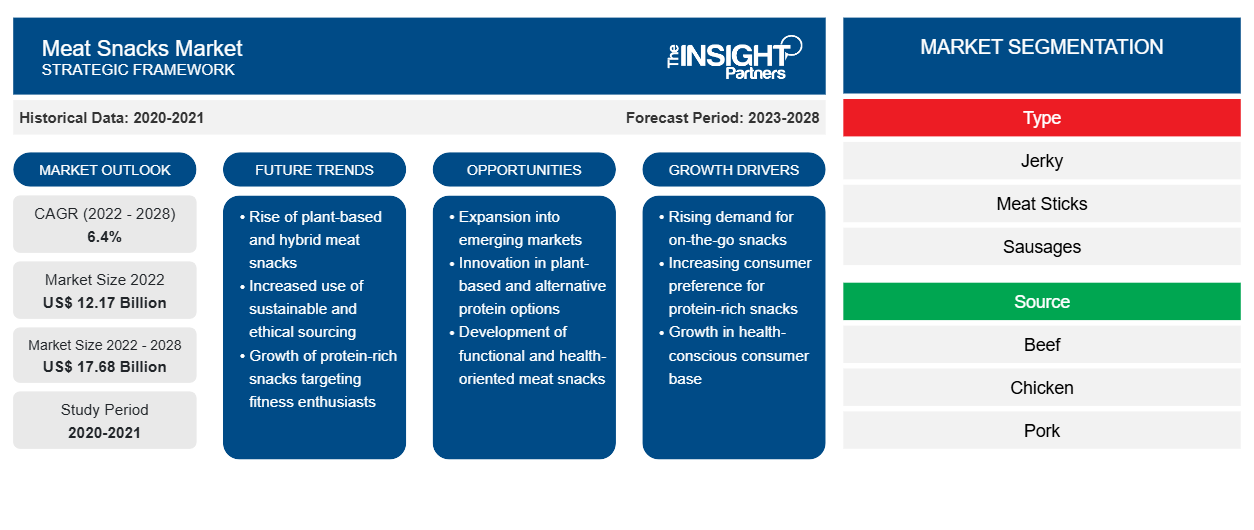

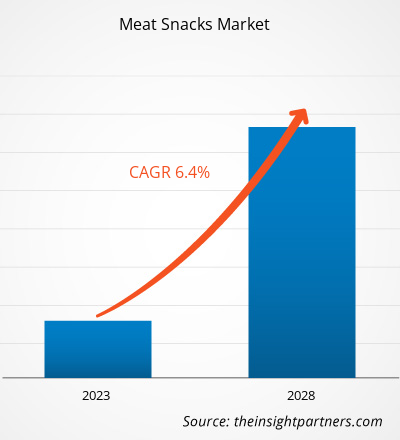

[Research Report] The meat snacks market size is expected to grow from US$ 12,169.01 million in 2022; it is estimated to grow at a CAGR of 6.4% from 2022 to 2028

Meat snacks are gaining immense traction among consumers as they are rich in protein, iron, creatine, and several vitamins. Moreover, they are available in a variety of sweet and savory flavor, which increases their demand among consumers. Currently, majority of the meat-based snacks available in the market are made with beef or pork. However, with increased health and wellness concerns, people are shifting toward leaner sources of animal protein. Beef, pork, and lamb consist of higher saturated fat content than chicken. Due to increasing prevalence of obesity and heart diseases, consumers are preferring low fat meat products. This factor is driving the demand for chicken-based meat snacks among consumers.

