Masterbatch Market Size and Competitive Analysis by 2031

Historic Data: 2020-2022 | Base Year: 2023 | Forecast Period: 2024-2031Masterbatch Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (White, Black, Additives, Color, Filler, and Others), Polymer (Polyethylene, Polypropylene, Polyethylene Terephthalate, Polystyrene, and Others), and End-Use Industry (Building and Construction, Automotive, Packaging, Agriculture, Electrical and Electronics, and Others)

- Report Date : May 2024

- Report Code : TIPRE00016538

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 235

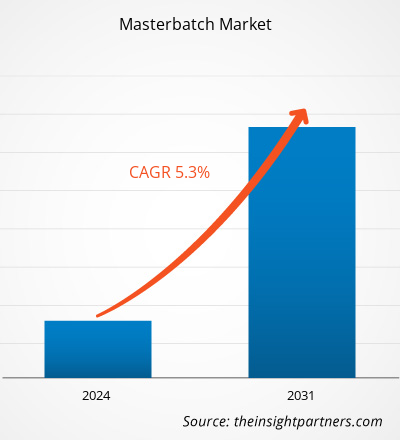

The masterbatch market was valued at US$ 12.32 billion in 2023 and is expected to reach US$ 18.56 billion by 2031; it is estimated to register a CAGR of 5.3% from 2023 to 2031.

Market Insights and Analyst View:

Masterbatch can include pigments, additives, or fillers encapsulated during a heat process into a carrier resin, which is then cooled and cut into a granular shape. The demand for masterbatch is driven by the growing plastics industry and other sectors such as packaging, automotive, construction, and consumer goods. Masterbatch is generally used in the production of sheets, fibers, films, injection-molded parts, and extruded profiles. Key market players offer a wide range of products such as additive masterbatches, white masterbatches, color masterbatches, special effects, and filler masterbatches. Additionally, environmental concerns and regulations regarding plastic waste management influence the demand for compostable or biodegradable masterbatch, aiding in the masterbatch market growth.

Growth Drivers and Challenges:

The upsurging demand for plastic packaging in emerging economies and rising demand for black masterbatches from end-use industries contribute to the growing masterbatch market size. The presence of established sectors, including food & beverages and consumer goods, in countries such as China, India, Japan, and South Korea propels the demand for packaging solutions in Asia Pacific. The plastic packaging market in Asia Pacific has witnessed notable growth due to the rapidly expanding packaging industry, growing food retail sector, and rising consumer awareness of the sustainable range of plastic packaging. Black masterbatch is a cost-effective and widely preferred option in the masterbatch market. It is mostly used in packaging applications for products such as films, bags, bottles, and containers. It provides opacity, UV protection, and aesthetic appeal. Black masterbatch is also suited for the production of hoses and geomembranes due to its properties such as UV and thermal protection. The growth in consumer electronics, packaging, automotive, construction, and other end-use industries bolsters the demand for black masterbatches. The growing demand for plastic packaging in emerging economies and rising demand for black masterbatches from end-use industries drive the masterbatch market.

The fluctuations in raw material prices can restrain the masterbatch market. Raw materials used in masterbatch manufacturing are traded as commodities in the global markets, subjecting them to commodity market dynamics. Crude oil-derived polymers are subject to price volatility due to various factors, including disruptions in supply chain and fluctuations in demand. The rising crude oil prices due to fluctuating global economic conditions are increasing the resin prices. The relationship between crude oil prices and polymer costs can be determined based on several factors such as production cost, market volatility, supply chain implications, and market competition. Price hikes in petroleum products and other raw materials can restrain the profit margins on the products, posing a challenge to the masterbatch market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Masterbatch Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Masterbatch Market Analysis and Forecast to 2031" is a specialized and in-depth study with a significant focus on global market trends and growth opportunities. The report aims to provide an overview of the market with detailed market segmentation by type, polymer, and end-use industry. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the use of masterbatch globally. In addition, the global masterbatch market report provides a qualitative assessment of various factors affecting the market performance globally. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses were conducted to identify the key driving factors, masterbatch market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The masterbatch market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

Segmental Analysis:

The global masterbatch market is segmented on the basis of type, polymer, and end-use industry. Based on type, the market is segmented into white, black, additive, color, filler, and others. The white segment accounted for a significant masterbatch market share in 2023. White masterbatch is a type of additive used as a colorant in polymer manufacturing. It provides white tones to the colorants. White masterbatch contains high-quality titanium dioxide grades, which can scatter light. In the plastic industry, white masterbatch is used in lamination, coating, protective films, molding, etc.

