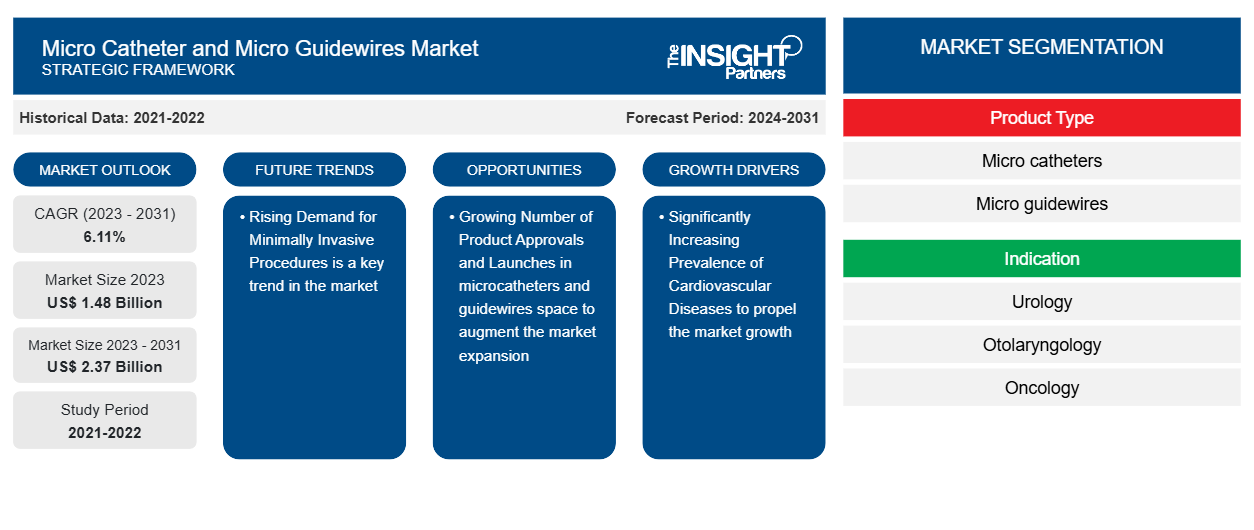

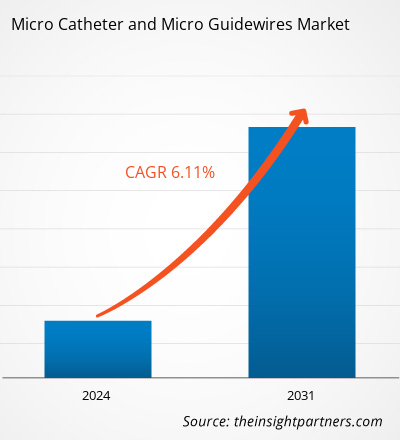

The Micro Catheter and Micro Guidewires market size is projected to reach US$ 2.37 billion by 2031 from US$ 1.48 billion in 2023. The market is expected to register a CAGR of 6.11% in 2023–2031. Key factors that are driving growth of the market are significantly increasing prevalence of cardiovascular diseases and increasing incidences of neurovascular diseases. However, the lack of expert professionals is anticipated to deter market growth.

Micro Catheter and Micro Guidewires Market Analysis

Micro catheter is small-diameter catheter, preferably used during minimally invasive surgeries. Micro catheters are small, with diameter range of 0.70 to 1.30 mm. On similar lines, micro-guidewires are also used during diagnostic as well as therapeutic procedures. The devices have various applications in catheterization. Moreover, the devices are also utilized during cardiovascular and neurovascular surgeries.

Micro Catheter and Micro Guidewires Market Overview

Among the most prevalent CVDs are aortic aneurysms, heart failure, stroke, rheumatic heart disease, and peripheral artery disease. A few major contributing factors to the rising prevalence of CVDs worldwide include the adoption of poor diets, tobacco use, sedentary lifestyles, and drunkenness. The World Health Organization (WHO) states that cardiovascular diseases (CVDs) are the leading cause of death worldwide. Additionally, the Centers for Disease Control and Prevention (CDC) projected that, in the US, cardiovascular diseases (CVDs) account for one death every 36 seconds on average in 2020. Furthermore, the nation reports an estimated 850,000 incidents of heart attacks annually, per the same study.

