Medical Courier Market Growth and Forecast by 2030

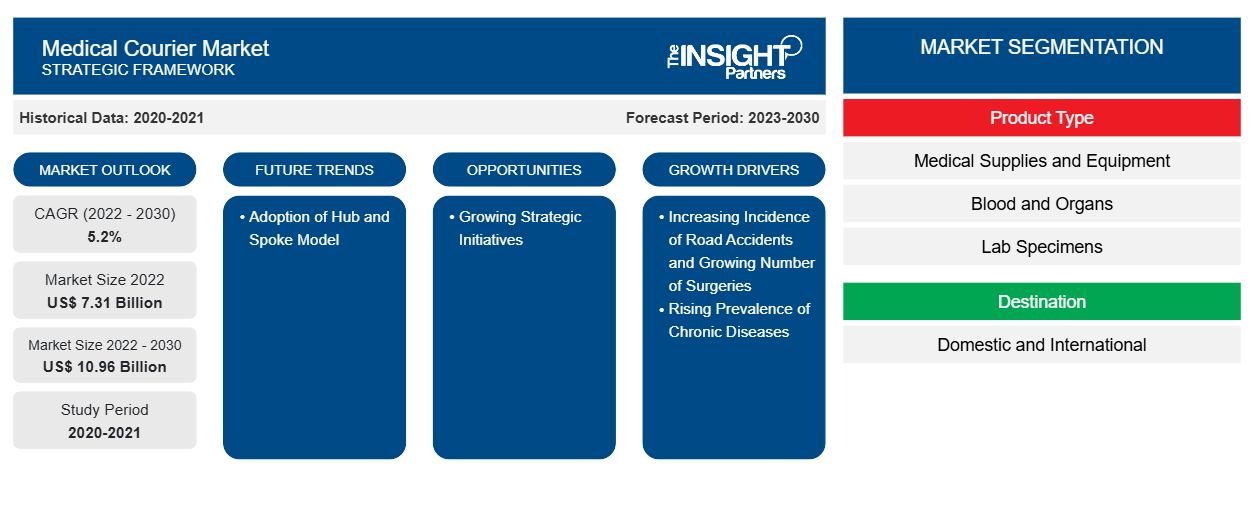

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030Medical Courier Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Medical Supplies and Equipment, Blood and Organs, Lab Specimens, Medical Notes, and Others), Destination (Domestic and International), Service (Standard Service and Rush and On-Demand Services), End Users (Hospital and Clinics, Diagnostic Labs, Blood and Tissue Banks, Pharmacy, In Home Support, Pharmaceutical and Biotechnology Companies, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

- Report Date : Sep 2023

- Report Code : TIPRE00014429

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 179

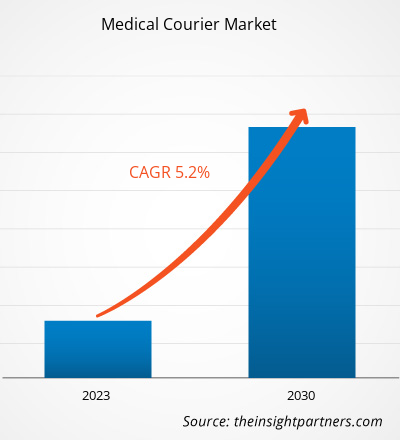

[Research Report] The medical courier market size was valued at US$ 7,305.20 million in 2022 and is expected to reach US$ 10,964.43 million by 2030. It is estimated to register a CAGR of 5.2% during 2022–2030.

Market Insights and Analyst View:

The medical courier market size is growing rapidly due to the increasing number of medical courier; growing need for medical samples, transportation of blood and blood samples in emergency cases; and high inclination toward home delivery of medicines.

Extensive advancements are occurring in the field of medicine, especially in diagnostic laboratory services, and revolutionary techniques are being discovered at a regular pace, attracting a substantial number of people to work in this sector, subsequently pushing the diagnostic laboratory services market to gain boundless growth. Many people are gradually getting aware of the immense benefits offered by quality diagnostic services when it comes to understanding and treating particular ailments. Due to this increase, there is increase in the number of sample analyzed in these laboratories, which require timely delivery of samples and reports. Thus, the development of diagnostic laboratories and increase in its number globally are factors fueling the market growth.

Growth Drivers and Challenges:

According to International Diabetes Federation, 2021, 1 in 11 adults have diabetes, i.e., 61 million. Europe has the highest number of children and adults with type 1 diabetes, i.e., 295,000. The top 5 countries for age-adjusted prevalence of people with diabetes (20–79 years) are Turkey, Spain, Andorra, Portugal, and Serbia.

