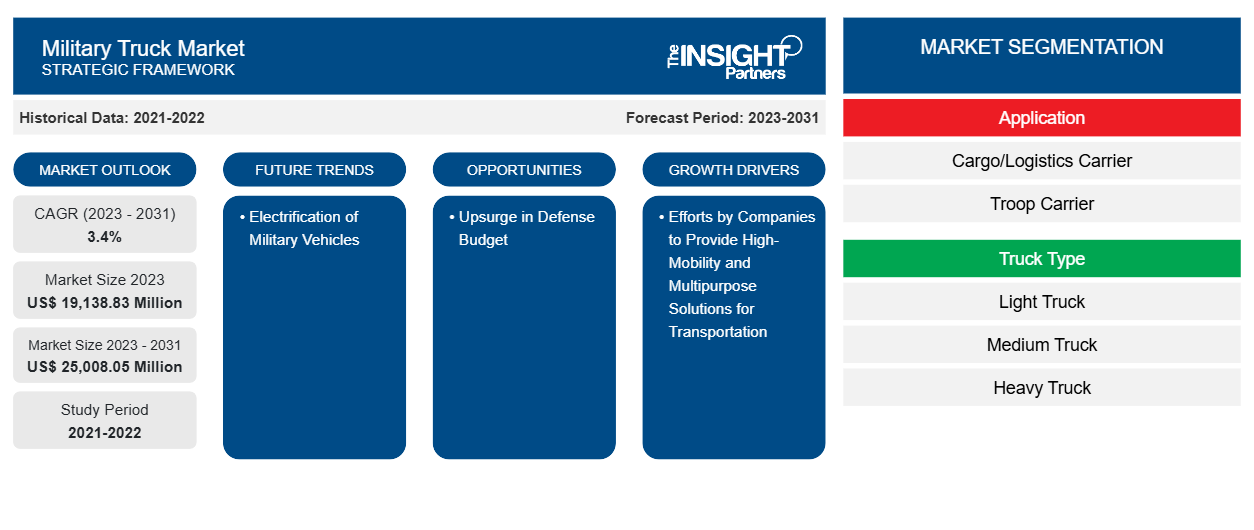

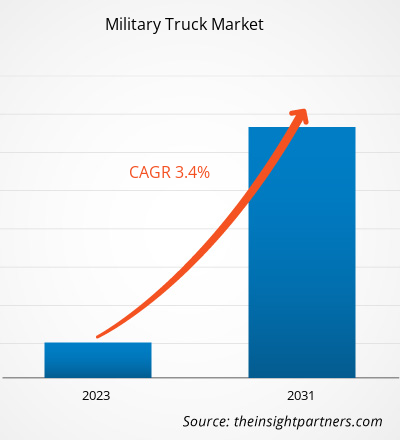

The military truck market size is projected to reach US$ 25,008.05 million by 2031 from US$ 19,138.83 million in 2023. The market is expected to register a CAGR of 3.4% in 2023–2031. Governments of various countries are working on expanding their military troops to enhance their capabilities. In January 2021, the government of China announced that it would start conducting recruitment drives twice a year from 2021 onward. This proposal was approved by the State Council and the Central Military Commission. The first phase of recruitment will take place from February to March, and the second phase will take place from August to September. Similarly, the Indian government is also working on expanding its military troops to protect its borders from China and Pakistan's invasion. Thus, such growing recruitments in the military forces indicate the need for military trucks to transfer troops, fuel, and equipment along asphalted roads and unpaved dirt roads, thereby driving the growth of the military truck market.

Military Truck Market Analysis

Using the fueled military vehicle can be expensive for the armed forces. The US military has been one of the largest consumers of petroleum, using ~4.2 billion gallons of fuel each year. The Defense Logistics Agencies had to spend over US$ 9 billion on fuel in 2019. Thus, to lessen the spending on fuel, the US Army is leading the way and investing in pilot programs for electric and hybrid vehicles. The new Climate Strategy by the US Army has set a 2027 target to deploy an all-electric, light-duty, nontactical fleet. In addition, they have also set a 2035 target for the deployment of a full all-electric nontactical fleet and hybrid tactical vehicles.

Military Truck Market Overview

Military and defense sectors are heavily investing in advanced technologies to strengthen their capabilities with advanced war machineries and transportation equipment. The countries such as Russia, US, France and others developing advanced military truck for global market. Military trucks manufacturers such as Volvo Defense AB; Tata Motors Ltd; Rheinmetall AG; Oshkosh Corporation; and General Dynamics European Land Systems SLU are leading the market growth. Developing nations such as India, China, Indonesia and others are strengthening their military strength due to rising border clash with neighboring countries. The military trucks are important parts of the military transportation and demand is growing with rising military troops and equipment procurement. The huge investment from the governments and the technological developments from the truck manufacturer is augmenting the market growth. For instance, as per the Oshkosh company, the US Army released its draft requirements for the Common Tactical truck (CTT) in 2021 for the procurement of the 7,000 to 10,000 vehicles worth of US$ 5.1 billion. Such procurement from the governments for the ground vehicles is ultimately supporting the market growth and enhancing the product offering in the market. In addition, the US-based Oshkosh Defense is focusing more on such contract or requirement with the development of advanced propulsion system. For instance, the company has introduced the ProPulse Hybrid Diesel-Electric System for the HEMTT A3 and Medium Tactical Vehicles to improve fuel economy.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Truck Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Truck Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Military Truck Market Drivers and Opportunities

