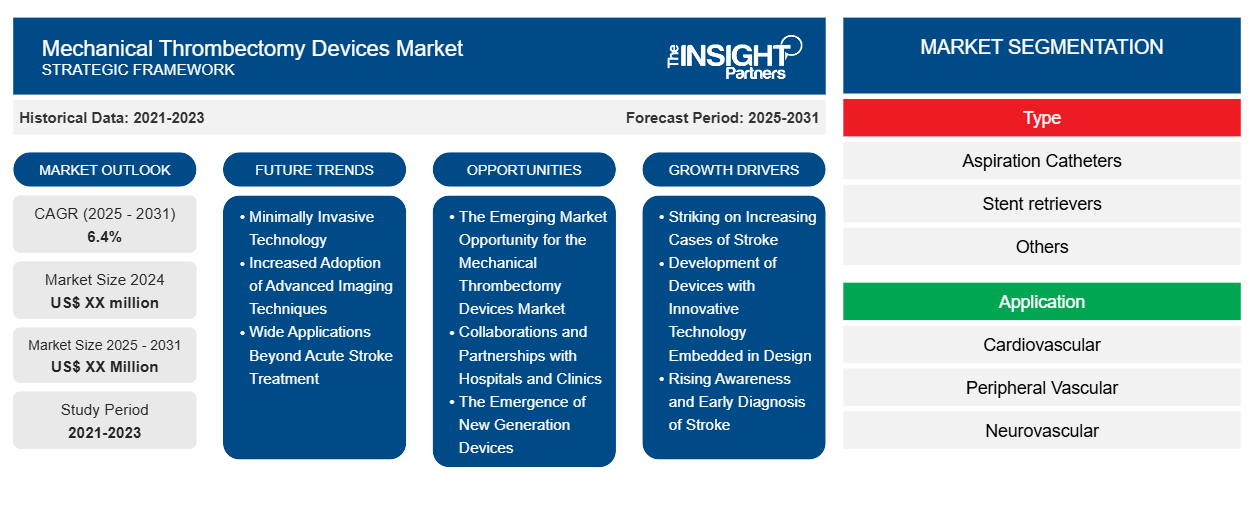

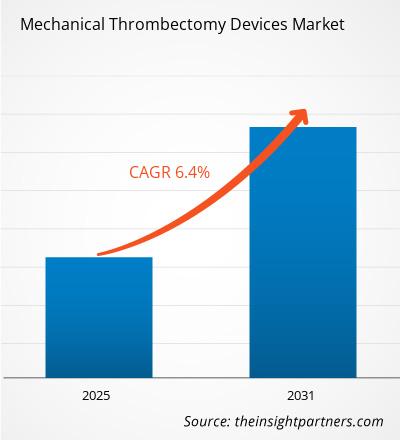

The Mechanical Thrombectomy Devices Market is expected to register a CAGR of 6.4% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented By Type (Aspiration Catheters, Stent retrievers, Others); Application (Cardiovascular, Peripheral Vascular, Neurovascular), End User (Academic & Research Institutes, Hospitals & Clinics, Ambulatory Surgical Centers). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Mechanical Thrombectomy Devices Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Mechanical Thrombectomy Devices Market Segmentation

Type

- Aspiration Catheters

- Stent retrievers

- Others

Application

- Cardiovascular

- Peripheral Vascular

- Neurovascular

End User

- Academic & Research Institutes

- Hospitals & Clinics

- Ambulatory Surgical Centers

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mechanical Thrombectomy Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mechanical Thrombectomy Devices Market Growth Drivers

- Striking on Increasing Cases of Stroke: It is growing incidence of stroke, primarily ischemic strokes that adds impetus to this segment-the mechanical thrombectomy devices market. With the soaring statistics of stroke cases worldwide, it has steered on the demand for effective and minimally invasive treatment methods such as the thrombectomy devices. These devices help in the removal of blood clots, better patient outcomes and would hence bring the market growth.

- Development of Devices with Innovative Technology Embedded in Design: The continuous technological advancements in the design of the devices have contributed to the development of the market for mechanical thrombectomy devices. The devices are becoming increasingly sophisticated, user-friendly, and have progress improved clot retrieval. Smaller, more flexible catheters, along with clot trapping technologies and real-time imaging integration, have significantly improved the therapeutic outcome of this new generation of devices and increased their application in the clinical setting.

- Rising Awareness and Early Diagnosis of Stroke: The market for mechanical thrombectomy devices has highly profited from public awareness regarding strokes and improvement in stroke diagnosis. Symptoms of stroke are better recognized, and hence medical intervention happens more quickly so that more patients qualify for the procedures. Early diagnosis not only improves the chances of recovery but also fuels demand for ambulatory thrombectomy devices.

Mechanical Thrombectomy Devices Market Future Trends

- Minimally Invasive Technology: This will mark the mechanical thrombectomy devices' growing favor towards more and more approach of minimally invasive procedures. Patients are moving along with the clinicians to treatment strategies requiring smaller incisions and shorter recovery periods. All these lead to demand among patient populations for mechanical thrombectomy devices ensuring effective clot removal at lower risk and faster recovery times.

- Increased Adoption of Advanced Imaging Techniques: Revolutionizing the market of mechanical thrombectomy devices are advanced imaging technologies, such as real-time intraoperative imaging and robotic assistance. These raise the precision of the clot retrieval procedure, outcomes of the procedure, and give more improved visualization in interventions. As imaging will be more advanced, it is expected that the use of thrombectomy devices will increase, thus improving clinical results and boosting the market segment.

