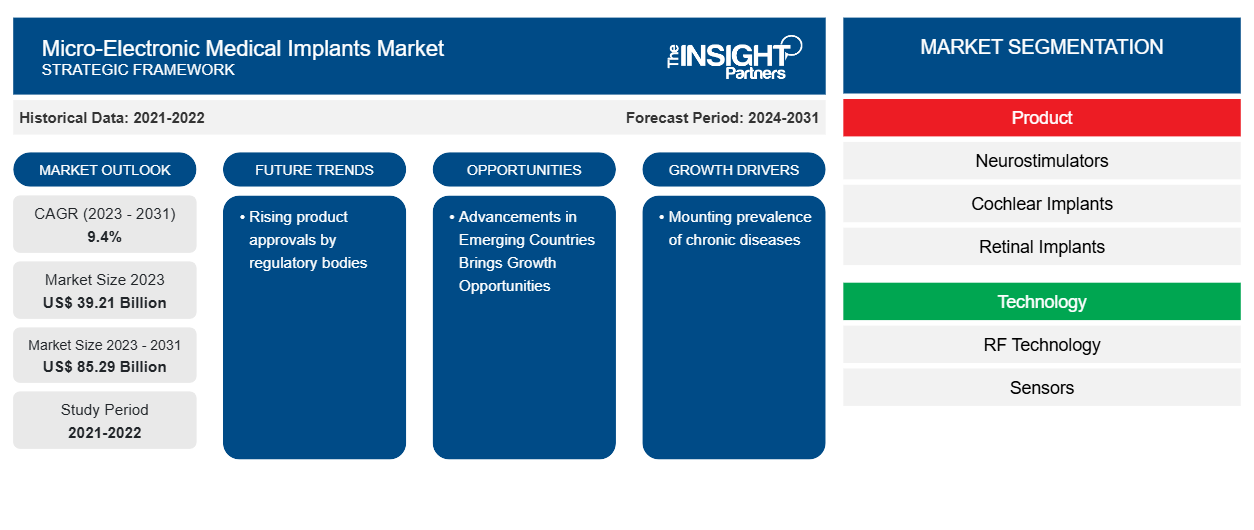

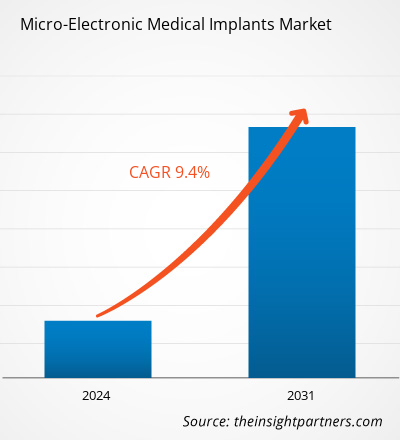

The Micro-electronic medical implants market size is projected to reach US$ 85.29 billion by 2031 from US$ 39.21 billion in 2023. The market is expected to register a CAGR of 9.4% during 2023–2031. The Development of novel medical devices and the demand for personalized medicine are likely to remain key trends in the market.

Micro-electronic medical implants Market Analysis

Implantable medical devices offer monitoring, diagnosis, and therapy for a variety of medical diseases. The development of these devices has advanced significantly over time as a result of significant advancements in electrode technology, microelectronics, and packaging. Medical implantable devices like pacemakers, cochlear implants, ventricular assist devices, spinal cord stimulators and others, are used to treat various chronic conditions The rising incidences of chronic diseases increase the demand for micro-electronic medical implants.

