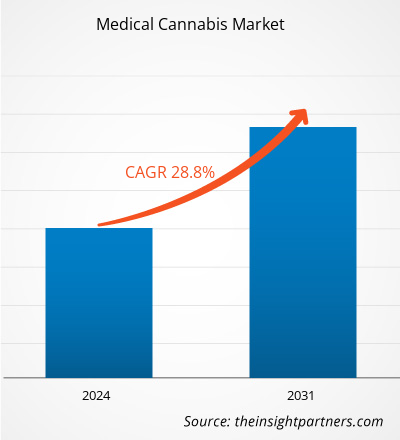

The medical cannabis market size is projected to reach US$ 97.20 billion by 2031 from US$ 16.56 billion in 2023. The market is expected to register a CAGR of 28.8% during 2023–2031. Lifestyle changes will likely remain a key trend in the market.

Medical Cannabis Market Analysis

The increasing number of approvals for medical cannabis products, rising acceptance for medicinal use of Cannabis in developing countries, growing research on medicinal use of Cannabis, and escalating government funding for spreading awareness and exploring medicinal benefits of Cannabis are the key driving factors behind the market development. Furthermore, the growing demand for Cannabis during COVID-19 is a crucial opportunity for the medical cannabis market players.

Medical Cannabis Market Overview

The medicinal potential of Cannabis has attracted various researchers and companies to use Cannabis in medical applications. For instance, tetrahydrocannabinol (THC) is predominantly being used for producing medicinal products. The US Food and Drug Administration (FDA) has approved THC-based medicinal products such as nabilone (Cesamet) and dronabinol (Marinol) that are prescribed for the treatment of nausea in patients receiving chemotherapy; these drugs are also prescribed to stimulate appetite in patients with wasting syndrome developed as one of the indications in AIDS. Similarly, various marijuana-based products have been approved or are in clinical trials. For instance, nabiximols (Sativex) is an approved drug that has been commercialized in Canada, and the UK and a few European countries. Nabiximols is a cannabis extract used to treat spasticity and neuropathic pain related to multiple sclerosis. It is formulated with a combination of THC and other cannabidiol (CBD). In February 2020, CanaQuest Medical Corp, a Canadian company, applied for approval to produce and commercialize Mentabinol for Health Canada. Mentabinol is a THC-based product, and its approval application has been filed under the Cannabis Act.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Cannabis Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Cannabis Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Cannabis Market Drivers and Opportunities

Growing Research on Medicinal Use of Cannabis

With the legalization of Cannabis in many European countries, cannabis producers are increasingly emphasizing on coming up with quick and accurate means to determine the quality and potency of their products. The use of Cannabis is propelling the demand for efficient cannabis testing processes, which has been boosting research activities in the region. The parliament of the European Union (EU) is aiming to propose an EU-wide policy for medical Cannabis, based on well-funded scientific research; the Members of the European Parliament (MEPs) resolved the medicinal use of Cannabis in February 2019, with a main purpose to make a clear distinction between medical and other uses of these plants. However, no EU country authorizes the smoking or home-growing of Cannabis for medicinal purposes. At the same time, the WHO has made an official recommendation to deny the classification of CBD as a controlled substance. Nevertheless, the EU has no universal rules for the medical or recreational use of Cannabis in the region. Cannabis or cannabinoids help stimulate appetite and alleviate mental disorders such as epilepsy, asthma, cancer, and Alzheimer's; however, more research is needed in these fields. The primary objective of the European Parliament is to address research gaps in medical Cannabis in the region and to promote seizing of the potential of cannabis-based medicines in their member states.

Growing Demand for Cannabis During COVID-19

As per the Worldometer data, the global count of COVID-19 cases has reached ~138 million, with a total death count of 2.9 million, as of April 15, 2021. Researchers are exploring numerous possible treatment options, including existing drugs. Researchers are looking into numerous options for possible treatment, including existing drugs. They have found that medical Cannabis can be used in the treatment of COVID-19. According to Medical Cannabis Network, by HEALTH EUROPA, “researchers at the University of Miami would be conducting an anonymous survey to obtain from medical cannabis patients regarding their mental health and physical health, as well as examining changes in patient’s frequency of use of cannabis, dosage, and route of administration based on COVID-19-related closures and updates.” Further, as per an article posted by the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA) in May 2020, Cannazon, a market devoted to cannabis products, sold cannabis worth ~US$ 4.83 million (EUR 4.3 million) from January 2020 to March 2020, representing 1.6 metric tons of Cannabis, in terms of volume. Thus, the rising urge to control the COVID-19 pandemic is boosting the demand for medical Cannabis, thereby providing opportunity for the medical cannabis market players.

