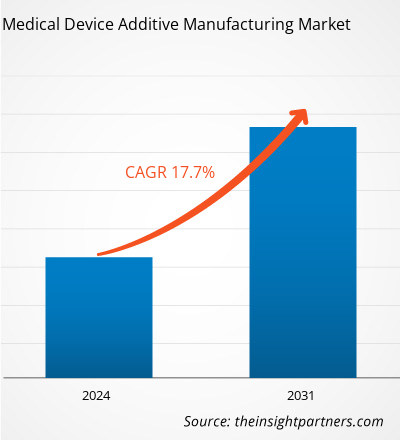

The medical device additive manufacturing market size is projected to reach US$ 25.62 billion by 2031 from US$ 6.93 billion in 2023. The market is expected to register a CAGR of 17.7% during 2023–2031. The development of novel medical devices using CAD-CAM and 3D printing and the demand for personalized medicine are likely to remain key trends in the market.

Medical Device Additive Manufacturing Market Analysis

The additive manufacturing (AM) method, also known as 3D printing, has the potential to produce innovative medical devices and instrumentation, including orthoses, prostheses, medical models, inert implants, and biomanufacturing. AM allows companies to provide extensive customization based on individual patient requirements for medical applications by saving time and reducing the wastage of raw materials. The technique helps overcome the constraints of conventional manufacturing methods—mainly associated with mass customization, fabrication, milling, casting, forging, and so on. Additionally, recent advancements in biomaterials catalyze the clinical implications of healthcare products using AM technology.

Medical Device Additive Manufacturing Market Overview

As highlighted by the AM3D Printing annual medical report by A. S. of Mechanical Engineers (ASME), material extrusion was found to be the most popular category with 55% usage in 2022, followed by vat photopolymerization with 57% and powder bed fusion with 51% acceptance rate. The rest of the processes had a shorter contribution in the medical sector. The US Food and Drug Administration (FDA) encourages the utilization of advanced technologies, including medical device additive manufacturing, to yield better outputs. For instance, in June 2023, the FDA established an additive manufacturing lab to enhance its readiness to handle medical device issues during premarket and post market stages. Therefore, the increasing investments in life science research and medical device technology by the government and private sectors favor medical device additives manufacturing market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Additive Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Additive Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Device Additive Manufacturing Market Drivers and Opportunities

Mounting Demand for Additive Manufacturing in Orthopedics and Dental Sectors to Favor Market

Permanent orthopedic implants such as joint replacements for the knee, hip, or wrist or some of the temporary fixation devices such as plates, pins, screws, and wires can be inserted into the body to let fractured bones heal within a short period. These devices are designed using AM technologies and offer advantages such as choice of customization, option for appropriate and wide range of materials, and the ability to design complex shapes and structures. Propelling incidences of orthopedic interventions and endodontic operations are significant drivers of medical device additive manufacturing market share.

Demand for Personalized Medicine

The healthcare industry is increasingly focused on achieving better patient outcomes through personalized medical devices that match each patient's anatomy or physiology. Examples include orthopedic implants and prosthetic leg sockets. Personalized medical devices offer several advantages, including reducing the cost of care, improving functionality and aesthetics, and increasing load distribution. Advanced technologies such as additive manufacturing and medical imaging can support the design and manufacturing. As per an article published by the MDPI Journals in April 2022, tailoring drug doses, dosage forms, and drug release adjustments to individual patients can optimize their therapy. Extrusion-based 3D printing techniques, such as fused filament fabrication (FFF) and semi-solid extrusion (SSE), are versatile, precise, feasible, and cost-effective. Hence, AM technology is seen to have a positive impact on the market, as it has an opportunity to customize medical devices to cater to the specific needs of the patients.

Medical Device Additive Manufacturing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical device additive manufacturing market analysis are technology, product, and application.

- The medical device additive manufacturing market is segmented based on technology into laser sintering, electron beam melting, stereolithography, and extrusion. The laser sintering segment held the largest market share in 2023.

- By product, the market is segmented into surgical guides, surgical instruments, implants & prosthetics, tissue engineering, and other products. The surgical instruments segment held the largest share of the market in 2023.

- By application, the market is segmented into dental, orthopedic, bioengineering, and craniomaxillofacial. The orthopedic segment held a significant share of the market in 2023.

Medical Device Additive Manufacturing Market Share Analysis by Geography

The geographic scope of the medical device additive manufacturing market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. Asia Pacific is expected to grow with the highest CAGR in the coming years.