Micro-electronic medical implants Market Overview

According to an article published by Yale Medicine ~ 3 million Americans have pacemakers, the majority of whom are elderly (about 70% of those who receive a pacemaker are at least 65 years of age). A pacemaker is a cardiac implant that contains sensors to track its rhythm, and use this data to determine when and how often to send electrical pulses. Therefore, high utilization of defibrillator and pacemakers due to incidences of heart failure increases the demand for micro-electronic medical implants.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Micro-Electronic Medical Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Micro-Electronic Medical Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Micro-electronic medical implants Market Drivers and Opportunities

Mounting Product Approvals by the Regulatory Bodies to Favor Market

The US Food and Drug Administration (FDA) evaluates high-risk medical devices such as cardiac implantable electronic devices (CIEDs), neurostimulators, cochlear implants, and retinal implants via the premarket approval (PMA) process, in which the company submits its clinical data ensuring safety and effectiveness. Premarket approval supplements are used to approve changes that are made in existing high-risk devices. For instance, in March 2022, FDA approved eCoin Peripheral Neurostimulator developed by Valencia Technologies Corporation to help stimulate nerves related to bladder control in patients with urgency urinary incontinence. Rising approvals by these regulatory bodies drives the micro-electronic medical implants market growth.

Advancements in Emerging Countries Brings Growth Opportunities

The shift in the focus on medical devices with innovative technologies in developing countries is increasing the demand for medical devices integrated with micro-electronics. The developing countries such as India, China and UAE are witnessing rapid healthcare infrastructure development and increased access to medical care owing to their large patient population base and increasing healthcare expenditure thus illustrating immense medical devices market potential. Additionally, presence of major market players and growth strategies adopted by them are likely to bring opportunities in the micro-electronic medical implants market.

Micro-electronic medical implants Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Micro-electronic medical implants market analysis are product, technology, application, and end user.

- The Micro-electronic medical implants market is segmented based on product into neurostimulators, cochlear implants, retinal implants, pacemakers & defibrillators, implantable drug pumps, ocular implants, and others. The pacemakers & defibrillators segment held the largest market share in 2023.

- By material, the market is segmented into RF technology, sensors, and others. The RF technology segment held the largest market share in 2023.

- By application, the market is segmented into cardiology, neurology, oncology, ophthalmology, and others. The cardiology segment held a significant share of the market in 2023.

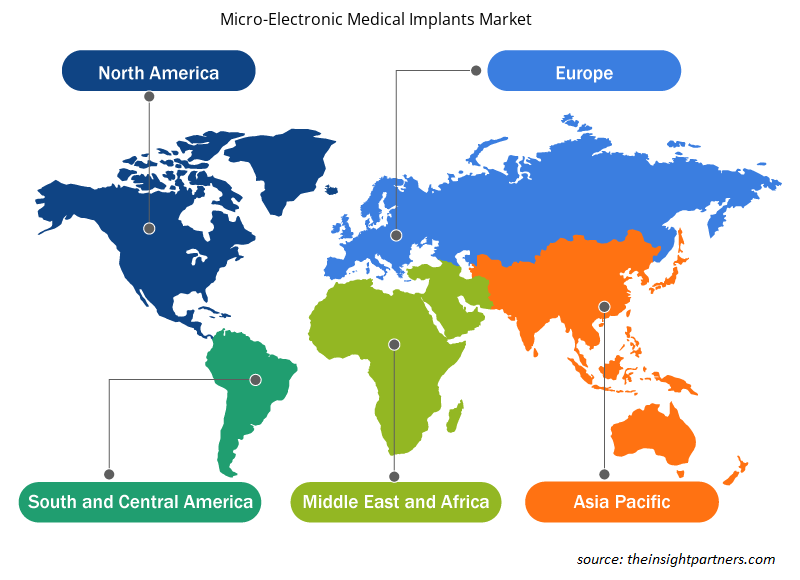

Micro-electronic medical implants Market Share Analysis by Geography

The geographic scope of the Micro-electronic medical implants market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. Asia Pacific is expected to grow with the highest CAGR in the coming years.

The micro-electronic medical implants market in North America is analyzed based on the three major countries: the US, Canada, and Mexico. The US is estimated to have a larger share of the North America Micro-electronic medical implants market in 2023. The growth in this region is characterized by increasing burden of chronic disorders including cardiovascular diseases, neurological & hearing disorders, growing technological advancements, and rising large pool of geriatric population.