Efforts by Companies to Provide High-Mobility and Multipurpose Solutions for Transportation

Modern forces play various roles ranging from providing mission support in battlegrounds to carrying out logistical tasks in the homeland. Military trucks are also used to carry troops, staff, (mounted) weapons, supplies, evacuate wounded soldiers, etc. Furthermore, they are required to deploy military units at different locations to enhance national protection. Thus, the demand for military trucks is rising with the growing number of military missions as they are deployed to move military personnel, equipment, and goods, as well as to carry vehicles and weapons recovered from mission sites. Considering these needs, military truck manufacturers are continuously working on bringing advanced trucks to the market. In November 2019, ARQUUS introduced its new 8×8 carrier at the Forum Entreprise Défense. The new Arquus 8×8 carrier truck is equipped with an Automatic Traction Control (ATC) electronic power train management, providing optimum mobility on all types of terrain. It also helps troupes save on fuel consumption and confers protection against tire and axle wear. In May 2021, Rheinmetall AG launched the latest generation of its HX family of heavy-duty tactical trucks for military use. The truck is fully redesigned with new technologies and military-off-the-shelf (MOTS) products. It features an autonomous driving capability, which can serve as the basis for several artillery systems. Moreover, the truck offers improved protection, reliability and mobility, driving comfort, and digital interface architecture. Owing to these features, this truck can be used to carry out tactical and technical missions. Thus, efforts made by military truck manufacturers to provide high-mobility and multipurpose solutions for transportation boost the growth of the military truck market.

Upsurge in Defense Budget

Governments of various countries continuously focus on strengthening their military capabilities by spending more on the modernization of their operations. According to Global Firepower, the US, China, Russia, India, and Germany are the top 5 nations with the largest defense budget in 2023. In March 2023, the US Department of Defense proposed a request to provide US$ 842 billion to the Department of Defense (DoD) in the defense budget for the fiscal year 2024, which is higher by US$ 26 billion from FY 2023 and US$ 100 billion from FY 2022. Out of this, the US government has allotted US$ 13.9 billion for the modernization of combat equipment used by the US Army and Marine Corps, which include armored multipurpose vehicles, amphibious combat vehicles, and optionally manned fighting vehicles. In addition, US$ 271 million is allotted for the Army to modernize next-generation combat vehicles with silent watch and mobility features, increased operational duration, and more onboard electrical power.

In February 2023, the Government of India announced the allocation of a total budget of US$ 72.64 billion (INR 593,537.64 crore) to the Ministry of Defence, with an increase of 13.0% compared to the amount allocated in 2022. Out of this, capital allocations of US$ 19.9 billion (Rs 162,600 crore) are for the modernization and infrastructure development of defense services, which indicates a rise of 6.7% compared to 2022. Out of this total budget allotted to MoD, ~57% will be for Army. Furthermore, in 2023, the Indian Army received 23% of the total modernization funds among the defense services. Moreover, in March 2023, the government of China announced its official defense budget of ~US$ 224.8 billion for FY 2023, marking a 7.2% increase compared to 2022. According to the defense ministry of the country, the increased defense expenditure helps provide Chinese forces with better training and more advanced equipment. Thus, the growing defense expenditure by governments of different countries would create significant opportunities for the growth of the military truck market during the forecasted period.

Military Truck Market Report Segmentation Analysis

Key segments that contributed to the derivation of the military truck market analysis are application, vehicle type, propulsion type, and transmission type.

- Based on application, the military trucks market categorized into cargo/logistics carrier, and troop carrier. The troop carrier segment held a larger market share in 2023.

- Based on vehicle type, the military trucks market categorized into light truck, medium truck, and heavy truck. Furthermore, the increasing inclination towards heavy truck is accelerating segment growth at highest CAGR rate.

- Based on propulsion type, the military trucks market can be bifurcated into electric/hybrid and diesel. The electric/hybrid segment held a larger market share in 2023.

- Based on level of transmission type, the military trucks market categorized into automatic transmission and manual transmission. The automatic segment held a larger market share in 2023.

