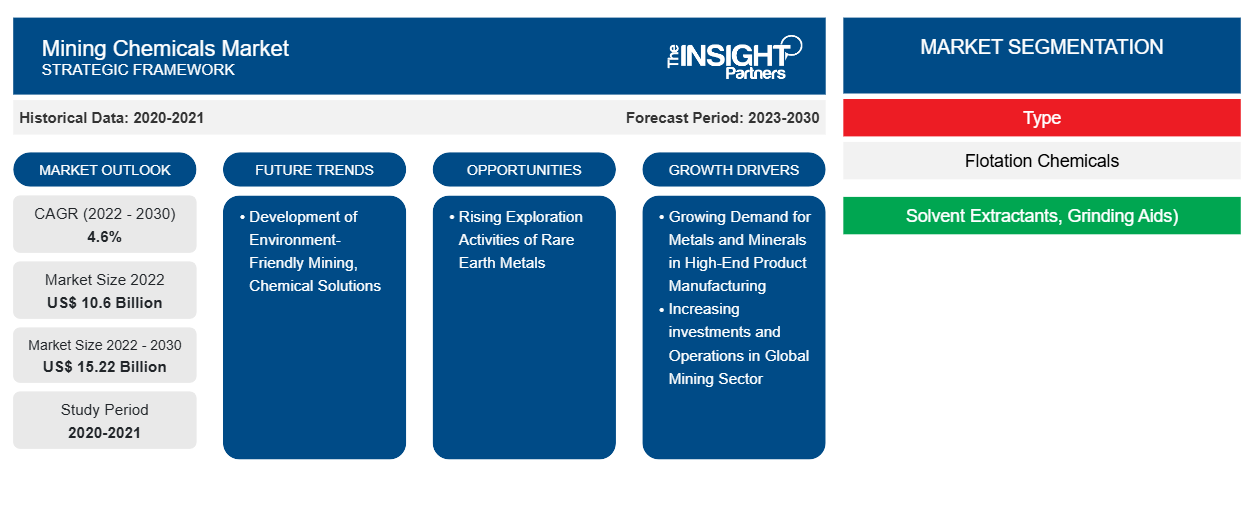

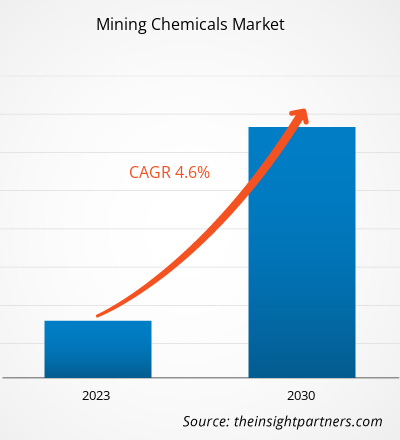

[Research Report] The market size is expected to grow from US$ 10.60 billion in 2022 to US$ 15.22 billion by 2030; it is estimated to register a CAGR of 4.6% from 2022 to 2030.

Market Insights and Analyst View:

The mining chemicals are used in applications such as mineral processing, wastewater treatment, and others. Different chemicals are used in the mining processes, depending on mineral and ore type. The mining chemicals are used in chemical processes to separate the desired mineral particles from the ore. They also help upgrade low mineral concentrations into pure metals. Different mining chemicals include flotation chemicals such as frothers, flocculants, depressants, collectors, and others; solvent extractants; grinding aids; and dust control or suppression chemicals. A few dust control or suppression chemicals used in the mining industry are calcium chloride, magnesium chloride, lignin sulfonate, asphalt emulsion, oil emulsion, and polymeric emulsion. Various benefits of mining chemicals, the strong growth of the mining industry, and the increase in demand for different metals and minerals drive the growth of the mining chemicals market.

