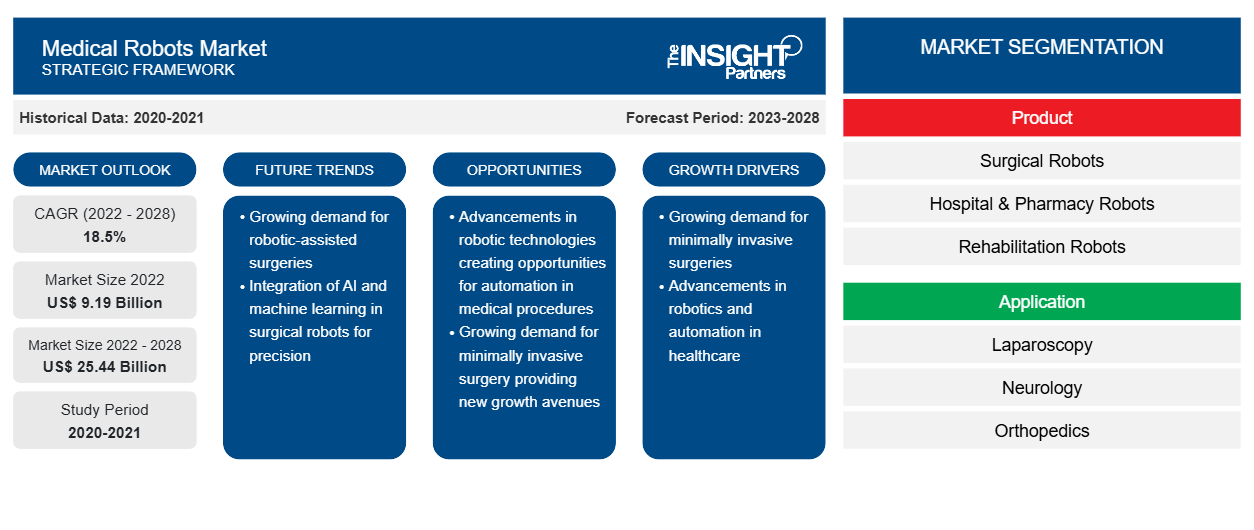

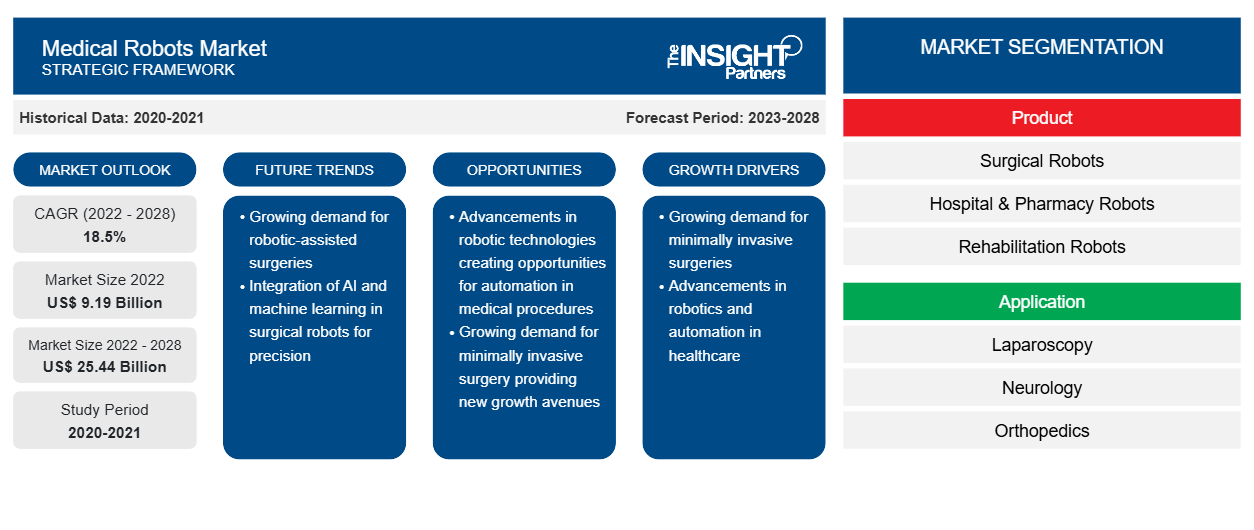

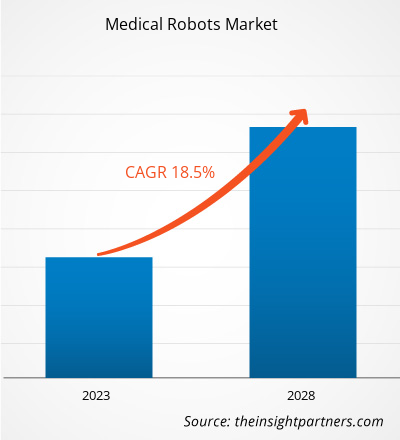

The medical robots market is projected to reach US$ 25,443.36 million by 2028 from an ectimated value of US$ 9,189.70 million in 2022; it is expected to grow at a CAGR of 18.5% from 2022 to 2028.

