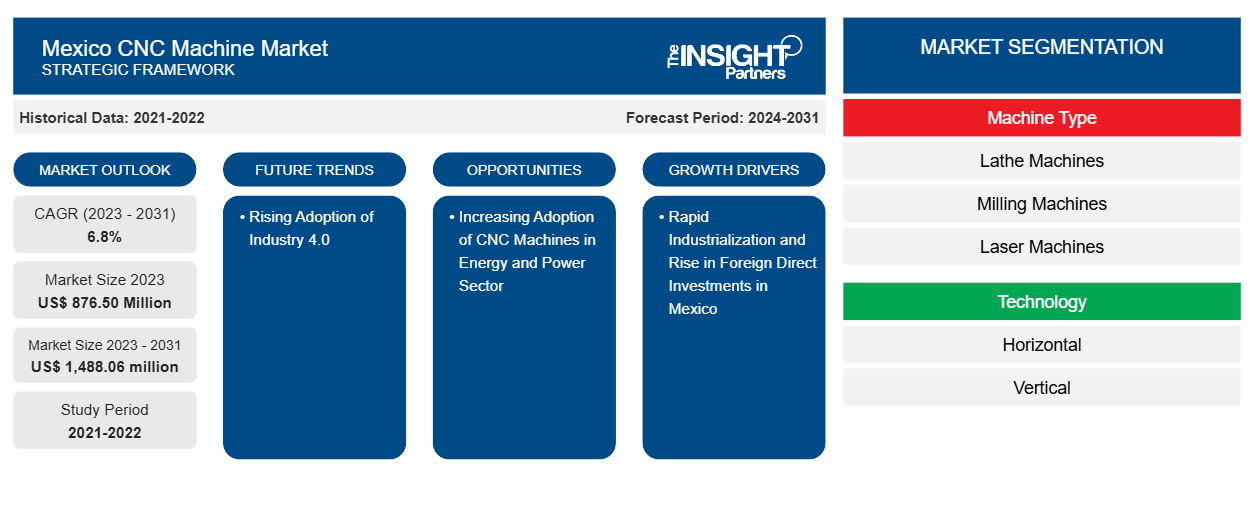

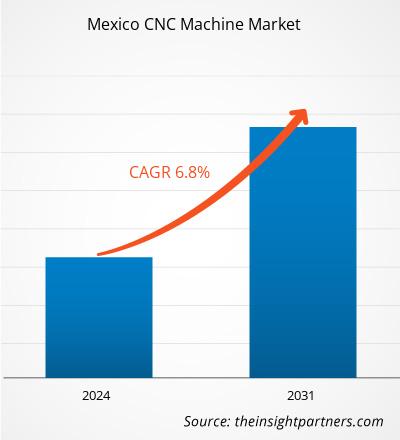

The Mexico CNC machine market size is expected to reach US$ 1,488.06 million by 2031 from US$ 876.50 million in 2023. The market is estimated to record a CAGR of 6.8% from 2023 to 2031. The rising adoption of Industry 4.0 is likely to bring new trends to the market in the coming years.

Mexico CNC Machine Market Analysis

CNC machines are automated machines that play a major role in the manufacturing sector. These machines are used for complex cutting and manufacturing of a wide range of items by eliminating the risk of human errors. CNC machines use software programming languages such as G-code to produce the parts. These machines are used to manufacture automotive and aerospace parts. There is an increase in investments across the aerospace sector in Mexico, which is driving the CNC machine market growth. According to the International Trade Administration, the aviation and aerospace sector in Mexico received significant investment of more than US$ 11.8 billion annually as of 2024. Further, automotive sector export in Mexico was valued at ~US$ 189 billion in 2023, which increased by 14.3% compared to 2022. The automotive industry has become the major driver for the growth of the CNC machine market.

Mexico CNC Machine Market Overview

The manufacturing sector in Mexico is developing, with a major focus on advanced technologies such as industrial automation, robotics, the Internet of Things, artificial intelligence (AI), 3D printing, additive manufacturing, automation, wireless technologies, and autonomous vehicles. The rise of Industry 4.0 in Mexico, with the rising adoption of smart factories and industrial automation, is expected to be a key trend in the CNC machine market. The integration of automation and robotics in CNC machine manufacturing is increasing rapidly growing. CNC machine manufacturers are developing artificial intelligence and sensors-based machines to meet the growing industry 4.0 demand. For instance, in May 2024, ANCA CNC Machines integrated autonomous manufacturing and artificial intelligence into their machines. ANCA's Integrated Manufacturing System offers an ecosystem to automate the production of cutting tools using CNC machines.

