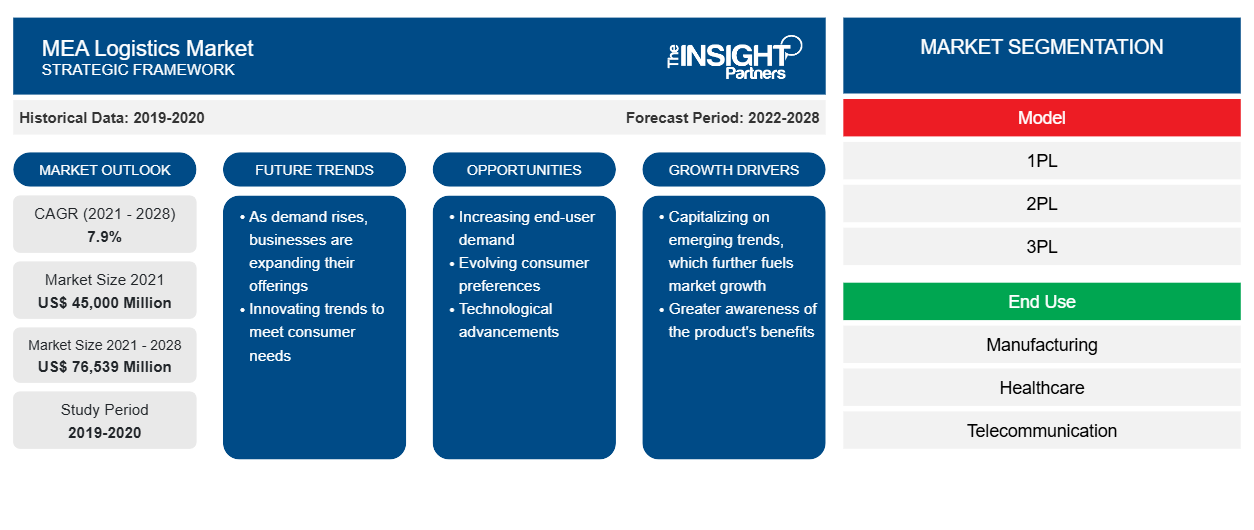

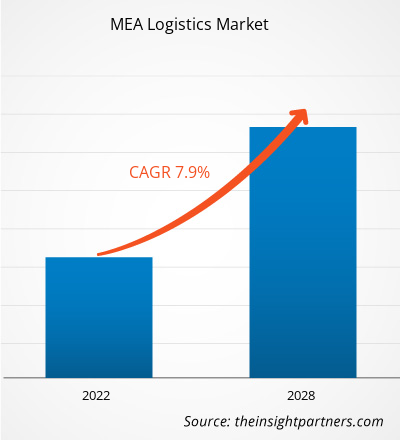

The MEA Logistics Market was valued at US$ 45,000 Million in 2021 and is projected to reach US$ 76,539 Million by 2028; it is expected to grow at a CAGR of 7.9% from 2021 to 2028.

Logistics is defined as arranging and transporting resources from one site to the storage of the intended destination, including equipment, food, liquids, inventories, materials, and people. It controls the flow of commodities from the point of origin to the point of consumption to fulfill client demands. Logistics management is concerned with the efficient and effective administration of everyday operations related to the production of completed goods and services by a corporation. This sort of management is a part of supply chain management and is responsible for planning, implementing, and controlling the efficient, effective forward, reverse, and storage of commodities. Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), inbound logistics, outbound logistics, reverse logistics, green logistics, construction logistics, digital logistics, military logistics, and other logistics services are all part of the logistics market.

Logistics Market growth is fueled by factors such as the expanding e-commerce industry and an increase in reverse logistics operations and trade agreements. In addition, the rising acceptance of IoT-enabled linked devices and the emergence of tech-driven logistics services are propelling logistics market growth. However, the market's growth is hampered by manufacturers' lack of control over logistical services and increasing logistics expenses. Furthermore, the rise of last-mile deliveries, logistics automation, cost reduction, and lead time reduction due to implementing a multi-modal system is boosting the market growth. Several new technologies are making their way into the ever-complicated area of logistics, with the potential to increase communication while also improving speed and precision. Robotics solutions are already infiltrating the logistics market, enabling zero-defect procedures and increasing efficiency due to rapid technology improvements and lower costs.

