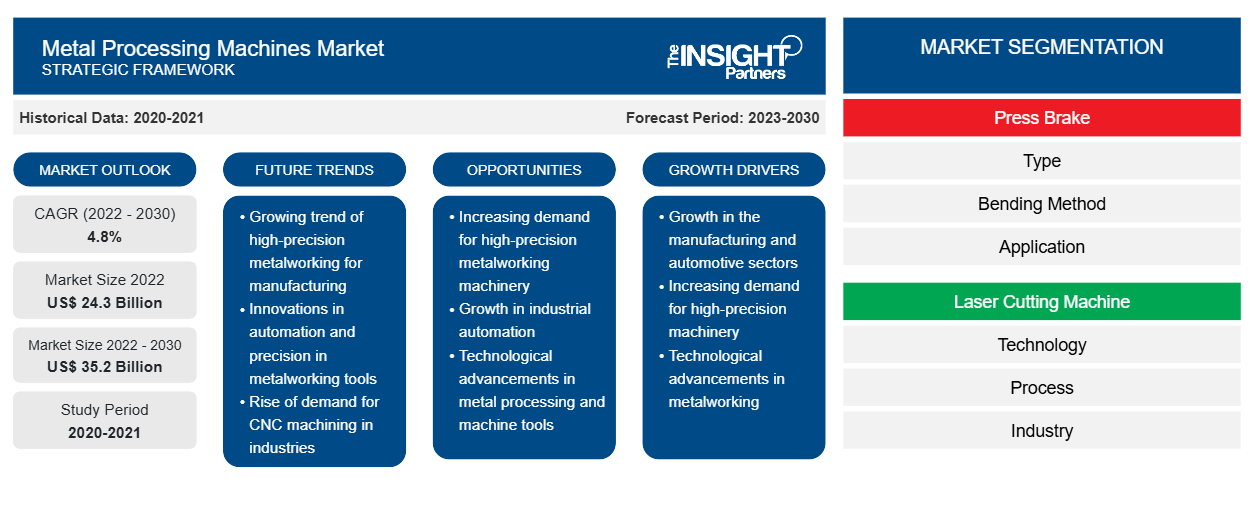

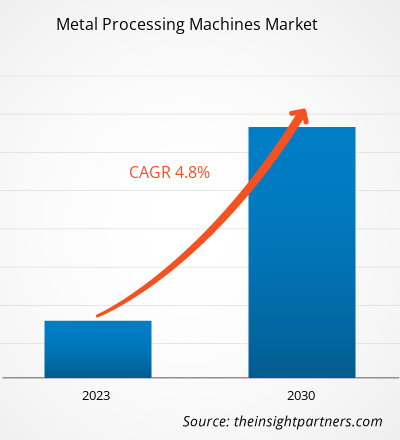

[Research Report] The metal processing machines market is projected to reach US$ 35.2 billion by 2030 from US$ 24.3 billion in 2022. it is expected to register a CAGR of 4.8% during 2023–2030.

Analyst Perspective

Investments in defense and aerospace sector and increase in demand for consumer electronics driven by rising disposable incomes are expected to contribute to the market's growth. In 2022, the Tamil Nadu government released Aerospace and Defense Industrial Policy. This policy aims to attract substantial investments of ~US$ 10.5 billion over the next decade and generate nearly 100,000 job opportunities. The demand for the latest technologies and advancements in manufacturing processes is expected to propel the market further. Sheet metal cutting is vital in aerospace, automotive, marine, construction, and electronics industries. The market is witnessing ongoing advancements in digital technology, particularly in embedded systems. Additionally, there is a focus on innovation in additive manufacturing, smart robotics, and computerized monitoring and control systems. These trends are expected to propel the market growth by enhancing the efficiency and precision of metal processing machines.

