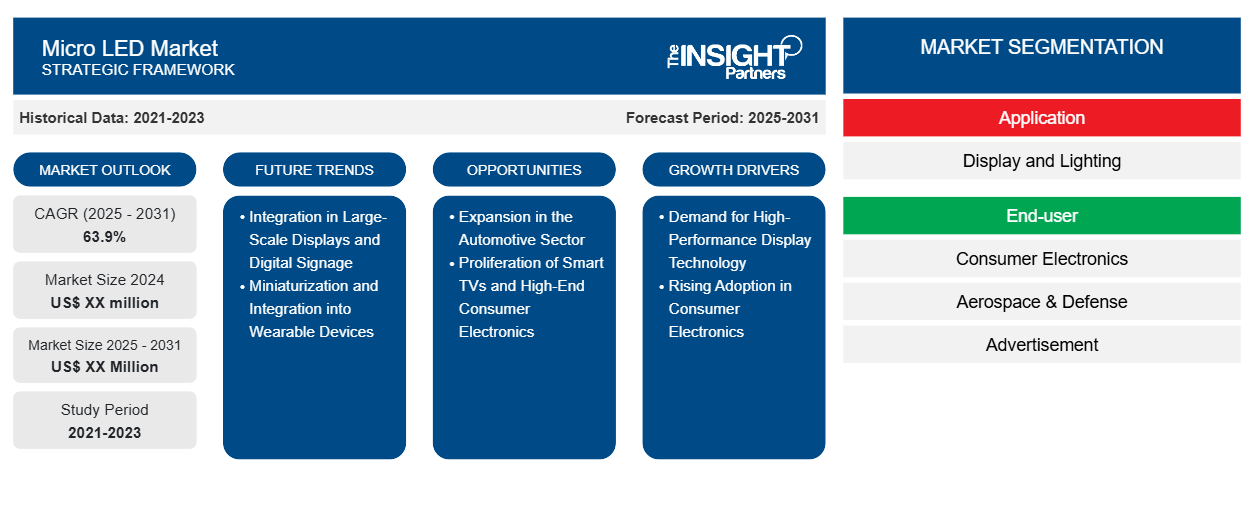

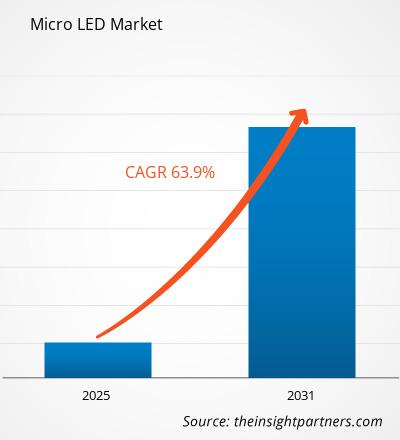

The Micro LED Market is expected to register a CAGR of 63.9% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Application (Display and Lighting), End-user (Consumer Electronics, Aerospace & Defense, Advertisement, and Automotive). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments

Purpose of the Report

The report Micro LED Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Micro LED Market Segmentation

Application

- Display and Lighting

End-user

- Consumer Electronics

- Aerospace & Defense

- Advertisement

- Automotive

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Micro LED Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Micro LED Market Growth Drivers

- Demand for High-Performance Display Technology: One of the primary drivers for the growth of the Micro LED market is the increasing demand for high-performance display technologies in consumer electronics. Micro LED displays offer superior brightness, color accuracy, contrast ratios, and energy efficiency compared to traditional LCD or OLED displays. As industries such as gaming, entertainment, and mobile devices strive for better visual experiences, Micro LED technology is gaining prominence, driving the market’s growth.

- Rising Adoption in Consumer Electronics: The widespread adoption of Micro LED technology in consumer electronics, particularly in high-end televisions, smartphones, and wearables, is significantly boosting the market. Micro LED’s ability to deliver stunning visuals, longer lifespan, and power efficiency is appealing to manufacturers who are constantly striving to meet consumer expectations for improved display quality in next-generation devices. This growing demand from consumers for advanced displays fuels the expansion of the Micro LED market.

Micro LED Market Future Trends

- Integration in Large-Scale Displays and Digital Signage: Micro LED technology is increasingly being adopted for large-scale displays and digital signage. Due to its excellent brightness, scalability, and ability to maintain high picture quality at various sizes, Micro LEDs are becoming the preferred choice for commercial and advertising applications, such as stadium screens, shopping mall displays, and corporate environments. The trend of using Micro LED displays for large, seamless installations is expected to drive market growth in commercial sectors.

