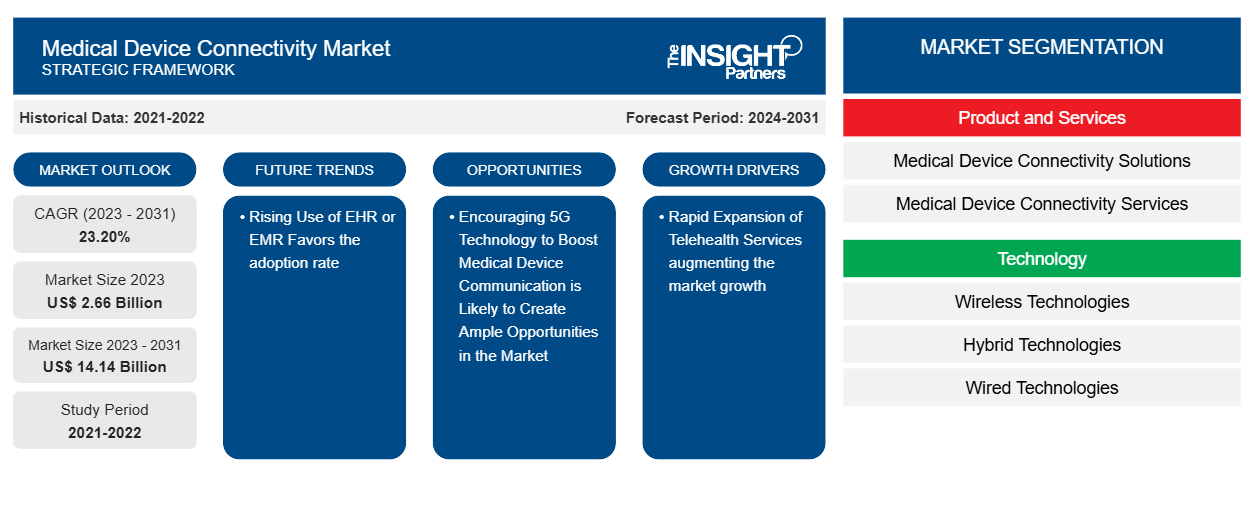

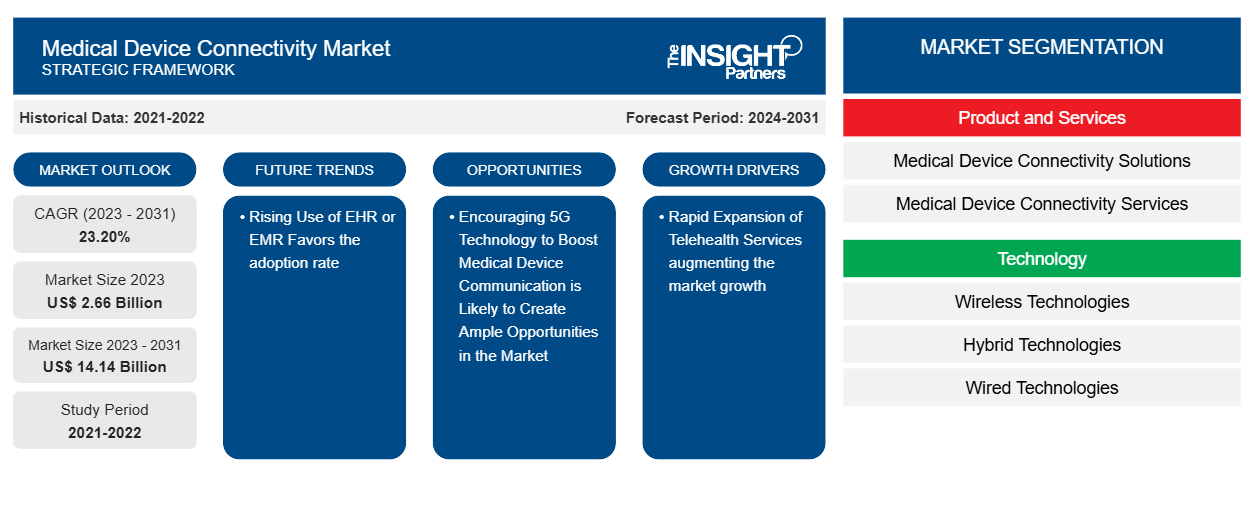

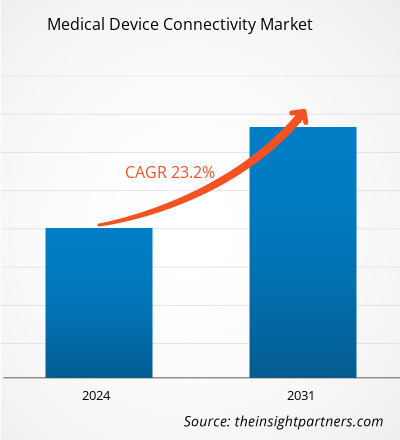

The medical device connectivity market size is projected to reach US$ 14.14 billion by 2031 from US$ 2.66 billion in 2023. The market is expected to register a CAGR of 23.20% during 2023–2031. The inclination toward home healthcare will likely remain a key market trend.