Market Overview

Metal processing machines are crucial in various industries as they provide efficient and precise cutting solutions for a wide range of ferrous and nonferrous metals. Metal cutting machines are extensively utilized to produce finished products with the desired geometry, offering numerous advantages such as surface texture, dimensional accuracy, complex shaping, and required size. The metal cutting machines market is expected to grow significantly over the forecast period due to the increasing demand for advanced mechanized cutting solutions. In North America, the US dominates the metal processing machine market, driven by robust demand from defense, aerospace, and automotive industries. Technological innovations and a surge in military expenditure are expected to drive the market in the region. Major players in defense and aerospace sectors are improving manufacturing technology in designing and producing complex components that reduce aircraft weight, which is driving the demand for laser metal-cutting machines.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Metal Processing Machines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Metal Processing Machines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver

Increasing Government Spending on Military Reinforcement to Drive Growth of Metal Processing Machines Market

Military organizations heavily invest in defense equipment, weapons systems, and vehicles to strengthen their capabilities. Metal processing machines are crucial in fabricating armor plates, munitions, and other critical systems required in defense operations. The need to modernize defense forces, enhance national security, and respond to evolving threats compels governments to increase their military expenditures every year. In 2023, the Biden-Harris Administration submitted a request to allocate US$ 842 billion for the Department of Defense (DoD) in the FY 2024 Budget, an increase of US$ 26 billion over FY 2023 levels. Such massive financial aid for military reinforcement would encourage defense-related component manufacturers to invest more in their operations, triggering the demand for metal processing machines, in the coming years. The war between Ukraine and Russia has catalyzed investments in defense activities. Consequently, many countries across the world have raised their defense budgets. Advanced metal processing machines are required to produce cutting-edge weaponry and defense systems, as precise fabrication, shaping, and assembly of metal components are crucial for the optimal performance and durability of these products.

The need for improved vehicle armor and military infrastructure upgrades further drives the demand for metal processing machines. These machines are used for processing specialized materials and manufacturing critical components in armored vehicles, tanks, and military aircraft. In 2022, Collins Aerospace, a US-based Raytheon Technologies, invested US$ 200 million in India and inaugurated its new global engineering and technology center (GETC) and Collins India operation center in Bengaluru. With this move, Collins Aerospace intends to expand its manufacturing operations with the acquisition of digital technology and engineering capabilities. Such initiatives by companies would help domestic metal processing machine manufacturers extend their clientele. Further, the surge in defense expenditure is not limited to established defense powers; many emerging economies have been exhibiting the rise in their defense budgets. Metal processing machine manufacturers need to understand the unique requirements of the defense industry and develop solutions that comply with domestic and international quality standards and regulations. This can be achieved through close collaborations with defense organizations and the ability to provide customized solutions with continuous innovation efforts. Thus, a surge in defense expenditure worldwide provides a significant boost to the metal processing machine market.

Segmental Analysis

On the basis of type, the global metal processing machines market is segmented into manual, hydraulic, and electronic. The hydraulic press brake dominates the market during the forecast period. Hydraulic press brakes have gained significant popularity in the metalworking industry due to their enhanced power and versatility. Hydraulic systems are used to generate the force needed for bending metal. Hydraulic press brakes offer superior control, allowing operators to adjust parameters such as pressure and speed precisely. They can handle various materials and thicknesses, making them suitable for numerous applications such as wood, metal, automobile and more. Also, the hydraulic press brakes replaced the mechanical press brakes due to their low cost. Also, it has variable speed control, which led to the wide acceptance of the hydraulic press break. The demand for hydraulic press brakes has been substantial due to their efficiency, ease of use, and ability to handle complex bending tasks. Adopting computer numerical control (CNC) technology has further revolutionized hydraulic press brakes, enabled automated operations and improved accuracy. End users of hydraulic press brakes are metal fabrication shops, automotive manufacturers, the aerospace industry, and sectors requiring high-volume and precise bending operations.