Medical Cannabis Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical cannabis market analysis are type, delivery, and application.

- Based on product type, the medical cannabis market is segmented into flowers, concentrates, tablets, cannabis oil and topical ointments, capsules, and beverages and edibles. The flowers segment held a most significant market share in 2023.

- Based on medical application, the medical cannabis market is segmented into pain management, neurological health management, mental health management, and others. The pain management segment held a most significant market share in 2023.

- Based on medical compound, the medical cannabis market is segmented by Tetrahydrocannabinol (THC)-Dominant, Cannabidiol (CBD)-Dominant, and Balanced THC and CBD. The Tetrahydrocannabinol (THC)-Dominant segment held a largest market share in 2023.

Medical Cannabis Market Share Analysis by Geography

The geographic scope of the medical cannabis market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In North America, the US medical cannabis market holds the region's largest share. The US is the largest and fastest-growing country in the North American region for the medical cannabis market. US is dominating the medical cannabis market due to legalization and appeal of Cannabis products. The growth of this market is primarily driven by public awareness regarding to medical Cannabis, increasing number of research and collaboration to explore innovative therapeutic applications, In addition, Legalization of medical Cannabis, along with public and private awareness programs, will fuel the growth of market. For instance, Medical Cannabis is legalized in 36 states in the US for medical use of Cannabis.

According to the recent research on Cannabis of the American Cancer Society, the study of patients with advanced cancer with pain refractory to opioids found that patients receiving low and medium doses of Cannabis reported improved analgesia compared with placebo and experimentally helped to release the chronic pain of patients. The growth of the U.S. legal Cannabis industry, valued at $13.6 billion in 2019, generated nearly 340,000 jobs devoted to handling plants, according to the Economics of cannabis trade.

Medical Cannabis Market Regional Insights

The regional trends and factors influencing the Medical Cannabis Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Cannabis Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Cannabis Market

Medical Cannabis Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 16.56 Billion |

| Market Size by 2031 | US$ 97.20 Billion |

| Global CAGR (2023 - 2031) | 28.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

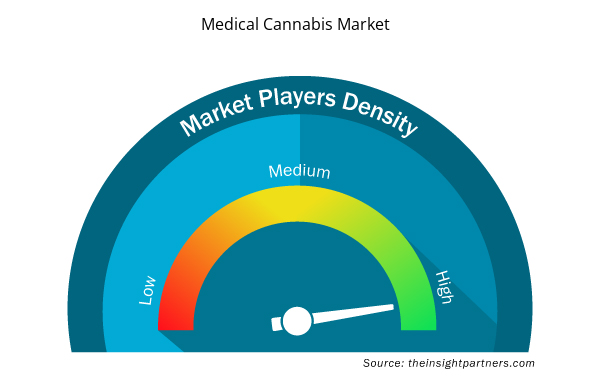

Medical Cannabis Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Cannabis Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Cannabis Market are:

- Aphria, Inc.

- Aurora Cannabis

- Cannabis Science, Inc

- Canopy Growth Corporation

- Medical Marijuana, Inc.

- VIVO Cannabis Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Cannabis Market top key players overview

Medical Cannabis Market News and Recent Developments

The Medical Cannabis Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the medical cannabis market are listed below:

- Tilray Medical, a division of Tilray Brands, Inc. ("Tilray Brands") (NASDAQ: TLRY and TSX: TLRY) and a global leader in medical Cannabis, empowering the therapeutic alliance between patients and healthcare practitioners to make informed individualized health decisions, thereby transforming healthcare, today announced the launch of Broken Coast EU-GMP certified medical cannabis products in Australia. (Source: Tilray Medical., Company Website, June 2024)

Medical Cannabis Market Report Coverage and Deliverables

The “Medical Cannabis Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Parenteral nutrition market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Parenteral nutrition market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Parenteral nutrition market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the medical cannabis market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Medical Application, Compound

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 28.8% during 2023–2031.

Widespread Distribution of Medical Cannabis will likely remain a key trend in the market.

Aphria, Inc., Aurora Cannabis, Cannabis Science, Inc, Canopy Growth Corporation, Medical Marijuana, Inc., VIVO Cannabis Inc, Tikun Olam, Tilray, The Cronos Group, Canvory.

Key factors driving the growth of the market are increasing number of approvals for medical cannabis products, rising acceptance for medicinal use of Cannabis in developing countries, growing research on medicinal use of Cannabis, and escalating government funding for spreading awareness and exploring medicinal benefits of Cannabis.

North America dominated the medical cannabis market in 2023

Get Free Sample For

Get Free Sample For