As per a white paper by Economist Impact, funded and initiated by AstraZeneca, chronic kidney disease (CKD) affects about 1 in 10 adults across Europe. An estimated, 100 million people in Europe are living with this long-term, progressive disease, and a further 300 million individuals will be at risk in 2023. According to CDC, in 2023, ~35.5 million people, i.e. ~14% of the total population, in the US are living with CKD.

Prostate cancer (PCa) is one of the most common non-cutaneous cancers in men. It is anticipated to exhibit declining mortality in the European Union (EU) due to various recent improvements in treatment. The incidence of PCa in Europe is high compared to other geographical areas such as Africa or Asia due to comparably high rates of prostate-specific antigen (PSA) screening, which were reported to be increasing in Eastern and Southern Europe. A biopsy helps in cancer detection in which a small amount of tissue from the area of the body where cancer may be present is taken, and that tissue is sent to a laboratory.

Thus, the increasing cases of chronic diseases such as diabetes, CKD, and cancer globally is simultaneously propelling the demand for medical supplies and positively influencing the medical courier market growth.

Delays in delivering consignments might cause a courier company to lose its clientele. It can also increase the overall shipping cost, resulting in customer dissatisfaction and a high return to origin (RTO) rate. For instance, in September 2021, General practitioners (GPs) across the UK faced a two-week delay in flu jab deliveries due to the shortage of truck drivers. Seqirus (the largest supplier of influenza vaccines in the UK) told that the deliveries of jabs were disrupted due to "unforeseen challenges linked with road freight delays." Following the disruption, GPs across England and Wales were advised to reschedule their appointments. An apparent exodus of truck drivers from the UK, who returned to EU during the COVID-19 pandemic and remained there, has been blamed for disruption in sectors of the economy. Thus, a lack of skilled truck drivers in the country is the primary factor leading to delays in deliveries, which, in turn, hinder market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Courier Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The medical courier market share is divided on the basis of product type, destination, service, end user, and geography. The medical courier market, by product type, is segmented into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical courier market, by destination, is segmented into domestic and international. The medical courier market, by service, is bifurcated into standard services, and rush and on-demand services. The medical courier market, by end user, is segmented into hospitals and clinics, diagnostic labs, pharmaceutical and biotechnology companies, blood and tissue banks, in-home support, and others. The medical courier market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (France, Germany, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, India, Japan, South Korea, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on product type, the medical courier market is segmented into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical supplies and equipment segment held the largest share of the market in 2022. The lab specimens segment is anticipated to register the highest CAGR in the market during 2022–2030. Products including consumables, accessories, and many more are essential medical supplies that a healthcare facility center requires repeatedly. These medical supplies need refilling the stock at a healthcare facility center every few days. Therefore, the need for courier services is more in the country. For equipment, courier services are limitedly opted (while setting up the healthcare facility center or at the time of replacement due to damage or replacing old equipment with hi-tech equipment). However, the medical courier market for this segment is expected to grow faster as the demand for medical supplies is expanding every day. In addition, the country will likely experience increasing number of hospitals and other healthcare facility centers. According to the Department of Health and Social Care's announcement in October 2020, the UK government has confirmed funding of US$ 3 billion (£3.7 billion) to build 40 hospitals and eight schemes to offer funding to deliver 48 hospitals by 2030. Therefore, it is expected that the demand will grow for hi-tech equipment and advanced medical supplies from other countries worldwide simultaneously increasing the demand for courier services in the country.

Many labs and medical facilities have in-house delivery services to handle lab specimens. However, many labs and medical facility centers outsource medical logistics services offered by independent shipping and delivery companies. Lab specimens are critical products that need a temperature-controlled environment. While transporting lab specimens, it is essential to ensure safe and compliant collection, pickup, and delivery. Various guidelines are published by regulatory bodies in countries such as the UK for the safe transport of lab specimens. According to the Oxford University Hospitals NHS Foundation Trust data published in January 2023, over three-quarters of all medical diagnosis rely on laboratory diagnostics, and the NHS performs more than 6.5 million tests each year. Many diagnostic tests are done on blood, urine, or other body fluids or tissue samples. Among these samples, a few are routinely performed, and some require diagnostic tests that are rare and complex. Therefore, the tests needing transportation services are outsourced to advanced, hi-tech laboratories.