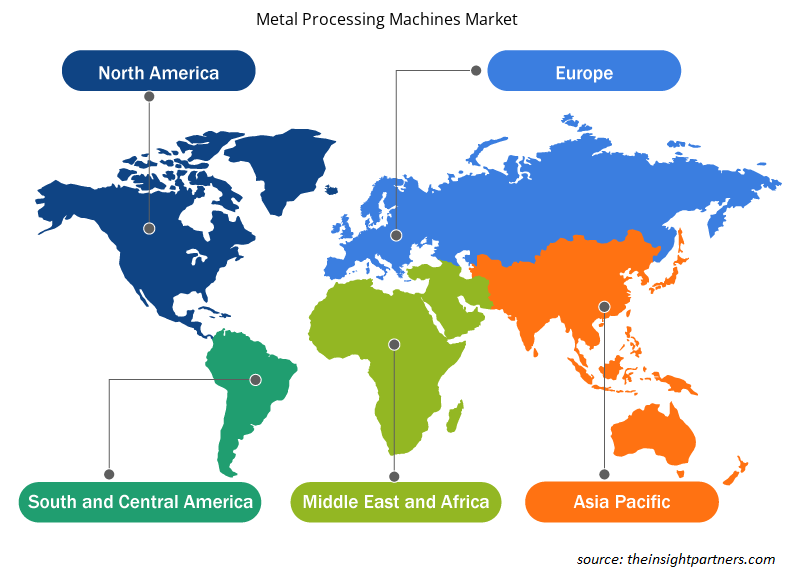

Regional Analysis

The metal processing machines market in APAC was valued at US$ 10.2 billion in 2022 and is projected to reach US$ 15.7 billion by 2030; it is expected to grow at a CAGR of 5.7% from 2023 to 2030. The metal processing machine market in APAC is segmented into South Korea, India, China, Japan, Australia, and the Rest of APAC. The region consists of various growing economies such as India, China, Indonesia, and the Philippines. These countries are witnessing a gradual rise in the adoption of advanced technologies. Further, the availability of low labor costs, low taxes and duties, and a strong business ecosystem are attracting global players in the manufacturing industry to expand their manufacturing facilities in this region. In October 2021, Novelis, one of the world's largest aluminum recycler companies, announced an investment of US$ 375 million in the expansion of a recycling and production facility in China for aluminum products used in the auto industry. In November 2022, Kennametal Inc. announced the launch of its new metal cutting inserts manufacturing facility in Bengaluru, India. With this strategic development, the company aims to enhance its capabilities and capacity to fulfill the growing demand from the APAC market. Thus, the growing manufacturing industry in APAC is anticipated to offer lucrative opportunities for the metal processing machinery market in the coming years. China is the world's largest manufacturer in terms of output and has become the manufacturing hub of the world. According to the World Steel Association AISBL, China was the largest steel producer in the world, with 1032.8 million tonnes in 2021. The country has the presence of several key market players in metal production industries, such as China Baowu Group, ShaGang Group, Jianglong Group, and Shougang Group are supporting the growth of the metal production industry. Thus, various market players aim to reduce transportation costs and ease import procedures by expanding their metal processing facilities near one of the largest metal manufacturing markets of the globe. The growing metal manufacturing of the country is bolstering the demand for metal processing machines. Moreover, owing to the growing urbanization of China, the country is witnessing rapid growth in the building and construction market. According to the report published by the American Institute of Architects (AIA), China will have to construct cities equivalent to the ten New York cities by 2025. In order to achieve this target, the government of China is implementing several urban renewal policies for the building and construction industry in China. The bending machines are utilized for a large number of applications in the construction industry, such as scaffolding safety hooks, ceiling hooks, and concrete frameworks. Thus, the growing building and construction industry of China is anticipated to offer lucrative growth opportunities for the metal processing machine market.

Key Player Analysis

The metal processing machines market analysis consists of the players such as Durmazlar Machinery Inc, Ermaksan Makina Sanayi Ve Ticaret AŞ, Dener Makina, LVD Company NV, Baykal Makina, Salvagnini Italia Spa, Amada (India) Pvt LTD, Prima Industrie SPA, Bystronic Group, and Trumpf. Among the players in the metal processing machines Prima Industrie SPA and Durmazlar Machinery Inc are the top two players owing to the diversified product portfolio offered.

