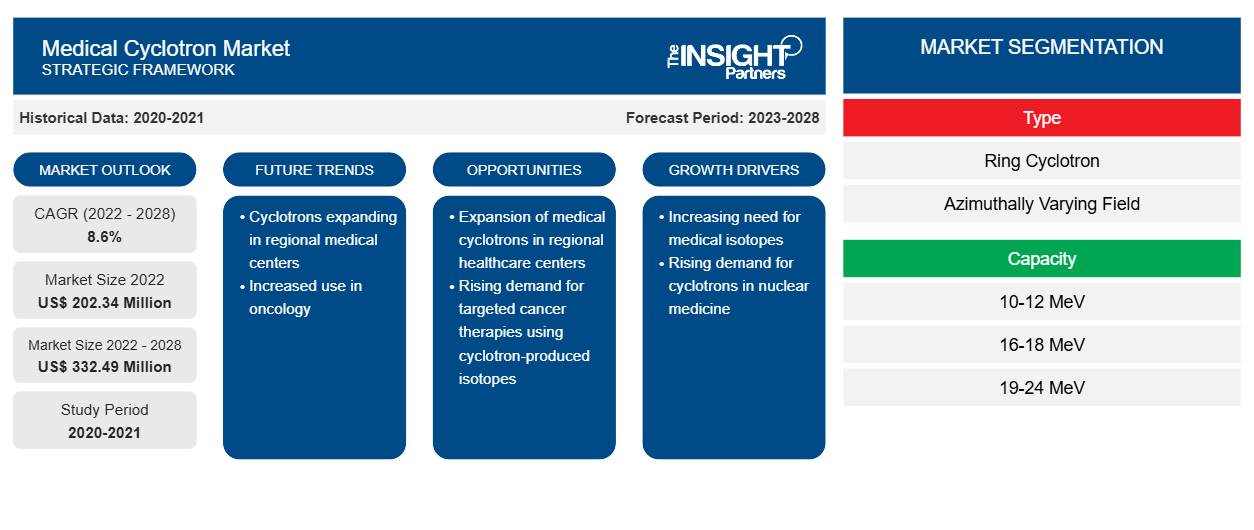

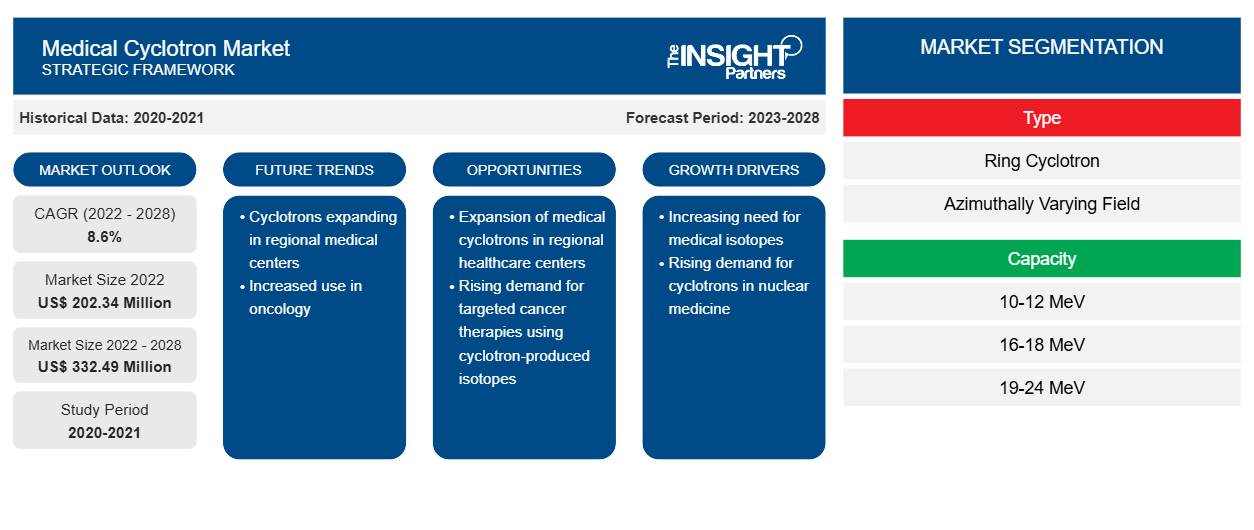

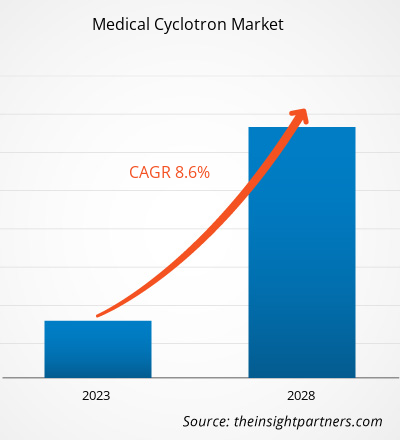

The medical cyclotron market is expected to grow from US$ 202.34 million in 2022 to US$ 332.49 million by 2028; it is estimated to grow at a CAGR of 8.6% from 2022 to 2028.

