 8.54 Billion |

| Global CAGR (2019 - 2027) | 7.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Deployment Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

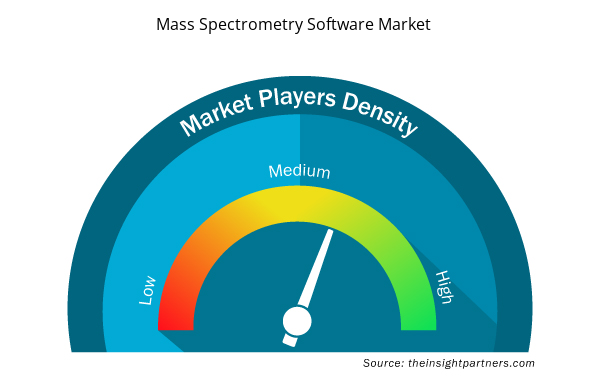

Mass Spectrometry Software Market Players Density: Understanding Its Impact on Business Dynamics

The Mass Spectrometry Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mass Spectrometry Software Market are:

- Waters. Corporation

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Sciex (Danaher Corporation)

- Advanced Chemistry Development

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mass Spectrometry Software Market top key players overview

By Deployment Type

- Cloud-based

- On-premises

By Application

- Pharmaceutical Companies

- Research Organizations and Institutions

- Others

By

Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South and Central America (SCAM)

- Brazil

- Argentina

- Rest of SCAM

Company Profiles

- Waters Corporation

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Sciex (Danaher Corporation)

- Advanced Chemistry Development

- Bruker

- Adaptas Solutions

- SpectralWorks Ltd.

- Shimadzu Scientific Instruments

- PerkinElmer, Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Mass Spectrometry Software Market

- Waters. Corporation

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Sciex (Danaher Corporation)

- Advanced Chemistry Development

- Bruker

- Adaptas Solutions

- SpectralWorks Ltd.

- Shimadzu Scientific Instruments

- PerkinElmer, Inc.

Get Free Sample For

Get Free Sample For