Increasing number of surgical procedures and rising number of product launches and approvals are expected to drive the medical robots market. However, the high cost of surgical procedures and installation hinders the market growth.

Medical robots are designed for specialized medical applications. These robots can perform a variety of medical tasks such as surgery, medical testing, and patient monitoring. They can perform surgery solely based on the surgeon's pre-surgical planning. Medical robots enable high precision in open and minimally invasive surgeries. They also significantly reduce the time required for surgery. Further, medical robots can be used to transport patients from one location in a hospital to another. Robots for remote caregiving, disinfectant robots to reduce hospital-acquired infections, and robotic exoskeletons for rehabilitation training that provide external support and muscle training are all examples of medical robot applications. Robotic technique in healthcare was first used in 1985, although it was only in 2000 that the da Vinci robot received US FDA approval for carrying out surgical procedures. The da Vinci robot is widely known for its applications in cardiac surgery, head and neck surgery, and urologic surgery.

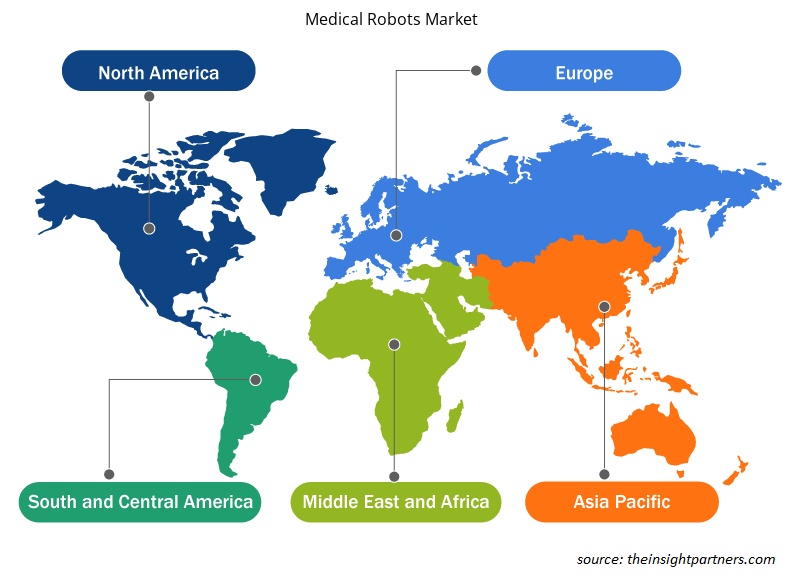

North America is likely to dominate the medical robots market during the forecast period. The US held the largest share of the North American market in 2022 and is expected to continue this trend during the forecast period. According to a study published by the American Society for Metabolic and Bariatric Surgery in 2022, the US witnessed around 62.0% of growth in bariatric surgeries during the past decade. In addition, according to the study published by the Agency for Healthcare Research and Quality in 2017, around 0.7 million total knee replacement surgeries were performed in the US per year. Such a significant number of surgical procedures is estimated to offer a favorable environment for adopting advanced healthcare facilities that will drive the US medical robots market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Robots Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Robots Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The medical robots market is segmented based on product, application, end user, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The medical robots report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, market dynamics, and the competitive analysis of the globally leading market players.

Market Insights

High Number of Surgical Procedures

There is a rise in the number of surgeries performed worldwide. There has been an increase in the incidence of cardiovascular diseases in European countries in the last 25 years. In the region, the rise in diabetic cases and lifestyle changes are increasing the number of cardiovascular surgeries and general surgeries.

Cancer and diabetes are among the leading causes of mortality globally. As per a study by the American Cancer Society (ACS), in 2021, ~1.9 million new cancer cases were diagnosed in the US. In 2021, according to Dutch Cancer Registry, around 123,672 new cancer cases were registered in the Netherlands. Moreover, according to the International Diabetes Federation (IDF), in 2021, an estimated 537 million people across the world had diabetes. The number is expected to reach 783 million by 2045.

