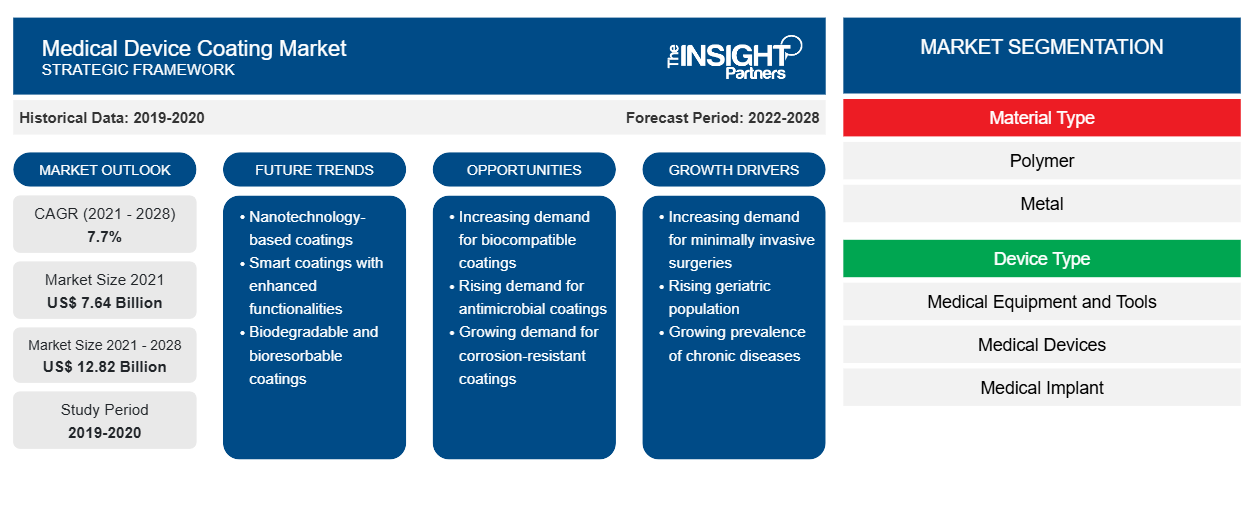

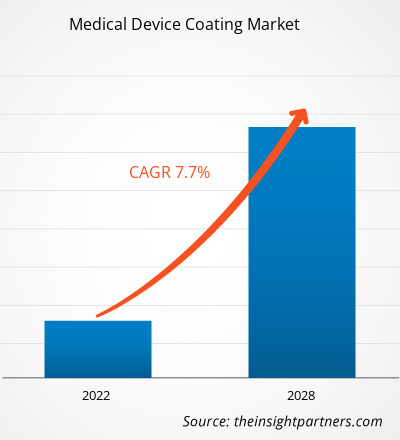

The global medical device coating market was expected to reach US$ 7,644.09 million in 2021 and it is estimated to grow at a CAGR of 7.7% from 2022 to 2028.

Rising demand for coated medical devices intended for surgical and diagnostic procedures drives the medical device coating market growth. Further, rising product launches and product developments would provide lucrative opportunities for the global market during the forecast period.

Medical devices are required for various invasive and minimally invasive surgical and diagnostic procedures including laparoscopy, biopsy, and endoscopy. Laparoscopic ureterolithotomy, a process of removing stones from the ureter, is performed using a laparoscope and catheters. The use of coated medical devices significantly reduces the time taken for cardiac and urinary catheterization. Coatings prevent infections during biopsy, excision, and cryotherapic diagnostic procedures where the contact between medical devices and body is integral. Besides, coated medical devices are significantly cost-effective. According to WHO, an estimated 2 million types of medical devices are categorized into more than 7,000 generic groups.

Disposable medical devices, such as cannulas, blades, anvils, triggers, diagnostic probes, and guide wires, need coatings for anti-infectious procedures and maneuverability improvement. The diagnosis and treatment of abdominal pain, kidney stones, varicose veins, and intestinal infections are increasing, demanding coated medical devices. As per the American Cancer Society, the number of carcinogenic cases is going to hit 27.5 million by 2040 leaping from the previous figure of 17.0 million in 2018. Such rising cases of diseases demanding medical devices for surgical procedures are propelling the growth of the medical device coating market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Coating Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Coating Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The continuous research in medical device development offers new innovative coating varieties. Product innovation and strategic activities by key market players create ample opportunities to step in new application areas. A few product launches and developments in the market are as follows:

- In April 2022, BioInteractions, a UK-based biomaterial company, announced "TridAnt," a coating technology with active and passive components for creating a non-leaching, effective, safe, and durable antimicrobial coating for medical devices and implants.

- In January 2021, LipoCoat launched LipoCoat-enabled contact lenses to develop the first coated catheters in the global market.

- In July 2020, Sahajanand Medical Technologies (SMT) Pvt Ltd signed an agreement with the Italian government for a purchase entity with Consip spa-a society of Economy & Finance Ministry (CONSIP) delivering up to 40,000 biodegradable polymer-coated DES "Supraflex" stents.

