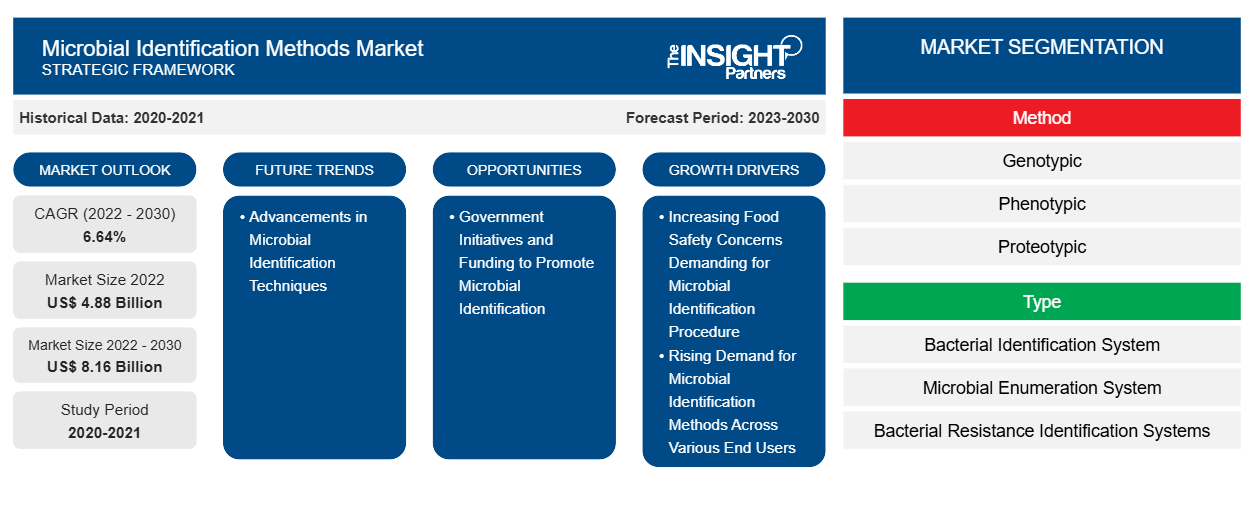

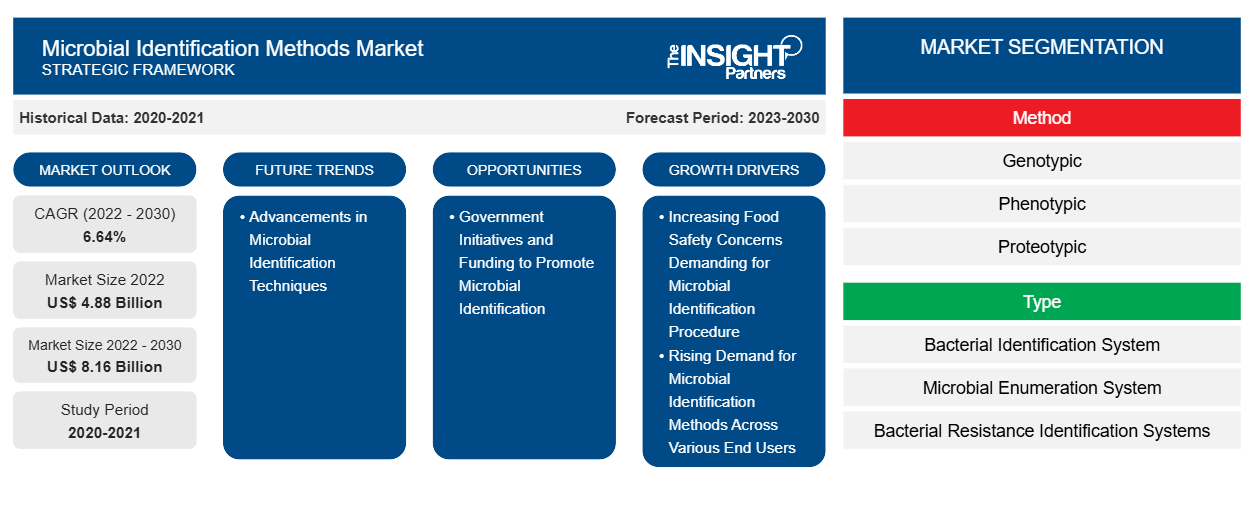

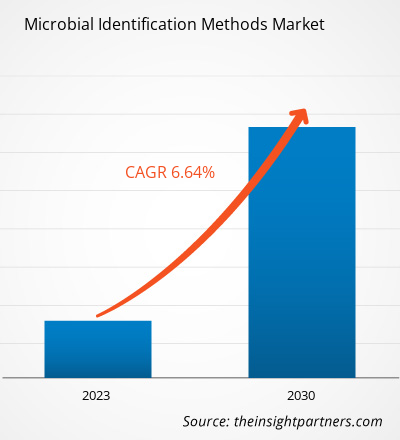

[Research Report] The microbial identification methods market size is expected to grow from US$ 4,882.85 million in 2022 and is expected to reach a value of US$ 8,164.74 million by 2030; it is anticipated to record a CAGR of 6.64% from 2022 to 2030.

