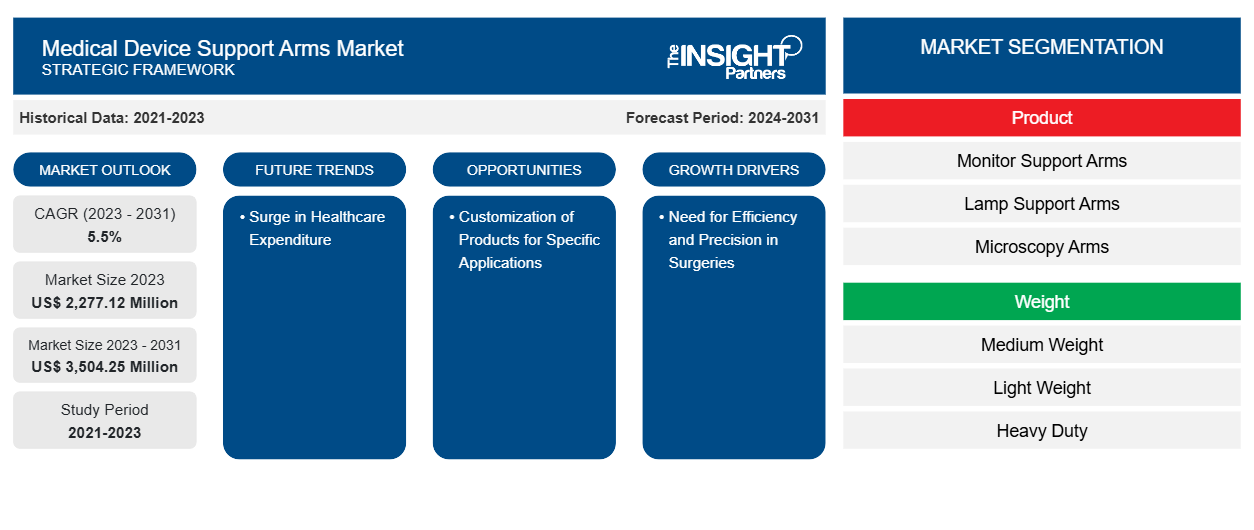

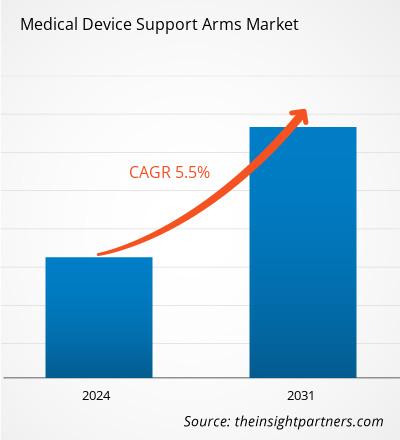

The medical device support arms market size is projected to reach US$ 3,504.25 million by 2031 from US$ 2,277.12 million in 2023. The market is expected to register a CAGR of 5.5% during 2023–2031. Growing functionality and adaptability of articulated support arms in modern medical practice are likely to remain key trends in the medical device support arms market.

Medical Device Support Arms Market Analysis

The medical device support arms market is expected to witness substantial growth in the coming years due to the increasing demand for advanced healthcare technologies, minimally invasive procedures, and automation in medical settings. Support arms are used to position and stabilize medical devices such as cameras, monitors, and surgical instruments by holding them in place, thereby enhancing precision during surgeries and medical procedures. The market is driven by innovations in robotics, the rise of outpatient surgeries, and the increasing adoption of modular operating room setups. Further research in advanced material usage and ergonomic designs is expected to contribute considerably to the market expansion in the coming years.

Medical Device Support Arms Market Overview

The medical device support arms market is rapidly evolving, fueled by advancements in minimally invasive surgeries, surge in healthcare investments, and rise in demand for robotic-assisted surgeries and precise medical equipment necessary for the desired patient outcomes. Medical device manufacturing companies such as Siemens Healthineers and KUKA are playing a prominent role in the development of robotic-assisted systems, where camera support arms are essential components. Additionally, in 2023, the German Government continued to prioritize digital health initiatives as part of the Digital Healthcare Act, focusing on the expansion of telemedicine and the use of cutting-edge medical imaging technologies such as support arms and cameras. Thus, growing digitalization is expected to bring in new opportunities for companies in the medical device support arms market to launch innovative monitor support arms, camera support arms, lamp support arms, etc., in Europe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Support Arms Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Support Arms Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Device Support Arms Market Drivers and Opportunities

Need for Efficiency and Precision in Surgeries Bolsters Market Growth

Minimally invasive surgeries, including laparoscopy, endoscopy, and robotic-assisted surgeries, require precise positioning of tools, cameras, and other devices. Medical device support arms are essential for enhancing surgical efficiency by holding instruments and cameras in the required place, especially in minimally invasive procedures. For instance, in laparoscopic surgeries, surgeons utilize a camera to visualize the internal area, and support arms are employed to stabilize the camera and other instruments. Stability and flexibility conferred by these components render them crucial for achieving optimal outcomes in complex surgeries. These arms permit fine adjustments, enabling surgeons to operate with high precision while minimizing tissue damage. A support arm with a flexible rod, manufactured by VBM Medizintechnik GmbH, comes with an adjustable height and features a tube holder plate with a safety lock for the safe fixation of respiration tubing.

