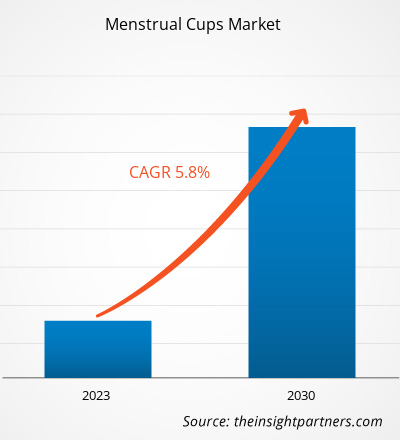

[Research Report] The menstrual cups market size was valued at US$ 1,050.81 million in 2022 and is expected to reach US$ 1,644.06 million by 2030; it is estimated to register a CAGR of 5.8% from 2022 to 2030.

Market Insights and Analyst View:

Menstrual cups are reusable, bell-shaped devices designed for feminine hygiene during menstruation. Typically made of medical-grade silicone or rubber, these cups are inserted into the vagina to collect menstrual fluid rather than absorbing it like traditional tampons or pads. They create a seal to prevent leaks and can be worn for up to 12 hours before needing to be emptied, offering a sustainable and cost-effective alternative to disposable products. Menstrual cups are gaining popularity for their environmental benefits and long-term cost savings compared to traditional menstrual hygiene options.

Growth Drivers and Challenges:

The surging demand for sustainable menstrual products is a primary driver propelling the menstrual cup market. In recent years, there has been a global shift toward sustainability, with consumers becoming increasingly aware of the environmental impact of traditional disposable menstrual products. Traditional pads and tampons contribute significantly to plastic waste, and their production involves consuming resources and energy. Every year, an average woman trashes nearly 150 kilograms of nonbiodegradable waste. In India alone, roughly 121 million women and girls use an average of eight disposable and non-compostable pads per month, generating 1.021 billion pads waste monthly, 12.3 billion pads waste annually, and 113,000 metric ton of annual menstrual waste. Menstrual cups have emerged as a leading choice as individuals seek eco-friendly alternatives due to their reusable nature. This heightened environmental consciousness drives consumers to opt for products that minimize their ecological footprint, boosting the demand for menstrual cups.

The increased demand for sustainable menstrual products is closely tied to a broader movement advocating women's health and well-being. Consumers are increasingly prioritizing products that are not only good for the environment but also safe and beneficial for their health. Menstrual cups, typically made from medical-grade silicone, rubber, or thermoplastic elastomers, are considered safe and hygienic, reducing the risk of irritation and allergic reactions often associated with traditional products. The alignment of menstrual cups with environmental sustainability and women's health contributes to their appeal, acting as a driver for their rising popularity.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Menstrual Cups Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Menstrual Cups Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The call for sustainability in menstrual products has been amplified by various advocacy groups, NGOs, and government initiatives that aim to raise awareness about the environmental impact of disposable options. Campaigns promoting sustainable menstruation have been crucial in educating the public about the benefits of reusable alternatives like menstrual cups. The growing visibility and endorsement of sustainable menstrual practices contribute to a positive shift in consumer attitudes, fostering greater acceptance and adoption of menstrual cups.

The demand for sustainable menstrual products is also fueled by a younger generation of consumers prioritizing eco-conscious choices. Millennials and Generation Z, in particular, drive the demand for sustainable and ethical products across various industries, including personal care. These demographics' awareness and preferences influence market trends, and menstrual cups, being a sustainable and forward-thinking option, align well with their values. As this demographic continues to grow in purchasing power, the demand for menstrual cups will also grow, reinforcing their position in the market as a leading sustainable menstrual product.

However, consumer perception and unawareness represent significant restraints in the menstrual cup market, impacting adoption rates globally. Many individuals remain uninformed about the benefits of menstrual cups due to a lack of comprehensive education and awareness campaigns. The unfamiliarity with the product and its advantages, such as cost-effectiveness, reduced environmental impact, and extended wear time, contributes to potential users' reluctance to switch from traditional menstrual products. This lack of knowledge can lead to misconceptions and inhibitions, hindering the broader acceptance of menstrual cups as a viable and practical alternative.

