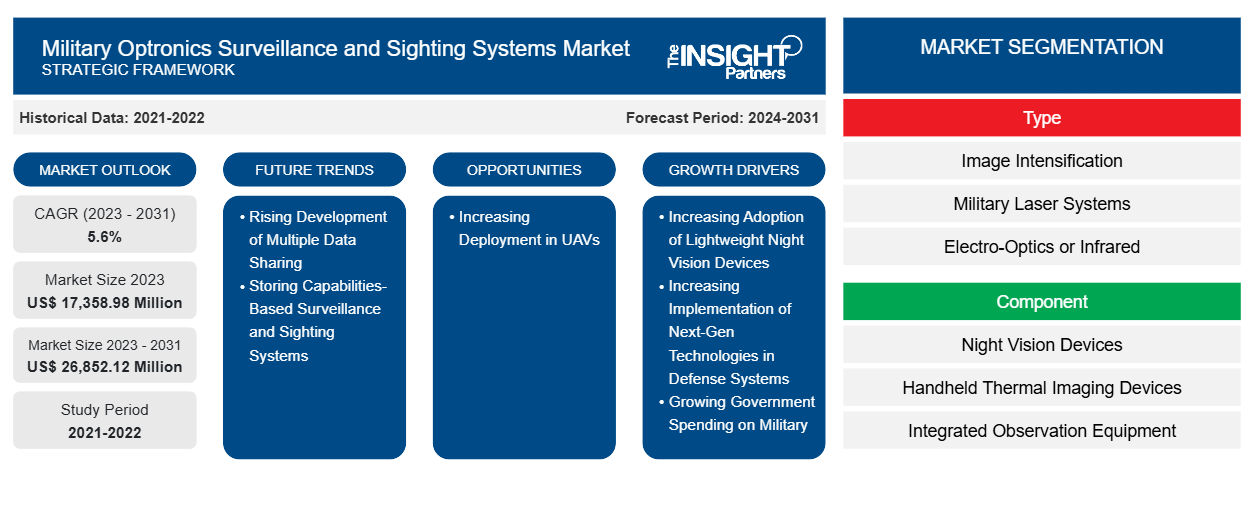

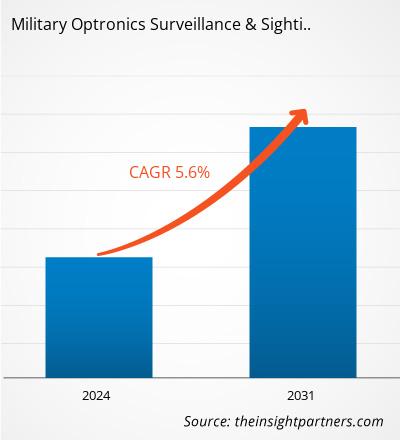

The military optronics surveillance and sighting systems market size is projected to reach US$ 26,852.12 million by 2031 from US$ 17,358.98 million in 2023. The market is expected to register a CAGR of 5.6% during 2023–2031. The rising development of multiple data sharing and storing capabilities-based surveillance and sighting systems is likely to bring new key trends in the market in the coming years.

Military Optronics Surveillance and Sighting Systems Market Analysis

With the increasing innovation and rising threat of terrorist attacks at night, the adoption of night vision devices is rising. Likewise, thermal imaging helps soldiers locate a target in poor visibility conditions. Thermal imaging night vision devices are gaining popularity across the globe to strengthen individual warfighter systems. Night vision devices provide soldiers with greater situational awareness by illuminating their surroundings during nighttime operations. Increasing government initiatives to develop and adopt advanced technologies-based lightweight night vision devices have created massive demand for the military optronics surveillance & sighting systems market growth. For instance, in January 2022, The Defence Advanced Research Projects Agency (DARPA) of the US Department of Defence selected 10 defense and university research teams for the development of lightweight night vision optics for military soldiers in America. The department designed the Enhanced Night Vision in Eyeglass Form (ENVision) program to adopt the new technology to develop night vision systems.

Increasing deployment of UAVs across the globe to protect lands from neighboring countries is expected to create ample opportunity for the optronics surveillance and sighting system market growth during the forecast period. For instance, in 2022, the Indian Army deployed the first batch of more than 25 Israeli-made UAVs named Searcher Mark II. . Moreover, in May 2024, The US government began delivering UAVs to its military as part of its government program to counter China's defense capabilities. Also, in March 2023, scientists in China developed a military drone that is capable of rapidly splitting into six separate units in midair. These drones are made with air separation technologies. Such increasing investment and deployment of UAVs by several countries' governments is expected to create ample opportunities for the optronics surveillance and sighting system market during the forecast period.

