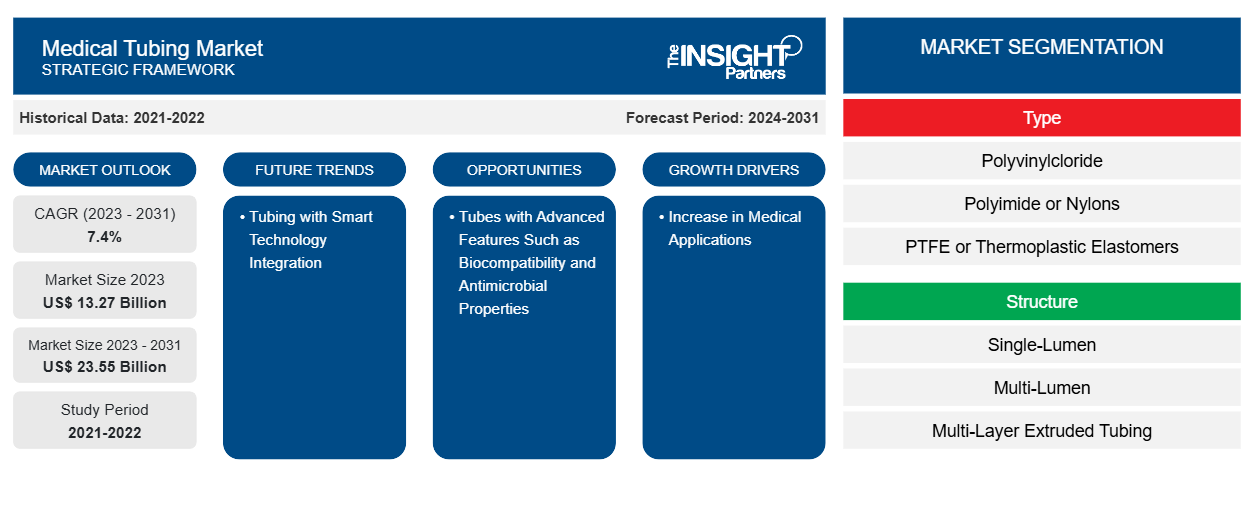

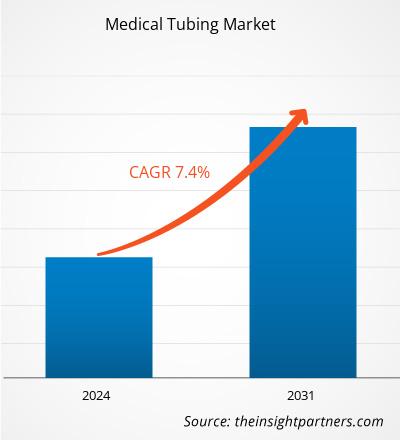

The medical tubing market size is projected to reach US$ 23.55 billion by 2031 from US$ 13.27 billion in 2023; the market is estimated to grow at a CAGR of 7.4% during 2023–2031. The adoption of tubing with smart technology integration are likely to act as a future trend in the market in the coming years.

Medical Tubing Market Analysis

The use of medical tubing is on the rise in the pharmaceutical and biopharmaceutical industries. Bioprocessing involves utilizing living cells or their components to produce desired products. This process requires specialized tubing solutions to ensure efficiency, safety, and adherence to strict regulatory standards. The sterility of materials used is crucial in bioprocessing applications. Medical-grade tubing made from biocompatible materials such as silicone and thermoplastic elastomers (TPE) is essential to prevent the leaching of harmful substances into biopharmaceutical products. The increasing regulatory emphasis on product safety and efficacy drives the demand for medical tubing solutions that guarantee high levels of purity and biocompatibility during bioprocessing.

The tubing with advanced features such as biocompatibility and antimicrobial properties would generate significant growth opportunities in the medical tubing market in the future. Manufacturers can customize tubing for medical devices such as catheters, endoscopes, and infusion systems by collaborating with healthcare professionals, ultimately enhancing the functionality and effectiveness of end products. In January 2022, Otsuka Pharmaceutical Factory, Inc. introduced "Actreen," a single-use catheter with a tube and connector. It can be used by patients who have lost the urge to urinate or who opt for self-catheterization due to the difficulty faced during urinating.