Additionally, product approvals by the regulating bodies are expected to augment the growth of the market significantly during the forecast period.

Micro-electronic medical implants Micro-Electronic Medical Implants Market Regional Insights

The regional trends and factors influencing the Micro-Electronic Medical Implants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Micro-Electronic Medical Implants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Micro-Electronic Medical Implants Market

Micro-Electronic Medical Implants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 39.21 Billion |

| Market Size by 2031 | US$ 85.29 Billion |

| Global CAGR (2023 - 2031) | 9.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

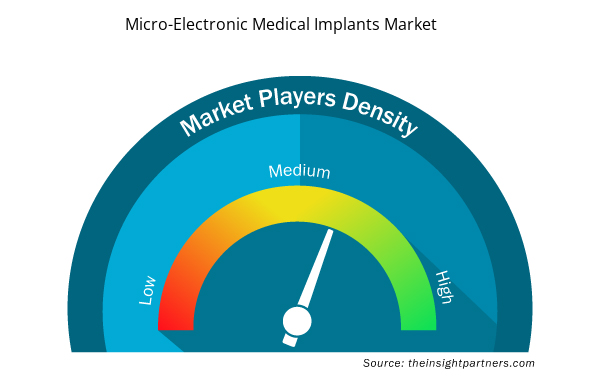

Micro-Electronic Medical Implants Market Players Density: Understanding Its Impact on Business Dynamics

The Micro-Electronic Medical Implants Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Micro-Electronic Medical Implants Market are:

- Sonova

- NeuroPace, Inc

- ABBOTT

- Medtronic

- Cochlear Ltd

- LivaNova PLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Micro-Electronic Medical Implants Market top key players overview

Micro-Electronic Medical Implants Market News and Recent Developments

The micro-electronic medical implants market is evaluated by gathering qualitative and quantitative data from primary and secondary research, which includes essential corporate publications, association data, and databases. A few of the developments in the Micro-electronic medical implants market are listed below:

- MicroPort CRM, announced the launch of the ULYS Implantable Cardioverter Defibrillator (ICDs) and INVICTA defibrillation lead in Japan. Both devices are MRI conditional at 1.5T and 3T when implanted as a system. The ULYS ICD has advanced technology with low current consumption, resulting in a longer predicted lifespan compared to other ICD devices. (Source: MicroPort CRM, Press Release, October 2023)

- Medtronic plc announced availability of its FDA-approved InterStim Micro neurostimulator for sacral neuromodulation (SNM) therapy in the US. Cleveland Clinic performed the first patient implant in the nation with the new device. (Source Medtronic plc, Press Release, 2020)

Micro-Electronic Medical Implants Market Report Coverage and Deliverables

The “Micro-Electronic Medical Implants Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Micro-electronic medical implants market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Micro-electronic medical implants market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Micro-electronic medical implants market analysis covering key market trends, global and regional framework, significant players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the micro-electronic medical implants market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Adaptive Traffic Control System Market

- Wind Turbine Composites Market

- Aircraft Wire and Cable Market

- Surety Market

- Architecture Software Market

- Trade Promotion Management Software Market

- Dealer Management System Market

- Data Annotation Tools Market

- Pipe Relining Market

- Visualization and 3D Rendering Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product By Technology , By Material By Application , By End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

North America dominated the micro-electronic medical implants market in 2023.

Factors Including mounting prevalence of chronic diseases and rising product approvals by regulatory bodies are driving the micro-electronic medical implants market growth.

Development of novel medical devices and the demand for personalized medicine are future trends in the market.

Sonova; NeuroPace, Inc; Abbott; Medtronic; Cochlear Ltd; LivaNova PLC; Abiomed; Boston Scientific Corporation; BIOTRONIK SE&Co. KG; and Zimmer Biomet are some leading players operating in the micro-electronic medical implants market.

The micro-electronic medical implants market is estimated to reach US$ 85.29 billion by 2031.

The micro-electronic medical implants market is anticipated to grow at a CAGR of 9.4% during 2023-2031.

Get Free Sample For

Get Free Sample For