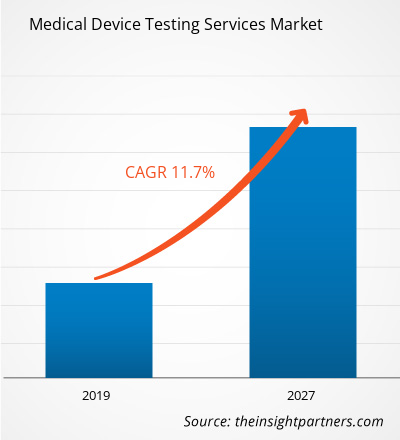

The Medical Device Testing Services in healthcare market was valued at US$ 5505.4 million in 2018 and it is projected to reach US$ 14,660.1 million by 2027; it is expected to grow at a CAGR of 11.7% from 2019 to 2027.

Medical devices are very critical as they have a direct impact on patient's life. To deliver high-quality and safe experiences to the patients’ medical device manufacturers test the medical devices before delivering it to the market. Medical device manufactures prefer to do in-house testing or outsource the testing services to the contract research organizations (CROs) to comply with the stringent regulatory guidelines. The testing of the medical devices is to ensure the service safety, quality and consistency during all stages of development and usage of medical device. The medical treatment is highly dependent on medical devices, hence it's important to ensure that the testing of medical devices is done with the outmost proficiency. The growth of the Medical Device Testing Services in healthcare market is attributed to the innovative product development, collaborations, mergers and acquisitions, stringent regulatory scenario for medical device approval are boosting the growth of the market over the years. Also, the developments in the medical device industry is likely to have a positive impact on the demand for the market during the forecast period. However, the growth of the market is restrained by factors such as interruptions in contractual obligations.

The Medical Device Testing Services in healthcare market is expected to witness substantial growth post-pandemic SGS SA, Eurofins, Toxikon, Pace Analytical Services, LLC, Intertek Group plc, NORTH AMERICAN SCIENCE ASSOCIATES INC., Charles River, WuXi AppTec, Element Materials Technology, TÜV SÜD AG mRNA is expected to emerge and shift the pharmaceutical industry and market is also expected to witness more vertical integration and joint ventures in coming years.

Market Insights

Growing Applications of Medical Device Testing Services in Healthcare to Drive Medical Device Testing Services in Healthcare Market Growth

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Testing Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Device Testing Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical device testing needs strong experience of the domain, native and national legislations, and information about the devices, infrastructure, and ability to support the testing. The healthcare and medical device industry is an active one due to continuous development and advanced solutions. The enhancements in medical device technology have significantly enhanced the efficiency of patient care in the last few decades.

However, manufactures of various medical devices sometimes face challenges in making products ready for the market. The regulations are occasionally complex and challenging to understand, majorly when relating to applications of innovative and novel medical devices.

A recall is a process of eliminating or modifying products that are not as per the laws administered by the Food and Drug Administration (FDA). Mostly the medical device recalls are conducted voluntarily by the company under 21 CFR 7. The product recalls are classified into various designation, such as I, II, or III by the FDA for indicating the comparative degree of health hazard offered by the product being recalled.

As per the FDA in 2018, stated that there are above 80,000 incidents identified since 2008, due to the medical device injury. Since, last few years, medical device companies and doctors have observed that spinal-cord stimulators have helped the patients who suffer from pain disorders. Due to this, it has become one of the most rising products in the $400 billion medical device industry. Therefore, the increasing incidences of product recall and higher demand for quality products are growing the need for testing of medical devices. Hence, it will boost the market for medical device testing services.

The medical device technology is improving life by identifying diseases at an early stage and enhancing treatment, diagnosis, and patient monitoring. The small and medium-sized enterprises (SMEs) training programs have been implemented in the countries such as China, Chile, Indonesia, Mexico, Malaysia, Singapore, Philippines, Peru, Russia and Viet Nam and others. In 2018, the medical device market in the U.K. was valued approximately US$10.6 billion. Among which, around 2,500 are small to medium-sized medical device companies in the U.K. Moreover, a large number of multinational companies have established their head offices or subsidiaries in the country. Furthermore, every year, the acute trusts spend around an average of US$ 6.6 billion on clinical supplies, which include medical equipment.

Furthermore, in 2018, the International Trade Administration (ITA) mentioned that there are above 1,300 medical device firms in France, of which one-third of the entire medical device companies are overseas companies. However, these foreign medical device companies bring around two-third of the total business.

Additionally, among the 1,300 medical device companies in France, approximately 92% are small and medium-sized enterprises (SMEs), out of which 88% produce entirely medical devices. SME’s outsource the medical device testing as it requires high cost, time, and skilled labor.