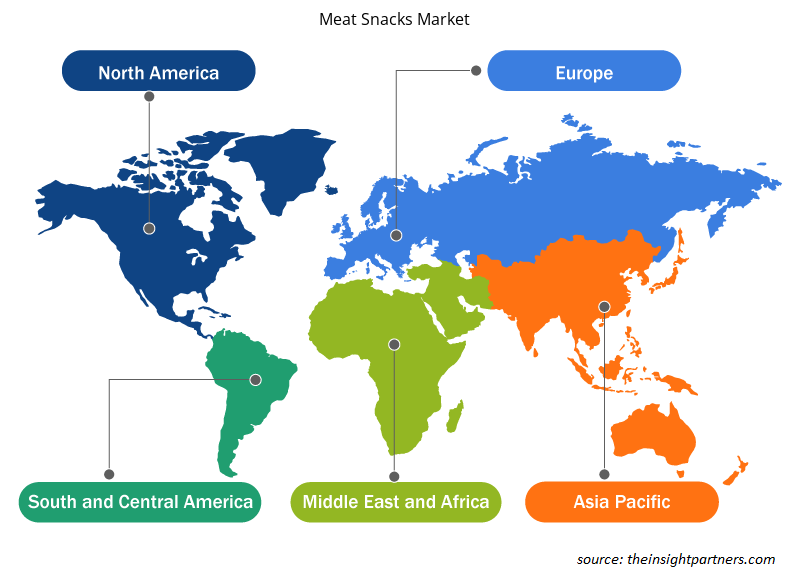

In 2021, North America held the largest share of the meat snacks market, whereas Asia Pacific is estimated to register the highest CAGR during the forecast period. Poultry meat and pork are widely consumed meats across Asia Pacific. According to the National Bureau of Statistics, pork production in China increased to 35.9% in 2021 from previous year. Moreover, the poultry industry is growing rapidly in China, India, Japan, and other Asia Pacific countries, as the demand for poultry meat is increasing significantly. These factors are expected to drive the growth of the meat snacks market across Asia Pacific over the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Meat Snacks Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Meat Snacks Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Meat Snacks Market

The food & beverages sector faced unexpected challenges due to the COVID-19 pandemic. Government restrictions, such as lockdowns, production shutdowns, travel bans, and border restrictions, disrupted the global supply chains in 2020. Disruptions in manufacturing and raw material sourcing operations hampered the growth of the meat snacks market during the initial months of the pandemic. However, the demand for frozen meat snacks increased amid this global crisis due to panic buying by consumers. Consumers in countries such as the US, Canada, Germany, and the UK dramatically shifted to a plant-based diet. According to research by The Vegan Society, one in every five British people reduced their meat consumption since the start of the pandemic. This factor hampered the demand for meat snacks. In 2021, the marketplace witnessed recovery, as the governments announced relaxation in previously imposed restrictions and permitted manufacturers to work at full capacities. Thus, increased production volumes and improved supply chain operations bolstered the growth of the meat snacks market. The pandemic had a mixed impact on the global meat snacks market.

Market Insights

Strategic Developments by Key Market Players to Drive Meat Snacks Market during Forecast Period

Companies are expanding their production capabilities to meet the rising demand for meat snacks across the world. For instance, in April 2022, Jack Link’s, one of the prominent meat snacks brands in the US, invested US$ 450 million to build a new manufacturing facility in Georgia. Similarly, in July 2020, Conagra Brands invested US$ 100 million to expand its meat snacks manufacturing facility in Ohio, US, to meet the increasing demand for Slim Jim meat products and Duke’s Smoked Sausages. Such strategies are expected to significantly drive the meat snacks market growth during the forecast period.

Type Insights

Based on type, the meat snacks market is segmented into jerky, meat sticks, sausages, and others. The jerky segment held the largest share in the market in 2021. However, the meat sticks segment is expected to register the highest CAGR from 2022 to 2028. Jerkies are the most popular meat snacks. Manufacturers are developing healthier versions of jerky snacks to meet the emerging health concerns of consumers. For instance, in September 2019, the US-based Werner Gourmet Meat Snacks, a jerky and snack manufacturer, launched a new product in the meat snack category with a zero-sugar jerky made with grass-fed beef. Such products are expected to gain immense traction among consumers, which would fuel the meat snacks market growth during the forecast period.

