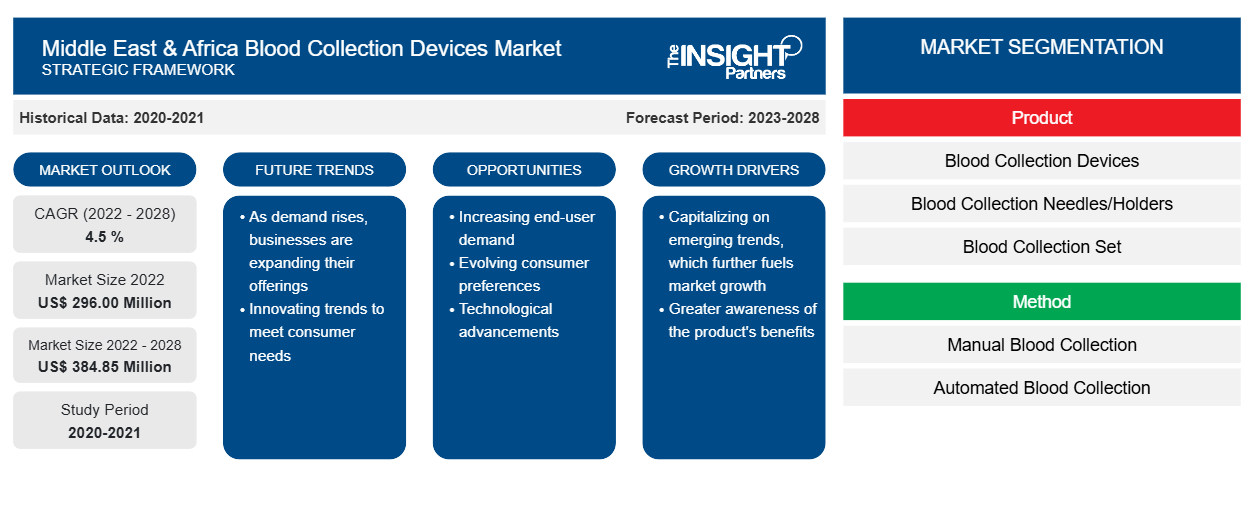

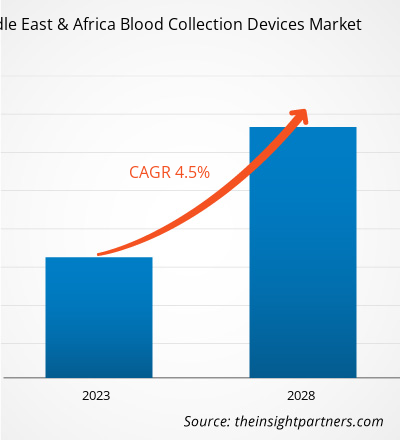

[Research Report] The Middle East & Africa blood collection devices market is expected to reach US$ 384.85 million by 2028 from US$ 296.00 million in 2022; it is estimated to grow at a CAGR of 4.5 % from 2022 to 2028.

The growth of the market is attributed to the key driving factors such as the growing government support for blood test services and prevalence of blood and genetic disorders. However, problems associated with smooth collection of specimens by blood collection devices hinders the market growth.

Analyst Viewpoint

The Middle East & Africa blood collection devices market aims to support compliance regulations across regions. Growing government support for blood test services and prevalence of blood and genetic disorders are the factors responsible for influential growth of blood collection devices market. Further, technological developments in blood collection techniques and tubes acts as a future trend for the market to grow during 2022–2028. According to the segmentation profiled in the report, based on product segment, blood collection needles/holders held the largest share, whereas based on method, the manual blood collection segment dominated the market recording maximum share in 2021. Furthermore, by end user, the hospitals & pathology laboratories segment will account considerable share for the blood collection devices and will dominate the market growth during the forecast period.

Blood collection tubes are sterile plastic or glass tubes that collect blood, urine, and serum samples from patients to diagnose blood-related diseases. Most blood collection devices comprise an additive that either accelerates the clotting of blood (clot activator) or prevents the blood from clotting (anticoagulant). The most commonly used blood collection devices comprise light-blue, red, green, lavender, gray, or gold mottled or "tiger" top. These tubes are generally used in clinical laboratories for coagulation, serology, immunology, and chemical tests. The growth is attributable to the growing government support for blood test services and prevalence of blood and genetic disorders.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Government Support for Blood Test Services