Market Insights and Analyst View:

Microorganisms can be identified by the three main techniques—genotypic, proteotypic, and phenotypic. Key factors driving the growth of microbial identification methods are increasing food safety concerns demanding microbial identification procedures and rising demand for microbial identification methods across various end users. However, the high cost of automated microbial identification systems and delay in the approval process of new microbial diagnostic test due to complex regulatory framework hinder the microbial identification methods market growth.

Growth Drivers and Restraints:

Foodborne diseases are a prevalent and expanding public health and economic problem. The prevalence of foodborne infections is influenced by recent changes in food production and processing methods and consumers' ever-evolving eating patterns. The interaction between known pathogens during infection is one of the concerns, and new difficulties have emerged in recent years. Despite the rising adoption of chemical preservatives, cold chains, and a greater understanding of microbes, foodborne illnesses are a significant public health issue for both industrialized and developing nations. The Food Security Cluster estimates that each year ~420,000 people die, and over 600 million people—nearly one in ten people worldwide—get sick after consuming contaminated food, resulting in a loss of 33 million DALYs in June 2022. According to the European Food Safety Authority (EFSA) and the European Centers for Disease Control (ECDC), there were 4,005 foodborne outbreaks in Europe in 2021, a 29.8% increase compared to 2020. Salmonella, Campylobacter, bacterial toxins, and viruses caused most reported outbreaks. To preserve food quality and guarantee consumer safety, quick detection of foodborne pathogens, spoilage microorganisms, and other biological pollutants in complex food matrices is crucial. The conventional approach is cultivating bacteria using a variety of nonselective and selective enrichment techniques, followed by biochemical confirmation. The time-to-detection is a significant limitation when testing foods, especially those with short shelf lives such as fresh meat, fish, dairy products, and vegetables. Several newer detection methods use spectroscopic approaches, such as matrix-assisted laser desorption ionization-time of flight and hyperspectral imaging protocols. Thus, the increase in cases of foodborne diseases is driving the microbial identification methods market.

The microbial identification methods market is further driven by rising demand for microbial identification methods across various end users. There is an escalating demand for microbial identification products across various industries, including pharmaceuticals, biotechnology, food & beverages, and diagnostics. For instance, Charles River Laboratories processes more than 620,000 environmental isolates yearly through their microbial identification and strain typing services, expanding the organism library based on real samples frequently recovered from QC laboratories worldwide. This rise in demand is fueled by a confluence of elements that highlight the crucial role that microbial identification plays in guaranteeing the quality, safety, and advancement of research. In the pharmaceutical and biotechnology sectors, stringent regulatory requirements necessitate precise identification of microorganisms to maintain the integrity of drug production processes. Furthermore, in pharmaceutical and biotechnology, microbial identification products play a vital role in research and development, aiding scientists in understanding and manipulating microorganisms for therapeutic and industrial applications. The demand for microbiological identification is also growing across the food & beverages industry. With consumers becoming increasingly conscious of food safety and quality, companies in this sector rely on these methods to detect and mitigate potential contaminants and spoilage organisms. This not only ensures the production of safe and high-quality consumables but also helps extend shelf life, reduce waste, and meet regulatory standards. In the field of diagnostics, microbial identification has revolutionized the healthcare landscape. Timely and accurate identification of pathogens is crucial for diagnosing infectious diseases, guiding treatment decisions, and controlling outbreaks. Molecular techniques and advanced microbial identification products have become indispensable tools for healthcare providers and clinical laboratories. Besides these sectors, microbial identification finds applications in environmental monitoring, water treatment, research, and academia. Researchers across various disciplines depend on these products to unravel the intricacies of microbial ecosystems, conduct groundbreaking experiments, and contribute to scientific advancements. Microbial identification products are becoming more widely available, effective, and adaptable as technology develops. A shared dedication to quality, safety, and scientific advancement is likely to sustain their rising popularity across these different end-user categories. This emphasizes the crucial significance that microbial identification plays in determining the direction of many industries and guaranteeing the health of communities worldwide.