According to the study published by the American Society for Metabolic and Bariatric Surgery, in 2019, around 252,000 weight loss surgeries were performed in the US. The increasing number of surgical procedures creates a need for robotic surgery instruments. Therefore, the staggering prevalence of chronic conditions and the rising number of surgical procedures generate the demand for robotic surgery instruments.

Product Insights

Based on product, the global medical robots market is segmented into surgical robots, rehabilitation robots, non-invasive radio surgery robots, hospitals & pharmacy robots, and others. The surgical robots are subsegmented into neurological surgery robotic systems, cardiology surgery robotic systems, laparoscopic surgical robotic systems, and orthopedic surgical robotic systems. In 2022, the surgical robots segment held the largest share of the market. Robotic surgeries are surgical procedures performed using robotic surgical systems. Surgical robots are self-automated and computer-controlled medical devices that are programmed to assist in the positioning and manipulating the surgical instruments, these surgical robots helps surgeons to perform complex surgical procedures. These robots has the ability to enhance the capabilities of surgeons performing open surgery. Therefore, the surgical robots are allowed to perform the complex and advanced surgical procedures with increases precision through minimally invasive ways. However, the rehabilitation robots segment is anticipated to register the highest CAGR during the forecast period.

Application Insights

Based on application, the global medical robots market is segmented into laparoscopy, neurology, orthopedics, gynecology, urology, cardiology, and others. In 2022, the laparoscopy segment held the largest share of the market. However, the neurology segment is expected to register the highest CAGR during the forecast period. Laparoscopy is a surgical diagnostic procedure used to examine the organs inside the abdomen. Robotic surgery is a minimally invasive procedure that requires only small incisions and has low risk. In 2000, the da Vinci surgery system became the first robotic surgery system approved by the FDA for general laparoscopic surgery. And the latest high-end model is the da Vinci Xi. The deployment of medical robots has led to improved efficiency in laparoscopic surgical procedures. In January 2022, a robot performed laparoscopic surgery on the soft tissue of a pig without the guiding hand of a human. As the medical field moves toward more laparoscopic approaches for surgeries, it will be important to have an automated robotic system designed for such procedures to assist. One of the major reasons behind the growing preference for laparoscopic procedures in recent years is the gradual shift of the healthcare sector away from open surgeries. The laparoscopy market is likely to grow in the coming years due to all the factors mentioned above.

End User Insights

Based on end user, the global medical robots market is segmented into hospitals, ambulatory surgical centers, and others. In 2022, the hospitals segment held the largest share of the market. Moreover, the same segment is expected to register the highest CAGR in the market during the forecast period, owing to the medical advantages and usage of medical robots in the surgical procedures at an increased rate and enhaced performance of the robots during surgical procedures.

Product launches and collaborations are highly adopted strategies by the global medical robots market players to expand their global footprints and product portfolios. The players also focus on the partnership strategy to enlarge their clientele, which, in turn, permits them to maintain their brand name globally. They aim to flourish their market shares with the development of innovative products. A few of the recent key market developments are listed below:

- In February 2022, Capsa Healthcare a leading innovator in healthcare delivery solutions for hospitals, long-term care, and retail pharmacy providers acquired Humanscale Healthcare, a designer and manufacturer of flexible technology solutions and computing workstations based in New York, NY.

- In January 2022, Omnicell, Inc. launched Reimaging IV Station, a fully automated IV compounding robot that tackles industry issues head-on while delivering patient safety, accuracy, cost savings, supply chain control, and compliance benefits.

- In October 2021, Accuray launched Precision Treatment Planning System, enabling users to plan with ease, optimize with quality, and deliver treatments efficiently. VOLO Ultra is the latest evolution of the planning solution, the Accuray Precision Treatment Planning System. It helps accelerate Radixact and TomoTherapy treatments so clinicians can treat more patients each day. It includes a state-of-the-art optimizer with a modern and fast gradient-based algorithm that provides optimal plan quality for every treatment.

- In June 2021, ARxium launched a robot "RIVA" at the Lille University Hospital to prepare injectable chemotherapies.

Medical Robots Market Regional Insights

Medical Robots Market Regional Insights

The regional trends and factors influencing the Medical Robots Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Robots Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Robots Market

Medical Robots Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 9.19 Billion |

| Market Size by 2028 | US$ 25.44 Billion |

| Global CAGR (2022 - 2028) | 18.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

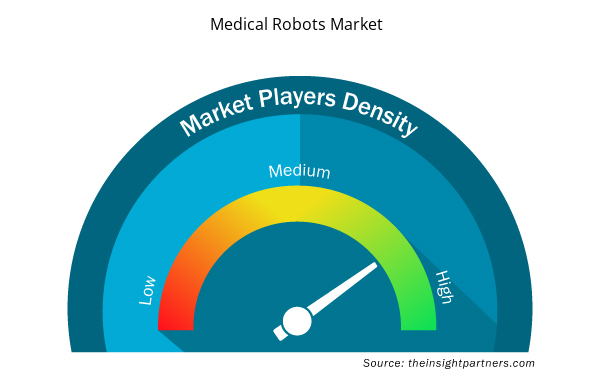

Medical Robots Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Robots Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Robots Market are:

- Abbott

- F. Hoffmann-La Roche Ltd.