The medical device additive manufacturing market in North America is analyzed based on the three major countries: the US, Canada, and Mexico. The US is estimated to have a larger share of the North America medical device additive manufacturing market in 2023. The growth in this region is characterized by increased demand for customized devices and advancements in medical device technologies supported by many investors and government funding.

Moreover, increasing focus on advanced method incorporation in healthcare, government, and private initiatives for the promotion of early disease diagnosis and increasing focus toward research in customized medical devices is further expected to stimulate the growth and contribute to exceptional revenue generation for the medical device additive manufacturing market in North America.

Medical Device Additive Manufacturing Market Regional Insights

The regional trends and factors influencing the Medical Device Additive Manufacturing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Device Additive Manufacturing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Device Additive Manufacturing Market

Medical Device Additive Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.93 Billion |

| Market Size by 2031 | US$ 25.62 Billion |

| Global CAGR (2023 - 2031) | 17.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

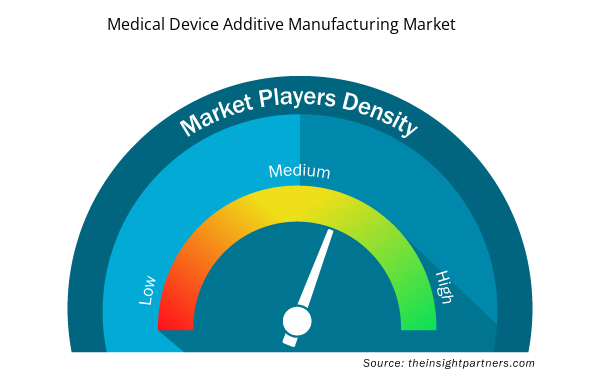

Medical Device Additive Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Device Additive Manufacturing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Device Additive Manufacturing Market are:

- 3D Systems, Inc

- GE Additives

- Materialise NV

- 3T Additive Manufacturing Limited

- Renishaw plc

- Stratasys Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Device Additive Manufacturing Market top key players overview

Medical Device Additive Manufacturing Market News and Recent Developments

The medical device additive manufacturing market is evaluated by gathering qualitative and quantitative data from primary and secondary research, which includes essential corporate publications, association data, and databases. A few of the developments in the medical device additive manufacturing market are listed below:

- Precision ADM, Inc. received approval from Health Canada for its CANSWAB nasopharyngeal swabs, the first Canadian-made COVID-19 testing products. The 3D-printed swabs have been clinically tested and proven to be as effective as traditional flocked swabs. Precision ADM has secured a facility to manufacture and ship hundreds of thousands of CANSWAB nasopharyngeal swabs weekly. (Source: Precision ADM, Inc, Press Release, July 2020)

- Armadillo Additive, a contract manufacturer based in Granbury, Texas, USA, launched a new advanced metal additive manufacturing facility. The facility focuses on precision engineering for the medical device sector. The company has installed a FormUp 350 Laser Beam Powder Bed Fusion (PBF-LB) additive manufacturing machine from AddUp and specializes in producing Ti-6Al-4V Grade 23 titanium products. (Source: Armadillo Additive, Inc., Press Release, February 2024)

Medical Device Additive Manufacturing Market Report Coverage and Deliverables

The “Medical Device Additive Manufacturing Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Medical device additive manufacturing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Medical device additive manufacturing market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Medical device additive manufacturing market analysis covering key market trends, global and regional framework, significant players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the medical device additive manufacturing market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology ; By Product ; and By Application , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the medical device additive manufacturing market in 2023.

Factors Including mounting demand for additive manufacturing in healthcare, recent advancements in biomaterials, rising government funding and product launches by the market players are the driving factors the medical device additive manufacturing market growth.

Development of novel medical devices using CAD-CAM and 3D printing and the demand for personalized medicine are future trends in the market.

3D Systems, Inc; GE Additives; Materialise NV; 3T Additive Manufacturing Limited; Renishaw plc; Stratasys Ltd; Vaupell, Inc; PRECISION ADM INC; EOS Gmbh; and ALLEVI, Inc are some leading players operating in the medical device additive manufacturing market.

The medical device additive manufacturing market is estimated to reach US$ 25.62 billion by 2031.

The medical device additive manufacturing market is anticipated to grow at a CAGR of 17.7% during 2023-2031.

Get Free Sample For

Get Free Sample For