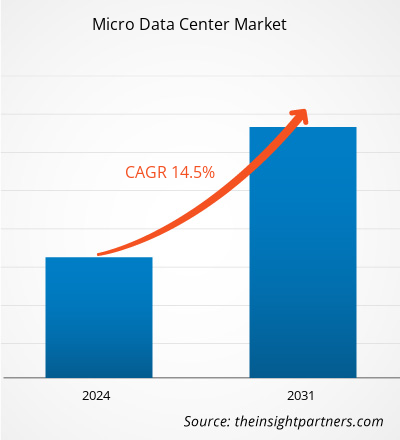

The micro data center market size is expected to reach US$ 11.93 billion by 2031 from US$ 4.04 billion in 2023. The market is estimated to record a CAGR of 14.5% from 2023 to 2031. AI-powered micro data centers and a rise in demand for edge computing are likely to be key market trends.

Micro Data Center Market Analysis

Increasing use of connected and IoT devices and growing rollout of 5G have increased the demand for low-latency data processing and storage everywhere, including remote locations. This has increased the need for more micro data centers, particularly in remote locations, which is one of the major factors fueling the growth of the micro data center market. In addition, micro data centers, with their compact size, can help lower the energy needed for cooling, and their placement near data sources helps minimize the energy lost during long-distance data transfer. This can help the companies to meet their sustainability target, creating an opportunity for the market growth. Regions such as North America, Europe, and the MEA are witnessing a rise in the number of SMEs, which is expected to propel the growth of the micro data center market during the forecast period. Moreover, the demand for edge computing technology is increasing as it can help in real-time data processing and analysis, further fueling the market growth.

Micro Data Center Market Overview

A micro data center is a small-scale modular data center comprising all the computing, storage, networking, power, cooling, and other infrastructure required for a given workload. The majority of micro data centers include server racks, network equipment, servers, and in-rack cooling solutions. Typically, micro data centers support critical loads of no more than 100–150 kW and come in sizes ranging from a single 19-inch rack to a 40-foot shipping container. Due to their compact size, they can be installed in spaces where a standard data center would not be feasible. They are ideal for edge applications, especially in distributed, remote, or unconditioned locations. As the entire system is enclosed into the size of one standard IT rack, micro data centers can be deployed in existing network closets or small server rooms, open office spaces, retail stores, and clinics.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Micro Data Center Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Micro Data Center Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Micro Data Center Market Drivers and Opportunities

Increasing Adoption of Prefabrication and Micro-modular Data Center Solutions

The increasing adoption of prefabrication and micro-modular data center solutions is significantly driving the growth of the micro data center market. As organizations seek to enhance their operational efficiency and scalability, these innovative solutions offer a compelling alternative to traditional data center models. The modular design allows for rapid deployment and flexibility, enabling businesses to quickly respond to changing demands and optimize their infrastructure. This is particularly important in sectors such as IT, telecommunications, and healthcare, where the need for advanced data processing capabilities is on the rise. The modular design of micro data centers significantly enhances their appeal across various industries by enabling flexible and just-in-time deployment tailored to the unique needs of each sector. This adaptability means that organizations can quickly scale their infrastructure in response to fluctuating demands, allowing them to efficiently manage resources without the long lead times typically associated with traditional data center construction. For example, in the IT industry, companies can deploy micro data centers to support cloud services and edge computing, ensuring minimal latency and improved performance for end users. Similarly, the telecommunications industry benefits from the ability to rapidly install modular units at strategic locations, enhancing network reliability and capacity, especially as 5G technology rolls out. In the banking industry, where data security and compliance are paramount, micro-modular data centers can be quickly implemented to safeguard sensitive information while providing the necessary computational power for transactions and analytics. As these industries experience high growth rates in data center capacity, the modularity of micro data centers positions them as an ideal solution to support their evolving infrastructure needs efficiently and effectively.

Growing Cloud Computing Investments

The growing investment in cloud computing is poised to significantly boost the micro data center market, driven by the increasing demand for efficient, scalable, and flexible data processing solutions. For instance, in June 2024, Oracle announced its intention to invest over US$ 1 billion to establish a third cloud region in Madrid, aimed at enhancing AI skills development throughout the country. This new public cloud region will empower Oracle's customers and partners across various industries in Spain, including the significant financial services sector, to transition their mission-critical workloads from on-premises data centers to Oracle Cloud Infrastructure (OCI). Additionally, this initiative will support organizations in meeting essential regulatory requirements, such as the Digital Operational Resilience Act (DORA) and the European Outsourcing Guidelines established by EBA, EIOPA, and ESMA. Telefónica España has been designated as the host partner for the upcoming cloud region, reinforcing the collaborative efforts to advance cloud capabilities in the region. As businesses continue to embrace cloud technologies, micro data centers will play a crucial role in meeting their evolving infrastructure needs, ultimately shaping the future of data management across various sectors.

