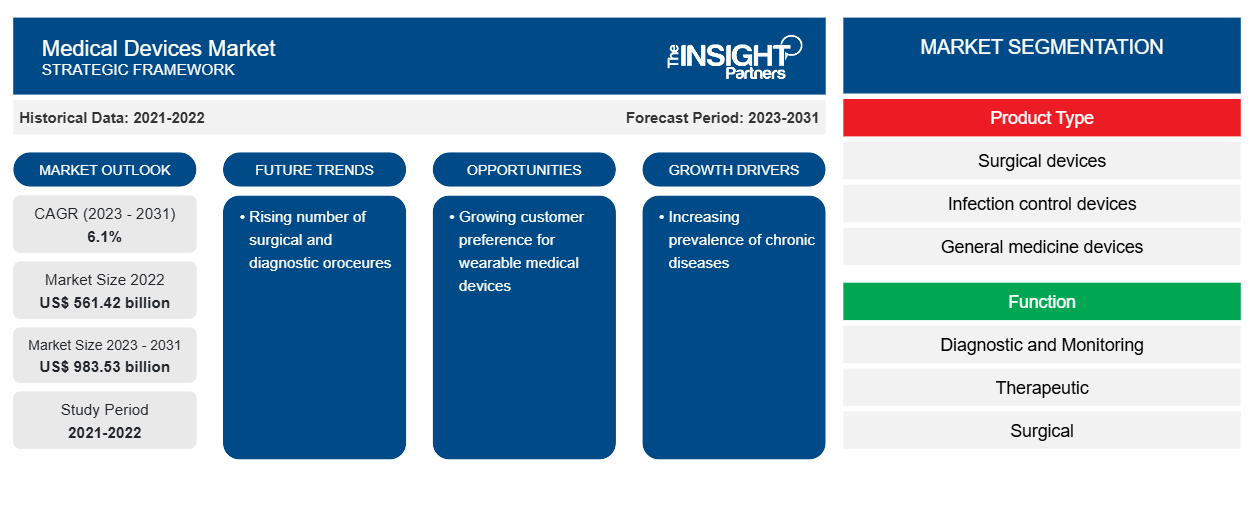

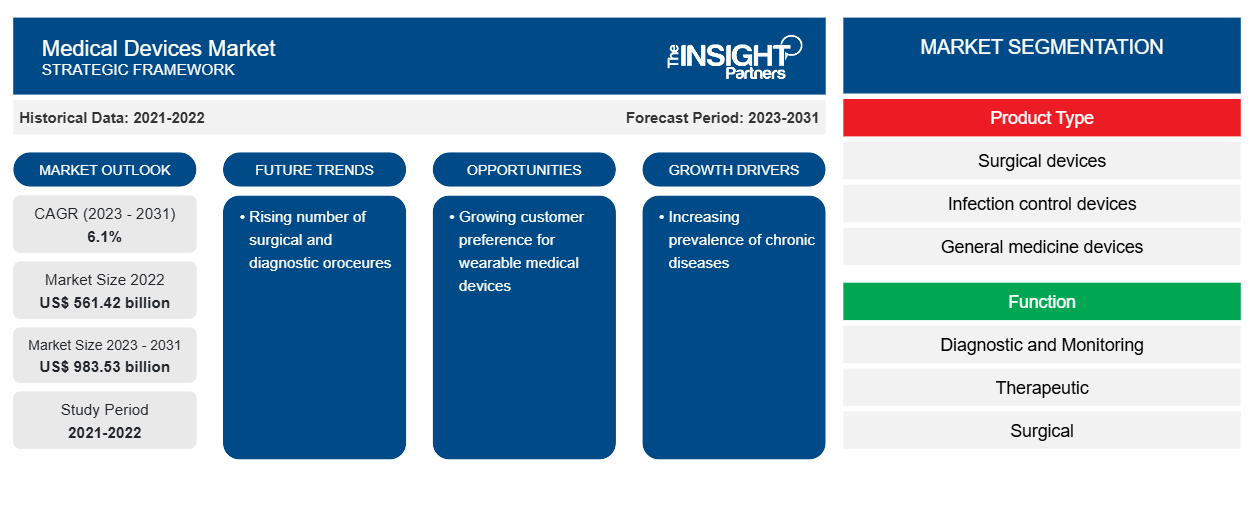

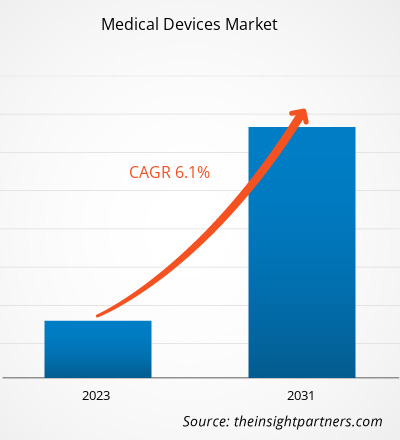

The Medical Devices Market size is projected to reach US$ 983.53 billion by 2031 from US$ 561.42 billion in 2022. The market is expected to register a CAGR of 6.1% in 2023–2031.

The increasing prevalence of chronic diseases, rising population of elderly population prone to several chronic conditions, and technological advancements related to medical devices is likely to remain key Medical Devices market trends.

Medical Devices Market Analysis

Early detection of chronic as well as acute diseases and medical conditions, rising geriatric population, and rapid development in advanced medical devices are growing significantly globally, resulting in increased demand for patients requiring medical intervention and treatment. This factor has further resulted in demand for medical devices that support the management, diagnosis, and treatment of diseases. Chronic diseases such as cancer, cardiovascular diseases, diabetes, and respiratory disorders have been increasing globally. For instance, according to the article published in A Cancer Journal for Clinicians in 2023, In 2023, approximately, 1,958,310 new cancer cases and 609,820 cancer deaths were projected to occur in the United States. For the treatment of chronic diseases, continuous monitoring, and management with medical devices like glucose monitors, blood pressure monitors, and respiratory therapy equipment is required, which in turn is driving the overall market.

Medical Devices Market Overview

North America is the largest market for medical Devices market growth with the US holding the largest market share followed by Canada. The rising aging population has resulted in age-related diseases and conditions, which require medical devices such as hearing aids, joint replacements, and assistive devices, which is anticipated to further propel the overall North American medical devices market. This increasing prevalence of diseases is expected to drive the growth of