- Wide Applications Beyond Acute Stroke Treatment: Expansion in its clinical application beyond acute ischemic stroke in clinical trials and studies through pulmonary embolism and deep vein thrombosis includes another direction. The flowing trend is very significant as it would open up new market possibilities. As it will be tested in these areas, it may prove an effective therapy and thus create a more widespread use of the instruments that will enhance the overall growth of the market.

Mechanical Thrombectomy Devices Market Opportunities

- The Emerging Market Opportunity for the Mechanical Thrombectomy Devices Market: Emerging markets always have the biggest opportunity areas wherein improving health care infrastructures and the growing incidences of stroke are increasing. Further development will lead to enhanced utilization of such advanced medical treatment options of mechanical thrombectomy due to an increased access to modern medical technology. This growth in the emerging market opens doors of business opportunity to effective, affordable innovation addressing regional needs.

- Collaborations and Partnerships with Hospitals and Clinics: There is a lot of opportunity for manufacturers to collaborate with hospitals, stroke centers, and clinics to expand their adoption of mechanical thrombectomy devices. Strategic partnership with these could result in better clinical training, more awareness, and better opportunities to benefit from advanced treatments. Such partnerships could thereby enhance patient outcomes while boosting the market entry for providers of thrombectomy devices.

- The Emergence of New Generation Devices: Next-generation mechanical thrombectomy devices have enormous growth potentials in the marketplace as they are very flexible and improve the efficacy rates of clot retrieval in combination with integral imaging. This improvement on the current technology would promise improved clinical outcomes if successfully addressed by the manufacturers to augment their competitive market positions by responding better than the rest to physician/clinician needs.

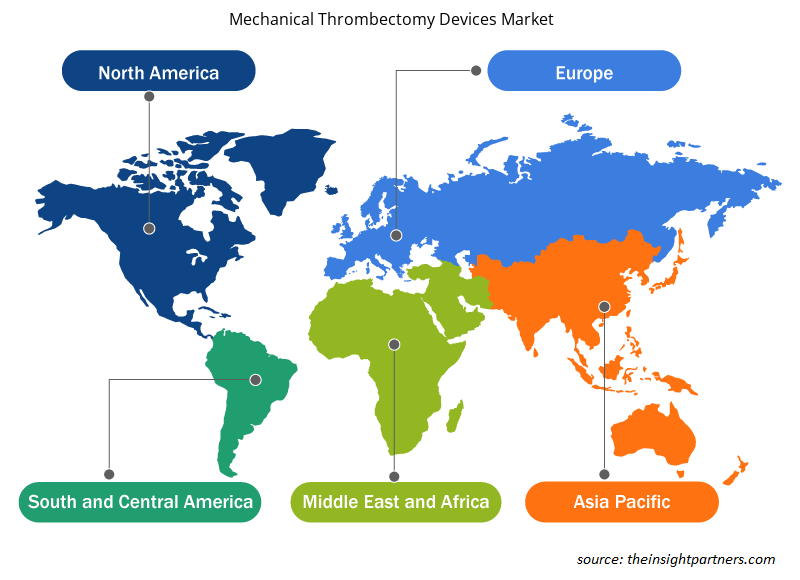

Mechanical Thrombectomy Devices Market Regional Insights

The regional trends and factors influencing the Mechanical Thrombectomy Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mechanical Thrombectomy Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mechanical Thrombectomy Devices Market

Mechanical Thrombectomy Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 6.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

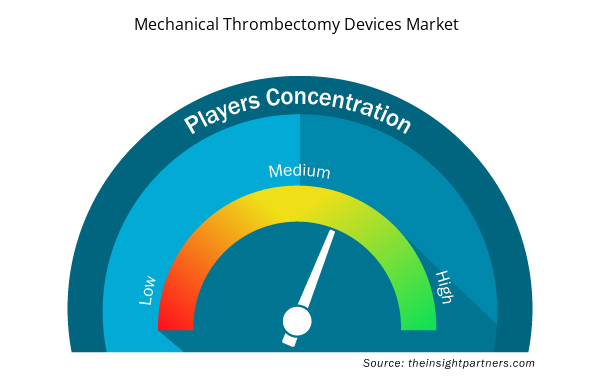

Mechanical Thrombectomy Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Mechanical Thrombectomy Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mechanical Thrombectomy Devices Market are:

- Stryker

- Boston Scientific

- Medtronic

- Terumo

- Johnson & Johnson

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mechanical Thrombectomy Devices Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Mechanical Thrombectomy Devices Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Mechanical Thrombectomy Devices Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to grow at a CAGR of 6.4%

Striking on Increasing Cases of Strokeis the major factors boosting the Mechanical Thrombectomy Devices Market growth

Stryker, Boston Scientific, Medtronic, Terumo, Johnson & Johnson are the major companies operating in the Mechanical Thrombectomy Devices Market

Asia Pacific is estimated to grow at the highest CAGR over the forecast year (2023 - 2031)

The final report will duly include market size and projection estimates for all the segments from 2021 to 2031, along with a revenue share and compound annual growth rate (%) for the regional

/

country-wise market wherein 2021-2022 are the historic years, 2023 is considered to be the base year, and the forecast will be provided till 2031, along with CAGR (%)

The North America region accounts for highest revenue share Mechanical Thrombectomy Devices Market ?

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Stryker

- Boston Scientific

- Medtronic

- Terumo

- Johnson & Johnson

- Penumbra

- Spectranetics

- Teleflex

- Argon Medical Devices

- Edwards Lifesciences

Get Free Sample For

Get Free Sample For