In September 2023, Okuma America Corporation launched a next-generation CNC machine with advanced technology integration. The new advanced control Okuma OSP-P500 CNC machine is the latest technology-based machine that fully optimizes modern manufacturing operations.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mexico CNC Machine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mexico CNC Machine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mexico CNC Machine Market Drivers and Opportunities

Rapid Industrialization and Rise in Foreign Direct Investments in Mexico

Mexico is the 15th largest economy globally and the largest exporter in Latin America. In 2022, Mexico's gross domestic product (GDP) was valued at US$ 1.41 trillion. According to the World Bank Report in 2022, the industrial and services sector in Mexico accounted for 32.1% of the country's GDP. The industrial sector in Mexico, including mining, manufacturing, and oil & gas, has contributed between 25% and 35% of the overall GDP. The Mexico CNC machine market is driven by increasing industrial activities and rising foreign trade. In 2023, Mexico's Ministry of Economy reported an increase in foreign direct investments (FDIs) by 27%, reaching US$ 36 billion; 50% of this investment is in the manufacturing sector in Mexico.

From January 2024 to June 2024, FDIs in Mexico reached US$ 31.1 billion across several industrial sectors. Mexico's overall manufacturing output for 2023 was valued at US$ 360.73 billion, which increased by 14.73% compared to 2022. The increase in FDIs and the growth of the industrial sector in Mexico drive the Mexico CNC machine market.

Increasing Adoption of CNC Machines in Energy and Power Sector

CNC machines are widely used to manufacture various industrial components in the energy and power sector. In the energy and power sector, CNC machines are widely used to produce various components, such as seals, gears, pumps, and valves. These components are used in various energy and power-related applications, such as hydroelectric dams, wind turbines, and oil and gas drilling rigs. In 2022, the National Power System in Mexico's power generation was 340,713 GWh, ~31.2% of the clean energy sources. In August 2024, the Federal Electricity Commission in Mexico and the government invested ~US$ 19.31 billion in energy generation-related projects. This investment funded the development of nearly 35 generation projects and 41 distribution projects. In 2023, five energy-related transmission projects were completed, with a total investment of US$ 16.04 million. The rising investment in energy and power-related projects across the country is expected to create significant opportunities for the CNC machine market growth during the forecast period.

Mexico CNC Machine Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Mexico CNC machine market analysis are machine type, technology, and industry.

- By machine type, the market is segmented into lathe machines, milling machines, laser machines, grinding machines, boring machines, and others. The lathe machines segment dominated the market in 2023.

- Based on technology, the market is segmented into horizontal and vertical. The horizontal segment dominated the market in 2023.

- Based on industry, the market is segmented into aerospace and defense, automotive, industrial, metals and mining, energy and power, and others. The automotive segment dominated the market in 2023.

Mexico CNC Machine Market Share Analysis by Geography

Based on machine type, the CNC machine market is segmented into lathe machines, milling machines, laser machines, grinding machines, boring machines, and others. Among these, the lathe machines segment held a significant market share in 2023, owing to the increasing demand from the automotive industry for producing and shaping automotive components such as automotive gears, pistons, cylinders, bolts, and automotive tow bars and rods. These components require frequent maintenance and repair, which utilizes CNC machines to shape and machine the automotive components. According to the International Trade Administration, Mexico is the seventh-largest manufacturer of passenger cars, producing more than 3.5 million vehicles annually. The rapidly growing automotive industry in Mexico has created a massive demand for CNC machines, such as lathe machines, to manufacture automotive components in the country.

