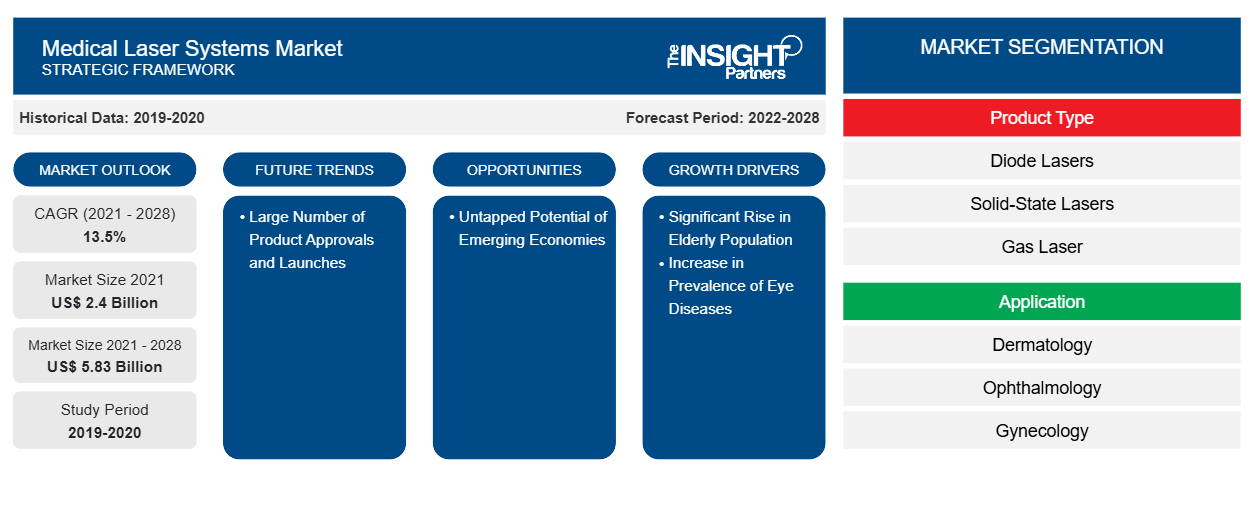

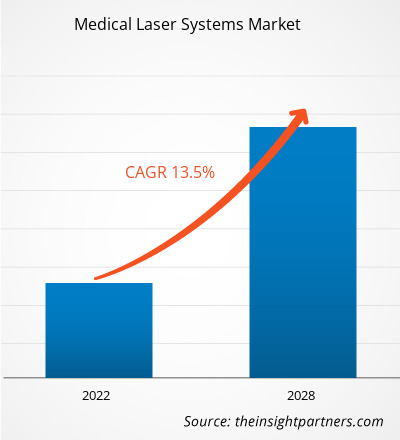

[Research Report] The medical laser systems market size is projected to reach US$ 5,834.02 million by 2028 from US$ 2,398.60 million in 2021. It is expected to grow at a CAGR of 13.5% from 2021 to 2028.

Market Insights and Analyst View:

Medical laser systems are medical devices that are utilized precisely for treating or removing tissues using precisely focused lights. With proper utilization surgeons can accomplish more complex tasks, reduce blood loss, decrease postoperative discomfort, reduce wound infection chances, and achieve better-wound healing. Increasing importance of aesthetics and rising patient pool using advanced laser-based treatments worldwide are contributing to the growth of medical laser systems market. Furthermore, Laser vision correction is one of the most common surgical procedures. Reasons for the increasing preference of patients for laser vision correction are the continued improvements in the visual results achieved and the constant reduction in the incidence of postoperative complications.

Growth Drivers and Challenges:

For laser safety worldwide there are standards that are benchmarked to contain normative and instructive recommendations for laser manufacturers, doctors, and facility administrators. Documents 60601, 60825, and 60825-Part 8 of the International Electrotechnical Commission (IEC) are available as international standards. They serve as the foundation for national standards in most countries. These standards are harmonized with national standards in several countries (the US, Australia, and Canada) and are mandated as the foundation for all other rules and professionally recommended practices. The 4173 (Guide to the Safe Use of Lasers in Healthcare) and the AS/NZ 2211 (Laser Safety) have established the expected standard for laser safety in healthcare in Australia. Despite not being regulatory, they have had the effect of regulation due to their widespread acceptance. It has been included in state regulations, such as the Radiation Safety Act 1999 in Western Australia, Tasmania, and Queensland. Owing to the stringent regulations, all medical laser manufacturers are following the safety regulations to meet the demand as there is an increasing prevalence of eye diseases. For instance, according to the National Eye Institute, the number of persons suffering from cataracts would rise to ~50 million by 2050. Also, according to the WHO, cataracts affect ~65.2 million people and cause moderate to severe vision loss in over 80% of cases. As populations age and average life expectancy continues to increase worldwide, the number of people with cataracts will continue to grow.