A cyclotron is a particle accelerator and is an electrically powered machine that produces a beam of charged particles used for industrial, research, and medical purposes. In medical applications, cyclotrons produce beams that are used to manufacture radioisotopes for medical imaging. Various medical cyclotrons are being used to produce Single-Photon Emission Computerized Tomography (SPECT) and Positron Emission Tomography (PET) isotopes used for therapeutic and other medical applications. Cyclotrons can be used in particle therapy to treat cancer with the help of ion beams that can penetrate the body and kill the tumors with the help of radiation. The increasing prevalence of cancer and growing inclination toward nuclear scans for accurate diagnosis is contributing to the growth of the medical cyclotron market

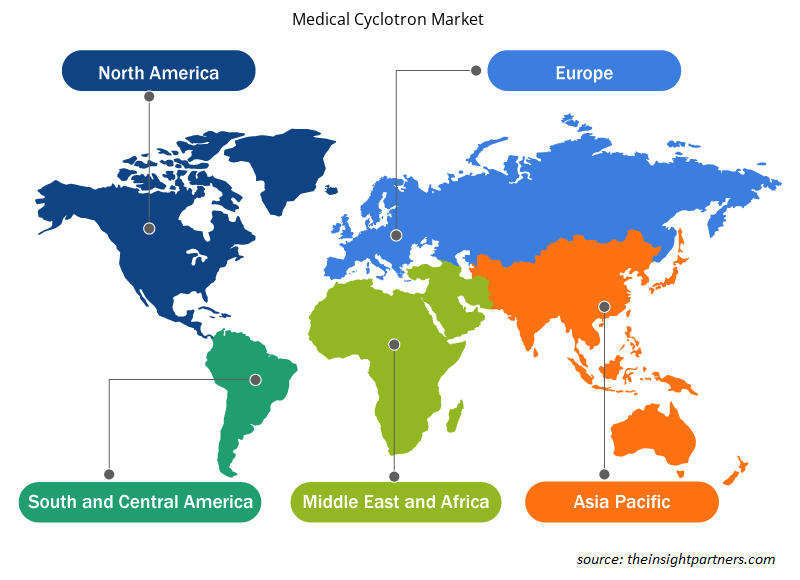

The medical cyclotron market is segmented based on type, capacity, end user, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The medical cyclotron market report offers insights and in-depth analysis of the market, emphasizing market trends, technological advancements, market dynamics, and the competitive analysis of the globally leading market players.

Market Insights

Increasing Prevalence of Cancer to Drive Medical Cyclotron Market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Cyclotron Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Cyclotron Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cyclotron therapy is commonly used to treat various types of cancer. The prevalence of cancer is increasing every year. According to the World Health Organization (WHO), cancer is the leading cause of death worldwide. Further, as per its estimates, in 2020, cancer was a cause of 10 million deaths worldwide. It also reported that about one in six deaths globally occurred due to cancer. Hence, the increasing prevalence of cancer is supporting the growth of the medical cyclotron market.

Type Insights

Based on type, the global medical cyclotron market is segmented into ring cyclotron and azimuthally varying fields (AVF). The ring cyclotron segment will hold the largest share of the market in 2022 and is estimated to register the highest CAGR during 2022–2028. Ring cyclotron is used for proton therapy; it utilizes high-energy beams of accelerated protons to treat cancer. Proton therapy targets only cancerous cells and maintains the biological property of other cells. Therefore, it is increasing the demand for ring cyclotrons in medical applications. Also, the growing incidence of cancer worldwide is influencing the market's growth.

Capacity Insights

Based on capacity, the global medical cyclotron market is segmented into 10-12 MeV, 16-18 MeV, 19-24 MeV, and 24 MeV and above. In 2022, the 16-18 MeV suppression segment hold the largest market share; it is expected to register the highest CAGR during 2022–2028. Due to its compact size, it utilizes small space and is installed easily and quickly. The 16-18 MeV range is generally used to produce an 18F-Fluoride radio particle. These are also accounted for as compact medical cyclotrons with self-shielding to reduce neutron fluxes. Hence, these reasons are likely to boost the segment growth during the forecast period.

Product launches and mergers and acquisitions are highly adopted strategies by the global medical cyclotron market players. A few of the recent key market developments are listed below:

In January 2022, IBA announced that it had launched a new low energy and compact size cyclotron, the Cyclone KEY. The new machine will enable small and medium-sized hospitals to produce their radiopharmaceutical products in-house while providing more widespread global access to diagnostic solutions in oncology, neurology, and cardiology.

In August 2020, The German health company Siemens Healthineers acquired Varian Medical Systems Inc. in an agreement that values the U.S. manufacturer of cancer treatment equipment and software at $16.4 billion.