- Immunexpress Inc.

- BD

- Danaher

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Robots Market top key players overview

Medical Robots – Market Segmentation

The global medical robots market is segmented based on product, application, and end user. In terms of product, the global medical robots market is segmented into surgical robots, rehabilitation robots, non-invasive radiosurgery robots, hospital & pharmacy robots, and others. Based on application, the global medical robots market is segmented into laparoscopy, neurology, orthopedics, gynecology, urology, cardiology, and others. In terms of end user, the medical robots market is segmented into hospitals, ambulatory surgical centers, and others.

Company Profiles

- Intuitive Surgical, Inc.

- Stryker Corporation

- Hocoma AG

- Medtronic

- Auris Health, Inc.

- Accuray Incorporated

- Omnicell Inc.

- Arxium

- Ekso Bionics Holdings, Inc.

- Kirby Lester LLC.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, and End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The pandemic of coronavirus disease 2019 (COVID-19) has increased hospital resource us. As a result, health care systems are overburdened, and the delivery of medical care to all patients has become a challenge in the region. In addition, medical device industry is also facing negative impact of this pandemic. As the COVID-19 pandemic continues to unfold, medical device companies are finding difficulties in managing their operations. Many companies offering medical robots have their business operations in the United states and business are adversely being affected by the effects of a widespread outbreak of COVID-19. This has disrupted and restricted company’s ability to distribute products, as well as temporary closures of company’s facilities. However, gradually hospitals have started resuming elective procedures as the COVID-19 recovery rate is increasing the demand for medical equipment like medical robots is expected to increase.

In 2022, North America is likely to account for the largest share in the global medical robots market. However, Asia Pacific is projected to grow at a faster pace over the forecast period. The growth of the medical robots market in this region is primarily due to increasing number of minimally invasive surgeries in Japan and China, due to the rise in the medical tourism in India, and the growth in the initiatives taken by government to enhance the usage of medical robots.

The medical robots market majorly consists of players such as Intuitive Surgical, Inc., Stryker Corporation, Hocoma AG, Medtronic, Auris Health, Inc., Accuray Incorporated, Omnicell Inc., Arxium, Ekso Bionics Holdings, Inc., ad Kirby Lester LLC among others.

Intuitive Surgical, Inc., and Stryker Corporation are the top two companies that hold huge market shares in the medical robots market.

The surgical robots segment is likely to for the largest share in the global medical robots market by product owing to key factors like rise of technological innovations in robotic systems to increase their efficiency and utility, rapid advancements in surgical robots, rising demand for minimal invasive surgical procedures, advantages of robotic assisted surgeries, the post-surgery benefits, and rising per capita healthcare spending in emerging countries.

The CAGR value of the medical robots market during the forecasted period of 2022-2028 is 18.5%.

Medical robots are designed to assist surgeons during the surgical procedures. Medical robots are professional service robots that are used inside and outside of the hospital settings to progress the overall level of patient care. They reduce the workload of healthcare staff, enabling them to spend more time caring directly to patients while creating substantial operational procedure which provides efficacy and reduced cost investments for healthcare amenities. The medical robots are majorly used for surgical producers, there are different types of medical robots. The types of the medical robots include surgical robots, rehabilitation robots, hospital & pharmacy robots, and more.

The use of the medical robots is more in countries of US as the technological advancement is matured and is highly involved in the research and developments for the healthcare and medical industries. The Canada is also a matured market for the medical robotics as the rise in the support by the government for the developments of the medical equipment is rising with the help of financial support. However, the Mexico is the late adopter of the medical robots still the market is likely to propel significantly in the forecasted period due to the advantages provided by the medical robots.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Medical Robots Market

- Abbott

- F. Hoffmann-La Roche Ltd.

- Immunexpress Inc.

- BD

- Danaher

- Luminex Corporation

- Thermo Fisher Scientific Inc.

- bioMerieux SA.

- T2 Biosystems, Inc.

- Axis-Shield Diagnostics Ltd.

Get Free Sample For

Get Free Sample For