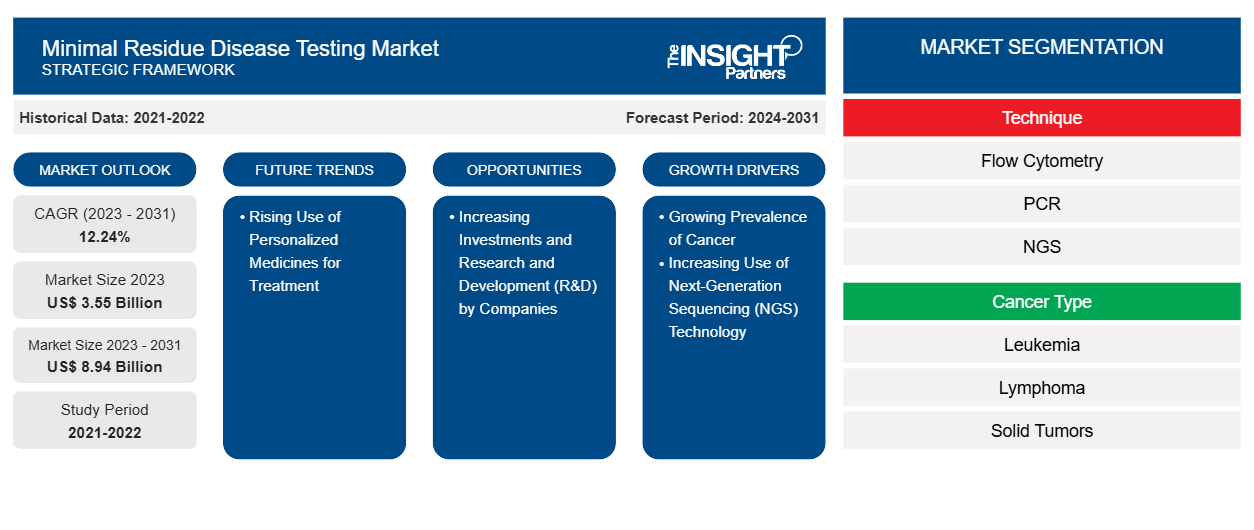

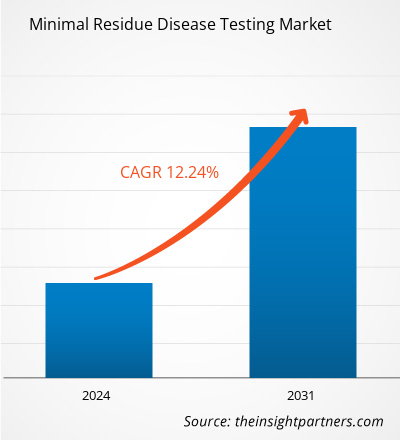

The minimal residue disease testing market size is projected to surge from US$ 3.55 billion in 2023 to US$ 8.94 billion by 2031; the market is estimated to record a CAGR of 12.24% during 2023–2031.

Analyst Perspective:

The report includes growth prospects owing to the current minimal residue disease testing market trends and their foreseeable impact during the forecast period. The increasing global prevalence of various cancers, such as leukemia, lymphoma, and solid tumors, and the demand for minimal residue disease testing products and services. Healthcare providers and researchers recognize the clinical utility of minimal residue disease assessment in monitoring treatment response, predicting relapse, and guiding therapeutic interventions. As minimal residue disease testing continues to evolve and emerge as a critical tool in cancer management, market players focus on innovation, standardization, and accessibility to capitalize on the lucrative opportunities in the minimal residue disease testing market.