The companies engaged in the medical cyclotron market witnessed an adverse impact on their services in early 2020 due to the temporary shutdown of their laboratories. Supply chain and manufacturing activities have been disrupted globally due to lockdowns implemented by governments, restricted movement, and other COVID-19 safety precautions. According to the data by the International Atomic Energy Agency (IAEA) survey in April 2020, the production of medical radioisotopes continued during the COVID-19 pandemic as facilities in medical radioisotopes were considered essential service by the government. However, COVID-19 restrictions led to the disruption of transportation and distribution of these medical radioisotopes, which hampered the medical cyclotron market during the COVID-19 pandemic.

Medical Cyclotron– Market Segmentation

The global medical cyclotron market is segmented based on type, capacity, end user, and geography. Based on type, the market is segmented into ring cyclotron and azimuthally varying field (AVF). Based on capacity, the market is segmented into 10-12 MeV, 16-18 MeV, 19-24 MeV, and 24 MeV and above. Based on end user, the market is bifurcated into hospitals, specialized clinics, pharmaceutical companies, and other end users. By geography, the medical cyclotron market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Medical Cyclotron Market Regional Insights

Medical Cyclotron Market Regional Insights

The regional trends and factors influencing the Medical Cyclotron Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Cyclotron Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Cyclotron Market

Medical Cyclotron Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 202.34 Million |

| Market Size by 2028 | US$ 332.49 Million |

| Global CAGR (2022 - 2028) | 8.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Medical Cyclotron Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Cyclotron Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Cyclotron Market are:

- General Electric Company

- Best ABT Molecular Imaging, Inc.

- IBA

- Sumitomo Heavy Industries, Ltd.

- Siemens AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Cyclotron Market top key players overview

Company Profiles

- General Electric Company

- Best ABT Molecular Imaging, Inc.

- IBA

- Sumitomo Heavy Industries, Ltd.

- Siemens AG

- Advanced Cyclotron Systems

- ISOSOLUTION

- ALCEN

- IONETIX Corporation

- Best Cyclotron System, Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Transdermal Drug Delivery System Market

- Pharmacovigilance and Drug Safety Software Market

- Animal Genetics Market

- E-Bike Market

- Bathroom Vanities Market

- Asset Integrity Management Market

- Space Situational Awareness (SSA) Market

- Mobile Phone Insurance Market

- Integrated Platform Management System Market

- Digital Language Learning Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Capacity, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global Medical Cyclotron market based on type, is bifurcated into ring cyclotron and azimuthally varying fields (AVF). The ring cyclotron segment held the largest share of the market in 2022. The segment is estimated to register the highest CAGR of 9.1% during the forecast period.

The increasing acceptance of medical accelerators for cancer treatment and diagnosis is emerging as a prominent trend in the medical cyclotron market. With the mounting awareness related to cancer prevention, the number of radiation scans is also on the rise. The escalating demand for nuclear scans from 2022 to 2021 drove the medical cyclotron market growth. The demand for nuclear scans is due to the increasing incidences and prevalence of cancer, heart disease, gastrointestinal, endocrine, and neurological disorders. Such diseases are diagnosed in comparatively early stages by nuclear imaging equipment and other equipment. For instance, as per the American Cancer Society 2020, 1.8 million new cancer cases were diagnosed, and 606,520 cancer deaths were witnessed in the US, many of which were diagnosed by nuclear imaging devices. With this escalating demand, these innovations are likely to make rapid progress in the medical diagnostics industry. Furthermore, the demand for medical cyclotrons is expected to rise in the future.

The factors that are driving and restraining factors that will affect the Medical Cyclotron market in the coming years. Factors such as the rising prevalence of cancer and growing inclination toward nuclear scans for accurate diagnosis characterizes the growth of the market. However, high cost of procedures and lack of expertise is hindering the medical cyclotron market growth.

The Medical Cyclotron market majorly consists of the players such as General Electric Company, Best ABT Molecular Imaging, Inc., IBA, Sumitomo Heavy Industries, Ltd., Siemens AG, Advanced Cyclotron Systems, ISOSOLUTION, ALCEN, IONETIX Corporation, and Best Cyclotron System, Inc.

A cyclotron is a particle accelerator. It is an electrically powered machine that produces beam of charged particles used for industrial, research and medical purposes. In medical applications, cyclotrons produce beams that are used to manufacture radioisotopes for the purpose of medical imaging. Various medical cyclotrons are being used for the production of SPECT and Positron Emission Tomography (PET) isotopes used for therapeutic as well as other medical applications. Cyclotrons can be used in particle therapy to treat cancer with the help of ion beams that can penetrate the body and kill the tumors with the help of radiation.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Medical Cyclotron Market

- General Electric Company

- Best ABT Molecular Imaging, Inc.

- IBA

- Sumitomo Heavy Industries, Ltd.

- Siemens AG

- Advanced Cyclotron Systems

- ISOSOLUTION

- ALCEN

- IONETIX Corporation

- Best Cyclotron System, Inc.

Get Free Sample For

Get Free Sample For