Source Insights

Based on source, the meat snacks market is segmented into beef, chicken, pork, and others. The beef segment held the largest market share in 2021. However, the chicken segment is projected to register the highest CAGR during the forecast period. Beef, pork, and lamb consist of higher saturated fat content than chicken. Thus, high consumption of beef, pork, lamb, and other meats with high saturated fat content increases the blood cholesterol level, which thereby increase the vulnerability of heart diseases, obesity, and high blood pressure. Therefore, consumers are increasingly preferring chicken-based meat products to fulfill the protein requirements while keeping the calorie count low. This factor is expected to drive the growth of the market in the chicken segment in the coming years.

Distribution Channel Insights

Based on distribution channel, the meat snacks market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. The supermarkets & hypermarkets segment accounted for the largest market share in 2021, whereas the market in the online retail segment is expected to witness the fastest growth during the forecast period. Online retail stores offer various products with heavy discounts. Also, consumers can conveniently buy desirable products remotely through e-commerce platforms, such as Amazon.com, Walmart, and E-bay. Consumers are increasingly preferring online retail platforms for buying meat snacks due to the availability of a wide range of products of different brands at discounted prices and availability of home delivery services. This factor is driving the market growth in the online retail segment.

Tyson Foods Inc, Bridgford Foods Corporation, General Mills Inc, Werner Gourmet Meat Snacks, Premium Brands, Hormel Foods Corporation, Conagra Brands Inc, Link Snacks Inc, Country Archer Provisions, and Organic Valley are among the major players operating in the meat snacks market. These companies mainly focus on product innovation to expand their market size and meet emerging market trends. For instance, in September 2020, Noel Alimentaria, a Spain-based company launched better-for-you, on-the-go meat snacks under the brand ‘Picalos.’ The company adopted a unique production technology that slowly dehydrates and bakes the snacks in an artisanal way and retains the nutritional qualities of meat. Such products are expected to gain high traction among consumers during the forecast period.

Meat Snacks Market Regional Insights

Meat Snacks Market Regional Insights

The regional trends and factors influencing the Meat Snacks Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Meat Snacks Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Meat Snacks Market

Meat Snacks Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 12.17 Billion |

| Market Size by 2028 | US$ 17.68 Billion |

| Global CAGR (2022 - 2028) | 6.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Meat Snacks Market Players Density: Understanding Its Impact on Business Dynamics

The Meat Snacks Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Meat Snacks Market are:

- Tyson Foods, Inc.

- Bridgeford Foods Corporation

- General Mills Inc.

- Werner Gourmet Meat Snacks

- Premium Brands

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Meat Snacks Market top key players overview

Report Spotlights

- Progressive industry trends in the meat snacks market to help companies develop effective long-term strategies

- Business growth strategies adopted by the meat snacks market players in the developed and developing countries

- Quantitative analysis of the market from 2020 to 2028

- Estimation of global demand for meat snacks

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the meat snacks market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the meat snacks market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the meat snacks market at various nodes

- Detailed overview and segmentation of the market, as well as the meat snacks industry dynamics

- Size of the meat snacks market in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Source, Category, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

strategic developments by the key market players is driving the meat snacks market. The manufacturers of meat snacks are adopting various strategies such as product innovation, expansion, and collaboration to increase their customer reach and boost product sales. For instance, in September 2020, Noel Alimentaria, a Spain-based company launched better-for-you, on-the-go meat snacks under the brand ‘Picalos.’ The company adopted a unique production technology which slowly dehydrates and bakes the snacks in an artisanal way and help in retaining the nutritional qualities of meat. The product is available in Spain, Denmark, and the UK across several retail channels including Carrefour and Eroski. Companies are incorporating plant protein along with meat in meat snacks to address the requirements of conscious carnivores. For instance, Applegate, a wholly owned subsidiary of Hormel Foods, launched ‘The Great Organic Blend Burger’ which is made by blending meat with mushrooms. The burger is made with 100% organic, grass-fed beef, organic turkey, mushrooms, and rosemary extracts which makes it nutritious and flavorful. Such product launches are expected to significantly drive the growth of meat snacks market over the coming years.