Medical Device Connectivity Market Analysis

To share patient data, medical device connectivity creates and maintains the connection between equipment and medical devices in healthcare facilities. These devices' connectivity options include wired hybrid and wireless connections based on Bluetooth, RFID, and the cloud. The main forces propelling the market forward are the ubiquity of EHRs and EMRs and the rapid expansion of telehealth services.

Medical Device Connectivity Market Overview

The market for medical device connectivity is anticipated to grow as more people use electronic medical records. Furthermore, the medical device connectivity market should have plenty of opportunities to expand due to the rising use of telehealth services. For instance, according to the Centers for Disease Control and Prevention, 37.0% of adults in the US utilized telemedicine in 2021.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Connectivity Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Connectivity Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Device Connectivity Market Drivers and Opportunities

Rising Use of EHR or EMR Favors the Market Growth

The ability to gather, handle, and use data from medical devices has grown more complicated as more devices are used in patient care. To enable data interchange, medical device connectivity refers to connecting medical devices to electronic health records (EHRs) or electronic medical records (EMRs). A patient's paper chart is digitally replicated in an electronic health record (EHR). EHRs are patient-centered, real-time records that give authorized users instant, secure access to information. A more comprehensive picture of a patient's care can be included in an EHR system designed to go beyond the typical clinical data gathered in a provider's office. Modern healthcare relies heavily on integrating clinical solutions and EMR systems with medical device and equipment data.

Based on information from Health IT, a US government website, US physicians used EHR software from 10% to 16% between 2019 and 2021. Physicians in developed nations are using EHR software more frequently, necessitating connecting medical devices to the software so doctors can access patient medical histories. EMR solutions are widely used, and governments in developed and developing nations are placing more and more emphasis on creating national healthcare information exchanges. These factors are predicted to drive demand for effective medical device connectivity solutions. Therefore, the market for medical device connectivity is expanding due to the rising use of EHR/EMR and medical devices.

Encouraging 5G Technology to Boost Medical Device Communication is Likely to Create Ample Opportunities in the Market

A network that can handle high-definition videos and real-time remote patient monitoring is necessary for telemedicine. It can take a while to transfer larger files between departments using 4G or older networks, forcing doctors to waste time waiting for the process to finish. These barriers can be removed by switching to 5G, giving healthcare providers a more efficient network that can keep up with emerging technologies. The next generation of wireless technology, or 5G, offers faster speeds, larger bandwidths, and more capacity to connect devices, which is advantageous to all devices within a network. Compared to standard hospital wireless networks, 5G technology offers 100–2,000 times faster speeds. Doctors can efficiently proceed with diagnosis, prescriptions, and treatment plans while monitoring a patient's vitals remotely due to intelligent data applications and artificial intelligence (Al) in conjunction with connected medical devices. 5G technology's quick speed, low latency, and enhanced data accuracy has the potential to change the healthcare industry completely. Altogether, 5G and Al can potentially advance the healthcare industry significantly. Furthermore, 5G is rapidly being integrated into various medical devices and is a critical enabling technology for digital health and the Internet of Things (loT). Connectivity between devices at home, in the hospital, and anywhere else a need arises is made possible by wireless technology. Wearables with 5G capabilities can send big data packets all day, leading to better patient outcomes from ongoing remote monitoring. Therefore, as the use of medical devices becomes more connected, there is a greater need for networks and technology. One such technology that presents growth opportunities for the market over the forecast period is 5G.

Medical Device Connectivity Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical device connectivity market analysis are Product and Services, application, and end user.

- Based on Product and Services, the medical device connectivity market is divided into medical device connectivity solutions, medical device connectivity services. The medical device connectivity solutions segment held the most significant market share in 2023.

- By technology, the market is categorized into wireless technologies, hybrid technologies, wired technologies. The wireless technologies segment held the largest share of the market in 2023.

- By application, the market is categorized into vital signs and patient monitors, anesthesia machines, ventilators, infusion pumps, others. The vital signs and patient monitors segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals, ambulatory surgical centers, imaging and diagnostic centers, homecare settings. The hospitals segment held the largest share of the market in 2023.