Micro Data Center Market Report Segmentation Analysis

Key segments that contributed to the derivation of the micro data center market analysis are rack type, organization size, and application.

- Based on rack type, the market is divided into single rack and multi rack. The single rack segment dominated the market in 2023.

- In terms of organization size, the market is categorized into large enterprises and SMEs. The large enterprises segment dominated the market in 2023.

- Based on application, the market is divided into BFSI, retail, IT and telecom, manufacturing, healthcare, and others. The IT and telecom segment dominated the market in 2023.

Micro Data Center Market Share Analysis by Geography

- The micro data center market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

- The micro data center market in North America is segmented into the US, Canada, and Mexico. The micro data center market in North America is experiencing significant growth, driven mainly by the increasing demand for edge computing solutions and the deployment of 5G infrastructure. Telecommunications companies in the US are particularly active in this space, strategically placing micro data centers at cell towers and network aggregation points to enhance network performance and reduce latency. The introduction of innovative power solutions, such as advanced uninterruptible power supply (UPS) systems, is expected to further bolster the market. Moreover, the ongoing digital transformation across various sectors, coupled with the increasing volume of data generated by IoT devices, is propelling the demand for micro data centers. These facilities offer advantages such as portability, scalability, and energy efficiency, making them an appealing option for organizations looking to boost their data management strategies.

Micro Data Center Market Regional Insights

The regional trends and factors influencing the Micro Data Center Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Micro Data Center Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Micro Data Center Market

Micro Data Center Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.04 Billion |

| Market Size by 2031 | US$ 11.93 Billion |

| Global CAGR (2023 - 2031) | 14.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Rack Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

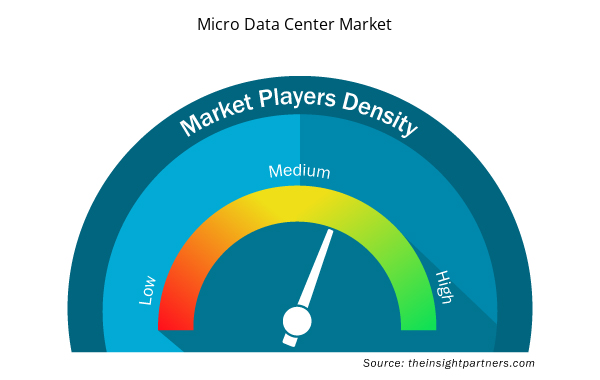

Micro Data Center Market Players Density: Understanding Its Impact on Business Dynamics

The Micro Data Center Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Micro Data Center Market are:

- Eaton Corp Plc

- Cannon Technologies Ltd

- SCHÄFER Ausstattungssysteme GmbH

- Rittal GmbH & Co KG

- Delta Electronics Inc

- Datwyler IT Infra GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Micro Data Center Market top key players overview

Micro Data Center Market News and Recent Developments

The micro data center market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the micro data center market are listed below:

- Vertiv, a global provider of critical digital infrastructure and continuity solutions, introduced the Vertiv SmartAisle 3, a micro modular data center system that utilizes the power of Artificial Intelligence (AI), providing enhanced intelligence and enabling efficient operations within the data center environment. Now available in Southeast Asia, Australia and New Zealand, the SmartAisle 3 can be configured up to 120kW of total IT load. It is ideal for a wide range of industry applications, including banking, healthcare, government, and transportation.

(Source: Vertiv, Press Release, April 2024)

- Rittal GmbH & Co. KG launched a new product, RiMatrix micro data centers. RiMatrix micro data centers are compact, powerful, and fully-fledged homes for IT hardware. Rittal RiMatrix micro data centers ensure that the IT is securely packaged and operates with the smallest carbon emissions, regardless of the location. Moreover, the combination of global standardization and adaptability means that these new packages make even better use of their advantages.

(Source: Rittal GmbH & Co. KG, Press Release, November 2022)

Micro Data Center Market Report Coverage and Deliverables

The "Micro Data Center Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Micro data center market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Micro data center market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Micro data center market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the micro data center market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Rack Type, Organization Size, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is anticipated to expand at a CAGR of 14.5% during 2023-2031.

Schneider Electric, Legrand SA, Eaton, Rittal GmbH & Co. KG, and Delta Electronics Inc are major players in the market.

The market is expected to reach a value of US$ 11.9 billion by 2031.

North America is anticipated to dominate the micro data center market in 2023.

Rise in demand for micro data centers in remote areas, increasing adoption of prefabrication and micro-modular data center solutions and emergence of 5G are driving the market growth.

AI-powered micro data center and rising demand for edge computing is a key trend in the market.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Micro Data Center Market

- Eaton Corp Plc

- Cannon Technologies Ltd

- SCHÄFER Ausstattungssysteme GmbH

- Rittal GmbH & Co KG

- Delta Electronics Inc

- Datwyler IT Infra GmbH

- Schneider Electric SE

- Intellinet Network Solutions

- Panduit

- Legrand SA

Get Free Sample For

Get Free Sample For