Military Optronics Surveillance and Sighting Systems Market Overview

Military optronics, surveillance, and sighting systems equip personnel with sufficient tools to identify, track, monitor, and engage threats in airborne, land, and naval warfare environments. These systems provide the armed force with precision detection, recognition, and identification of targets and situational awareness using an integration of high-performance optical components and advanced sensors. Additionally, the optronics, surveillance, and sighting systems find application in meeting the border control, base protection, reconnaissance, and intelligence gathering mission requirements. Technological advancements in optronics and surveillance systems, coupled with the ongoing demand for defense forces to upgrade their existing equipment and systems, are driving the global military optronics, surveillance, and sighting systems market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Optronics Surveillance and Sighting Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Optronics Surveillance and Sighting Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Military Optronics Surveillance and Sighting Systems Market Drivers and Opportunities

Increasing Adoption of Lightweight Night Vision Devices

With the increasing innovation and rising threat of terrorist attacks at night, the adoption of night vision devices is rising. Earlier, night vision devices used relatively heavier components, adding weight to a soldier. Various market players are now introducing lightweight night vision products. For example, ACTinBlack has developed a lightweight binocular night vision device with high optical performance and an ergonomic design. In October 2023, Thermoteknix Systems, a US-based thermal imaging and augmented reality (AR) company, launched a night-vision solution called the Fused Night Vision Goggle with advanced Augmented Reality (FNVG-AR). FNVG-AR system is a lightweight binocular night vision goggle (NVG) integrated with advanced technology-based next-generation 16 mm white phosphor night vision tubes and a high-resolution thermal imager.

Increasing Deployment in UAVs

Unmanned systems have become an integral part of military forces worldwide as they reduce the risk to human lives. Due to the various benefits offered by unmanned aerial vehicles (UAVs), many countries, such as the US, India, and China, have allocated substantial budgets to deploy more UAVs in their military forces, primarily for surveillance applications. Deploying optronics surveillance and sighting systems on unmanned platforms facilitates the transmission of surveillance and imagery data. The integration of unmanned systems with communication antennas and other surveillance equipment assists in various critical missions. Therefore, the increasing deployment of UAVs for airborne and naval surveillance and mapping missions is resulting in a growing need for optronics surveillance and sighting systems that can be effectively integrated within the UAV platform without hampering its overall efficiency. Thus, several major industry players, including Rafael Advanced Defense Systems Ltd. and Lockheed Martin, in the military optronics surveillance and sighting system market emphasize developing and offering optronics surveillance and sighting systems for UAV platforms.

Military Optronics Surveillance and Sighting Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the military optronics surveillance and sighting systems market analysis are type, component, and end users.

- Based on type, the military optronics surveillance and sighting systems market is classified into image intensification, military laser systems, and electro-optics/infrared. The electro-optics segment held the largest share of the market in 2023.

- By component, the market is categorized into night vision devices, handheld thermal imaging devices, integrated observation equipment, standalone infrared, seismic and acoustic sensors, and others. The seismic and acoustic sensors segment dominated the market in 2023.

- In terms of end users, the military optronics surveillance and sighting systems market is categorized into ground, airborne, and naval. The ground segment held the largest share of the market in 2023.

Military Optronics Surveillance and Sighting Systems Market Share Analysis

The geographic scope of the military optronics surveillance and sighting systems market report offers a detailed global analysis. North America, Europe, and Asia Pacific are major regions witnessing significant growth in the Military Optronics Surveillance and Sighting Systems Market. The military optronics surveillance & sighting systems market in North America is further segmented into the US, Canada, and Mexico. In 2023, the US dominated the military optronics surveillance & sighting systems market in North America with a significant market share in 2023, followed by Canada and Mexico. These developed economies spend a considerable portion of their GDP on military expenditure. As per the World Bank collection of development indicators, which are compiled from officially recognized sources, military expenditure in the US was reported to be ~3.5% of its GDP in 2023. Also, in the fiscal year 2023, the US government spent US$ 820 billion on the national defense sector, according to the US Federal Department of Budget. The amount was estimated to be 13% of the US federal spending. Major players in the market are developing advanced technologies based on airborne optronics surveillance systems, advanced digital thermal imaging cameras, track & search systems, and others. For instance, the US-based Obsidian Sensors Inc. launched a new technology in 2023 that processes thermal imaging using affordable high-resolution sensors.