On the flip side, the high cost of automated microbial identification systems represents a significant challenge for many laboratories and institutions looking to invest in advanced microbiology technology. These systems offer numerous benefits, including rapid and accurate microbial identification, reduced manual labor, and enhanced data analysis capabilities. However, their substantial price tags often present barriers to adoption. One primary reason for the elevated cost of automated microbial identification systems is the intricate technology they incorporate. These systems employ sophisticated equipment, advanced algorithms, and specialized databases to identify microorganisms precisely. The research and development and ongoing maintenance and updates contribute to their high initial and operational expenses. Automated microbiological identification tools have a substantial price tag and are outfitted with cutting-edge features and functions. For instance, A MALDI-TOF-based system costs ~US$ 150,000–850,000.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Microbial Identification Methods Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Microbial Identification Methods Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The microbial identification methods market, by method, is segmented into genotypic, phenotypic, and proteotypic. The phenotypic segment held the largest market share in 2022. The genotypic segment is anticipated to register the highest CAGR from 2022 to 2030. The microbial identification methods market, by type, is segmented into bacterial identification systems, microbial enumeration systems, bacterial resistance identification systems, microbiology analyzers, and others. The bacterial identification system segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030.

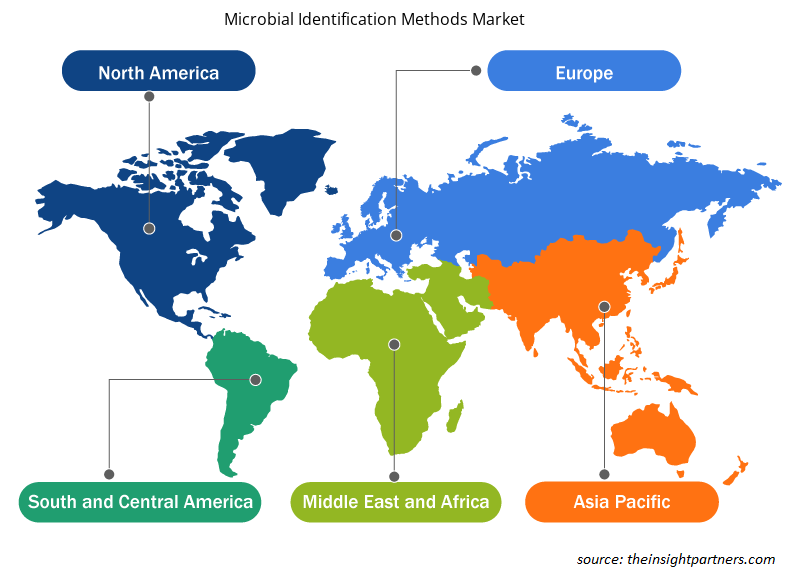

The microbial identification methods market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and Latin America (Brazil, Mexico, and the Rest of Latin America).

Segmental Analysis:

The microbial identification methods market, by method, is segmented into genotypic, phenotypic, and proteotypic. The phenotypic segment held the largest market share in 2022. The genotypic segment is anticipated to register the highest CAGR during 2022–2030. The phenotypic methods are often called the "traditional" method for microbial identification. The phenotypic method for microbial identification relies on metabolic variations across species to identify microorganisms. This method generally includes Gram staining, culture, and biochemical assays. In phenotypic methods, different tests are carried out, due to which the results narrow the possible options until an identification is obtained. API strips, FAME analysis, and VITEK are a few well-known phenotypic tests.

The microbial identification methods market, by type, is segmented into bacterial identification systems, microbial enumeration systems, bacterial resistance identification systems, microbiology analyzers, and others. The bacterial identification system segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030.

Regional Analysis:

Based on geography, the global microbial identification methods market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest share of the global microbial identification methods market size. Asia Pacific is estimated to register the highest CAGR from 2022 to 2030. The North America microbial identification method market has experienced substantial growth in the past few years due to an upsurge in the demand for accurate and rapid microbial identification across various industries such as healthcare, pharmaceuticals, food & beverages, and environmental monitoring. The growth is attributed to several factors, including the rising incidence of infectious diseases, the need for stringent quality control measures in food and pharmaceutical production, and the growing awareness of the importance of microbial monitoring in maintaining public health. The E. coli outbreak connected to frozen falafel resulted in 20 instances of sickness and five hospitalizations, according to a November 2022 update from the CDC. Furthermore, advancements in technology, the introduction of innovative microbial identification methods, and the existence of significant players are anticipated to support the market expansion in the coming years. For instance, the BD Kiestra IdentifA system, intended to automate the preparation of microbiology bacterial identification testing, received 510(k) clearance by the FDA in January 2022. In addition, Bruker Corporation, a US-based organization, introduced the MBT Sepsityper Kit IVD in January 2021 to quickly identify more than 425 bacteria from positive blood cultures using the MALDI Biotyper CA System. Additionally, automation and artificial intelligence (AI) are pivotal in streamlining the identification process, reducing human error, and improving overall efficiency. The pharmaceutical and biotechnology sectors are major contributors to the growth of the microbial identification market in North America. The need for precise identification of microorganisms for drug development, quality control, and regulatory compliance has led to a high demand for advanced identification methods. Thus, increasing demand for accurate and rapid microbial identification across various end users, rising incidence of infectious diseases, the need for stringent quality control measures in food and pharmaceutical production, and growing awareness of the importance of microbial monitoring in maintaining public health are a few other factors driving the market in North America.