- In August 2020, Hydromer partnered with N8 Medical to supply coatings to manufacture CeraShield endotracheal tubes. These tubes play a crucial role in the treatment of COVID-19 patients. This development exhibits the company's active involvement in the medical device coatings market.

- In February 2020, Biocoat launched HYDAK UV. The new version of its original HYDAK coating is designed to be cured using ultraviolet (UV) light. This coating allows for flexible integration with industry-standard UV coating systems.

Thus, the increasing medical device coating product launches and various organic and inorganic developments are expected to provide lucrative opportunities for the medical device coating market growth during the forecast period.

The complications associated with medical device coatings and frequent product recalls limit the overall medical device coating market growth. Medical device coatings are susceptible to peeling, flaking, or shedding, which may be potentially fatal in surgical procedures. According to the Food and Drug Administration (FDA), coating separation, which may include delamination or sloughing off or degradation, may adversely impact clinical performance and result in inflammation at the access site, pulmonary embolization, pulmonary infarct, myocardial embolization, myocardial infarct, embolic stroke, cerebral infarct, tissue necrosis, or death in worst scenarios. Furthermore, various studies published by National Center for Biotechnology Information (NCBI) in 2018, 2020, and 2022 revealed that it is common for the coating material to peel off from medical devices and travel through the bloodstream to areas where plastic particles can cause inflammation or block blood flow to critical organs.

As per FDA safety communication, ~500 medical device reports (MDRs) have listed cases of coatings that peeled, flaked, shed, delaminated, or sloughed off since 2014. Various manufacturers have had major recalls of medical devices due to coating delamination. Covidien (now part of Medtronic) issued a voluntary recall of 650 of its Pipeline embolization devices and Alligator retrieval devices after quality test revealed delamination. In 2019, the US FDA reported that Cook Medical recalled a needle used in heart surgery due to a potentially lethal manufacturing fault reported to be an error related to coatings. Such events highlighting the issues of dislodging and damaging vital organs due to coated devices are hampering the growth of the global medical device coating market.

Regional Overview

China is a well-developed country in Asia Pacific and has a well-established healthcare system. It is one of the leading producers of medical devices in the region. The country has an increasing burden of diseases such as obesity, cardiovascular disorders, and orthopedic disorders owing to the presence of a large geriatric population. As per the Lancet Public Health Journal 2020, China has experienced ~4 million deaths due to cardiovascular disorders. Additionally, the medical device coating market growth is attributed to the presence of a large geriatric population prone to orthopedic conditions and joint replacement procedures, a surge in number of surgical procedures, an increase in healthcare expenditure, and rise in investments in the development of advanced coatings to avoid healthcare-associated infections and surgical site infections.

The healthcare industry in China is proliferating, which subsequently helps in the medical device coatings market growth. According to China’s National Coating Industry Association (NCIA), had proposed and drafted the medical device coating standards that people's health concern has increased significantly, due to which medical device coated products with antiviral and antibacterial properties has gained the popularity among the Chinese population. As a result, the demand for antiviral and antibacterial coatings is expected to increase in the coming years, which would promote the overall growth of the medical device coating market during the forecast period.

Material Type Based Insights

Based on material type, the medical device coating market is segmented into polymer, metal, and others. The polymer segment is estimated to hold the largest market share and register the highest CAGR from 2022 to 2028. Medical devices are made of various biocompatible materials to prevent complications caused due to the material. These devices are further coated with different materials to avoid side effects, which enhances the overall recovery process of the patient. Polymer is one of the highly used biocompatible materials for different coating, which improves the overall efficiency of the medical devices. Polymers exhibit good biocompatibility and enables the drug delivery process that can modify and can be dissolved in the body over time. For instances, Polyelectrolyte multilayers is one of the highly used polymers in medical devices coatings owing to its biocompatible nature with wide applications, which provide numerous possibilities to create various surface coatings. These layers can also be modified as drug releasing coating with balanced pH and many more. Silicon, polyethylene, polystyrene, polyurethane, and polypropylene are a few types of polymer coatings available in the market. Thus, the aforementioned factors are likely to boost the medical device coating market growth for the polymer segment from 2022 to 2028.

Companies operating in the medical device coating market adopt the product innovation strategy to meet the evolving customer demands across the world, which also permits them to maintain their brand name in the market.