Furthermore, 121.5 million adults in the US—roughly half of the adult population in the US—struggle with cardiovascular diseases (CVDs), according to American Heart Association (AHA) 2019 estimates. In addition, 0.6 million fatalities in the UK were attributed to cardiovascular diseases (CVDs), as per research released by the British Heart Association in 2020. The same study also indicated that the country's total mortality from CVDs was primarily attributable to chronic rheumatic heart disease and diseases of the circulatory system. The European Cardiovascular Disease Statistics 2019 report that over 1.8 million fatalities in the European Union (EU) and 3.9 million deaths in Europe are attributed to cardiovascular diseases (CVDs) annually. Additionally, a 2020 study that was published in the Journal of Lancet Public Health estimates that CVDs account for almost 4.0 million deaths in China annually. The rising global prevalence of CVDs significantly increases the number of cardiac operations performed. For example, a 2020 study by the Society of Thoracic Surgeons (STS) found that TAVR surgeries are significantly increasing in the United States.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Micro Catheter and Micro Guidewires Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Micro Catheter and Micro Guidewires Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Micro Catheter and Micro Guidewires Market Drivers and Opportunities

Increasing Incidence of Neurovascular Diseases Boosting Demand for Micro Catheter and Micro Guidewires

The constant flow of nutrients and oxygen, provided by arteries and veins, is vital to the neurovascular system. Any flaw in the system can hinder the brain's ability to operate and might potentially be fatal because the brain depends on oxygen and nutrients to function. Brain tumors, ischemic stroke, hemorrhagic stroke, brain aneurysms, and vascular malformations are a few common neurovascular illnesses, diseases, or disorders.

The prevalence of neurological illnesses has dramatically increased in recent years. One example of a neurovascular disease is cerebral aneurysm. Globally, this condition is becoming far more common. As a result, its prevalence has sharply increased worldwide. Every year in the United States, brain aneurysm rupture affects around 30,000 people. Every eighteen minutes, a brain aneurysm ruptures. In the nation, there are roughly 8–10 cases of brain rupture for every 100,000 persons annually. Thus, the market for microcatheters and microguidewires is growing as a result of the increased incidence of cerebral aneurysms.

Growing Number of Product Approvals and Launches – An Opportunity in Micro Catheter and Micro Guidewires Market

Micro catheter and micro guidewire demand is increasing as a result of new devices' expanded functionality and technological advancements. The CE approved Transit Scientific's XO CrossQ Microcatheter platform in March 2021. Better functioning is provided by the innovative non-tapered design of the new microcatheter. Better torque responsiveness, trackability, and additional pushability levels are also provided by the new platform during a surgical process. Moreover, Baylis Medical declared in January 2021 that the JLL electrophysiological microcatheter would be available in the European market. With the advent of the catheter, doctors can now access difficult-to-reach places within the heart. Additionally, Insight Lifetech's TruePhysio Rapid Exchange FFR microcatheter was granted CE clearance in June 2020. For precise treatments, the recently introduced catheter works with any 0.014" guidewire. Additionally, Sniper K-tip microcatheter under sniper balloon occlusion microcatheter was introduced by Embolx, Inc. in May 2019. This recently released microcatheter is specifically made for the process of arterial embolization. Additionally, the FDA approved Scientia Vascular's Zoom Wire 14 guidewire in August 2020. The novel gadget has the ability to enter the nervous system during ischemic and hemorrhagic strokes, as well as other related vascular procedures. Therefore, throughout the forecast period, the increasing number of product releases and approvals is anticipated to present profitable prospects for the growth of the micro catheter and micro guidewires market.

Micro Catheter and Micro Guidewires Market Report Segmentation Analysis

Key segments that contributed to the derivation of the micro catheter and micro guidewires market analysis are type, indication, end user, and geography

- Based on type, the micro catheter and micro guidewires market is divided into micro catheters and micro guidewires. The micro catheters segment held a higher market share in 2023.

- Based on indication, the market is segmented into urology, otolaryngology, oncology, others.

- Based on end user, the market is segmented into hospitals, specialty clinics, ambulatory surgical centers.

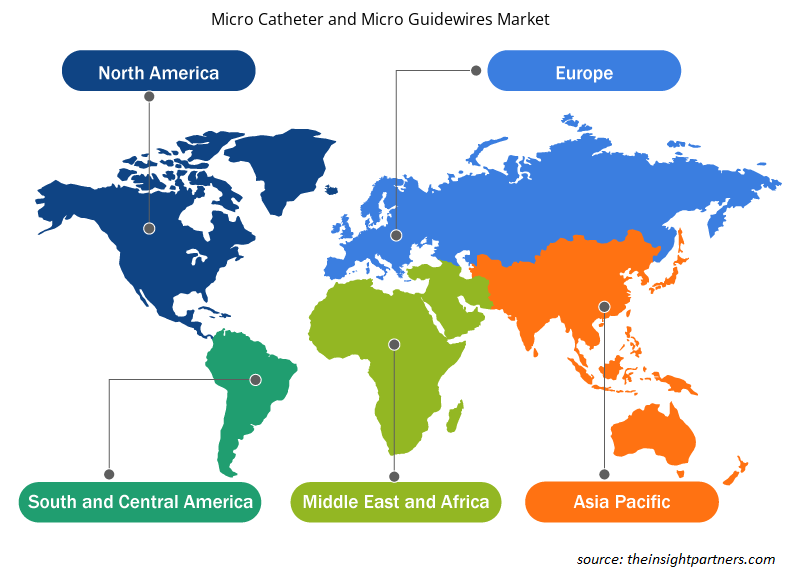

Micro Catheter and Micro Guidewires Market Share Analysis by Geography

The geographic scope of the micro catheter and micro guidewires market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

The North America micro catheter and micro guidewires market is segmented into the US, Canada, and Mexico.

