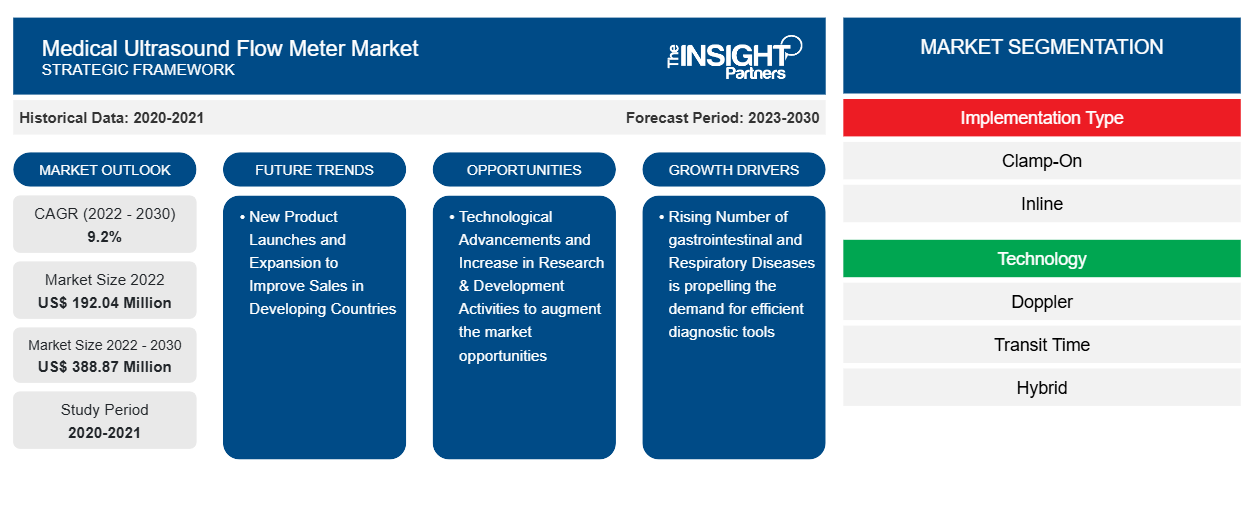

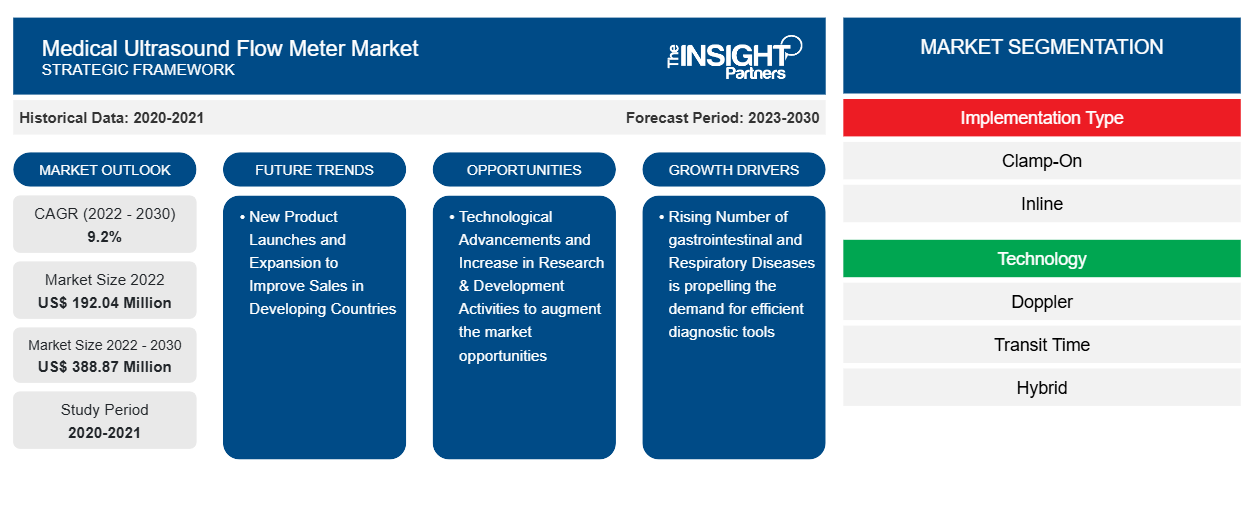

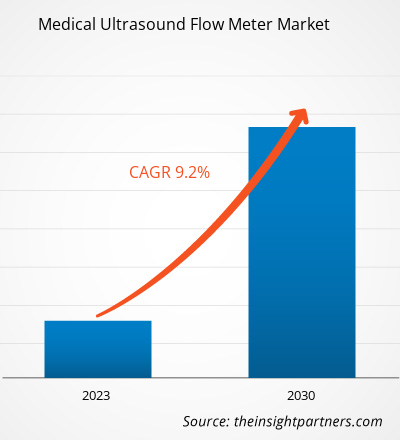

The Medical Ultrasound Flow Meter market size is projected to reach US$ 388.87 million by 2030 from US$ 192.04 million in 2022. The market is expected to register a CAGR of 9.2% in 2022–2030. The rising number of cardiovascular diseases and respiratory diseases and the increasing need for transplant procedures are the key driving factors for the market development. However, high cost and low accuracy of the ultrasonic flow meter are hampering the market growth.

Medical Ultrasound Flow Meter Market Analysis

Over recent years, ultrasound flow measurement has been promising in medical applications. Rising incidences of peripheral vascular disorders, together with an expanding base of geriatric population, are likely to trigger expansion of the global flow medical ultrasound flow meter market

Medical Ultrasound Flow Meter Market Overview

Millions of deaths are recorded due to cardiovascular diseases (CVDs) annually across the world. For instance, CVDs accounted for 45% of deaths in Europe and 37% in the European Union (EU). According to the 2022 Heart Disease & Stroke Statistical Update Fact Sheet, Global Burden of Disease, 119.1 million patients succumbed to death globally due to CVD in 2020. It also stated that the global prevalence of stroke and ischemic stroke in 2020 was 89.1 million and 68.2 million, respectively. As per the National Center for Chronic Disease Prevention and Health Promotion, Division for Heart Disease and Stroke Prevention, about 697,000 people were reported to have had heart disease in the US in 2022. According to the American Heart Association, ~ 