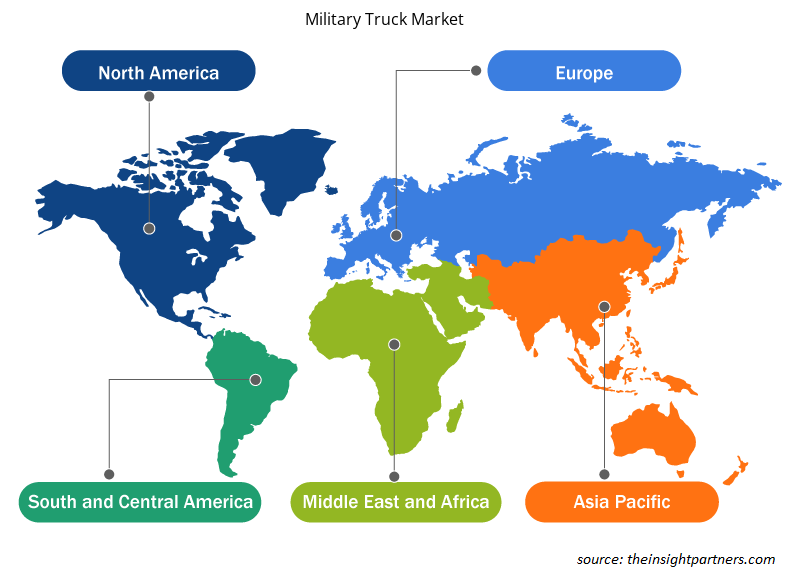

Military Truck Market Share Analysis by Geography

The military truck market has been segmented into five major regions—North America, Europe, APAC, MEA, and SAM.

According to the Global Firepower ranking, the US ranks 1st out of 145 countries in terms of military strength in 2023. The country is continuously investing in upgrading its military capabilities and adopting new technology. Along with the US, other North American countries are also investing in expanding the fleet of their military vehicles. For instance, in April 2020, the government of Canada received 1,587 trucks and 322 trailers from Mack Defense as the last part of the Medium Support Vehicle System (MSVS) Standard Military Pattern (SMP) program. These new trucks were procured to replace the trucks that were in service since the 1980s.

A large number of market players, including Arquus SAS, Rheinmetall AG, TATRA TRUCKS AS, General Dynamics European Land Systems SLU, AB Volvo, and Iveco Group NV, have presence in Europe. These market players are continuously working on advancing the military trucks based on the requirement of the armed forces of different countries. For instance, in January 2023, Rheinmetall AG, in collaboration with GM Defense, received the prototype contracts from the US Army. Thus, the increasing expansion efforts by military truck vendors in Europe favor the market growth in the region.

Military Truck Market Regional Insights

The regional trends and factors influencing the Military Truck Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Military Truck Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Military Truck Market

Military Truck Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 19,138.83 Million |

| Market Size by 2031 | US$ 25,008.05 Million |

| Global CAGR (2023 - 2031) | 3.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

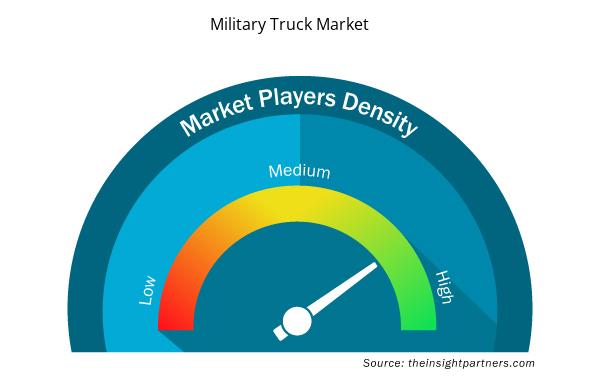

Military Truck Market Players Density: Understanding Its Impact on Business Dynamics

The Military Truck Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Military Truck Market are:

- Volvo Defense AB

- Tata Motors Ltd

- Rheinmetall AG

- Oshkosh Corporation

- General Dynamics European Land Systems SLU

- Iveco Group NV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Military Truck Market top key players overview

Military Truck Market News and Recent Developments

The military truck market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In February 2023, Tatra Trucks, the Czech-based truckmaker, exceeded its expected sales for 2022, with 1,326 vehicles produced and sold. It achieved sales of CZK7.12bn ($325.6m), up 10% on what was planned. Most of the production went to the domestic market, with less than half made for civilian sectors such as construction, mining and agriculture, as well as for fire and rescue customers. Tatra also produced vehicles for the defence sector, which slightly prevailed due to international security concerns and the needs of the Czech army. Tatra is planning a further increase in production for 2023. (Source: Tatra Trucks, Press Release)

- In November 2022, Oshkosh Corporation announced the acquisition of Hinowa S.p.A. This privately held international company produces track-based aerial work platforms, mini dumpers, lift trucks, and undercarriages. Hinowa is known for its advanced track designs and electrification expertise, making it an ideal addition to Oshkosh's Access Equipment segment. The acquisition is expected to accelerate Oshkosh's electrification capabilities and provide growth opportunities in core and adjacent markets. (Source: Oshkosh Corporation, Press Release)

Military Truck Market Report Coverage and Deliverables

The “Military Truck Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Military truck market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Military truck market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Military truck market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Military truck market landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, Truck Type, Propulsion Type, and Transmission Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For