Healthcare service in Saudi Arabia is given a top priority by the government. As per the World Health Organization (WHO) report, the Saudi healthcare system is ranked 26th among 190 of the world's health systems. Likewise, rising health concerns have led to increased demand for public and private medical and research laboratories in the UAE. The primary focus of medical laboratories is clinical research, where they offer several testing services. MaxMed laboratories, Al Rayan Medical Laboratory, and Al Tiraq Laboratory are among the clinical laboratories where blood sample collection and analysis procedures are performed daily as per the laboratory's standard guidelines. These laboratories have special facilities for blood sample preparation and storage of blood specimens. In October 2022, the Dubai Health Authority (DHA) announced the launching the UAE's first-of-its drive-through blood test services. The UNILABS will provide this new service, recognized by the ISO-certified Emirates International Accreditation Center (EIAC), in collaboration with the United Medical Center (UMC) in Dubai. By launching such a service, customers can undergo drive-through blood tests as recommended by the physicians. The Parent's Guide to Cord Blood Foundation 2022 report states that most of the biobanks in the UAE are either cord blood banks or adipose stromal cell banks. According to a rule passed by the UAE Ministry of Health in 2020 that took effect in January 2022, banks that collect cord blood units in the UAE are required to establish a laboratory and storage facility in the UAE. In 2020, the Government of Dubai passed a law that focuses on the regulations on autologous adipose cellular therapies coupled with blood collection/specimen for research activities. Therefore, growing government support for advanced biotherapies, such as cell therapy, immunomodulation therapy, gene therapies, and tissue engineering, where blood sample/specimen collection and storage plays a critical role, triggers the need for blood collection devices.

Product-Based Insights

Based on product, the Middle East & Africa blood collection devices market is segmented as blood collection needles/holders, blood collection tubes, blood collection set, and others. The blood collection needles/holders segment held the largest market share in 2022. The blood collection tubes segment is likely to register the highest CAGR during the forecast period 2022–2028. Blood collection needles/holders are one of the crucial and integral components of the blood collection system. It is a medical device that helps safely reach the blood vessels during blood collection. A needle is attached to the blood collection devices and blood collection devices to draw blood. In the market, needle holder products are available that help in the easy and safe execution of blood collection procedures. In the Middle East & Africa markets, key players offer products such as blood collection needle holders that facilitate blood collection procedures and lower the possibility of needlestick injuries. For instance, market players such as Greiner Bio-One, and BD offer blood collection needle/holder products under its brand BD VACUETTE Blood Transfer Unit and Vacutainer Eclipse blood collection needle. This product includes an attachable holder system. These products are single use to avoid contamination of the blood sample. The aforementioned factors are responsible for influential segmental growth, thereby dominating overall market growth during the forecast period.

Method-Based Insights

Based on method, the Middle East & Africa blood collection devices market is bifurcated into manual blood collection and automated blood collection. The manual blood collection segment held a larger market share in 2021. The automated blood collection segment is expected to register a higher CAGR during the forecast period.

End User-Based Insights

In terms of end user, the Middle East & Africa blood collection devices market is categorized into hospitals & pathology laboratories, blood banks, and others. The hospitals & pathology laboratories segment held the largest share for Middle East & Africa blood collection tubes market share in 2022 and is likely to register a higher CAGR during the forecast period. Hospitals and pathology laboratories provide healthcare facilities through specialized scientific equipment. The team of trained staff is assigned to deal, investigate, restore the problems associated with modern medical science in the hospital and pathology laboratories. Various medical research teams are constantly working on introducing innovative technologies related to the treatment methods, laboratory investigations, and other activities in the medical field. The patients generally prefer the hospital to take treatment due to advanced treatment options for patients for the treatment of chronic conditions. The blood collection devices are being frequently used in hospitals and pathology laboratories. In the hospitals are generally the point of blood collection from the patients. In the hospital, blood collection devices such as blood collection devices, needles, holders, blood collection sets, and other consumables are utilized during the blood collection. In the laboratories, the collected/sampled blood is used for clinical tests. The blood collection containers, such as tubes, help secure handling of the sampled blood. The aforementioned factors are responsible for accounting considerable share for the Middle East & Africa blood collection devices market during the forecast period.