130 million people in the US accounting for about 45.1% of the total population) are likely to be affected by some type of cardiovascular disease by 2035. Further, according to the National Library of Medicine, ~ 400,000 coronary artery bypass grafting (CABG) surgeries were performed in 2022.

Chronic obstructive pulmonary disease (COPD) obstructs the airflow from the lungs, which can lead to various respiratory failure. It is one of the life-threatening illnesses that cause millions of deaths across the world. According to the World Health Organization (WHO), Chronic obstructive pulmonary disease (COPD) was the third leading cause of death in 2022. In 2020, about 90% of COPD deaths occurred in low- and middle-income countries. According to the Centers for Disease Control and Prevention (CDC), in 2020, COPD was the sixth leading cause of death in the US. Thus, the increasing number of CVDs and respiratory diseases has promoted the growing use of external support devices incorporated with ultrasound flow meters. For instance, extracorporeal membrane oxygenation (ECMO)—a life support system that provides a temporary solution for pumping fluids in the patient’s body through medical tubing—is incorporated with ultrasound flow meters to work in place of heart or lungs in order to ensure the accurate flow of oxygenated blood during surgical procedures.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Ultrasound Flow Meter Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Ultrasound Flow Meter Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Ultrasound Flow Meter Market Drivers and Opportunities

Growing Incidence of Organ Failure Boosting Demand for Medical Ultrasound Flow Meter