Furthermore, according to National Center for Biotechnology Information (NCBI), the total number of POAG cases in adult population will be 79.76 million in 2040. Thus, the rising prevalence of eye diseases worldwide highly demands medical lasers. Also, in Qatar, laser hair removal procedures is the common technique practiced and has reached to a new height from the past few years due to market for hardware cosmetology in the beauty industry has developed rapidly. This will also help the medical and beauty laser market to grow.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Laser Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Laser Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Medical laser systems Market” is segmented based on product type, application, end user, and geography. Based on product type, the medical laser systems market is divided into diode lasers, solid state lasers, gas lasers, and dye lasers. Solid state lasers is further subsegmented into holmium yttrium aluminum garnet (Ho:Yag) lasers, erbium yttrium aluminum garnet (Er:Yag) lasers, neodynium yttrium aluminum garnet (Nd:Yag) lasers, potassium titanyl phosphate (KTP), alexandrite lasers, and ruby lasers. Additionally, gas lasers is further subsegmented as CO2 laser, argon laser, krypton laser, metal vapor (Au and Cu) laser, helium-neon laser, and excimer laser. The medical laser systems market, based on application, has been segmented into dermatology, ophthalmology, gynecology, dentistry, cardiology, urology, and others. The global medical laser market, based on end user is segmented into hospitals, specialty clinics, ambulatory surgery centers, and others. The medical laser systems market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on product type, the medical laser systems market is divided into diode lasers, solid state lasers, gas lasers, and dye lasers. Solid state lasers is further subsegmented into holmium yttrium aluminum garnet (Ho:Yag) lasers, erbium yttrium aluminum garnet (Er:Yag) lasers, neodynium yttrium aluminum garnet (Nd:Yag) lasers, potassium titanyl phosphate (KTP), alexandrite lasers, and ruby lasers. Additionally, gas lasers is further subsegmented as CO2 laser, argon laser, krypton laser, metal vapor (Au and Cu) laser, helium-neon laser, and excimer laser.

The solid-state lasers segment is likely to hold the largest share of the market in 2021. Moreover, the diode laser segment is anticipated to register the highest CAGR in the market during the forecast period, due to their incumbent usage, high volume consumption, and product innovation. Also, these lasers are most energy-efficient and cost-effective lasers. Therefore, widely utilized in the field of medical therapies. Also, diode lasers are becoming increasingly popular in medical applications due to their small size and robustness and compactness. Other factors are cost-effectiveness, ease of operations as well as possess high efficiency as per the NCBI report. Apart from that, Open Access Publisher report states that diode lasers are also utilized in dentistry as diodes prove effective in soft-tissue surgery for achieving good coagulation and haemostasis. For e.g., the potential utility of diode lasers in dentistry is for different surgical procedures and especially in pediatric dental patients since its inception. Apart from that, diode lasers have proven effective in treating skin disorders. For records, three hundred patients have been treated with ultra-pulsed 980 nm laser for skin disorders as per the Indian Journal of Dermatology report. Also, demand for solid state laser is increasing and among all types of solid state laser, medical laser fibers is in high demand due to its advantages.