the medical devices market during the forecast period. The geriatric population is more prone to acquiring age-related diseases that are observed less prevalent among younger people. For instance, according to the data published in NCBI in 2022, the overall self-reported prevalence of cardiovascular diseases (CVDs) in the population above 45 years and above was 29.4%. Similarly, the prevalence rate increased with age, from 22% in the 45-54 age group to 38% in the 70+ age group, indicating that the geriatric population is at high risk of developing CVDs. Thus, the rising geriatric population in North America population is fueling the overall market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Devices Market Drivers and Opportunities

Rising Prevalence of Chronic Diseases Demanding for Medical Device Favors the Market

The increasing burden of chronic diseases globally is driving the demand for medical devices and treatment services that involve surgical and diagnostic procedures. For instance, according to 2022 statistics published by IDF, approximately, 2.9 million people were surviving with diabetes in Canada in 2021. This number is projected to reach 3.2 million and 3.4 million by 2030 and 2045, respectively. Thus, the increase in the number of people who have diabetes expected to increase the demand for various wearable and portable medical devices.

Technological Advancements in Medical Devices – An Opportunity in Medical Devices Market

The rising focus on manufacturing technologically advanced medical devices and increasing product launches related to medical devices are contributing to the market growth. For instance, in April 2022, Medline UNITE launched the Calcaneal Fracture Plating System and IM Fibula Implant. The system provides a titanium foot and ankle trauma system to address nearly all fractures requiring Open Reduction and Internal Fixation (ORIF) with plate and screw fixation.

Medical Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Medical Devices Market analysis are services, service providers, and end users.