Medical Tubing Market Overview

The healthcare sector in China is rapidly growing due to rising health expenditures, an increasing aging population, and surging demand for medical equipment. The country is obliged to modernize its medical facilities and healthcare, which fuels the demand for quality medical devices. Medical tubing is often required in applications such as intravenous therapy, respiratory care, and surgical procedures. Innovation is a highly relevant driving force in the Chinese marketplace. Manufacturers in various healthcare industries are highly innovation oriented; they are coming up with materials and technologies with better performance, safety features, etc. Medical tubing products manufactured using biocompatible material and smart technologies are gaining significant traction in the Chinese market. Medical tubing devices integrated with smart technologies aid in the real-time monitoring of patient conditions. By mapping such potential growth avenues, key players are focusing on expanding their production bases in China and other similar markets in Asia Pacific. For instance, as per its announcement made in August 2022, DuPont added new manufacturing capacity for its silicone Liveo Pharma Tubing at its eastern China production facilities. The company also aims to boost manufacturing to produce high-purity biopharmaceutical tubing for the market in Greater China.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Tubing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Tubing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Tubing Market Drivers and Opportunities

Increase in Medical Applications of Tubing Fuels Market

Medical tubing is utilized in various medical and pharmaceutical applications, including fluid management, drainage, anesthesiology, respiratory equipment, intravenous (IV) administration, catheters, peristaltic pumps, dialysis, feeding tubes, and biopharmaceutical laboratory equipment. Medical interventions that involve specialized medical tubing are often needed in the management of chronic diseases, such as diabetes, cardiovascular diseases, and cancer. In 2022, the American Cancer Society estimated 26,380 new cases of stomach cancer (gastric cancer) in the US. According to the Global Cancer Statistics published in 2022 by GLOBOCAN, the category of trachea, bronchus, and lung cancer was the most common cancer condition worldwide, followed by breast cancer and colorectal cancer, respectively. As per the International Agency for Research on Cancer (IARC), nearly 1 in 5 people would develop cancer during their lifetime, and ~1 in 9 men and ~1 in 12 women succumb to the disease. With the rising prevalence of chronic diseases, healthcare systems continuously seek medical devices such as infusion devices, catheters, and IV administration systems using tubing to effectively manage these conditions. Companies such as RAUMEDIC AG and Saint-Gobain offer a wide range of medical tubing systems for drug delivery devices, infusion devices, internal feeding systems, and peristaltic pumps. RAUMEDIC's silicone tubing is ideal for use in medical pump devices. Patients suffering from chronic diseases often require hospitalization, wherein treatment processes such as catheterization, drainage, and infusion involve the use of medical tubing. Patients with serious chronic conditions may also need surgical interventions, making medical tubing products invincible. Reliable and effective medical tubing solutions significantly contribute to patient safety and the success of treatments.

Tubes with Advanced Features Such as Biocompatibility and Antimicrobial Properties to Offer Opportunities for Market

As healthcare evolves, the demand for advanced medical tubing solutions tailored to various applications is increasing. By creating tubing systems with enhanced features, such as antimicrobial properties or integrated drug delivery systems, the manufacturers can differentiate their innovations and meet evolving consumer demands. They are also focusing on medical tubing made from advanced materials that enhance flexibility, durability, and biocompatibility. Biodegradable polymers and antimicrobial coatings help meet regulatory standards while improving patient outcomes. Companies such as Trelleborg Group, Medtronic, and Saint-Gobain offer antimicrobial tubing solutions. Fresenius Kabi offers antimicrobial medical tubing aimed at intravenous therapy and enteral feeding applications; this tubing is engineered to improve patient safety by reducing microbial contamination. Thus, the creation of innovative products generates significant opportunities for manufacturers in the medical tubing market.

