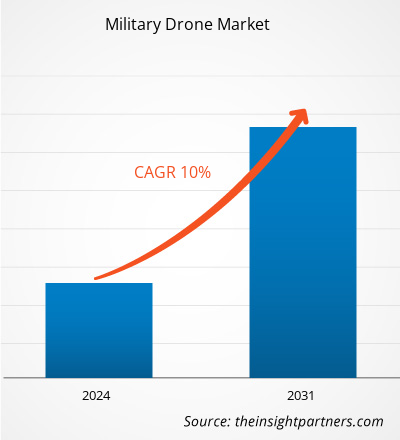

The Military Drone Market size is projected to reach US$ 27.63 billion by 2031 from US$ 12.93 billion in 2023. The market is expected to register a CAGR of 10.0% in 2023–2031. Technological advancement in military drones is their capability to refuel manned vehicles in the air. This is considered as a major achievement in the era of manned-unmanned teaming operations. For instance, in September 2021, Boeing’s MQ-25 Stingray drone refueled an F-35 joint strike fighter, as a part of the testing performed by the US Navy. With this, US Navy allocated a budget of US$ 16.8 billion for the MQ-25 Stingray drones to utilize their ability to refuel F-35Cs, F/A-18s, and other carrier-operated air platforms. In addition to their popular use in ISR and warfare applications, using military drones for refueling would increase their demand in the coming years.

Military Drone Market Analysis

The procurement and deployment of technologically advanced military drones play a vital role in boosting the security of any country. A bird’s-eye view provided by drones helps in real-time monitoring and detects unwanted activities across national borders. It also helps detect or destroy the enemy or harmful incomings within the borders. Although drones may capture images, recognizing people in crowded spaces becomes challenging. Therefore, researchers and security agencies are engaged in developing an effective technology for the facial recognition of people in crowded places. According to an article published by Mantra Softech (India) Pvt. Ltd. in October 2021, the US military is working on facial recognition solutions through the “Advanced Tactical Facial Recognition at a Distance Technology” project at US Special Operations Command (SOCOM) and the “Intelligence Advanced Research Projects Activity (IARPA) Biometric Recognition and Identification” as a part of the Altitude and Range initiative. In addition, the US is engaged in bringing facial recognition technology into action to boost the efficiency of its military operations. In February 2023, RealNetworks, Inc., a provider of AI and computer vision-based products, signed a US$ 729,056 contract with US Air Force to deploy its facial recognition technology, SAFR, on small drones for special operations. Thus, the growing trend of using military drones integrated with facial recognition technology would trigger their demand in the coming years.

Military Drone Market Overview

The key stakeholders in the military drones market are raw material suppliers, component suppliers, military drones manufacturers & software integrators, and end users. Raw material suppliers play a major role in the military drones market. As the material sourcing and operations of the raw material suppliers were affected, the demand and supply gap increased among the raw material suppliers and component manufacturers. During the COVID-19 pandemic, the raw material suppliers have faced several supply chain challenges in procuring transportation services, difficulties in internal production operations due to several factors such as lack of manpower and other resources, along with several remote operational challenges. All these factors have increased the demand and supply gap between raw material suppliers and battery manufacturers across the globe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Drone Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Drone Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Military Drone Market Drivers and Opportunities

Surge in Global Defense Sector

According to the European Union (EU) data published in December 2022, defense sector spending in the EU reached US$ 242 billion (EUR 214 billion) in 2021, recording an increase of 6% compared to 2020. Such a rise in the defense sector contributes to the adoption of many technologies and weapons to strengthen the country’s defense and security. According to January 2023 updates from Ukraine's Defense Minister Oleksiy Reznikov, the country is planning to invest US$ 550 million in the procurement of drones in 2023. The government has signed 16 supply deals with Ukrainian drone manufacturers. Such factors have been pushing the growth of military drone market.

Use of Drones in Military Cargo Operations

A cargo air vehicle (CAV), used to carry different materials, is one of the latest drone technologies. Transportation of goods through drones has proven benefits compared to traditional ways of transportation, such as helicopters and airplanes. Cargo drones are cheaper and more versatile than the abovementioned air carriers, and they require less maintenance. They have elevated carrying power and need no direct human involvement. Cargo drones are used to carry lifesaving supplies at dangerous locations reducing risk to human life. Owing to such benefits, governments have started considering the procurement of such drones in several operations. In December 2022, the Indian Ministry of Defense issued a Request for Information (RFI) for the list of potential vendors to procure 570 Logistic Drones (LD) for the Indian Army (IA). The vendors will be finalized on the two versions of drones based on altitude standards—up to 12,000 feet and above 12,000 feet.