Additionally, in Madrid and Catalonia accounts for more than 80 percent of medical device sales. Among that, 90% of the medical device market is small and medium-sized companies that generate around 40% revenue from the total medical device revenue. Since these companies are start-ups, they choose to outsource the medical device testing for reducing the cost and saving time. Thus, the growing need in the industry is likely expected to drive the growth of the global medical device testing services market over the coming years. Bringing advanced medical device technology for the consumers is a high

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Many laboratories across North America, Europe, and the Asia Pacific offer regulatory compliance knowledge and qualified GMP/GLP/ISO 17025 testing for ensuring fast improvement times using the highest level of service, and most advanced technologies for the microbiological, analytical chemical, biocompatibility, and package testing requirements.

In other countries, various regulatory bodies are present to regulate medical devices. The medical devices in Spain are controlled and permitted by the Spanish Agency of Medicines and Health Products (AEMPS). The Food and Drugs Act (FDA) set out a regulatory framework for numerous medical devices. The Medical Devices Bureau is another body responsible for medical devices guidelines that allow sale and import of medical devices.

All medical devices have an exclusive and systematic set of testing necessities imposed by the FDA, China Food and Drug Administration (CFDA), EU Notified Bodies, and other regulatory bodies, which should be followed before entering the market.

In Canada, Health Canada implemented mandatory reporting of medical device incident reports by importers and manufacturers and also inspires reporting from healthcare practitioners, hospitals, and consumers/ patients. In Mexico, COFEPRIS is responsible for approval and registration of the medical device. The manufacturer should fulfill all the testing requirements and comply with seeking COFEPRIS approval.

Medicines and Healthcare products Regulatory Agency (MHRA) is the selected authority that administers the law on medical devices in the UK. It inspects the medical devices products with potential problems and ensures their safety and quality. In Japan, its Japan’s Ministry of Health, Labour and Welfare (MHLW) and Pharmaceuticals and Medical Devices Agency (PMDA) that works together to conduct scientific tests of marketing application medical devices to monitor their post-marketing safety.

Thus, the growing strict regulations for innovative and precise devices are expected to drive the growth of the medical device testing services market during the forecast period.

Service-Based Insights

In terms of service, the Medical Device Testing Services in healthcare market is segmented into biocompatibility test, chemistry test, microbiology & sterility testing, and package validation. In 2018, the microbiology & sterility testing held the most significant market share 53.55% of the medical device testing services market, by service.

Medical Device Testing Services Market Regional Insights

The regional trends and factors influencing the Medical Device Testing Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Device Testing Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Device Testing Services Market

Medical Device Testing Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 5.51 Billion |

| Market Size by 2027 | US$ 14.66 Billion |

| Global CAGR (2018 - 2027) | 11.7% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

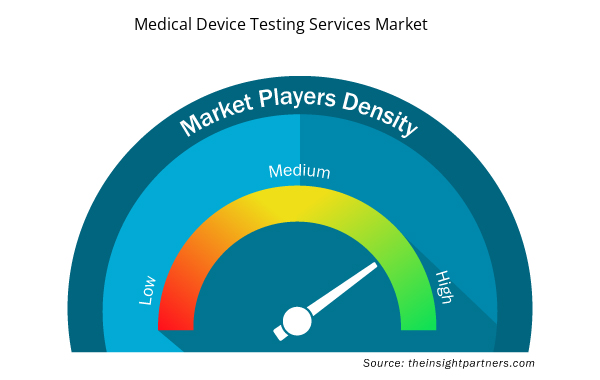

Medical Device Testing Services Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Device Testing Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Device Testing Services Market are:

- SGS SA

- Eurofins

- Toxikon

- Pace Analytical Services, LLC

- Intertek Group plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Device Testing Services Market top key players overview

Phase-Based Insights

Based on phase, the Medical Device Testing Services in healthcare market is segmented into preclinical, and clinical. In 2018, the preclinical segment held a considerable market share of 68.17% of the medical device testing services market, by phase.

The Medical Device Testing Services in healthcare market players are adopting the product launch and expansion strategies to cater to changing customer demands worldwide, which also allows them to maintain their brand name globally.

Medical Device Testing Services in Healthcare Market – by Service

- Biocompatibility Test

- Chemistry Test

- Microbiology & Sterility Testing

- Package Validation

Medical Device Testing Services in Healthcare Market – by Phase

- Preclinical

- Clinical

Medical Device Testing Services in Healthcare Market – by Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South America and Central America (SCAM)

- Brazil

- Argentina

- Rest of SCAM

Company Profiles

- SGS SA

- Eurofins

- Toxikon

- Pace Analytical Services, LLC

- Intertek Group plc

- NORTH AMERICAN SCIENCE ASSOCIATES INC.

- Charles River

- WuXi AppTec

- Element Materials Technology

- TÜV SÜD AG

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Service , Phase , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

- SGS SA

- Eurofins

- Toxikon

- Pace Analytical Services, LLC

- Intertek Group plc

- NORTH AMERICAN SCIENCE ASSOCIATES INC.

- Charles River

- WuXi AppTec

- Element Materials Technology

- TÜV SÜD AG

Get Free Sample For

Get Free Sample For