Medical Tubing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical tubing market analysis are type, structure, application, end user, and geography

- The medical tubing market, based on type, is segmented into polyvinyl chloride (PVC), polyimide/nylons, polytetrafluoroethylene (PTFE)/thermoplastic elastomers (TPES), thermoplastic polyurethanes (TPUS), polyvinylidene fluoride (PVDF), polypropylene and polyethylene, silicone, and others. The Polyvinyl Chloride (PVC) segment held the largest share in the medical tubing market in 2023, and it is expected to register the highest CAGR during 2023–2031.

- The market, based on structure, is segmented into single-lumen tubing, multi-lumen tubing, multilayer extruded tubing, tapered or bump tubing, braided tubing, balloon tubing, corrugated tubing, heat shrink tubing, and others. The single-lumen segment held the largest share of the medical tubing market in 2023.

- Based on application, the market is segmented into bulk disposable tubing, catheter and cannula, drug delivery systems, and others. The bulk disposable tubing segment held the largest share of the medical tubing market in 2023.

- In terms of end user, the medical tubing market is segmented into hospitals, clinics, ambulatory care centers, medical device companies, laboratories, etc. The hospital and clinics segment held the largest share of the medical tubing market in 2023.

Medical Tubing Market Share Analysis by Geography

The geographic scope of the medical tubing market report is mainly divided into 5 major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America dominated the market in 2023. Investors are increasingly focusing on companies that produce high-quality medical tubing, which serves a critical role in healthcare applications such as anesthesia delivery and fluid management. Innovative materials such as specialty polymers and biocompatible plastics determine the performance and safety of medical devices. In June 2020, Nordson Corporation acquired Fluortek, Inc., an Easton, Pennsylvania-based precision plastic extrusion manufacturer that serves the medical device industry with custom-dimensioned tubing. As Nordson MEDICAL continues expanding differentiated product offerings, the acquisition of Fluortek enhances its ability to deliver critical components that make customers' most complex medical device innovations possible. This expansion further reinforces Nordson MEDICAL's position as a component and device manufacturing capability provider for OEMs throughout the interventional, minimally invasive, and surgical medical device landscape.

The higher rate and early adoption of emerging medical technologies, coupled with the rising prevalence of chronic diseases, are likely to increase the demand for medical tubing solutions. As healthcare delivery continues to focus on efficiency and patient safety, investing in this area is expected to reap good returns and present an attractive investment avenue for growth-driven investors across the US.

Medical Tubing Market Regional Insights

The regional trends and factors influencing the Medical Tubing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Medical Tubing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Medical Tubing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.27 Billion |

| Market Size by 2031 | US$ 23.55 Billion |

| Global CAGR (2023 - 2031) | 7.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

Medical Tubing Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Tubing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Medical Tubing Market top key players overview

Medical Tubing Market News and Recent Developments

The medical tubing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- NuVasive, Inc., a leader in spine technology and innovation, launched the NuVasive Tube System (NTS) and Excavation Micro, which is a minimally invasive surgery system that provides comprehensive solutions for both transforaminal lumbar interbody fusion (TLIF) and decompression. With these additions, the company expanded and enhanced its instrumentation technology offerings. (Source: NuVasive, Inc, Company Website, November 2022).

- Smiths Medical launched a new polyvinyl chloride (PVC) tube portfolio to its family of tracheostomy tubes. With the launch of this new PVC tracheostomy, the company can cater to a broad patient population and help clinicians offer better patient care. (Source: Smiths Medical, Company Website, April 2020)

Medical Tubing Market Report Coverage and Deliverables

The "Medical Tubing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Medical tubing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Medical tubing market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Medical tubing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the medical tubing market

- Detailed company profiles

Frequently Asked Questions

What are the future trends in the medical tubing market?

Which are the leading players operating in the medical tubing market?

Which country dominated the medical tubing market in 2023?

What are the factors driving the medical tubing market growth?

What is the expected CAGR of the medical tubing market?

What would be the estimated value of the medical tubing market by 2031?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For