The nation's market for microcatheters and microguidewires is anticipated to increase significantly as a result of the growing incidence of cardiac disorders. According to the "Heart Disease and Stroke Statistics 2019" published by the American Heart Association, 121.5 million adult Americans have a cardiovascular disease, and 805,000 Americans experience a heart attack annually. Furthermore, the CDC estimates that 795,000 Americans get a cerebrovascular stroke annually. Patients now pay higher treatment costs as a result. It is projected that the combined direct and indirect costs of all cardiovascular illnesses and stroke will exceed US$ 329.7 billion. This amount includes lost productivity as well as medical expenses.

Furthermore, the top five causes of death in the nation are heart disease and stroke, respectively. Although it can be effectively treated, hypertension is a significant risk factor for heart disease and stroke and has a high cost in terms of lives lost and health consequences. Statistics from the Centers for Disease Control and Prevention indicate that 75 million persons in the United States had high blood pressure in 2018. It is anticipated that the prevalence will rise in the near future, which would likely lead to an increase in cardiovascular occurrences. Additionally, the US is one of the most technologically advanced nations, offering a wide range of medical device technology. The nation also actively engages in medical device research and development.

For instance, Guerbet LLC USA introduced two innovative microcatheters for tumor and vascular aneurysm embolization operations, SeOure and DraKon, in May 2018. The FDA granted Surmodics 510(k) clearance in January 2018 for its Telemark.014-inch coronary support microcatheter. The XO Cross Microcatheter platform for guidewire support, exchange, and contrast media injection in the peripheral vasculature was just approved by the FDA and given to Transit Scientific in May 2020. By2028, the US market for microcatheters and microguidewires is anticipated to have grown thanks in part to the growing use of sophisticated catheters and guidewires. Cardiovascular Systems, Inc., for example, announced the first use of their OrbusNeich Teleport microcatheter in December 2018. The apparatus is specifically designed to fulfil the surgical requirements for peripheral and coronary procedures.

Micro Catheter and Micro Guidewires Market Regional Insights

The regional trends and factors influencing the Micro Catheter and Micro Guidewires Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Micro Catheter and Micro Guidewires Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Micro Catheter and Micro Guidewires Market

Micro Catheter and Micro Guidewires Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.48 Billion |

| Market Size by 2031 | US$ 2.37 Billion |

| Global CAGR (2023 - 2031) | 6.11% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

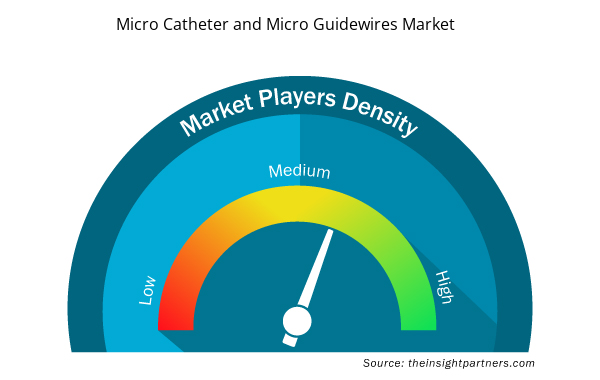

Micro Catheter and Micro Guidewires Market Players Density: Understanding Its Impact on Business Dynamics

The Micro Catheter and Micro Guidewires Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Micro Catheter and Micro Guidewires Market are:

- Cardinal Health Inc.

- Medtronic

- BD

- Stryker Corporation

- Boston Scientific Corporation

- B. Braun Melsungen AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Micro Catheter and Micro Guidewires Market top key players overview

Micro Catheter and Micro Guidewires Market News and Recent Developments

The micro catheter and micro guidewires market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In February 2024, BIOTRONIK launched the Micro Rx™ catheter, designed to streamline guidewire support during percutaneous coronary interventions (PCI) procedures. Launch by BIOTRONIK and manufactured by IMDS, this innovative device marks a significant addition to the company's product portfolio of interventional solutions in the United States. (Source: BIOTRONIK Press Release)

Micro Catheter and Micro Guidewires Market Report Coverage and Deliverables

The “Micro Catheter and Micro Guidewires Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Micro Catheter and Micro Guidewires Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Micro Catheter and Micro Guidewires Market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Micro Catheter and Micro Guidewires market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Micro Catheter and Micro Guidewires Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type ; Indication ; End User ; and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the micro catheter and micro guidewires market in 2023

Key factors that are driving growth of the market are significantly increasing prevalence of cardiovascular diseases

Rising demand for minimally invasive procedures activities are the current trend witnessed in the target market.

Cardinal Health Inc., Medtronic, BD, Stryker Corporation, Boston Scientific Corporation, B. Braun Melsungen AG, Terumo Corporation, Teleflex Incorporated, Cook Medical LLC, and Tokai Medical Products, Inc.

The market is expected to register a CAGR of 6.11% during 2023–2031.

Get Free Sample For

Get Free Sample For