The hesitation to use menstrual cups is often rooted in concerns about difficulty in insertion and removal. Several consumers perceive the learning curve associated with using menstrual cups as a barrier, assuming it requires a level of skill or comfort that they may not possess. The lack of understanding about menstrual cups' straightforward application and potential health benefits contributes to this apprehension. Overcoming these preconceived notions and misconceptions requires targeted educational efforts to highlight menstrual cups' ease of use, comfort, and positive environmental impact. By addressing these concerns and fostering awareness, the market can work toward dispelling myths and encouraging a more positive perception of menstrual cups among potential users.

Report Segmentation and Scope:

The global menstrual cups market is segmented on the basis of type, material, distribution channel, and geography. Based on type, the market is categorized into reusable and disposable. By material, the market is categorized into medical grade silicon, rubber, and thermoplastic elastomer. By distribution channel, the market is categorized into supermarkets and hypermarkets, specialty stores, online retail, and others. By geography, the global menstrual cups market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Segmental Analysis:

Based on type, the menstrual cups market is categorized into reusable and disposable. The reusable segment is expected to register the highest CAGR during 2022–2030. Reusable menstrual cups represent a sustainable and cost-effective revolution in menstrual hygiene. Typically crafted from medical-grade silicone, rubber, or thermoplastic elastomers, these bell-shaped cups are inserted into the vagina to collect menstrual flow rather than absorbing it like traditional tampons or pads. The flexibility and softness of the material ensure comfort and ease of use, adapting to the user's anatomy. Reusable menstrual cups can be worn for up to 12 hours, providing leak-free protection and allowing users greater flexibility in managing their periods. One of their most significant advantages is their environmental impact, as they can be reused. The cups significantly reduce the amount of menstrual waste produced, contributing to an eco-friendly menstrual care routine. In addition, the long-term cost savings and the convenience of not needing to purchase disposable products regularly make reusable menstrual cups an increasingly popular choice for users looking for sustainable and practical alternatives in menstrual hygiene.

Regional Analysis:

The menstrual cups market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America dominated the global menstrual cups market in 2022, as the market in this region was valued at US$ 395.41 million. Europe is a second major contributor, holding more than 30% share of the global market. Asia Pacific is expected to register a considerable CAGR of over 5% during 2022–2030. The surge in demand for menstrual cups in Asia Pacific can be attributed to various factors, including rising cultural shifts, increasing awareness, and the growing importance of women's health. There has been a rising movement toward breaking taboos surrounding menstruation in many Asian countries.

COVID-19 Pandemic Impact:

The COVID-19 pandemic initially hindered the global menstrual cups market due to the shutdown of manufacturing units, shortage of labor, disruption of supply chains, and financial instability. The disruption of operations in various industries due to the economic slowdown caused by the COVID-19 outbreak restrained the menstrual cups supply. Moreover, various stores were closed, which limited the sales of menstrual cups. Nevertheless, businesses started gaining ground as previously imposed limitations were revoked across various countries in 2021. Moreover, the implementation of COVID-19 vaccination drives by governments of different countries eased the situation, leading to a rise in business activities worldwide. Several markets, including the menstrual cups market, reported growth after the ease of lockdowns and movement restrictions.

Menstrual Cups Market Regional Insights

Menstrual Cups Market Regional Insights

The regional trends and factors influencing the Menstrual Cups Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Menstrual Cups Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Menstrual Cups Market

Menstrual Cups Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.05 Billion |

| Market Size by 2030 | US$ 1.64 Billion |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Menstrual Cups Market Players Density: Understanding Its Impact on Business Dynamics

The Menstrual Cups Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Menstrual Cups Market are:

- Nixit

- Lunette Global

- Lena Cup LLC

- Diva International Inc

- Saalt

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Menstrual Cups Market top key players overview

Competitive Landscape and Key Companies:

Nixit, Lunette Global, Lena Cup LLC, Diva International Inc., Saalt, Pixie Cup, June Cup, Cora, The Flex Company, and Blossom Cup are among the prominent players operating in the global menstrual cups market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The major players operating in the global menstrual cups market are Nixit, Lunette Global, Lena Cup LLC, Diva International Inc., Saalt, Pixie Cup, June Cup, Cora, The Flex Company, and Blossom Cup among others.

