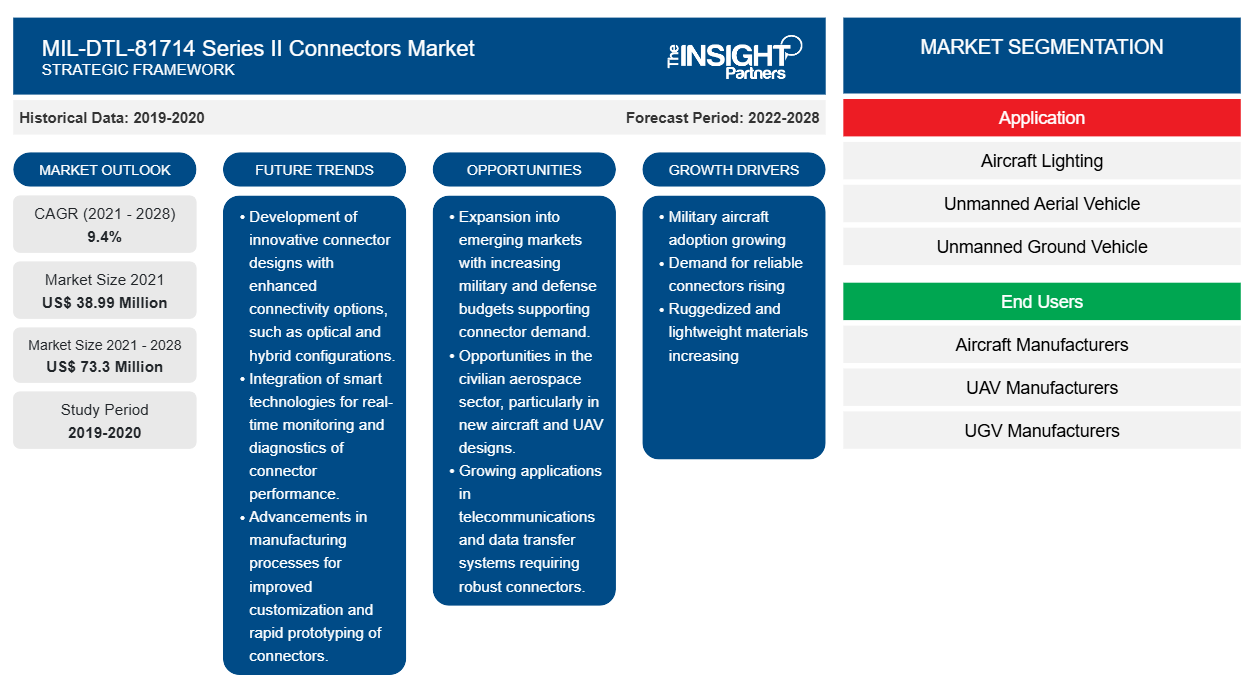

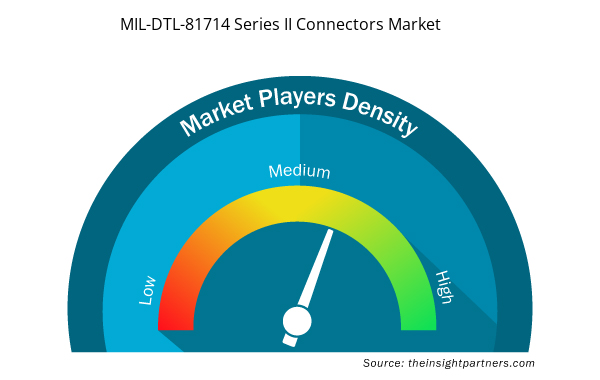

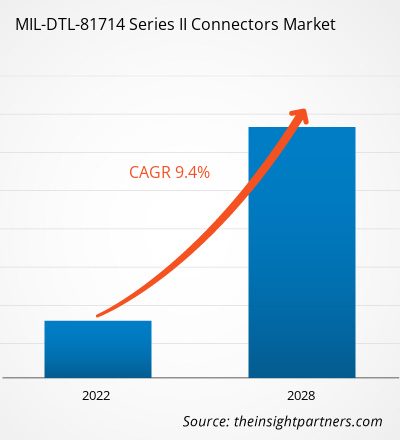

The MIL-DTL-81714 Series II connectors market was valued at US$ 38,991.02 thousand in 2021 and is anticipated to reach US$ 73,295.13 thousand by 2028. The market is expected to grow at a CAGR of 9.4% from 2021 to 2028.