Based on application, market is segmented into dermatology, ophthalmology, gynecology, dentistry, cardiology, urology, and others. The dermatology segment is likely to hold the largest share of the market in 2021. Moreover, the ophthalmology segment is anticipated to register the highest CAGR in the market during the forecast period, due to growing demand laser treatment for many eye diseases treatment. Advances in medical laser systems have enabled successful surgeries for multiple eye diseases, including diabetic retinopathy, glaucoma, and others. The lasers help to prevent vision loss and improve sight. The manufacturers are also bringing innovative products to the market. For instance, Nidek introduced the YC-200 S plus ophthalmic YAG and SLT laser system/YC-200 ophthalmic YAG laser system. This system will ensure efficacious treatments and enhancing surgeon visualization of laser delivery. Laser has been one of the mainstays for the treatment of many vitreo-retinal diseases in the years from its introduction. Advances in laser delivery systems have facilitated a new approach called the sub-threshold micro-pulse mode. The other development in recent times has been the advent of multi-spot laser delivery systems. Thus, the advances in laser systems for ophthalmologic applications are likely to boost the growth of the segment in the coming years.

Based on end use, the medical laser systems market is segmented into hospitals, specialty clinics, ambulatory surgery centers, and others. In 2021, the specialty clinics segment is likely to hold the largest share of the market. Moreover, hospitals segment is also expected to witness growth over the forecast period.

Regional Analysis:

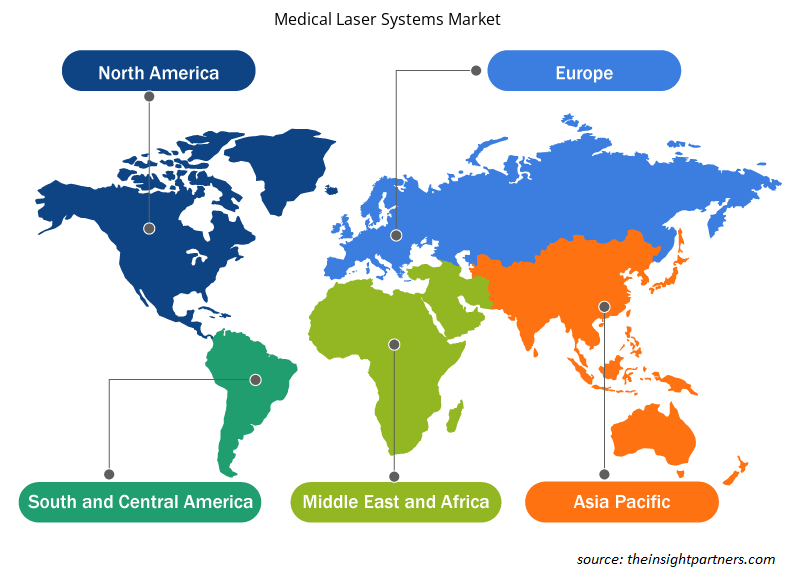

Based on geography, the medical laser systems market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest share of the global medical laser systems market, and Asia Pacific is estimated to register the highest CAGR during the forecast period. The medical laser systems market growth is attributed to Increasing adoption of technological advancements and rising research and development activities are projected to accelerate the growth of the medical laser systems market. Moreover, the presence of large healthcare businesses and the growing usage of medical laser systems is propelling the market's expansion in North America. In the Asia Pacific the market is growing faster owing to factors such as increasing application to treat various conditions, rising prevalence of chronic disorders along with growing demand for minimally invasive procedures.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global medical laser systems market are listed below:

- In July 2021, Lumenis launched the comprehensive global educational platform called MOSES HoLEP University. This will enable urologists to offer their patients holmium laser enucleation of the prostate (HoLEP) with MOSES.

- In November 2021, BIOLASE, Inc. the global leader in dental lasers, launched the Epic Hygiene Academy, bringing together leaders in the dental hygiene profession to provide improved continuing education and support the delivery of superior patient care through laser technology.

- In May 2023, International Medical Lasers (IML) launched a new laser accessory by partnering with DEKA Trio. This will feature a scanner for scar revision and treatment, giving the DEKA Trio laser technology the ability to treat tissue scarring and other medically necessary conditions through CO2 lasers.

Covid-19 Impact:

The COVID-19 pandemic affected economies and industries in various countries across the globe. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the medical device industry. During the initial surge in the 2019 coronavirus disease (COVID-19) pandemic, healthcare systems in the United States (US) quickly adapted to reduce disease transmission and reserve capacity for the infected. Although elective and non-urgent procedures were initially required to be delayed. Prolonged delays or cancellations could lead to other public health crises due to preventable and chronic diseases. The disease was increasingly becoming a cause for concern throughout the healthcare field. As surgeons resumed the full spectrum of surgical practices, the Academy offered guidance on how the COVID-19 pandemic would affect surgical decision-making, particularly regarding the indications. In general, the scientific basis for assessing the risk of SARS-CoV-2 infection in most surgeries is early and evolving. The observations and guidance would expand and change as science progresses. Even after the easing of the restrictions, the fear of infection led many patients to cancel appointments for examinations. Refractive surgery has indeed proven to be an exception and hereby appears to have benefited from a kickstart during the COVID-19 era.