The medical courier market, by destination, is segmented into domestic and international. The domestic segment held a larger market share in 2022 and the international segment is anticipated to register a higher CAGR during 2022–2030. Increasing e-commerce companies have resulted in rising the number of logistics companies in the country. Companies such as DHL Group; United Parcel Services of America, Inc.; FedEx Corporation; Hermes; Royal Mail; Yodel; DTDC; UPS; Agility; and UK Mail offer international services for medical couriers and non-medical couriers. Various other companies provide courier services through freight services, which has increased international courier services globally for medical products. The medical courier market, by service, is bifurcated into standard services and rush and on-demand services. The standard services segment held a larger market share in 2022 and the rush and on-demand services segment is anticipated to register a higher CAGR during 2022–2030. The medical courier market, by end user, is segmented into hospitals and clinics, diagnostic labs, pharmaceutical and biotechnology companies, blood and tissue banks, in-home support, and others. The hospitals and clinics segment held the largest share of the market in 2022 and the in-home support segment is anticipated to register the highest CAGR in the market during 2022–2030.

Regional Analysis:

Based on geography, the medical courier market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is the largest contributor to the growth of the market, and Asia Pacific is the fastest-growing region. The medical courier market in North America is segmented into the US, Canada, and Mexico. In 2022, the US held the largest market share in this region and is expected to continue its dominance during the forecast period. The projected growth of the medical courier market in North America is attributed to the increasing number of organ transplant surgeries owing to a rise in the number of organ failure cases such as kidney, liver, and heart. The rise in organ failure cases can be associated with a surge in the prevalence of chronic diseases related to the heart, kidney, and liver, which fuels the demand for organ transplants. According to the Organ Procurement & Transplantation Network, more than 42,800 organ transplants were performed in the US in 2022, reporting an annual increase of ~3.7%. According to the Canadian Institute of Health Information (CIHI), ~2,750 organ transplantations were carried out in Canada in 2021. Data published by the National Institutes of Health (NIH) states that ~8,500 transplantation procedures, including cornea, kidney, liver, and heart, were performed in Mexico from March 2019 to February 2021. During organ transplants, there may be a necessity to transfer the organ from one hospital to another. Medical courier businesses provide services to transport these organs on time in proper storage conditions.

Medical courier service providers adopt vital patient care procedures, and ensure the prompt and efficient transportation of records, reports, medical supplies, and laboratory supplies. According to the US Bureau of Labor Statistics, ~18,000 employees—approximately 4.5% of the total courier industry employment—were employed in the medical industry in the US in 2022. The increasing employment in the medical courier industry due to the growing demand for samples and medicines for overall treatment is fueling the growth of the market. Further, the ongoing technological advancements in healthcare facilities are likely to benefit the medical courier market in North America during the forecast period. In 2020, UPS Flight Forward and CVS partnered to deliver prescription medicines from CVS pharmacy stores to The Villages, Florida, the largest retired people’s community in the US, which is home to more than 135,000 residents.

Medical Courier Market Regional InsightsThe regional trends and factors influencing the Medical Courier Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Medical Courier Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Medical Courier Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.31 Billion |

| Market Size by 2030 | US$ 10.96 Billion |

| Global CAGR (2022 - 2030) | 5.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Courier Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Courier Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Medical Courier Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives by key players operating in the Medical Courier Market are listed below:

- In January 2023, UPS Supply Chain Solutions (SCS) opened of its new facility in Madrid, ES. The brand-new 6500 sqm premises will be a main distribution point for the Iberian Peninsula. The Madrid facility is the 4th UPS SCS to open in 2022, which also saw the unveiling of a new building in Roermon; selected for its central location and ground, ocean, rail, and air connections, these premises will also house the first UPS SCS Innovation Centre in Europe.

- In February 2023, ERS Medical merged with E-zec to expand their breadth of service expertise. The merger will create opportunities for both companies by combining operational best practice, expertise and high standards. The expanded business is expected to enlarge their business through delivering further opportunities for their employees, customers. In addition, the merger will be a better support for those who need the services most in the communities.

Competitive Landscape and Key Companies:

A few prominent players operating in the medical courier market are ERS Transition Ltd, Send Direct Ltd, Med Logistics Grp, Citysprint Ltd, United Parcel Services, FedEx Corp, MNX Global Logistics, Reliant Couriers & Haulage Ltd, ZIPLINE International Inc, and Deutsche Post AG. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

Frequently Asked Questions

What is the regional market scenario of the medical courier market?

Which segment is dominating the medical courier market?

Who are the major players in the medical courier market?

What are the driving factors for the medical courier market?

What is medical courier?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For