Medical Device Coating Market Regional Insights

Medical Device Coating Market Regional Insights

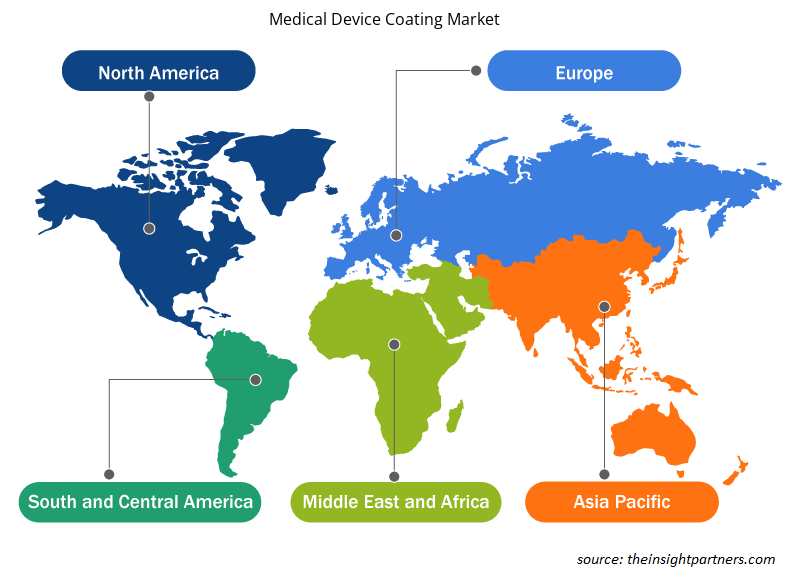

The regional trends and factors influencing the Medical Device Coating Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Device Coating Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Device Coating Market

Medical Device Coating Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.64 Billion |

| Market Size by 2028 | US$ 12.82 Billion |

| Global CAGR (2021 - 2028) | 7.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Medical Device Coating Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Device Coating Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Device Coating Market are:

- Koninklijke DSM NV

- Hydromer Inc

- Surmodics Inc

- Biocoat Inc

- AST Products Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Device Coating Market top key players overview

Medical Device Coating Market – Segmentation

Based on material type, the medical device coating market is segmented into polymer, metal, and others. The polymer segment accounted for the largest market share in 2021 and is expected to register the highest CAGR from 2022 to 2028. Based on devices, the market is segmented into medical equipment and tools, medical implants, medical devices, and others. The medical equipment and tools segment led the market in 2021 and is expected to retain its dominance during the forecast period. Based on coatings, the market is segmented into hydrophilic coatings, antimicrobial coatings, drug-eluting coatings, anti-thrombogenic coatings, and others. The hydrophilic coating segment led the market in 2021 and is expected to retain its dominance during the forecast period. Based on application, the medical device coating market is segmented into infectious diseases, neurology, orthopedics, general surgery, and others. Based on geography, the market is primarily segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

Company Profiles

- Koninklijke DSM NV

- Hydromer Inc.

- Surmodics Inc

- Biocoat Inc

- AST Products Inc

- Covalon Technologies Ltd

- Harland Medical Systems Inc

- Precision Coating Company Inc

- Kisco Ltd.

- Formacoat LLC.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Volumetric Video Market

- Integrated Platform Management System Market

- Animal Genetics Market

- Electronic Shelf Label Market

- Gas Engine Market

- Hydrocephalus Shunts Market

- Print Management Software Market

- Batter and Breader Premixes Market

- Arterial Blood Gas Kits Market

- Industrial Inkjet Printers Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material Type, Device Type, Coating, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Global medical device coating market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In North America, the U.S. is the largest market for medical device coating market. owing to the presence of more than 6,500 medical device companies comprising small and medium-sized enterprises (SMEs). The states in the US comprising the highest number of medical device companies involve California, Florida, New York, Pennsylvania, Michigan, Massachusetts, Illinois, Minnesota, and Georgia. Additionally, US medical device companies are highly recognized worldwide due to their innovative and high-technology products. Such factors act as a standalone factor responsible for the overall market growth of medical device coating in the US during the forecast period of 2022-2028.

Koninklijke DSM NV, Hydromer Inc, Surmodics Inc, Biocoat Inc, AST Products Inc, Covalon Technologies Ltd, Harland Medical Systems Inc, Precision Coating Company Inc, Kisco Ltd, and Formacoat LLC, among others are among the leading companies operating in the medical device coating market.

Hydrophilic Coating segment dominated the global medical device coating market and accounted for the largest market share during the forecast period of 2022-2028.

Based on the application, general surgery segment took the forefront leaders in the worldwide market by accounting largest share in 2021.

Based on device material type, the metal segment took the forefront leaders in the worldwide market by accounting largest share in 2021 and is expected to continue to do so till the forecast period.

Medical device coating refers to using an external layer of materials such as polymers, metals, and other materials to enhance the mobility and performance of a medical device. Medical device coatings are also utilized to prevent surfaces of several medical devices, such as dentistry, neurology, general surgery, and others. There are various types of medical device coatings available, which can be grouped into hydrophilic coatings, anti-microbial coatings, drug-eluting coatings, and anti-thrombogenic coatings, among others. Applying these coatings results in proper sanitation, corrosion resistance, and biocompatibility of medical devices.

Rising demand for coated medical devices in surgical and diagnostics procedures along with a high prevalence rate of healthcare-associated infections are driving the growth of the medical device coating market.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Medical Device Coating Market

- Koninklijke DSM NV

- Hydromer Inc

- Surmodics Inc

- Biocoat Inc

- AST Products Inc

- Covalon Technologies Ltd

- Harland Medical Systems Inc

- Precision Coating Company Inc

- Kisco Ltd

- Formacoat LLC

Get Free Sample For

Get Free Sample For