Based on the source, beef segment is projected to grow at the fastest CAGR over the forecast period. Beef is the culinary name for meat obtained from bovine animals, and manufacturers use it because consumers across the globe prefer to eat beef-based meat products. The factors contributing to increased consumption of beef meat snacks are food safety issues, including pathogen detection and chemical residues in other meats, such as poultry and pork. Due to the rapid and recent spread of diseases due to pork meat and poultry, the demand for beef meat snack has increased.Ans. Based on the source, beef segment is projected to grow at the fastest CAGR over the forecast period. Beef is the culinary name for meat obtained from bovine animals, and manufacturers use it because consumers across the globe prefer to eat beef-based meat products. The factors contributing to increased consumption of beef meat snacks are food safety issues, including pathogen detection and chemical residues in other meats, such as poultry and pork. Due to the rapid and recent spread of diseases due to pork meat and poultry, the demand for beef meat snack has increased.

North America accounted for the largest share of the global meat snacks market. Increasing North America is one of the prominent regions for the meat snacks market due to the increasing consumption of meat-based products as healthy and protein-rich food. The US is the world’s largest poultry meat exporter. Growing consumer preference for leaner meat options, with changing dietary patterns, boosts the demand for chicken-based meat snacks in the region. North America has been a desirable market for meat snack producers, with most consumers leading demanding lifestyles and seeking processed ready-to-eat food products, such as meat-based soup, sauces and snacks. Consumers' clean-label requirements create demand for developing new technologies that maintain the integrity of meat processing. There is a high concentration of several prominent meat snacks market players in North America such as Tyson Foods, Inc.; Bridgeford Foods Corporation; and General Mills Inc.

Based on type, jerky segments mainly have the largest revenue share. Jerky is a lean-trimmed meat cut into a strip and dehydrated to prevent spoilage. The jerky segment dominates the meat snacks market globally owing to its high protein benefits and consumer inclination from carbohydrate-enriched snacks to more nutritional snacks. In recent years, consumers have preferred healthy snacks that display the entire list of ingredients used. Clean labels, including low sodium, gluten-free, non-GMO, no artificial ingredients, no artificial ingredients, and no antibiotics, are rising trends in the industry, thereby driving the market's growth. Moreover, a wide range of flavors, including teriyaki, maple, pepper, barbecue, habanero, and others, are attracting consumers surging the market growth. Key players in the market are adopting strategic initiatives such as product launches, mergers, acquisitions, and joint ventures are further attributing the market growth.

The major players operating in the global meat snacks market are Tyson Foods, Inc.; Bridgeford Foods Corporation; General Mills Inc.; Werner Gourmet Meat Snacks; Premium Brands; Hormel Foods Corporation; Conagra Brands, Inc.; Link Snacks, Inc.; Country Archer Provisions; and Organic Valley.

The rising popularity of clean labelled and organic meat snacks anticipates lucrative growth for the meat snacks market. Clean-label trends are emerging rapidly across the meat industry. Meat eaters increasingly prefer all-natural and less processed meat products that offer high nutritional benefits. Organic and clean-label meat snacks are made from organically raised beef, chicken, or pork. They are free from synthetic additives such as colors, anti-caking agents, stabilizers, and preservatives. Furthermore, they are free from growth hormones and antibiotics. For instance, Organic Valley, a US-based co-operative, offers USDA-certified (United States Department of Agriculture-certified) organic beef sticks and sausages. These products are made from 100% grass-fed beef and are free of artificial color, flavors, preservatives, and genetically modified organisms (GMOs). Thus, the rising demand for clean-label and organic meat snacks is expected to provide lucrative growth opportunities to the market over the forecast period.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of company - Meat Snacks Market

- Tyson Foods, Inc.

- Bridgeford Foods Corporation

- General Mills Inc.

- Werner Gourmet Meat Snacks

- Premium Brands

- Hormel Foods Corporation

- Conagra Brands, Inc.

- Link Snacks, Inc.

- Country Archer Provisions

- Organic Valley

Get Free Sample For

Get Free Sample For