The upgrading of existing fighter jets is among the major factors fueling the adoption of the MIL-DTL-81714 Series II connectors. In 2018, Royal Thai Air Force announced its plans of upgrading of the Saab Early Warning System; replacement of F-16 fighter jets and L-39s trainers; and procurement of various transport aircraft, helicopters, and unmanned aircraft. Similarly, the Defense Acquisition Council (DAC) approved defense deals worth INR 389 billion in July 2020, including the purchase of 21 MiG-29 Indian Air Force (IAF) fighter jets, upgrading of 59 existing MiG-29 jets from the IAF inventory, and purchase of 12 Su-30MKI aircraft from Russia. Further, the increasing procurement of advanced fighter and transport aircraft is also propelling the MIL-DTL-81714 Series II connectors market growth. For example, the Government of India is finalizing the 83 Light Combat Aircraft (LCA) Mark 1 A contract and is also in the process of acquiring 200 aircraft fleet to cope with depleting aerial inventories of the Indian Air Force (IAF). In addition, Boeing, the US defense major, is considering offering its F-15EX Eagle fighter jets to the IAF and has also applied for a license from the US authorities to export them to India. The move is seen as Boeing's attempt to seize an IAF contract worth US$ 18 billion to procure 114 fighter jets. Similarly, Argentine Air Force has announced the procurement plan including aircraft such as IA 63, Mi-171, KC-390, and T-6C+. Thus, owing to growing adoption of military aircraft the MIL-DTL-81714 Series II connectors market is projected to witness significant growth.

Impact of COVID-19 Pandemic on MIL-DTL-81714 Series II Connectors Market

The COVID–19 outbreak has significantly impacted the global economy. Governments are imposing several limitations on industrial, commercial, and public activities to control the spread of infection. Therefore, the production volume of aircraft is decreasing drastically amid pandemic, which is declining the adoption rate of MIL-DTL-81714 Series II connectors. Thus, the aircraft manufacturers and aircraft MRO service providers are witnessing significant loss during the pandemic.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

MIL-DTL-81714 Series II Connectors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

MIL-DTL-81714 Series II Connectors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MIL-DTL-81714 Series II Connectors Market Insights

Emergence of Unmanned Aerial Vehicles

Rapid changes in modern warfare have been urging governments to allocate higher funds toward respective armed forces. The higher military budget allocation enables the military forces to engage themselves in the development and procurement of advanced warfare fleet, including unmanned aerial vehicles (UAVs). UAVs are widely used for intelligence gathering, surveillance, reconnaissance, target acquisition, battle damage management, delivery, transportation, combat operations, etc. At present, fleet modernization has become one of the common practices for the aerospace & defense industries in different countries. Thus, owing to growing adoption of unmanned aerial vehicles, the MIL-DTL-81714 Series II connectors market is projected to witness significant growth.

Application-Based Market Insights

Based on the application, the MIL-DTL-81714 Series II Connectors market is segmented into aircraft lighting, unmanned aerial vehicle, unmanned ground vehicle, and combat systems & weaponry. The aircraft lighting segment held the largest market share in 2020. The MIL-DTL-81714 Series II Connectors are used in powering up aircraft lamps, cabin lights, high-intensity lights, and beacons. Lighting has a significant impact on the interior and exterior of the aircraft. There is a continuous development in improving overall form and functional factor of interior and exterior lighting system for military aircraft by utilizing advanced lighting solution.