Middle East & Africa Blood Collection Devices Market, by Method – 2022 and 2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Insights

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The Middle East & Africa dominated the blood collection tubes market accounting maximum share. In the region, Saudi Arabia records maximum share for the blood collection tubes. Saudi Arabia is one of the fastest-developing countries, whose growth is driven by a vast population base, rising adoption of medical devices, and increasing prevalence of chronic diseases. Also, Under Vision 2030, the government plans to invest more than US$ 65 billion to develop Saudi Arabia’s healthcare infrastructure. In addition, it aims to increase private sector contribution from 40% to 65% by 2030 and targets to privatize 290 hospitals and 2,300 primary health centers. The newly constructed hospitals will be equipped with modern healthcare technologies and are expected to deliver health services in all specialization areas. Thus, the increasing number of laboratories and healthcare facilities is likely to offer a lucrative environment for the growth of the Saudi Arabia blood collection tubes market during the forecast period.

Companies operating in the Middle East & Africa blood collection devices market adopt the product innovation strategy to meet the evolving customer demands worldwide, permitting them to maintain their brand name in the global Middle East & Africa blood collection devices market.

In November 2021, Q-Sera Pty Ltd announced partnership with Terumo Corporation for "RAPClot" product a rapid serum tube technology manufactured and used in Japan. The RAPClot serum tubes will produce high quality serum in less than 5 minutes by reducing the turnaround time from sample collection to serum analysis. Also, the product is effective in producing high quality serum from blood samples comprising anti-coagulants such as heparin.

Company Profiles

- Becton, Dickinson, and Company

- SARSEDT AG & CO.KG

- Thermo Fisher Scientific, Inc.

- Cardinal Health

- Greiner Bio-One International GmbH

- Terumo Corporation

- ICU Medical, Inc.

- Grifols, S.A.

- Fresenius Kabi AG

- F.L. Medical S.R.L.

Middle East & Africa Blood Collection Devices Market Regional Insights

The regional trends and factors influencing the Middle East & Africa Blood Collection Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Middle East & Africa Blood Collection Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Middle East & Africa Blood Collection Devices Market

Middle East & Africa Blood Collection Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 296.00 Million |

| Market Size by 2028 | US$ 384.85 Million |

| Global CAGR (2022 - 2028) | 4.5 % |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

Middle East & Africa Blood Collection Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Middle East & Africa Blood Collection Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Middle East & Africa Blood Collection Devices Market are:

- Becton, Dickinson, and Company

- SARSEDT AG & CO.KG

- Thermo Fisher Scientific, Inc.

- Cardinal Health

- Greiner Bio-One International GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Middle East & Africa Blood Collection Devices Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Intradermal Injection Market

- Explosion-Proof Equipment Market

- Point of Care Diagnostics Market

- Virtual Production Market

- Molecular Diagnostics Market

- Advanced Planning and Scheduling Software Market

- Water Pipeline Leak Detection System Market

- Medical Second Opinion Market

- Radiopharmaceuticals Market

- Social Employee Recognition System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Method, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Algeria, Egypt, Israel, Kenya, Kuwait, Morocco, Nigeria, Qatar, Saudi Arabia, South Africa, Turkey, United Arab Emirates

Frequently Asked Questions

The CAGR value of the blood collection devices during the forecasted period of 2022-2028 is 4.5%.

Key factors that are driving the growth of this market are growing government support for blood test services and prevalence of blood and genetic disorders boost the market growth for the blood collection devices over the years.

The blood collection devices majorly consists of the players such Becton, Dickinson, and Company, SARSEDT AG & CO.KG, Thermo Fisher Scientific, Inc., Cardinal Health, Greiner Bio-One International GmbH, Terumo Corporation, ICU Medical, Inc., Grifols, S.A., Fresenius Kabi AG, and F.L. Medical S.R.L. .

The manual blood collection segment dominated the blood collection devices and held the largest market share in 2022.

Blood collection tubes are sterile plastic or glass tubes that collect blood, urine, and serum samples from patients to diagnose blood-related diseases. Most blood collection devices comprise an additive that either accelerates the clotting of blood (clot activator) or prevents the blood from clotting (anticoagulant). The most commonly used blood collection devices comprise light-blue, red, or gold (mottled or "tiger" top used with some tubes), green, lavender, and gray that are commonly intended for coagulation, chemistry, serology, immunology, and other clinical laboratory tests. The growth is attributable to the growing government support for blood test services and prevalence of blood and genetic disorders.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Middle East & Africa Blood Collection Devices Market

- Becton, Dickinson, and Company

- SARSEDT AG & CO.KG

- Thermo Fisher Scientific, Inc.

- Cardinal Health

- Greiner Bio-One International GmbH

- Terumo Corporation

- ICU Medical, Inc.

- Grifols, S.A.

- Fresenius Kabi AG

- F.L. Medical S.R.L.

Get Free Sample For

Get Free Sample For