In 2022, North America region accounted for the largest share of the global menstrual cups market. The surge in demand for menstrual cups in North America can be attributed to several factors that reflect changing attitudes toward menstrual hygiene products, environmental concerns, and a need for more sustainable and cost-effective alternatives. Awareness and acceptance of menstrual cups as an eco-friendly option compared to traditional disposable products such as tampons and pads is growing across the region. Menstrual cups are reusable and long-lasting, reducing the environmental effects associated with the disposal of single-use menstrual products. Single-use menstrual products and plastic packaging of pads, tampons, and panty liners generate more than 200,000 metric ton of waste annually. According to the data from the Harvard Business School, the US recorded the disposal of 12 billion pads and 7 billion tampons in landfills, sewage lines, and oceans annually. The rising focus on sustainability and environmental consciousness has prompted many individuals to seek products that align with their values. Menstrual cups, made of medical-grade silicone or other safe materials, significantly reduce the amount of waste generated from menstrual products. This resonates with consumers increasingly making choices based on environmental considerations, leading to a shift away from disposable options.

The convenience and cost-effectiveness offered by menstrual cups play an essential role in driving the demand for this innovative menstrual hygiene product. One of the primary drivers is the long-lasting durability of menstrual cups. Unlike traditional disposable options such as pads and tampons, which must be replaced frequently, menstrual cups can be reused for several years. This durability reduces the frequency of purchases and minimizes the environmental impact associated with the disposal of single-use products. Consumers are increasingly drawn to the cost-effectiveness of menstrual cups, recognizing them as a one-time investment that leads to long-term savings.

The convenience provided by menstrual cups is also a significant factor influencing market growth. Menstrual cups can be worn for up to 12 hours, depending on the flow, before emptying and cleaning. This extended wear time makes them particularly appealing to women with active lifestyles, as they do not require as much attention and change as traditional products. The convenience of not having to carry multiple pads or tampons, especially in situations where restroom facilities may be limited, adds to the appeal of menstrual cups. This aspect resonates with individuals seeking a hassle-free and practical approach to managing their menstrual hygiene.

The use of thermoplastic elastomers (TPE) in manufacturing menstrual cups is emerging as a notable trend in the menstrual cups market. Manufacturers are increasingly choosing TPE over other materials due to its unique properties that make it well-suited for this application. TPE is a versatile material that combines the characteristics of thermoplastics and elastomers, providing flexibility, durability, and ease of processing. Its ability to be molded into various shapes and forms makes it an ideal choice for crafting menstrual cups comfortably inserted and adapted to the user's anatomy.

Manufacturers opt for TPE in menstrual cup production because of its hypoallergenic and biocompatible nature. TPE is known for being safe for prolonged skin contact, making it suitable for intimate and sensitive applications like menstrual hygiene products. This characteristic is crucial for ensuring the comfort and well-being of users, reducing the risk of irritation or adverse reactions. The hypoallergenic properties of TPE enhance the overall user experience, positioning menstrual cups made from this material as a reliable and health-conscious choice in the market.

Based on product type, the menstrual cups market is categorized into reusable and disposable. The reusable segment is expected to register the highest CAGR during 2022–2030. Reusable menstrual cups represent a sustainable and cost-effective revolution in menstrual hygiene. Typically crafted from medical-grade silicone, rubber, or thermoplastic elastomers, these bell-shaped cups are inserted into the vagina to collect menstrual flow rather than absorbing it like traditional tampons or pads. The flexibility and softness of the material ensure comfort and ease of use, adapting to the user's anatomy. Reusable menstrual cups can be worn for up to 12 hours, providing leak-free protection and allowing users greater flexibility in managing their periods. One of their most significant advantages is their environmental impact, as they can be reused. The cups significantly reduce the amount of menstrual waste produced, contributing to an eco-friendly menstrual care routine. In addition, the long-term cost savings and the convenience of not needing to purchase disposable products regularly make reusable menstrual cups an increasingly popular choice for users looking for sustainable and practical alternatives in menstrual hygiene.

Based on distribution channel, the menstrual cups market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The rise of online retail platforms has significantly impacted the distribution of menstrual cups, facilitated a global reach, and provided convenience for consumers. The discreet and private nature of online shopping particularly appeals to individuals who may feel uncomfortable purchasing menstrual products in physical stores. Online platforms offer a wide range of menstrual cup options and serve as educational hubs, providing information on usage, benefits, and environmental impact. The accessibility of online retail transcends geographical barriers, making menstrual cups available to users worldwide, including regions where these products may not be readily accessible through traditional retail channels.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Menstrual Cups Market

- Nixit

- Lunette Global

- Lena Cup LLC

- Diva International Inc

- Saalt

- Pixie Cup

- June Cup

- Cora

- The Flex Company

- Blossom Cup

Get Free Sample For

Get Free Sample For