Market Overview:

The inclusion of minimal residual disease testing in health coverage plans and the application of this testing approach in solid tumor diagnosis are the factors driving the minimal residual disease testing market. The demand for minimal residual disease testing has also increased with the surge in consumer awareness worldwide. Healthcare providers and researchers recognize this trend and strive to meet patient expectations by integrating minimal residual disease testing into clinical practice. Other key factors driving the minimal residue disease testing market growth include the rising prevalence of cancer and the increasing use of next-generation sequencing technology.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Minimal Residue Disease Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Minimal Residue Disease Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Growing Prevalence of Cancer Propels Market Growth

In 2020, the number of cancer cases reached 19.3 million, and the number of cancer-related deaths reached 9.96 million. As per the International Agency for Research on Cancer, the count of cancer cases is expected to reach 21.9 million by 2025 and 24.6 million by 2030. According to the February 2021 report by the American Society of Clinical Oncology, ~235,760 adults (119,100 men and 116,6600 women) in the US were diagnosed with lung cancer. GLOBOCAN 2020 data that India accounted for 18.3% of the total new cancer cases recorded in the world; moreover, cervical cancer accounts for 9.4% of all cancer cases. According to the American Cancer Society (ACS), nearly 26,560 new cases of stomach cancer were discovered in the US in 2021, 16,160 men and 10,400 women. Statistics released by the National Breast Cancer Foundation in July 2021, ~63% of breast cancer patients were diagnosed with local-stage breast cancer, 27% were diagnosed with regional-stage breast cancer, and 6% were diagnosed with distant (metastatic) disease. In addition, the increasing prevalence of blood cancer worldwide bolsters the demand for better treatment options and accuracy in removing residual cancer cells. As per the statistics published by the American Cancer Society, an estimated 34,920 new cases of multiple myeloma were diagnosed in the US in January 2022. Such an upsurge in the number of cancer cases is likely to compel governments to launch new cancer prevention programs, which is expected to drive the minimal residue disease testing market growth.

Segmental Analysis:

The minimal residue disease testing market analysis has been carried out by considering the following segments: technique, cancer type, and end use.

Based on technique, the minimal residue disease testing market is segmented into flow cytometry, PCR, NGS, and others. The flow cytometry segment held the largest market share in 2023. The PCR segment is estimated to register the highest CAGR of 12.39% during 2023–2031. The PCR method can detect cancer cells based on characteristic genetic abnormalities such as mutations or chromosomal changes. The technique necessarily involves the amplification of tiny DNA or RNA fragments to aid their detectability and countability. This allows identifying genetic abnormalities even by using samples (such as blood cells or bone marrow) containing a scarce number of cancer cells. The high sensitivity of PCR allows it to detect as low as one cancer cell out of 100,000 normal cells. Obtaining test results can take 5–14 days.

The market, based on cancer type, is divided into leukemia, lymphoma, solid tumors, and multiple myeloma. The solid tumors segment held the largest minimal residue disease testing market share in 2023. The market growth for this segment is attributed to ongoing research studies focused on evaluating patients with solid tumors. There are no accepted recommendations for employing MRD testing for the detection of non-hematologic malignancies. The approach involving circulating tumor DNA (ctDNA) as a prognostic biomarker for residual molecular disease diagnosis following solid tumor therapy is rapidly being incorporated into clinical trial design and translational research investigations. This approach is suitable for use in standard clinical care. Although ctDNA detection technologies have evolved rapidly, the low sensitivity of these detection methods reduces their usefulness in the detection of MRD in various clinical applications.

Based on end user, the minimal residue disease testing market is divided into hospitals, specialty clinics, diagnostic laboratories, and others. The hospitals segment held the largest minimal residue disease testing market share in 2022, and the same is anticipated to register the highest CAGR of 12.79% during 2023–2031. Hospitals hold a significant share of the market, which can be primarily attributed to their role in acute care and patient management. Hospital admissions are often necessary for patients suffering severe health conditions, as hospital facilities enable better decision-making capabilities, allowing doctors and healthcare professionals to analyze patients and offer them better treatment options.