Mexico CNC Machine Market Regional Insights

The regional trends and factors influencing the Mexico CNC Machine Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mexico CNC Machine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mexico CNC Machine Market

Mexico CNC Machine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 876.50 Million |

| Market Size by 2031 | US$ 1,488.06 million |

| Global CAGR (2023 - 2031) | 6.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Machine Type

|

| Regions and Countries Covered | Mexico

|

| Market leaders and key company profiles |

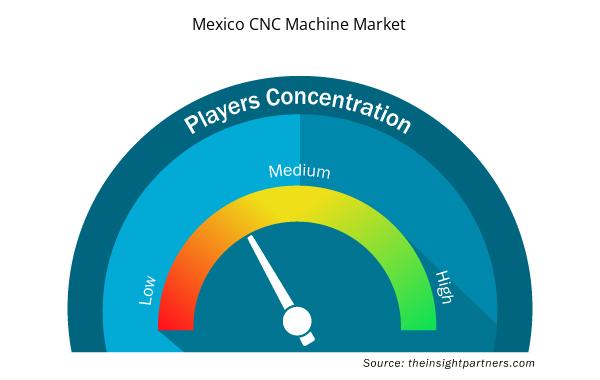

Mexico CNC Machine Market Players Density: Understanding Its Impact on Business Dynamics

The Mexico CNC Machine Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mexico CNC Machine Market are:

- CITIZEN MACHINERY CO., LTD

- Nakamura-Tome CO., LTD.

- Omnitec

- Haas Automation, Inc.

- Technocrafts

- DN SOLUTIONS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mexico CNC Machine Market top key players overview

Mexico CNC Machine Market News and Recent Developments

The Mexico CNC machine market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Mexico CNC machine market are listed below:

- Nakamura-Tome Precision Industry Co., Ltd. (CEO Shogo NAKAMURA) introduced the renewed AS-200 and AS-200L series, versatile multitasking lathes that have evolved to meet the demands of modern manufacturing. Launched originally in 2013, the AS Series quickly became their best-selling machine.

(Source: Nakamura-Tome Precision Industry Co., Ltd, Press Release, September 2024)

Mexico CNC Machine Market Report Coverage and Deliverables

The "Mexico CNC Machine Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Mexico CNC machine market size and forecast at country levels for all the key market segments covered under the scope

- Mexico CNC machine market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Mexico CNC machine market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Mexico CNC machine market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Mexico is the seventh-largest passenger vehicle manufacturer, producing more than 3.5 million vehicles annually. Automotive manufacturers are located in the northern region of Sonora, Baja California, Chihuahua, Nuevo León, Coahuila, and San Luis Potosí. Original equipment manufacturer (OEM) plants for automotive are in Aguascalientes, Guanajuato, Estado de Mexico, Jalisco, Morelos, Hidalgo, and Puebla. In terms of supply chains, automotive parts producers are located primarily in Chihuahua, Coahuila, Guanajuato, Nuevo León, Puebla, Queretaro, San Luis Potosi, Tamaulipas, and Estado de Mexico.

CITIZEN MACHINERY CO., LTD;Nakamura-Tome CO., LTD.; Omnitec; Haas Automation, Inc.; Technocrafts; DN SOLUTIONS;Jinan Takara Cnc Machine Co., Ltd.; JINN FA MACHINE; Tengzhou Borui Cnc Machine Tool Co., Ltd.; Zaozhuang Shenhuan Cnc Machine Co., Ltd.; OKUMA CORPORATION; Hision; DMG MORI; Yamazaki Mazak Corporation; Hyunndai Wia Machine Tool are the key market players operating in the Mexico CNC Machine market.

CNC machines are widely used to manufacture various industrial components in the energy and power sector. In the energy and power sector, CNC machines are widely used to produce various components, such as seals, gears, pumps, and valves. These components are used in various energy and power-related applications, such as hydroelectric dams, wind turbines, and oil and gas drilling rigs.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Mexico CNC Machine Market

- CITIZEN MACHINERY CO., LTD.

- Nakamura-Tome CO., LTD.

- Omnitec

- Haas Automation, Inc.

- Technocrafts

- DN SOLUTIONS

- Jinan Takara Cnc Machine Co., Ltd.

- JINN FA MACHINE

- Tengzhou Borui Cnc Machine Tool Co., Ltd.

- Zaozhuang Shenhuan Cnc Machine Co., Ltd.

- OKUMA CORPORATION

- Hision

- DMG MORI

- Yamazaki Mazak Corporation

- Hyunndai Wia Machine Tool

Get Free Sample For

Get Free Sample For