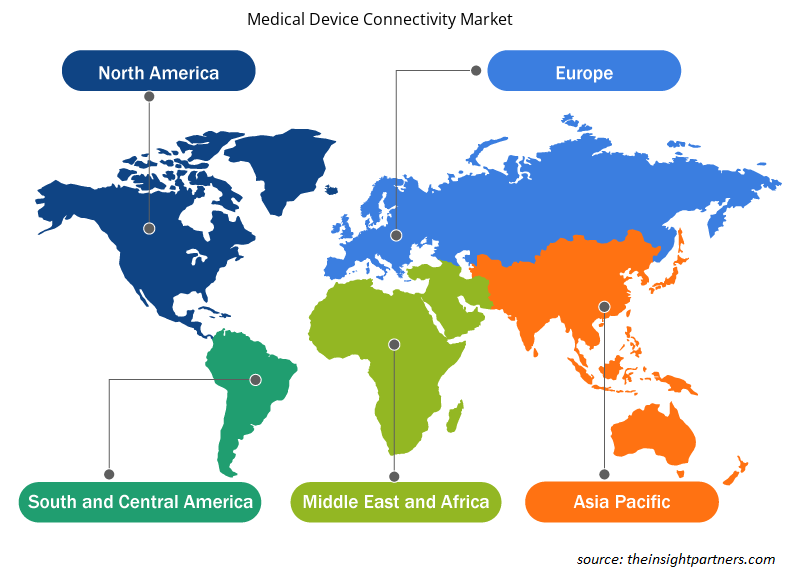

Medical Device Connectivity Market Share Analysis by Geography

The geographic scope of the medical device connectivity market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The medical device connectivity market in North America is segmented into the US, Canada, and Mexico. The US is expected to be the most significant contributor to the market in this region. The market growth in North America is ascribed to the rapid changes in the regulations of medical devices in the region. According to a system architect of Drägerwerk AG and Co. KGaA, as medical technology has continued to advance, interoperability capabilities between devices such as ventilators and fusion pumps have lagged. The U.S. Department of Health and Human Services Office of the National Coordinator for Health Information Technology and the Centers for Medicare and Medicaid Services have finalized and approved the medical device interoperability standards. Furthermore, various factors such as favourable reimbursement scenarios for telehealth, technological advancement, especially the use of 5G, adoption of home healthcare, etc., are factors likely to drive the growth of the market in the region

Medical Device Connectivity Market Regional Insights

The regional trends and factors influencing the Medical Device Connectivity Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Device Connectivity Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Device Connectivity Market

Medical Device Connectivity Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.66 Billion |

| Market Size by 2031 | US$ 14.14 Billion |

| Global CAGR (2023 - 2031) | 23.20% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product and Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

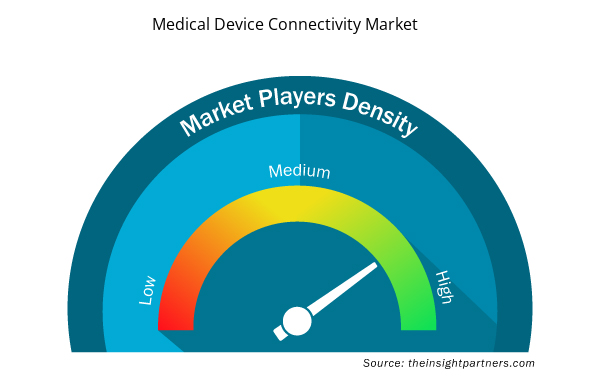

Medical Device Connectivity Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Device Connectivity Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Device Connectivity Market are:

- iHealth Labs Inc,

- Oracle Corp,

- Lantronix Inc,

- Infosys Ltd,

- Digi International Inc,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Device Connectivity Market top key players overview

Medical Device Connectivity Market News and Recent Developments

The medical device connectivity market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the medical device connectivity market are listed below:

- Siemens Healthineers announces the Food and Drug Administration (FDA) clearance of syngo Virtual Cockpit, a private, secure communication platform for real-time image visualization, acquisition, and collaboration between healthcare professionals across multiple sites. The software enables users to connect to computed tomography (CT), magnetic resonance (MR), positron emission tomography (PET), single-photon emission CT (SPECT), PET/CT, SPECT/CT, and PET/MR scanners from Siemens Healthineers as well as other equipment vendors, regardless of location. syngo Virtual Cockpit is the first and only multi-vendor remote scanning software to receive FDA clearance as a medical product. (Source: Siemens Healthineers, Press Release, January 2024)

- Of the more than 500 devices included by the U.S. FDA on a recently updated list of AI-enabled device authorizations, 42 are from GE Healthcare, a milestone that highlights the impact of the company’s digital strategy. (Source: GE HealthCare, Press Release, October 2022)

Medical Device Connectivity Market Report Coverage and Deliverables

The “Medical Device Connectivity Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Medical device connectivity market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Medical device connectivity market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Medical device connectivity market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the medical device connectivity market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product and Services, Technology, Application, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the medical device connectivity market in 2023

Key factors driving the market are the rising use of EHR or EMR and the rapid expansion of telehealth services.

The inclination toward home healthcare will likely remain a key market trend.

iHealth Labs Inc, Oracle Corp, Lantronix Inc, Infosys Ltd, Digi International Inc, Cisco System Inc, Medtronic Plc, Koninklijke Philips NV, GE HealthCare Technologies Inc, Silicon & Software Systems Ltd.

The market is expected to register a CAGR of 23.20% during 2023–2031.

Get Free Sample For

Get Free Sample For