The growing incidence of organ failure across the globe due to various chronic health conditions such as cardiovascular disorders, genetic conditions, and diabetes has triggered the demand for organ transplant procedures. As per the Health Resources and Service Administration report 2020, ~106,247 people are on the national transplant waiting list in the US. Every 9 minutes, a person is added to the transplant list. As per the Global Observatory on Donation and Transplantation, ~129,681 organ transplantations were performed in 2020 globally. Additionally, development in medical facilities to enhance the success rates of transplant procedures and minimise organ rejection rates as well has fuelled the demand for advanced organ transportation systems, subsequently contributing to the demand for medical ultrasound flow meters—critical components of organ transportation systems. The integration of ultrasonic flow meters into organ transportation systems emphasizes the growing importance of technology in medical and surgical applications to enhance the success rates of organ transplants. Ultrasonic flow meters in organ transportation systems are mainly used for advanced monitoring and preservation, which, in turn, extend the viability of organs and improve transplant outcomes.

New Product Launches and Expansion to Improve their Sales – An Opportunity in Medical Ultrasound Flow Meter Market

Companies operating in the medical ultrasound flow meter market constantly focus on new product launches and expansion to improve their sales. A few of the noteworthy developments in the medical ultrasound flow meter market are mentioned below.

- In April 2021, NovaSignal Corp. launched the NovaGuide 2 Platform that provides clinical teams with critical, real-time information about cerebral blood flow to guide diagnosis and advance patient results. The device is intended to integrate into current clinical practice; the platform contains the NovaGuide 2 Intelligent Ultrasound. The device autonomously captures blood flow data to identify brain illnesses and diseases. The NovaGuide View implements secure, cloud-based access to efficient exam data.

Thus, developments in ultrasound flow meters are anticipated to generate lucrative opportunities for the market growth during the forecast period.

Medical Ultrasound Flow Meter Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical ultrasound flow meter market analysis are implementation type, technology , application , end user.

- Based on implementation type, the medical ultrasound flow meter market is divided into clamp-on, inline, and others. The clamp-on segment held a higher market share in 2022.

- Based on technology, the market is segmented into doppler, transit time, and hybrid.

- In terms of application , the market is segmented heart and lung machines, extracorporeal membrane oxygenation, perfusion, organ transportation systems, and others.

- Based on end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, research laboratories, and others.

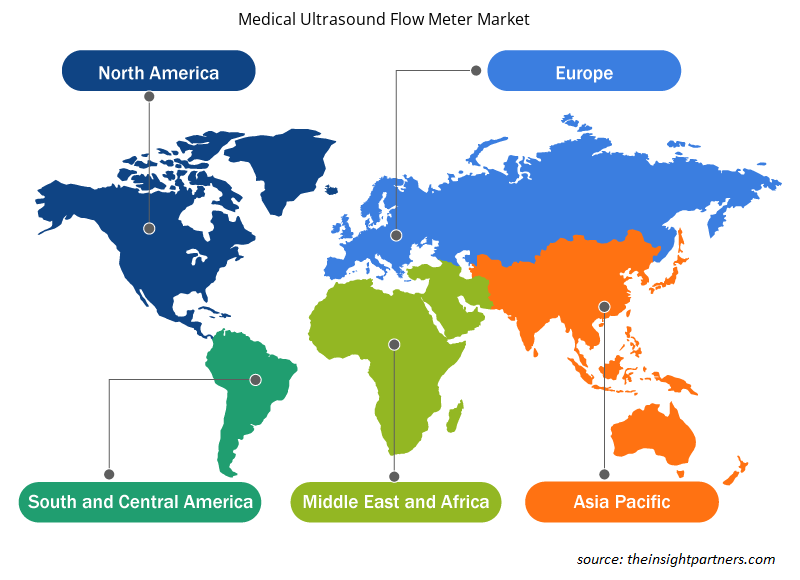

Medical Ultrasound Flow Meter Market Share Analysis by Geography

The geographic scope of the medical ultrasound flow meter market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

The North America medical ultrasound flow meter market is segmented into the US, Canada, and Mexico. The increasing prevalence of cardiovascular diseases and respiratory diseases and growing strategic developments by market players contribute to the market development in the region. The US holds the leading medical ultrasound flow meter market share.