Medical device support products such as product trolleys are essential for organizing and distributing instruments, supplies, and equipment efficiently during surgeries and medical procedures. Trolleys attached to support arms are equipped with organizational compartments, trays, and drawers to reduce search time during procedures. Well-organized instruments and supplies help surgeons quickly find surgical instruments and other entities they need, minimizing delays and enhancing precision. Such modular product trolleys are gaining popularity as they allow customization in different surgeries; this enables teams to pre-arrange instruments according to specific procedures, reducing errors and improving surgical efficiency.

Companies such as STERIS Healthcare, Stryker, Philips, and Ergotron offer medical device support arms, including monitor support arms, lamp support arms, and product trolleys, to various healthcare facilities to enhance various surgical procedures. Therefore, the increasing adoption of support arms to ensure a high level of accuracy and precision in surgical procedures bolsters the medical device support arms market growth.

Customization of Products for Specific Applications to Create Growth Opportunities

Customization of medical device support arms allows manufacturers to create products tailored to specific surgical procedures or environments. Support arms can be designed to fixate surgical monitors, instruments, or imaging equipment at optimal angles and positions, thereby improving accessibility and efficiency during operations. By developing specialized support arms for various applications—such as orthopedic surgeries or diagnostic imaging—manufacturers can enhance the overall functionality of their products, leading to greater adoption in healthcare facilities.

Companies are creating advanced support arms that incorporate smart technologies for real-time monitoring and improved usability. For instance, in March 2024, GCX, a leader in medical mounts for healthcare IT solutions, introduced the new GCX Tablet Roll Stand. This portable stand ensures secure access to patient services and medical records throughout the hospital. It features a fixed or adjustable height tablet arm for optimal viewing during video conferencing and accessing electronic medical records. Further, Stryker offers customizable monitor support arms to provide optimal positioning for surgical monitors. Customized support arms can significantly improve patient outcomes by facilitating better surgical practices. Moreover, prioritizing user-centric design can foster strong brand loyalty and encourage repeat business. Thus, customization of products for specific applications is expected to generate ample growth opportunities in the medical device support arms market in the coming years.

Medical Device Support Arms Market Report Segmentation Analysis

Key segments that were the foundation of the medical device support arms market analysis are product, weight, and end user.

- Based on product, the medical device support arms market is categorized into monitor support arms, lamp support arms, microscopy arms, products trolleys, breathing tube arms, and others. The monitor support arms segment held the largest share of the market in 2023.

- Based on weight, the market is classified into ultra-lightweight (up to 3 kg), lightweight (3–24 kg), medium weight (25–50 kg), and heavy-duty (more than 51 kg). The medium weight (25–50 kg) segment held the largest medical device support arms market share in 2023.

In terms of end user, the medical device support arms market is segmented into hospitals, clinics, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2023.

Medical Device Support Arms Market Share Analysis by Geography

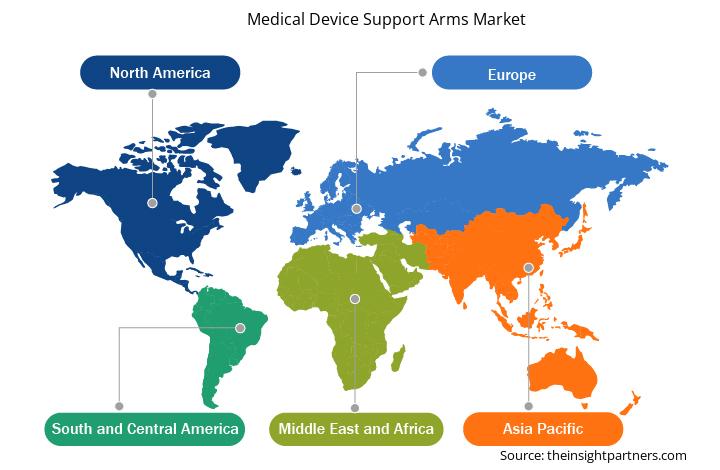

The geographic scope of the medical device support arms market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant share of the market in 2023. The regional market growth is driven by the ongoing innovations in medical device design, materials, and automation that fuel the demand for medical device support arms in North America. The presence of leading market players such as Stanley Healthcare, Parker Hannifin, ErgoTech, and Tractel is benefiting the medical device support arms market in this region. These companies emphasize adopting development strategies and launching various innovative products for end users in North America, including hospitals and clinics.