The players operating in the MIL-DTL-81714 Series II connectors market focus on strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- Eaton completed the acquisition of the Souriau-Sunbank Connection Technologies business of TransDigm Group Incorporated for US $920 million.

MIL-DTL-81714 Series II Connectors Market Regional Insights

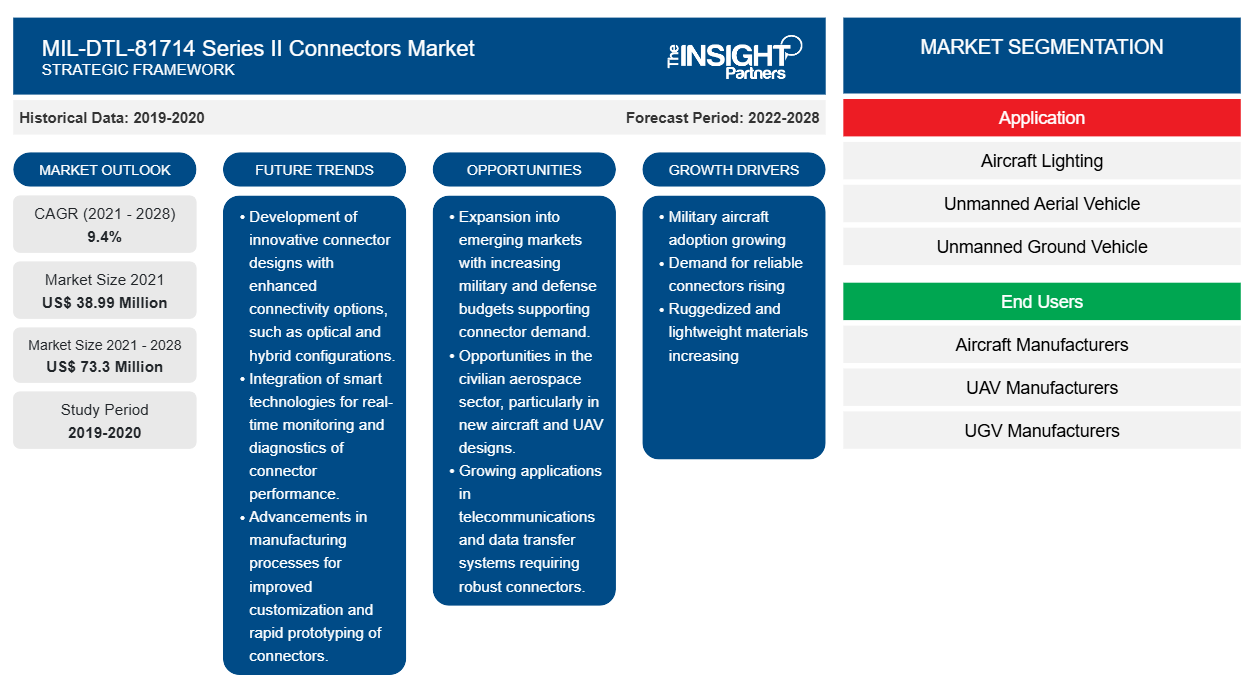

The regional trends and factors influencing the MIL-DTL-81714 Series II Connectors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses MIL-DTL-81714 Series II Connectors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for MIL-DTL-81714 Series II Connectors Market

MIL-DTL-81714 Series II Connectors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 38.99 Million |

| Market Size by 2028 | US$ 73.3 Million |

| Global CAGR (2021 - 2028) | 9.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