Metal Processing Machines Market Regional Insights

Metal Processing Machines Market Regional Insights

The regional trends and factors influencing the Metal Processing Machines Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Metal Processing Machines Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Metal Processing Machines Market

Metal Processing Machines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 24.3 Billion |

| Market Size by 2030 | US$ 35.2 Billion |

| Global CAGR (2022 - 2030) | 4.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Press Brake

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Metal Processing Machines Market Players Density: Understanding Its Impact on Business Dynamics

The Metal Processing Machines Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Metal Processing Machines Market are:

- TRUMPF

- Bystronic Group

- PRIMA INDUSTRIE S.P.A.

- AMADA CO.,LTD.

- Salvagnini Italia SPA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Metal Processing Machines Market top key players overview

Recent Developments

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the metal processing machines market. A few recent key market developments are listed below:

- In 2022, LVD introduced Puma, a new cost-efficient fiber laser cutting machine designed to provide high-technology features and performance at a lower total cost of ownership. With 3-, 6- or 12-kW laser in 3050 x 1525 mm, 4065 x 2035 mm, and 6160 x 2035 formats and automation-ready, Puma provides the ability to manage diverse cutting applications.

- In 2021, Ermaksan installed a 10 kW FIBERMAK series laser cutting machine equipped with TOWERMAK fully automatic loading and unloading systems in the customer site, Serbia.

- In 2022, At the Tube trade fair, the high-tech company TRUMPF is set to unveil a new automated loading solution for laser tube-cutting machines. Developed in collaboration with storage-system manufacturer STOPA, the new solution from TRUMPF automatically transfers tubes from the storage system to the tube-cutting machine.

- In 2021, The high-tech company TRUMPF presented the new generation of the TruLaser Series 1000 –with more productivity, process stability, and cost-effectiveness. The Highspeed Eco function is being used on this machine type for the first time.

- In 2023, LVD Company NV has acquired the solutions business unit of KUKA Automatisering + Robotics NV in Houthalen-Helchteren and launched a new company, LVD Robotic Solutions by which will significantly advance LVD's expertise and market reach in robotics automation.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Press Brake, Laser Cutting Machine, and Bending Machine

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Austria, Bahrain, Belgium, Canada, China, France, Germany, Hungary, Indonesia, Japan, Kuwait, Malaysia, Mexico, Netherlands, Norway, Oman, Poland, Qatar, Russian Federation, Saudi Arabia, South Korea, Spain, Sweden, Switzerland, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global metal processing machines market was estimated to be USD 24.3 billion in 2022 and is expected to grow at a CAGR of 4.8 %, during the forecast period 2023 - 2030.

The key players, holding majority shares, in metal processing machines market includes TRUMPF SE + Co KG, Amada (India) Pvt Ltd, Prima Industrie SpA, LVD Company NV and Bystronic AG.

The metal processing machines market is expected to reach US$ 35.2 billion by 2030.

The incremental growth, expected to be recorded for the metal processing machines market during the forecast period, is US$ 9.92 billion.

The development of user-friendly interfaces is an important trend that will shape the future of the metal processing machine market.

APAC is anticipated to grow with the highest CAGR over the forecast period with a CAGR of 5.7%.

The growing demand of machines from automotive & aerospace industries . Further, increasing government spending on military reinforcement for defence equipment, weapons systems, and vehicles to strengthen their capabilities are the major factors that propel the metal processing machines market growth.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Metal Processing Machine Market

- TRUMPF

- Bystronic Group

- PRIMA INDUSTRIE S.P.A.

- AMADA CO.,LTD.

- Salvagnini Italia SPA

- Baykal Makina

- LVD Company NV

- Dener Makina

- Ermaksan

- Durmazlar Machinery Inc.

Get Free Sample For

Get Free Sample For