Military Drone Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Military Drone Market analysis are type, application, range, technology, and geography.

- Based on type, the Military Drone Market has been segmented into group 1, group 2, group 3, group 4, and group 5. The group 5 segment held a larger market share in 2023.

- By application, the market has been segmented into ISR, warfare, and others. The ISR segment held the largest share of the market in 2023.

- In terms of range, the market has been segregated into short range, medium range, and long range. The medium range segment dominated the market in 2023.

- By technology, the market has been segmented into fixed-wing and rotary wing. The fixed-wing segment held the largest share of the market in 2023.

Military Drone Market Share Analysis by Geography

The geographic scope of the Military Drone Market report is mainly divided into five regions: North America, Europe, Asia Pacific, and Rest of the World.

North America has dominated the Military Drone Market in 2023, and it is likely to retain its dominance during the forecast period as well. Many regional drone manufacturers are upgrading their existing kamikaze drones. Kamikaze drones are packed with explosives, and they help destroy the enemy. In March 2023, AeroVironment, Inc. launched the newest version of Switchblade 300 (a kamikaze drone), named Switchblade 300 Block 20, with new operational features such as a new tablet-based Fire Control System. In addition, it is a lightweight and precision-guarded drone that can be deployed in less than 2 minutes via tube launch, improving mission flexibility. These features boost the drone's performance and capability improvements, contributing to its demand.

Military Drone Market Regional Insights

The regional trends and factors influencing the Military Drone Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Military Drone Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Military Drone Market

Military Drone Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.93 Billion |

| Market Size by 2031 | US$ 27.63 Billion |

| Global CAGR (2023 - 2031) | 10.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

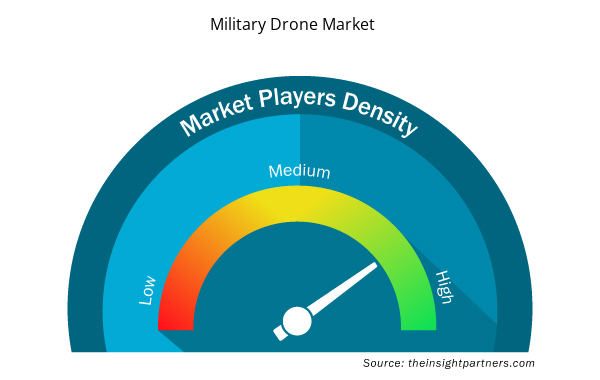

Military Drone Market Players Density: Understanding Its Impact on Business Dynamics

The Military Drone Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Military Drone Market are:

- Lockheed Martin Corp

- Northrop Grumman Corp

- Thales SA

- Boeing Co

- Elbit Systems Ltd

- General Atomics

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Military Drone Market top key players overview

Military Drone Market News and Recent Developments

The Military Drone Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for military drone market and strategies:

- In 2023, General Atomics and Hindustan Aeronautics Limited (HAL) jointly announced that turbo-propeller engines, which power GA-ASI’s state-of-art MQ-9B Remotely Piloted Aircraft System (RPAS), will be supported by the HAL Engine Division at Bengaluru for the Indian market. (Source: General Atomics, Press Release/Company Website/Newsletter)

- On February 2023, Aerovironment announced it was selected by the United States Army on Feb. 28, 2023, to move forward in the Future Tactical Unmanned Aircraft System FTUAS program. (Source: Aerovironment, Press Release/Company Website/Newsletter)

Military Drone Market Report Coverage and Deliverables

The “Military Drone Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Authentication and Brand Protection Market

- USB Device Market

- Asset Integrity Management Market

- Customer Care BPO Market

- Analog-to-Digital Converter Market

- Precast Concrete Market

- Dairy Flavors Market

- Latent TB Detection Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Hydrolyzed Collagen Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, Range, and Technology

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Canada, China, France, Germany, India, Italy, Japan, Mexico, Middle East & Africa, Russian Federation, South America, South Korea, United Kingdom, United States

Get Free Sample For

Get Free Sample For