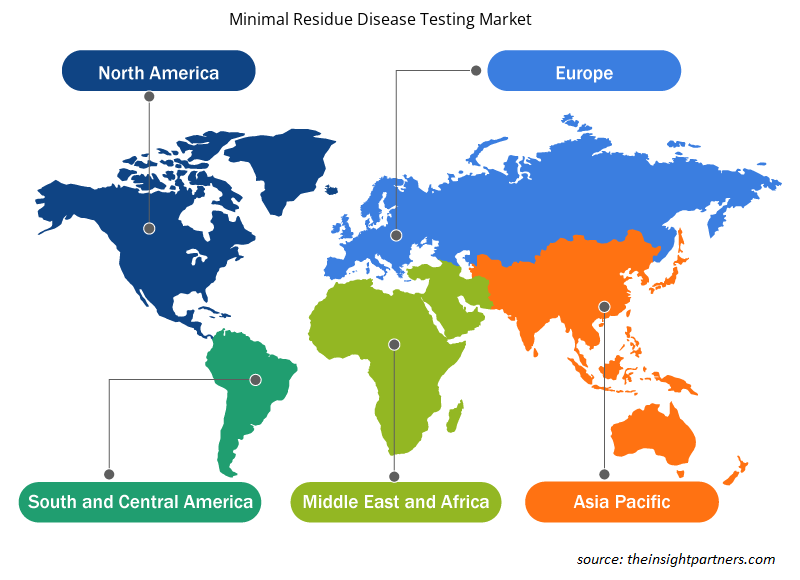

Regional Analysis:

The scope of the minimal residue disease testing market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 0.93 billion in 2023 and is projected to reach US$ 2.34 billion by 2031; it is expected to register a CAGR of 12.12% during 2023–2031. Significant increase in cancer incidence; the introduction of the latest technologies; and the established proteomics, genomics, and oncology research infrastructure solidify North America's position as a major contributor to the minimal residue disease testing market.

The Asia Pacific minimal residue disease testing market is expected to record the fastest CAGR of 12.68%. The region, especially with countries such as India and China, is home to a sizable pharmaceutical industry. In October 2021, Genetron Health (China) and Jiangsu Fosun (China) began commercializing MRD detection tests in China. They have also promoted Seq-MRD in hematology-focused hospitals and clinics in China in the past. This test offers accuracy, high throughput, cost-effectiveness, consistency, and fast turnaround times. Research is perceived as a primary focus area by major market players to develop novel tests. In addition to the increased focus on research, the surging need for monitoring cancer patients post-treatment continues to drive the minimal residue disease testing market progress in Asia Pacific. Additionally, improvements in healthcare infrastructure and the emerging pharmaceutical sector make Asia Pacific a key hub for the significant growth and development of the market.

Key Player Analysis:

Adaptive Biotechnologies; Natera; Bio-Rad Laboratories; F-Hoffmann La Roche Ltd; Guardant Health; LabCorp; Sysmex Corporation; ARUP Laboratories; Invivoscribe, Inc.; NeoGenomics Laboratories, Inc.; and Mission Bio, Inc are among the key players profiled in the minimal residue disease testing market report.

Minimal Residue Disease Testing Market Regional Insights

The regional trends and factors influencing the Minimal Residue Disease Testing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Minimal Residue Disease Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Minimal Residue Disease Testing Market

Minimal Residue Disease Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.55 Billion |

| Market Size by 2031 | US$ 8.94 Billion |

| Global CAGR (2023 - 2031) | 12.24% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technique

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

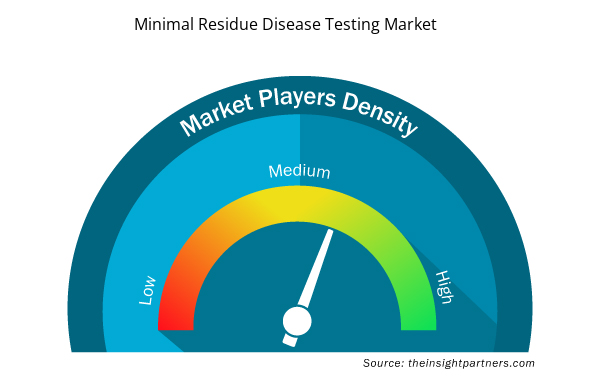

Minimal Residue Disease Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Minimal Residue Disease Testing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Minimal Residue Disease Testing Market are:

- Adaptive Biotechnologies,

- Natera,

- Bio-Rad Laboratories,

- F-Hoffmann La Roche Ltd,

- Guardant Health,

- LabCorp,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Minimal Residue Disease Testing Market top key players overview

Recent Developments:

Companies operating in the minimal residue disease testing market adopt mergers and acquisitions as key growth strategies. As per company press releases, a few recent market developments are listed below:

- In April 2023, Quest Diagnostics acquired Haystack Oncology to expand its oncology portfolio with the inclusion of advanced liquid biopsy technology. This addition allowed Quest to improve personalized cancer treatment by providing tools and other products with highly sensitive diagnostic capabilities.

