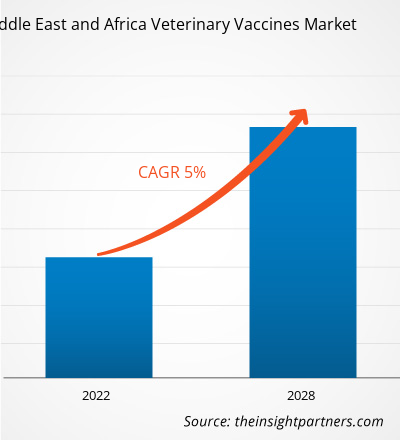

The MEA veterinary vaccines market is expected to grow from US$ 424.56 million in 2021 to US$ 599.21 million by 2028; it is estimated to grow at a CAGR of 5.0% from 2021 to 2028.

Animal-borne diseases can pose a high risk to public health and can be detrimental to businesses and economies. Therefore, farmers and governments take various precautions, such as maintaining clean animal stalls and animal vaccinations, to prevent disease outbreaks. Influenza, one of the most prevalent infectious diseases, is a highly contagious airborne disease that appears as an acute febrile sickness with variable degrees of systemic symptoms ranging from mild fatigue to respiratory failure and death during seasonal epidemics. Infectious illnesses of pets and farm animals are a substantial danger to animal health and welfare. Effective control is critical for agricultural health, national and international food security, and poverty alleviation in several countries. Various cattle illnesses are endemic in numerous places across the region. Existing and novel pathogen threats continue to emerge due to climate change, agricultural practices, and demographics, all of which favor the spread of arthropod-borne diseases to new geographical areas. Zoonotic illnesses are rising and offering a new serious threat to human health. They can be transmitted directly or indirectly between animals and humans. The new influenza A (H1N1) virus's pandemic status is a recent example of the threat posed by zoonotic viruses. The incidence of the vector-borne disease has grown considerably over the last decade, corroborating the hypothesis that climate change is causing the formation of conditions in which arthropod vectors are environmentally sensitive. The growth of new infectious illnesses has been tremendous in tropical places (EIDs). While zoonotic emerging infectious disease (EIDs) are associated with biodiversity in wildlife, those associated with the emergence of new drug-resistant strains are associated with agronomic factors such as antibiotic use and population density. Controlling numerous essential animal diseases continues to make progress, and procedures are now in place to combine critical scientific competence with political resolve to succeed. The first step of defense for many acute diseases is to employ cutting-edge diagnostic and surveillance techniques to establish a network of information about their spread and risk assessment. They are combined with efficient vaccine techniques for controlling important farm animal infections, particularly tests, and a continuous pipeline of new and improved vaccines that give long-lasting and durable protective immunity and are effective against many strains or variants. So, rising awareness related to diagnosis and treatment of infectious diseases is expected to drive the MEA market growth.

In case of COVID-19, MEA is highly affected especially South Africa. The demand for veterinary vaccines decreased for a certain period until the new spread of the virus in animals hasn’t been confirmed. When the cases of several animals tested positive for the virus were reported in various parts of the region, a mix of established pharmaceutical companies involved in veterinary vaccines have mounted up R&D and manufacturing efforts to produce and develop vaccines, and drugs against the SARS-CoV-2 virus. The demand for veterinary vaccines has been increasing due to increasing incidences of zoonotic diseases, but the supply chain and service providers cannot satisfy the needs and have impacted largely. Supply disruption and medicine shortages of veterinary medicines have been observed in several countries, primarily due to the temporary lockdowns of manufacturing sites, export bans, and growing demand for medicine, for the treatment of COVID-19. Governments took measures to alleviate the supply of medicines. For instance, the South African Health Products Regulatory Authority issued guidance for companies responsible for veterinary medicines, with respect to the adaptations to the regulatory framework, primarily to address the challenges faced during this pandemic situation. The current veterinary vaccines markets in the MENA region differ considerably between the various nations. For example, high purchasing power and a cultural predilection for expensive foreign brands in Saudi Arabia have resulted in 85% of pharmaceuticals being imported.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the MEA veterinary vaccines market. The MEA veterinary vaccines market is expected to grow at a good CAGR during the forecast period.

MEA Veterinary Vaccines Market Revenue and Forecast to 2028 (US$ Million)

MEA Veterinary Vaccines Market Segmentation

MEA Veterinary Vaccines Market – By Vaccine Type

- Livestock Vaccines

- Bovine Vaccines

- Small Ruminant Vaccines

- Companion Animal Vaccines

- Feline Vaccines

- Canine Vaccines

- Others

- Others

MEA Veterinary Vaccines Market – By Technology

- Live Attenuated Vaccines

- Inactivated Vaccines

- Toxoid Vaccines

- Recombinant Vaccines

- Conjugate Vaccines

- Others

MEA Veterinary Vaccines Market, by Country

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

MEA Veterinary Vaccines Market - Companies Mentioned

- BIOVAC

- Boehringer Ingelheim International GmbH

- Ceva

- Elanco

- Hester Biosciences Limited

- HIPRA

- Merck & Co., Inc.

- NEOGEN Corporation

- Virbac

- Zoetis Inc.

Middle East and Africa Veterinary Vaccines Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 424.56 Million |

| Market Size by 2028 | US$ 599.21 Million |

| Global CAGR (2021 - 2028) | 5.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vaccine Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- BIOVAC

- Boehringer Ingelheim International GmbH

- Ceva

- Elanco

- Hester Biosciences Limited

- HIPRA

- Merck & Co., Inc.

- NEOGEN Corporation

- Virbac

- Zoetis Inc.

Get Free Sample For

Get Free Sample For