Medical Lasers Systems Medical Laser Systems Market Regional Insights

The regional trends and factors influencing the Medical Laser Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Laser Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Laser Systems Market

Medical Laser Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.4 Billion |

| Market Size by 2028 | US$ 5.83 Billion |

| Global CAGR (2021 - 2028) | 13.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

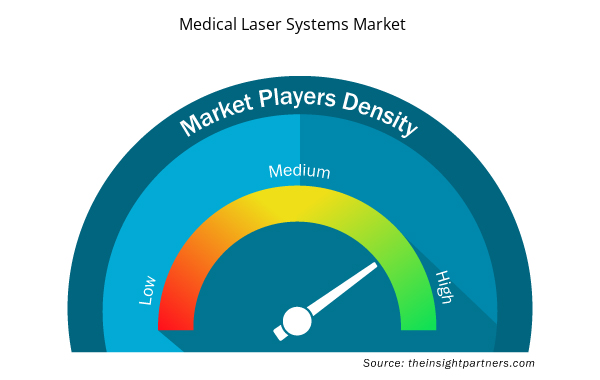

Medical Laser Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Laser Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Laser Systems Market are:

- Lumenis Be Ltd.

- Ellex

- Koninklijke Philips N.V.

- BIOLASE, Inc.

- Boston Scientific Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Laser Systems Market top key players overview

Competitive Landscape and Key Companies:

Some of the top medical laser companies operating in the global medical laser systems market include Lumenis Be Ltd., Ellex, Koninklijke Philips N.V., BIOLASE, Inc., Boston Scientific Corporation, Bausch Health Companies Inc., Alcon Inc., Iridex Corporation, Candela Medical, CryoLife, Inc. among others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Fixed-Base Operator Market

- Bioremediation Technology and Services Market

- Adaptive Traffic Control System Market

- Vessel Monitoring System Market

- Skin Graft Market

- Machine Condition Monitoring Market

- Lyophilization Services for Biopharmaceuticals Market

- Medical Devices Market

- Grant Management Software Market

- Resistance Bands Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Food and Drug Administration (FDA) defines medical laser systems as devices that are utilized and focused on light sources for treating or removing tissues, with proper utilization, medical laser systems allow the surgeons to accomplish more complex tasks, reduce blood loss, decrease postoperative discomfort, reduce the chances of wound infections, and better wound healing. Furthermore, medical laser systems use non-ionizing radiation, and so it does not have the same long-term risks as x-rays or other types of ionizing radiation.

Significant rise in the elderly population is one of the most significant factors responsible for the overall market growth.

The dermatology segment dominated the global medical laser systems market and accounted for the largest revenue of 652.99 Mn in 2021.

Lumenis Be Ltd., Ellex Medical Laser (Noval Eye Medical), Koninklijke Philips N.V., BIOLASE, Inc., Boston Scientific Corporation, Bausch Health Companies Inc., Alcon Inc., Iridex Corporation, Candela Medical, Atrivion Inc.. are among the leading companies operating in the global medical laser systems market

Global medical laser systems market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In North America, the U.S. is the largest market for medical laser systems market. The US is estimated to hold the largest share in the medical laser systems market during the forecast period. The presence of top players and favorable regulations related to product approvals coupled with commercializing new products are the contributing factors for the regional growth. Additionally, the increasing number of R&D activities is the key factor responsible for the Asia-Pacific regional growth for medical laser systems accounting fastest growth of the region during the coming years.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Medical Lasers Systems Market

- Lumenis Be Ltd.

- Ellex

- Koninklijke Philips N.V.

- BIOLASE, Inc.

- Boston Scientific Corporation

- Bausch Health Companies Inc.

- Alcon Inc.

- Iridex Corporation

- Candela Medical

- Artivion, Inc.

Get Free Sample For

Get Free Sample For