- In April 2023, Integrated DNA Technologies launched the Archer FUSIONPlex Core Solid Tumor Panel. This breakthrough testing solution has been improved and refined to cover a broader range of single nucleotide variants (SNVs) and indel (i.e., insertion, deletion, or insertion and deletion of nucleotides) capabilities or aid cancer research.

- In December 2022, Adaptive Biotechnologies launched clonoSEQ for assessing minimal residual disease using circulating tumor DNA (ctDNA) in patients that have diffuse large B-cell lymphoma (DLBCL).

- In October 2022, Adaptive Biotechnologies and Epic Systems Corporation partnered for the integration of the clonoSEQ assay into Epic's comprehensive electronic medical record (EMR) system. The clonoSEQ assay was monitored and approved by the US Food and Drug Administration (FDA) to detect minimal residual disease associated with multiple myeloma (MM), chronic lymphocytic leukemia (CLL), and B-cell acute lymphoblastic leukemia (ALL).

- In August 2022, Roche launched its first Digital LightCycler System, which is designed to accurately quantify trace quantities of specific RNA and DNA.

- In February 2022, Personalis collaborated with Moores Cancer Center to support clinical diagnostic testing in patients with advanced solid tumors and hematologic malignancies. The collaboration focused on conducting studies for the detection of highly sensitive minimal residual disease and cancer recurrence using a newly introduced liquid biopsy assay.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technique, Cancer Type, End Use, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global minimal residual disease testing market, based on technique is divided into flow cytometry, PCR, NGS, and others. The flow cytometry segment held the largest market share in 2023, and the PCR segment is likely to register the highest CAGR of 12.39% during 2023–2031. Based on cancer type, the market is segmented into leukemia, lymphoma, solid tumors, and multiple myeloma. The solid tumors segment held the largest market share in 2023, and the same segment is estimated to grow at the fastest CAGR during 2023–2031. The lymphoma segment held the second largest market share in 2023. Based on end user, the market is segmented into hospitals, specialty clinics, diagnostic laboratories, and others. The hospitals segment held the largest minimal residue disease testing market share in 2022, and the same is anticipated to register the highest CAGR of 12.79% during 2023–2031.

The minimal residual disease testing market is expected to be valued at US$ 8.94 billion in 2031.

The minimal residual disease testing market was valued at US$ 3.55 billion in 2023.

The minimal residual disease testing market majorly consists of the players such as Adaptive Biotechnologies; Natera; Bio-Rad Laboratories; F-Hoffmann La Roche Ltd; Guardant Health; LabCorp; Sysmex Corporation; ARUP Laboratories; Invivoscribe, Inc.; NeoGenomics Laboratories, Inc.; and Mission Bio, Inc.

The factors driving the growth of the minimal residual disease testing market include the surging prevalence of cancer and the increasing use of next-generation sequencing technology.

Patients achieving complete hematologic remission after blood cancer treatment may foster residual cancer cells in the bone marrow or peripheral blood. These cells can result in relapse, as they persist at levels so low that they cannot be detected by conventional cytomorphology. Similar is the case with several other cancer conditions, including solid tumors and multiple myeloma. Minimal residual disease testing is employed to detect and quantify cancer cells existing in small numbers in a patient's body. This testing is performed by using sensitive technologies such as polymerase chain reaction (PCR), next-generation sequencing (NGS), and flow cytometry to identify measurable residual disease at the molecular level. Minimal residual disease testing is clinically important because it helps monitor response to treatment, predicts risk of relapse, guides personalized therapies, and serves as an endpoint in clinical trials.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Minimal Residual Disease Testing Market

- Adaptive Biotechnologies

- Natera

- Bio-Rad Laboratories

- F-Hoffmann La Roche Ltd

- Guardant Health

- LabCorp

- Sysmex Corporation

- ARUP Laboratories

- Invivoscribe, Inc.

- NeoGenomics Laboratories, Inc.

- Mission Bio, Inc.

Get Free Sample For

Get Free Sample For