Based on polymer, the market is segmented into polyethylene, polypropylene, polyethylene terephthalate, polystyrene, and others. The polyethylene segment held a substantial masterbatch market share in 2023. Polyethylene-based masterbatch is a concentrated blend of additives and a base polymer, polyethylene, which is designed to improve the properties of plastics and other materials. Polyethylene products manufactured using masterbatch are used in packaging, automotive, construction materials, consumer goods, agriculture, textile, and footwear.

Based on end-use industry, the masterbatch market is segmented into building and construction, automotive, packaging, agriculture, electrical and electronics, and others. The packaging segment accounted for a significant market share in 2023. Masterbatch is highly utilized in the building & construction industry as it provides various advantages and functions for a variety of building materials. The plastic used in building and construction requires specialized additives to improve the performance, tensile strength, and aesthetic appeal of plastics. The industry uses masterbatch for color and aesthetics, UV resistance, flame retardancy, energy efficiency, and antistatic and conductive properties.

Regional Analysis:

The report provides a detailed overview of the market with respect to five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. In terms of revenue, Asia Pacific dominated the masterbatch market. The market in the region was valued at more than US$ 6 billion in 2023. The Asia Pacific market, by country, is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. Masterbatches are used in the manufacturing of automotive interior and exterior parts, offering several properties such as flame retardance, color dispersion, and UV stability. According to the International Organization of Motor Vehicle Manufacturers report, motor vehicle production in Asia Pacific was estimated to be 48.96 million units in 2022. These factors boost the masterbatch market growth in Asia Pacific.

The Europe masterbatch market is expected to reach more than US$ 2 billion by 2031. Europe marks the presence of several major packaging companies such as Tetra Laval International SA, Amcor plc, Berry Global Group Inc, Smurfit Kappa Group plc, DS Smith plc, Ardagh Group SA, and UPM-Kymmene Corp. Anti-slip additive masterbatch is used in film packaging to increase the coefficient of friction between films or sheets of polyethylene. However, sustainability initiatives and circular economy regulations have further prompted manufacturers to develop compostable or recycled masterbatch. Therefore, developments in the packaging industries in Europe drive the demand for masterbatches.

The masterbatch market in North America is expected to register a CAGR of ~5% during 2023–2031. According to the American Coatings Association, in the US, architectural coatings are the largest sector and segment of the paint industry, accounting for more than 50% of the total volume of coatings produced annually. According to the US Department of Transportation Federal Highway Administration, the US Government signed the Infrastructure Investment and Jobs Act in 2021, encompassing long-term infrastructure investment, providing US$ 550 billion over fiscal years 2022–2026 for the construction of roads, bridges, and mass transit and water infrastructure. Thus, the development of the construction industry in North America drives the masterbatch market in the region.

Masterbatch Market Regional InsightsThe regional trends and factors influencing the Masterbatch Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Masterbatch Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Masterbatch Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.32 Billion |

| Market Size by 2031 | US$ 18.56 Billion |

| Global CAGR (2023 - 2031) | 5.3% |

| Historical Data | 2020-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Masterbatch Market Players Density: Understanding Its Impact on Business Dynamics

The Masterbatch Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Masterbatch Market top key players overview

Industry Developments and Future Opportunities:

Following are a few initiatives taken by major companies in the masterbatch market, as per company press releases:

- In 2023, Ampacet Corporation introduced ColorMark, masterbatch additive technology. The developed product is compatible with polypropylene, polystyrene, polycarbonate, and polyamide. The masterbatch produces permanent and weather-resistant colors, available in six popular colors—red, orange, yellow, green, blue, and purple.

- In 2023, Penn Color Inc opened its first production plant in Thailand. The company aims to supply high-quality colorant and additive masterbatch to markets across Asia Pacific.

- In 2023, Cabot Corporation launched REPLASBLAK, a circular black masterbatch composed of sustainable material. The company launched three black masterbatch products—REPLASBLAK rePE5475 100% circular black masterbatch, REPLASBLAK rePE5265 70% circular black masterbatch, and REPLASBLAK rePE5250 60% circular black masterbatch.

Competitive Landscape and Key Companies:

Avient Corp, Ampacet Corporation, Cabot Corp, LyondellBasell Industries NV, Plastika Kritis SA, Penn Color Inc, Americhem, FRILVAM SPA, Polyvel Inc, and Vanetti Spa are among the key players profiled in the masterbatch market report. The global market players focus on providing high-quality products to fulfill customer demand.

Frequently Asked Questions

Which is the largest region of the global masterbatch market?

What are the opportunities for masterbatch in the global market?

Can you list some of the major players operating in the global masterbatch market?

Based on type, why did the white segment account for the significant market share in 2023?

What are the key drivers for the growth of the global masterbatch market?

Based on the polymer, which segment is projected to grow at the fastest CAGR over the forecast period?

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For