- Based on product, the medical Devices market is segmented into Surgical Devices, In-Vitro Diagnostic Devices, General Medicine Devices, Endoscopy Devices, Infection Control Devices, Ophthalmology, Endoscopy, Neurology, and Others. The IVD segment held a larger market share in 2023.

- By function, the market is segmented into Diagnostic and Monitoring, Therapeutics, Surgical, and Others. The diagnostic and monitoring segment held the largest share of the market in 2023. However, the surgical segment mode is expected to register the highest CAGR over the forecast period.

- By end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The hospitals segment held the major market share in the year 2023 and the highest CAGR during the forecast period.

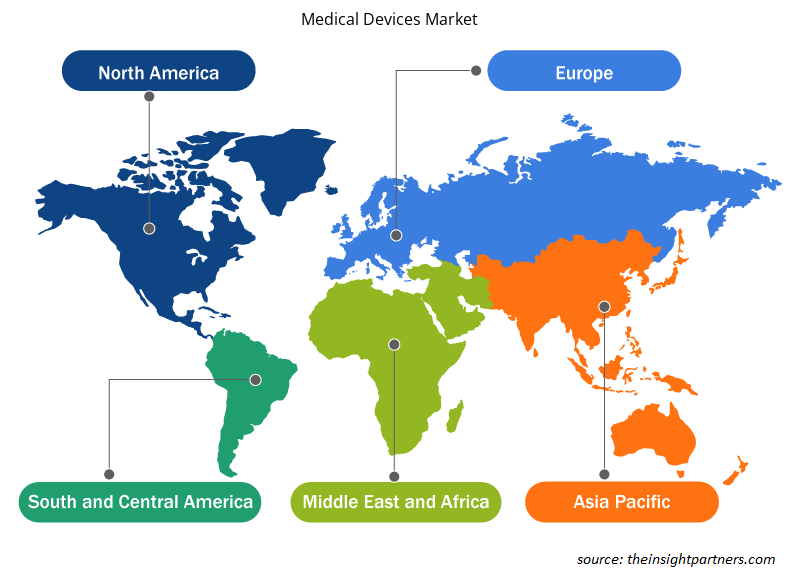

Medical Devices Market Share Analysis by Geography

The geographic scope of the Medical Devices Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the Medical Devices Market. The market growth can be attributed to the rising adoption of medical devices by healthcare facilities, the growing burden of chronic diseases, high healthcare expenditures, and the presence of major manufacturers of medical devices in North American countries.

Medical Devices Market News and Recent Developments

The Medical Devices Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders and strategies:

- Max Ventilator expanded its niche by rolling out intelligent devices including pulse oximeter, ECG, and monitors. The medical device come up with solutions that offer world-class quality at an affordable cost. (Source: Max Ventilator, Press Release/Company Website/Newsletter, April 2023)

- Stryker launched its EasyFuse Dynamic Compression System. Created using nitinol, a nickel titanium alloy metal well known for its strength and shape recovery, Stryker’s new foot and ankle staple system is designed to decrease surgical complexity, provide strong dynamic-compression implants and reduce waste in the operating room. (Source: Stryker, Press Release/Company Website/Newsletter, May 2022)

Medical Devices Market Regional Insights

Medical Devices Market Regional Insights

The regional trends and factors influencing the Medical Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Devices Market

Medical Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 561.42 billion |

| Market Size by 2031 | US$ 983.53 billion |

| Global CAGR (2023 - 2031) | 6.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Medical Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Devices Market are:

- Medtronic plc,

- Abbott

- Boston Scientific and Corporation,

- 3M,

- Siemens AG

- Koninklijke Philips

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Devices Market top key players overview

Medical Devices Market Report Coverage and Deliverables

The “Medical Devices Market Size and Forecast (2022–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type , Function , End User , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Abbott Laboratories Inc

- Boston Scientific Corporation

- F. Hoffmann-La Roche Ltd.

- GE Healthcare (General Electric Company)

- Johnson and Johnson

- Medtronic PLC

- Koninklinje Philips NV

- Siemens Healthineers (Siemens AG)

- Smith and Nephew PLC

- Stryker Corporation

Get Free Sample For

Get Free Sample For