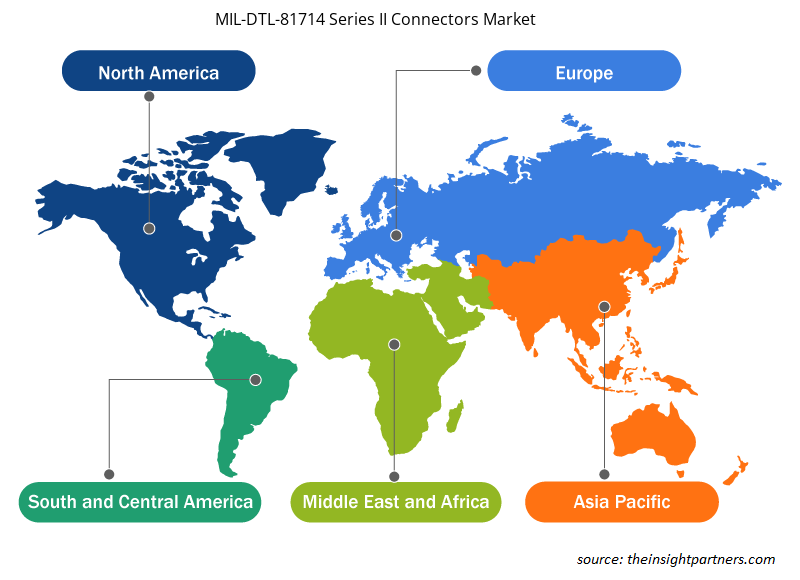

MIL-DTL-81714 Series II Connectors Market Players Density: Understanding Its Impact on Business Dynamics

The MIL-DTL-81714 Series II Connectors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the MIL-DTL-81714 Series II Connectors Market are:

- Amphenol Corporation

- TE Connectivity

- DME Interconnect

- Souriau

- Daniels Manufacturing Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the MIL-DTL-81714 Series II Connectors Market top key players overview

The global MIL-DTL-81714 Series II connectors market has been segmented as follows:

MIL-DTL-81714 Series II Connectors Market – by Application

- Aircraft Lighting

- Unmanned Aerial Vehicle

- Unmanned Ground Vehicle

- Combat Systems & Weaponry

MIL-DTL-81714 Series II Connectors Market – by End User

- Aircraft Manufacturers

- UAV Manufacturers

- UGV Manufacturers

- Aircraft MRO Service Providers

- Weaponry Manufacturers

- Combat System Integrators

MIL-DTL-81714 Series II Connectors Market – by Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- Russia

- UK

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- Japan

- Australia

- South Korea

- Rest of APAC

Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

South America (SAM)

- Brazil

- Rest of SAM

Company Profiles

- Amphenol Pcd

- DME INTERCONNECT

- Daniels Manufacturing Corporation

- TE Connectivity Ltd.

- SOURIAU SAS

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application and End Users

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Brazil, Canada, China, France, Germany, India, Israel, Italy, Japan, Mexico, Russian Federation, South Korea, Turkey, United Kingdom, United States

Frequently Asked Questions

Aircraft lighting is leading the global MIL-DTL-81714 Series II Connectors market. The increasing adoption of advanced LED lighting solution in military aircraft, the demand for MIL-DTL-81714 Series II Connectors is anticipated to experience significant growth during the forecast period.

Presently, North America held the largest share of the global MIL-DTL-81714 Series II Connectors market owing to the growing adoption of unmanned aerial vehicles and unmanned ground vehicles.

The upgrading of existing fighter jets is among the major factors fueling the adoption of the MIL-DTL-81714 Series II connectors. in 2018, Royal Thai Air Force announced its plans of upgrading of the Saab Early Warning System; replacement of F-16 fighter jets and L-39s trainers; and procurement of various transport aircraft, helicopters, and unmanned aircraft. In addition, Boeing, the US defense major, is considering offering its F-15EX Eagle fighter jets to the IAF and has also applied for a license from the US authorities to export them to India. The move is seen as Boeing's attempt to seize an IAF contract worth US$ 18 billion to procure 114 fighter jets. Similarly, Argentine Air Force has announced the procurement plan including aircraft such as IA 63, Mi-171, KC-390, and T-6C+.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - MIL-DTL-81714 Series II Connectors Market

- Amphenol Corporation

- TE Connectivity

- DME Interconnect

- Souriau

- Daniels Manufacturing Corporation

Get Free Sample For

Get Free Sample For