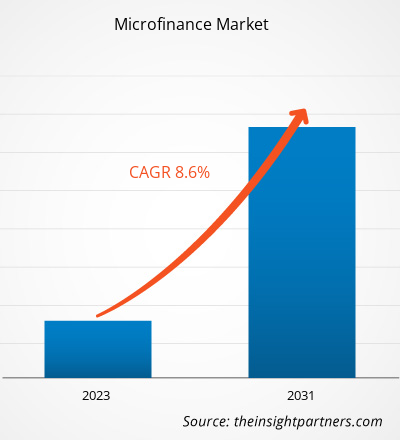

The microfinance market size is expected to grow from US$ 274.3 billion in 2023 to US$ 528.7 billion by 2031; it is anticipated to expand at a CAGR of 8.6% from 2023 to 2031. Shift from traditional loaning to microfinancing is expected to boost the market.

Microfinance Market Analysis

The microfinance industry is embracing technological advancements to enhance its services and reach. This includes the use of mobile banking, digital payments, and innovative financial technologies. These microfinance market trends enable greater accessibility, efficiency, and convenience for both microfinance institutions and their customers. There is an amplified focus on social impact and sustainability within the market.

Microfinance Market Overview

- Microfinance refers to the terms of financial services to individuals or groups with low incomes who are typically excluded from traditional banking systems. It aims to focus on the financial needs of marginalized populations, especially women and the marginalized population, by offering small working capital loans, microloans, or microcredit. However, microfinance institutions (MFIs) may also provide other financial services such as money transfers, insurance, and savings accounts.

- The primary objective of microfinance is to improve access to financial services for those who are financially excluded, promoting self-sufficiency and economic independence. It plays a crucial role in empowering individuals and communities by providing them with the means to start or expand their businesses, manage risks, and build financial resilience.

- Microfinance is particularly important in developing countries, where a considerable measure of the population lacks access to formal credit or savings. By offering tailored financial and non-financial services, microfinance institutions contribute to poverty alleviation, economic development, and the achievement of the United Nations' sustainable development goals.

- The market has experienced steady growth in recent years, this growth reflects the increasing recognition of the importance of financial inclusion and the positive impact that microfinance can have on individuals and enterprises.

Strategic Insights

Microfinance Market Driver

Shift from Traditional Loaning to Microfinance to Drive the Microfinance Market

- The market has witnessed a significant shift from traditional lending to microfinance, driven by several factors. This shift has brought about positive changes in the financial landscape, particularly for individuals and groups with low incomes who were previously excluded from accessing formal financial services. One of the major factors of the shift to microfinance is the aim to promote financial inclusion.

- Traditional lending institutions often have strict eligibility criteria and require collateral, making it difficult for low-income individuals to access credit. Microfinance institutions, on the other hand, focus on providing financial services to the financially underserved, enabling them to access small loans, microcredit, and other financial products.

- Microfinance is recognized for its potential to alleviate poverty and contribute to sustainable development. By providing individuals with the means to start or expand their businesses, microfinance helps create income-generating opportunities, reduce unemployment, and improve living standards. This social impact has attracted attention and support from governments, international organizations, and impact investors, further driving the microfinance market growth.

Microfinance

Market Report Segmentation Analysis

- Based on provider, the market is segmented into banks, micro finance institute (MFI), non-banking financial institutions (NBFI), and others. The banks segment is expected to hold a substantial microfinance market share in 2023.

- Banks are traditional financial institutions that offer a wide range of financial services, including loans, savings accounts, and other banking products. In the context of microfinance, banks play a significant role in providing financial services to low-income individuals and microenterprises. They may offer microcredit, micro-insurance, and other financial products tailored to the needs of the underserved population.

- Banks often have a broader customer base and extensive infrastructure, making them an important segment in the market. Microfinance institutions are specialized organizations that provide financial services to low-income individuals who have inadequate access to traditional banking services.

- MFIs focus on financial inclusion and aim to empower the financially underserved by offering micro-loans, microcredit, savings accounts, insurance, and other financial products. They often target marginalized populations, including women, rural communities, and small-scale entrepreneurs, which is further anticipated to boost the microfinance market growth.

Microfinance market Share Analysis by Geography

The scope of the microfinance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific (APAC) is experiencing rapid growth and is anticipated to hold a significant microfinance market share. The region's significant economic development, growing population, and increasing focus on financial inclusion across diverse economies have contributed to this growth. APAC's emerging markets, characterized by a large unbanked population and a growing entrepreneurial culture, have presented substantial opportunities for microfinance institutions and non-banking financial institutions (NBFIs) to expand their services and reach previously underserved communities.

Microfinance

Market Report Scope

The "Microfinance Market Analysis" was carried out based on provider, end-user, and geography. In terms of provider, the market is segmented into banks, micro finance institute (MFI), non-banking financial institutions (NBFI), and others. Based on end-user, the market is segmented into small enterprises, micro enterprises, and solo entrepreneurs or self-employed. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Microfinance

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the market. The microfinance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. A few recent key market developments are listed below:

- In February 2024, Ericsson and Telenor Microfinance Bank (TMB) further strengthened their partnership and shared commitment to promoting financial inclusion and empowerment in Pakistan. The two companies have recently signed a multi-year extension of their partnership, with the objective of enhancing the financial services provided by easypaisa and expanding the range of offerings within the fintech sector. This partnership aims to leverage the expertise and resources of both companies to drive the growth and accessibility of financial services for individuals and businesses in Pakistan.

[Source: Telefonaktiebolaget LM Ericsson, Company Website]

Microfinance

Market Report Coverage & Deliverables

The market report on “Microfinance Market Size and Forecast (2021–2031)”, provides an detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

Microfinance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 274.3 Billion |

| Market Size by 2031 | US$ 528.7 Billion |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Provider

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Shelf Label Market

- Procedure Trays Market

- Semiconductor Metrology and Inspection Market

- Cling Films Market

- Aesthetic Medical Devices Market

- Predictive Maintenance Market

- Social Employee Recognition System Market

- Latent TB Detection Market

- Point of Care Diagnostics Market

- Military Rubber Tracks Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Provider, End-user, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the market are Bandhan Financial Services Pvt. Ltd.; CDC Small Business Finance Corp.; Cashpor Micro Credit; Grameen America Inc.; and KIVA.

The market is expected to reach US$ 528.7 billion by 2031.

The market was estimated to be US$ 274.3 billion in 2023 and is expected to grow at a CAGR of 8.6% during the forecast period 2023 - 2031.

Increased focus on social impact and sustainability is anticipated to play a significant role in the market in the coming years.

Shift from traditional loaning to microfinance and lower operating costs and reduced market risk are the major factors that propel the market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Bank Rakyat Indonesia (BRI)

- Annapurna Microfinance Pvt. Ltd.

- Bandhan Financial Services Pvt. Ltd.

- CDC Small Business Finance Corp.

- Cashpor Micro Credit

- Grameen America Inc.

- KIVA

- Madura Microfinance Ltd.

- Pacific Community Ventures

- ESAF Small Finance Bank

Get Free Sample For

Get Free Sample For