Impact of COVID-19 Pandemic on Logistics Market

Due to COVID-19, Middle Eastern countries, like the rest of the globe, reacted quickly by imposing restrictions on the movement of people and products and closing borders. Based on the report by United Nations, around 65 percent of international airports monitored in the Gulf countries were completely shut down, while the remaining 30 percent were only partially operating. Nearly 60% of monitored land border crossing points were shut down completely, while 37% were partially working till August 2020. However, there have been reports of Arab countries loosening their restrictions and lifting their lockdowns since December 2020. Saudi Arabia, for instance, reopened its border with Bahrain, Kuwait, and the United Arab Emirates in January 2021 after an eight-month lockdown. Furthermore, in July 2021, the Kingdom announced to invest over US$ 133.34 billion (SAR 500 billion) in airports, seaports, rail, and other infrastructure in a bid to make the Kingdom a global transportation and logistics hub.

Market Insights– Logistics Market

Growing E- Commerce Industry

E-commerce refers to purchasing and selling items through the internet. Third-party logistics market providers handle the shipping of goods. Furthermore, the e-commerce sector employs logistics services to manage and control e-commerce enterprises' supply chains, allowing to concentrate on marketing and other company activities. Due to the multiple benefits that logistics provides to the e-commerce industry, the adoption of logistics services is increasing rapidly, fueling the expansion of the MEA logistics market.

In the Middle East, digital adoption has not followed the influence seen in other countries. The high level of internet penetration and rising GDP in several countries, including Bahrain and Saudi Arabia, are fueling the e-commerce business in the Middle East. While China traditionally supplied most of the Middle East's imports, many buyers in the countries are turning to other markets. Amazon and eBay are used just as regularly in the Middle East as local sites such as Cobone, Souq, and Sukar. Furthermore, an increase in online orders or e-shopping is already seen in the Middle East. As a result, firms will upgrade their last-mile delivery operations to speed up deliveries. In addition, technologies to track orders and shipments in real-time will be required to increase transparency and reduce delays. Thus, the Growing e-commerce industry drives the demand for the MEA logistics market.

Model-Based Logistics Market Insights

Based on model, the logistics market is segmented into 1PL, 2PL, 3PL, Cold Chain, Secure Logistics, and Last Mile Delivery. The cold chain segment has further bifurcated into frozen and chilled. Similarly, secure logistic segment is bifurcated into cash management and jewellery & precious metals. The 3PL segment dominates the market due easy availability and flexibility of the services.

End Use-Based Logistics Market Insights

Based on End Use, the Logistics market is segmented into manufacturing, healthcare, telecommunication, government and public utilities, travel and tourism, consumer goods, food and beverages, others. The total expansion of the logistics business is being driven by increased demand for manufacturing, consumer goods, medicines, beverages, and other products and services.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

MEA Logistics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Players operating in the logistics market are mainly focused on the development of advanced and efficient products.

- In January 2022, In central Israel, DHL Express has opened the Middle East's largest robotic sorting centre. A hundred conveyor belts sort 20,000 items every hour, five times faster than before, and are comparable to the most advanced centres in Europe.

- In April 2021, Agility and DSV Panalpina A/S have signed an agreement to acquire Agility’s Global Integrated Logistics (GIL) business. The combination is expected to create a top-three global freight forwarder based on revenues. This development would help the company to creates significant shareholder value and marks a new milestone in the company's growth.

Company Profiled

:- Agility

- United Parcel Service of America, Inc.

- Al Futtaim - Logistics

- CEVA Logistics AG

- DHL International GmbH (Deutsche Post DHL Group)

- FedEx Corporation

- Kuehne + Nagel Management AG

- RAK Logistics

- SAUDI TRANSPORT & INVESTMENT CO.

- YUSEN LOGISTICS CO., LTD.

- BRINK'S INCORPORATED

- Etihad Secure Logistics

- Securitas AB

MEA Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 45,000 Million |

| Market Size by 2028 | US$ 76,539 Million |

| CAGR (2021 - 2028) | 7.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Model

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

MEA Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The MEA Logistics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the MEA Logistics Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For