Military Optronics Surveillance and Sighting Systems Market Regional Insights

The regional trends and factors influencing the Military Optronics Surveillance and Sighting Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Military Optronics Surveillance and Sighting Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Military Optronics Surveillance and Sighting Systems Market

Military Optronics Surveillance and Sighting Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 17,358.98 Million |

| Market Size by 2031 | US$ 26,852.12 Million |

| Global CAGR (2023 - 2031) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

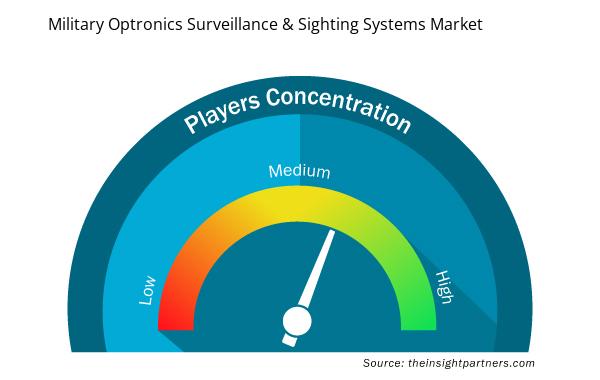

Military Optronics Surveillance and Sighting Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Military Optronics Surveillance and Sighting Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Military Optronics Surveillance and Sighting Systems Market are:

- Airbus

- Lockheed Martin Corporation

- Thales Group

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Israel Aerospace Industries

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Military Optronics Surveillance and Sighting Systems Market top key players overview

Military Optronics Surveillance and Sighting Systems Market News and Recent Developments

The military optronics surveillance and sighting systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the military optronics surveillance and sighting systems market are listed below:

- Sensor specialist HENSOLDT is supplying an unspecified number of state-of-the-art optical vision systems for the PUMA infantry fighting vehicle. Customers are the system houses KNDS and Rheinmetall, which produce the PUMA infantry fighting vehicle and distribute it through the jointly founded PSM GmbH. The order value is in the double-digit million range. In addition to vision systems for turrets of infantry fighting vehicles, the order includes the equipment for twelve turret trainers for training vehicle crews. With this delivery, HENSOLDT is helping to improve the PUMA on the K-Stand S1. (Source: HENSOLDT, Press Release, June 2024)

- French forces have received the first 300 Thales night vision goggles ordered by the French Defence Procurement Agency (DGA) in 2020 as part of the Bi-NYX contract. The 300 goggles delivered to the DGA are the first batch of an order for 2,000 sets placed in December 2023. The remaining 1,700 will ship by the end of this year. (Source: Thales, Press Release, October 2024)

Military Optronics Surveillance and Sighting Systems Market Report Coverage and Deliverables

The "Military Optronics Surveillance and Sighting Systems Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering:

- Military optronics surveillance and sighting systems market size and forecast at country levels for all key market segments covered under the scope

- Military optronics surveillance and sighting systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Military optronics surveillance and sighting systems market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the military optronics surveillance and sighting systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Device Type, and Platform

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Lockheed Martin Corporation, Thales Group, General Dynamics Corporation, L3Harris Technologies Inc., Israel Aerospace Industries, Leidos inc., Rafael Advanced Defense Systems Ltd., Raytheon Company, Safran S.A are the leading players operating in the global military optronics surveillance and sighting systems market.

The estimated value of the global military optronics surveillance and sighting systems market by 2031 is US$ 26,852.12 million.

The North America dominated the global military optronics surveillance and sighting systems market in 2023.

Government bodies of several countries are investing heavily to improve their surveillance and sighting systems to protect their land is one of the factors that is driving the demand of the military optronics surveillance and sighting systems.

Rising demand for advanced technology-based optronics to facilitate better decision-making on the battlefield is expected to spur the demand for optronics surveillance and sighting systems in the near future. The rising demand for various products, such as cameras with multiple data sharing and storage facilities, will drive market growth.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Military Optronics Surveillance and Sighting Systems Market

- Airbus

- Lockheed Martin Corporation

- Thales Group

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Israel Aerospace Industries

- Leidos inc.

- Rafael Advanced Defense Systems Ltd.

- Raytheon Company

- Safran S.A.

Get Free Sample For

Get Free Sample For