The increasing chronic kidney diseases and prevalence of the geriatric population in the US are projected to drive the medical ultrasound flow meter market. For instance, according to the National Chronic Kidney Disease fact sheet, in 2020, approximately 30 million people suffered from chronic kidney diseases in the US. According to the American Heart Association, in 2019 January, it was reported that by 2035, over 130 million, or 45.1% of people, are likely to suffer from some type of cardiovascular disease. Therefore, the growing incidence of chronic and cardiovascular diseases is upsurging the demand for Extracorporeal Membrane Oxygenation (ECMO) and organ transportation systems. Thus, all these factors are supporting the growth of the medical ultrasound flow meter market in the US

Medical Ultrasound Flow Meter Market Regional Insights

The regional trends and factors influencing the Medical Ultrasound Flow Meter Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Ultrasound Flow Meter Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Ultrasound Flow Meter Market

Medical Ultrasound Flow Meter Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 192.04 Million |

| Market Size by 2030 | US$ 388.87 Million |

| Global CAGR (2022 - 2030) | 9.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Implementation Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

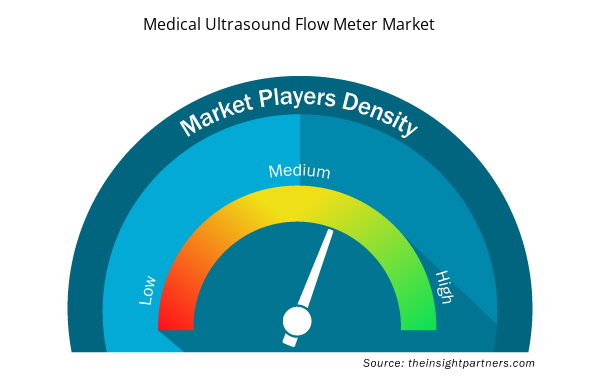

Medical Ultrasound Flow Meter Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Ultrasound Flow Meter Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Ultrasound Flow Meter Market are:

- Arjo AB

- PSG Dover, Moor Instruments Ltd

- Transonic Systems Inc.

- Compumedics Ltd

- Cook Medical Holdings LLC

- GF Health Products Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Ultrasound Flow Meter Market top key players overview

Medical Ultrasound Flow Meter Market News and Recent Developments

The medical ultrasound flow meter market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In June 2022, Sonotec GmbH enhanced its SONOFLOW CO.55 non-contact flow meter to increase the efficiency throughout PAT-related upstream and downstream processes in biotechnology applications. The new SONOFLOW CO.55 V3.0 sensor combines outstanding measurement accuracy and highest clamp-to-clamp repeatability. (Source: Sonotec GmbH Press Release)

Medical Ultrasound Flow Meter Market Report Coverage and Deliverables

The “Medical Ultrasound Flow Meter Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering the following areas:

- Medical Ultrasound Flow Meter Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Medical Ultrasound Flow Meter Market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Medical Ultrasound Flow Meter market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Medical Ultrasound Flow Meter Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Implementation Type, Technology, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 9.2% during 2022–2030.

North America region dominated the medical ultrasound flow meter market in 2022

Key factors that are driving growth of the market are rising number of cardiovascular and respiratory diseases.

Technological advancements and increase in research & development activities are the current trend witnessed in the target market.

Arjo AB, PSG Dover, Moor Instruments Ltd, Transonic Systems Inc., Compumedics Ltd, Cook Medical Holdings LLC, GF Health Products Inc., and Sonotec Gmbh.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Medical Ultrasound Flow Meter Market

- Arjo AB

- PSG Dover

- Moor Instruments Ltd

- Transonic Systems Inc

- Compumedics Ltd

- Cook Medical

- Holdings LLC

- GF Health Products Inc

- Sonotec Gmbh

- Deltex Medical Ltd

- Strain Measurement Devices Inc

- Siemens AG

- Perimed AB

- Sensirion Holding AG

Get Free Sample For

Get Free Sample For