- Miniaturization and Integration into Wearable Devices: Another notable trend is the integration of Micro LED technology into compact wearable devices such as smartwatches, fitness trackers, and AR/VR headsets. As wearable technology becomes more pervasive, the need for displays that offer high resolution, brightness, and energy efficiency in a small form factor is growing. Micro LEDs are an ideal solution for wearables, providing better performance while maintaining a low power consumption, and this trend is driving innovation in the market.

Micro LED Market Opportunities

- Expansion in the Automotive Sector: The automotive sector presents a significant growth opportunity for the Micro LED market. With the increasing integration of digital dashboards, advanced infotainment systems, and augmented reality (AR) displays in vehicles, Micro LED technology is well-positioned to deliver superior display performance in automotive applications. Its ability to offer high contrast, brightness, and power efficiency in varying environmental conditions makes it an ideal choice for next-generation automotive displays, presenting new opportunities for growth.

- Proliferation of Smart TVs and High-End Consumer Electronics: The continued demand for large-screen, high-definition, and ultra-high-definition televisions presents substantial opportunities for the Micro LED market. Micro LED’s ability to deliver superior picture quality with deeper blacks, better brightness, and superior energy efficiency compared to OLED and LCD makes it an ideal candidate for premium smart TVs and home entertainment systems. As consumer preference shifts toward high-quality visual experiences, there is a significant opportunity for Micro LED to capture a larger market share in the consumer electronics segment.

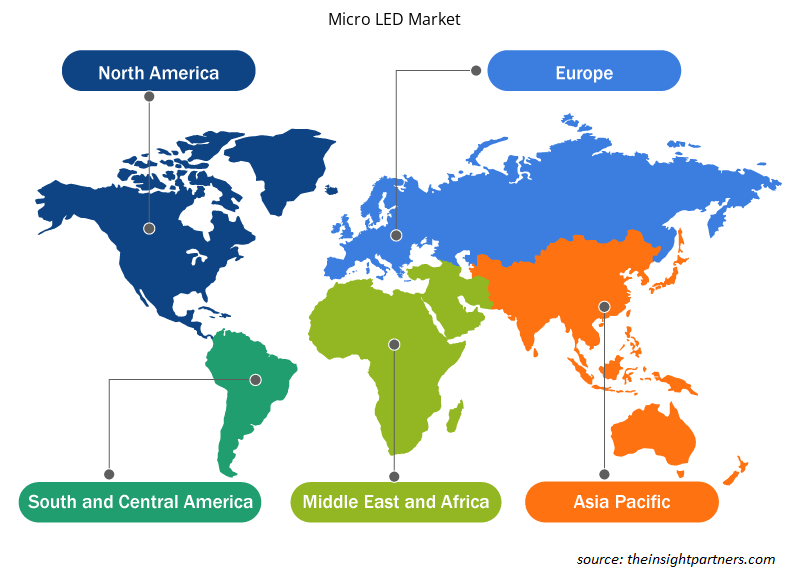

Micro LED Market Regional Insights

The regional trends and factors influencing the Micro LED Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Micro LED Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Micro LED Market

Micro LED Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 63.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

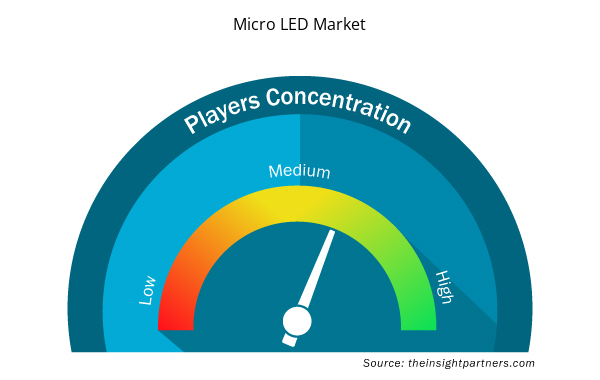

Micro LED Market Players Density: Understanding Its Impact on Business Dynamics

The Micro LED Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Micro LED Market are:

- Allos Semiconductors

- Cree, Inc.

- Epistar Corporation

- JBD Inc.

- LG Display Co. Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Micro LED Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Micro LED Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Micro LED Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, End-user, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The Micro LED Market is estimated to witness a CAGR of 63.9% from 2023 to 2034

Growing Demand for High-Quality Displays, Advancements in Display Technology, Rise of Augmented and Virtual Reality

Shift to Large-Scale Displays

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

1. Allos Semiconductors

2. Cree, Inc.

3. Epistar Corporation

4. JBD Inc.

5. LG Display Co. Ltd

6. Lumens

7. OSRAM Licht Group

8. Philips Lighting N.V.

9. Samsung Electronics Co. Ltd

10. Sony Corporation

Get Free Sample For

Get Free Sample For