Microbial Identification Methods Market Regional Insights

Microbial Identification Methods Market Regional Insights

The regional trends and factors influencing the Microbial Identification Methods Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Microbial Identification Methods Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Microbial Identification Methods Market

Microbial Identification Methods Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.88 Billion |

| Market Size by 2030 | US$ 8.16 Billion |

| Global CAGR (2022 - 2030) | 6.64% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Method

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Microbial Identification Methods Market Players Density: Understanding Its Impact on Business Dynamics

The Microbial Identification Methods Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Microbial Identification Methods Market are:

- Avantor Inc

- Becton Dickinson and Co

- bioMerieux SA

- Merck KGaA

- Thermo Fisher Scientific Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Microbial Identification Methods Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global microbial identification methods market are listed below:

- In June 2023, Biolog Inc announced the acquisition of MIDI Labs and MIDI, Inc., both headquartered in Newark, Delaware. Over the last two decades, both companies have served the microbial ID community, offering complementary products and services. MIDI Labs is an innovator in microbial identification that currently offers contract laboratory services for microbial identification and enumeration to deliver critical, time-sensitive ID for pharmaceutical, probiotic, food and beverage, and personal care manufacturing operations using sequencing and MALDI-TOF mass spectrometry.

- In April 2023, Bruker Corporation launched the fast next-generation MALDI Biotyper IVD Software and optimized MBT Mycobacteria IVD Kit and MBT HT Filamentous Fungi IVD Module. The launch is expected to complement the company's user-friendly, best-in-class diagnostic solutions for routine clinical microbiology and infection diagnostics laboratories.

- In July 2022, Accelerate Diagnostics Inc announced CE marking of its new Accelerate Arc Module and BC kit. Designed for labs with MALDI platforms, the Accelerate Arc Module and BC kit is a novel application of inline centrifugation and automated sample prep techniques, which, together with the blood culture (BC) kit, provides a suspension of cleaned microbial cells for direct transfer to a MALDI spotting plate.

- In January 2022, BD received 510(k) clearance from the US Food and Drug Administration (FDA) for the BD Kiestra IdentifA system, designed to automate microbiology bacterial identification testing preparation.

- In September 2020, Avantor announced a global distribution agreement with Oxford Nanopore Technologies, a market leading manufacturer of next-generation sequencing instruments, kits, and consumables. The agreement enables scientists to have broader access to Oxford Nanopore’s portable real-time nanopore sequencing device, MinION, associated with consumables and reagents.

Competitive Landscape and Key Companies:

Avantor Inc, Becton Dickinson and Co, bioMerieux SA, Merck KGaA, Thermo Fisher Scientific Inc, Bruker Corp, Shimadzu Corp, Accelerate Diagnostics Inc, Molzym GmbH & Co KG, and Biolog Inc are among the prominent players operating in the microbial identification methods. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Method, Type, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The microbial identification methods market was valued at US$ 4,882.85 million in 2022.

The microbial identification methods market, by type, is segmented into bacterial identification systems, microbial enumeration systems, bacterial resistance identification systems, microbiology analyzers, and others. The bacterial identification system segment held a largest market share in 2022 and same segment is anticipated to register a highest CAGR during 2022-2030.

The microbial identification methods market, by method, is segmented into genotypic, phenotypic, and proteotypic. The phenotypic segment held a larger market share in 2022. However, genotypic segment is anticipated to register a higher CAGR from 2022 to 2030.

Microbial identification is the characterization of microbes using a limited spectrum of pre-chosen tests appropriate to the studied problem. Microbial identification results help to decode the root of operational decisions. Therefore, it’s important to use accurate and reproducible microbial identification methods. The widely used methods for microbial identification are phenotypic, genotypic, and proteotypic.

The microbial identification methods market has major market players, including Avantor Inc, Becton Dickinson and Co, bioMerieux SA, Merck KGaA, Thermo Fisher Scientific Inc, Bruker Corp, Shimadzu Corp, Accelerate Diagnostics Inc, Molzym GmbH & Co KG, and Biolog Inc.

The microbial identification methods market is expected to be valued at US$ 8,164.74 million in 2030.

Factors such as increasing food safety concerns demanding for microbial identification procedure and rising demand for microbial identification methods across various end users propel the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Microbial Identification Methods Market

- Avantor Inc

- Becton Dickinson and Co

- bioMerieux SA

- Merck KGaA

- Thermo Fisher Scientific Inc

- Bruker Corp

- Shimadzu Corp

- Accelerate Diagnostics Inc

- Molzym GmbH & Co KG

- Biolog Inc

Get Free Sample For

Get Free Sample For