According to the Canadian Medical Association, the country’s healthcare spending was projected to reach US$ 264 billion in 2023. Such an upsurge in spending can be majorly attributed to the growing need for medical devices enabled by advanced technologies. A shift in patient preference toward minimally invasive procedures is contributing to the demand for medical device support arms in the country. Orthopedic, urology, and gastroenterology surgeries, and other complicated surgical pain procedures that require high-precision equipment are becoming common in both hospital and outpatient settings in Canada; this indicates the need for flexible and reliable medical device support arms. In April 2024, Burnaby Hospital Foundation and Fraser Health partnered to launch a new Mako robotic-assisted surgical system for the Jim Pattison Surgery Centre at Burnaby Hospital in Canada. The Mako Robotic Assisted System offers an arm that allows surgical teams to perform hip and knee replacement surgeries with better precision and accuracy.

Medical Device Support Arms Market Regional Insights

The regional trends and factors influencing the Medical Device Support Arms Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Device Support Arms Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Device Support Arms Market

Medical Device Support Arms Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,277.12 Million |

| Market Size by 2031 | US$ 3,504.25 Million |

| Global CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

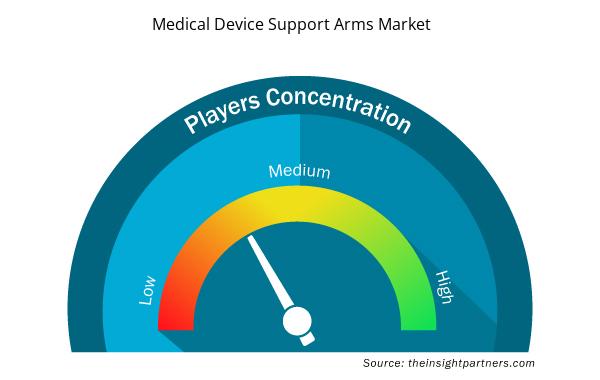

Medical Device Support Arms Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Device Support Arms Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Device Support Arms Market are:

- Amcaremed Technology Co. Limited,

- Amico Group of Companies

- Stryker Corp

- MZ Liberec, a.s.,

- Diwei Industrial Co. Ltd.,

- AFC Industries, Inc.,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Device Support Arms Market top key players overview

Medical Device Support Arms Market News and Recent Developments

The medical device support arms market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the medical device support arms market are listed below:

- GCX Mounting Solutions, a portfolio company of Audax Private Equity and a global leader in the design and manufacturing of healthcare-focused mounting and mobility solutions, announced the acquisition of Jaco, Inc. Based in Franklin (Massachusetts, US), Jaco designs, manufactures, and sells a full line of branded point-of-care IT workstation solutions for the healthcare markets, including powered carts, non-powered carts, wall arms, and video-presentation carts. (Source: GCX Mounting Solutions, Press Release, December 2022)

- Diwei Industrial Co., Ltd. introduced Tablet/PC Slim Arm with Wall Mounting (with VESA mount), a versatile and convenient solution for using tablets/PCs in various settings. This product is designed to support up to 2.5 kg of load and features a high-end flexible arm, making it ideal for use with tablet PCs in environments such as hospital beds or dental offices. (Source: Diwei Industrial Co., Ltd, Press Release, September 2024)

Medical Device Support Arms Market Report Coverage and Deliverables

The "Medical Device Support Arms Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Medical device support arms market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Medical device support arms market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Medical device support arms market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the medical device support arms market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Medical device support arms are mechanical systems used in healthcare settings to support and position medical equipment, tools, or devices. These support arms are often attached to walls, ceilings, or mobile bases and can move in multiple directions, such as up and down, side to side, or in a rotating manner. This adjustability helps improve workflow and patient care by ensuring that medical equipment is easily accessible and can be positioned optimally for both the patient and healthcare provider.

The factors driving the growth of the medical device support arms market include the need for efficiency and precision in surgeries, and a surge in healthcare expenditure. However, maintenance and durability concerns hamper the growth of the medical device support arms market.

The medical device support arms market is expected to be valued at US$ 3,504.25 million by 2031.

The medical device support arms market, by product, is segmented into monitor support arms, lamp support arms, microscopy arms, products trolleys, breathing tube arms, and others. In 2023, the monitor support arms segment held the largest share of the market.

The medical device support arms market was valued at US$ 2,277.12 million in 2023.

The medical device support arms market majorly consists of players, including Amcaremed Technology Co. Limited; Amico Group of Companies; Stryker Corp; MZ Liberec, a.s.; Diwei Industrial Co. Ltd.; AFC Industries, Inc.; AMTRION GmbH; AADCO Medical Inc.; GCX Corporation; Maclocks; ICWUSA.com, LLC; Bracci & Dispositivi; Steris Plc; Ondal Medical Systems; Koninklijke Philips NV; and Oasys Healthcare.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Medical Device Support Arms Market

- Amcaremed Technology Co. Limited

- Amico Group Of Companies

- Stryker Corp

- MZ Liberec, A.S.

- Diwei Industrial Co. Ltd.

- AFC Industries, Inc.

- AMTRION GmbH

- AADCO Medical Inc.

- GCX Corporation

- Maclocks

- ICWUSA.com, LLC

- Bracci & Dispositivi

- Steris Plc

- Ondal Medical Systems

- Koninklijke Philips NV

- Oasys Healthcare.

Get Free Sample For

Get Free Sample For