Growth Drivers and Challenges:

Upsurging demand for metals and minerals in high-end product manufacturing drives the growth of the global mining chemicals market. The demand for metals, rare earth elements, and minerals in manufacturing high-end products is driven by advancements in the automotive, aerospace, and electronics industries. The higher demand for metals prompts increased mining activity to extract and produce the required raw materials, ultimately leading to extensive use of mining chemicals to access ore deposits, eliminate impurities, and fragment rocks. In addition, with the growing demand for metals, mining companies increasingly focus on improving safety measures and operational efficiency. This includes advancing mining explosive technologies and formulations that can optimize blasting operations. Precious metals such as gold and platinum are sought for their properties, such as conductivity in the electrical & electronics industry. In the automotive industry, sports and other high-end vehicles are manufactured using lightweight metals such as aluminum, titanium, and high-strength steel. The demand for aluminum has significantly increased in the past few years due to the rising production of lightweight materials for internal combustion engines and electric vehicles.

Stringent government regulations related to hazardous mining chemicals restrain the mining chemicals market growth. The mining industry operates in a complex web of national, regional, and local regulatory frameworks. Each jurisdiction may have its own set of laws, regulations, and guidelines related to mining operations, safety standards, environmental protection, and community engagement. Navigating these regulatory requirements can be time-consuming and resource-intensive for mining companies. In addition, obtaining permits for mining operations can be a lengthy and bureaucratic procedure in many countries. It is mandatory for mining companies to submit comprehensive applications, conduct environmental impact assessments, and fulfill specific criteria to secure necessary permits. Several governments have banned some hazardous chemicals, such as cyanide and sulfuric acid, from utilization in mining operations to mitigate adverse effects on human health and the environment.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mining Chemicals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mining Chemicals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Mining Chemicals Market" is segmented on the basis of type, mineral type, application, and geography. Based on type, the market is segmented into flotation chemicals, solvent extractants, grinding aids, and others. The market for the flotation chemicals segment is further segmented into frothers, flocculants, depressants, collectors, and others. By mineral type, the global mining chemicals market is segmented into base metals, non-metallic minerals, precious metals, and others. By application, the market is segmented into mineral processing, wastewater treatment, and others. By geography, the market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the mining chemicals market is segmented into flotation chemicals, solvent extractants, grinding aids, and others. The flotation chemicals segment held the largest market share in 2022, and the market for the segment is expected to grow significantly from 2022 to 2030. Flotation chemicals are mining chemicals used to adjust the floatability of minerals in the mineral froth flotation process. They can increase the difference in wettability between various minerals, thus achieving the separation of gangue minerals and useful minerals. Most of the minerals are hydrophilic. Therefore, it is necessary to artificially adjust the flotation behavior of ore for mineral separation. The concentrators can selectively increase the hydrophilic or hydrophobic nature of certain minerals by adding a flotation reagent. Further, grinding aids are also one of the major types in the market. The grinding aids are substances that result in increased grinding efficiency and reduced power consumption when added to the mill charge. Grinding aids help to reduce ore cohesion and adhesion throughout the grinding circuit, increasing throughput and eliminating production bottlenecks. As high-grade ore deposits are becoming depleted, mining companies are tapping into lower-quality ore. Accessing these ore bodies is often a complex and difficult process. Hence, advanced chemistries and more energies are needed to process and extract the most valuable elements of ore.

Regional Analysis:

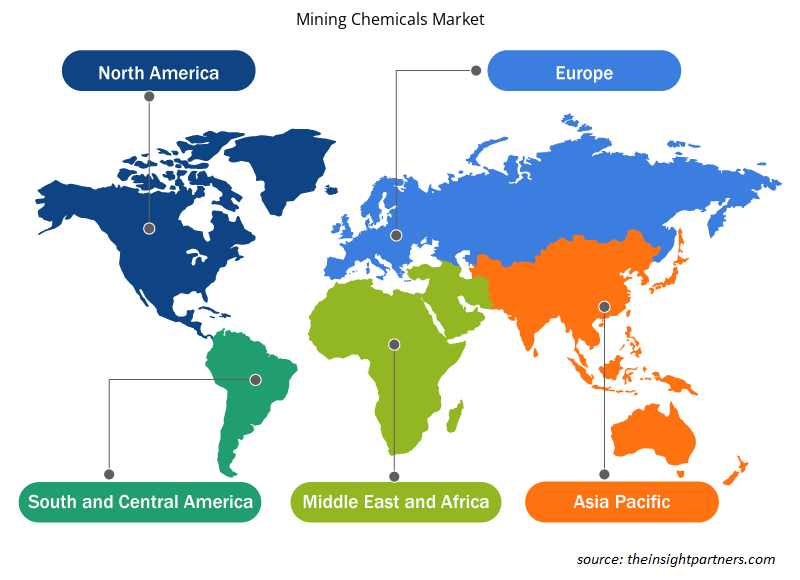

Based on geography, the mining chemicals market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global market, and the regional market accounted for ~ US$ 6.01 billion in 2022. Asia Pacific marks the presence of major mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, BHP, and others. The region has ten major surface mining projects—Green mine (China), Sangatta mine (Indonesia), Heidaigou mine (China), Oyu Tolgoi Copper-Gold mine (Mongolia), Gevra OC mine (India), Letpadaung Copper mine (Myanmar), Li mine (Thailand), FTB Project (Thailand), and Pasir mine (Indonesia). According to the report published by the US Geological Survey in 2022, China was the largest supplier of 25 non-fuel mineral commodities to several countries globally in 2021. Additionally, China is the producer of 16 critical minerals out of 25 listed minerals. The demand for mining chemicals is directly proportional to the mining operations and mineral exploration activities in the region. Therefore, growth in mining operations bolsters the demand for mining chemicals in Asia Pacific. Middle East & Africa is another major contributor holding more than 13% of global market share. The rise in mining production rates for minerals, metals, and nonmetals in the Middle East & Africa drives the demand for mining chemicals across the region. A report published by the Mineral Council South Africa in 2022 revealed that the value of mining production in South Africa grew from US$ 57.0 billion in 2021 to US$ 61.0 billion in 2022. The value of total sales generated from iron ore in South Africa accounted for US$ 5.4 billion in 2022, representing a rise of 47.3% compared to 2019.

Industry Developments and Future Opportunities:

The following are initiatives taken by the key players operating in the mining chemicals market:

- In October 2023, BASF SE mining solutions launched two new product brands—Luprofroth and Luproset—to complement its growing flotation portfolio. Luprofroth is for growing frothers, whereas Luproset is for flotation modifiers. These brands aim to communicate the company's flotation portfolio clearly and consistently, demonstrating its commitment to innovation and becoming a full solution provider for the mining industry.

- In October 2023, BASF SE and the Catholic University of the North partnered to enhance research, development, and innovation in mining, fostering collaboration between academia, students, and industry experts and establishing a technical service laboratory at UCN.

- In November 2022, BASF SE and Moleaer formed a strategic partnership to enhance copper recovery in the mining industry. The partnership will leverage BASF SE's LixTRA leaching aid and Moleaer's nanobubble technology, aiming to double global copper demand by 2035.

- In October 2023, Clariant's Oil and Mining Services opened a state-of-the-art Eagle Ford Technology, Sales & Operations Center in San Antonio, TX, focusing on North American oilfield services.

- In December 2021, Solvay expanded its Mount Pleasant facility in Tennessee due to increasing demand for its ACORGA and ACORGA OPT copper solvent extraction products. The copper market is expected to grow, particularly in the construction, infrastructure, manufacturing, and automotive segments.

- In December 2022, Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL) demerged its fertilizer and mining chemicals business in a move described as a strategic shift from commodity to specialty. The proposed corporate restructuring is expected to help create strong independent business platforms within the larger DFPCL brand umbrella.

- In December 2021, Solvay launched an exclusive digital knowledge hub, the Mining Chemicals Handbook, which provides 24/7 access to relevant mining chemical application information.

Mining Chemicals Market Regional Insights

Mining Chemicals Market Regional Insights

The regional trends and factors influencing the Mining Chemicals Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mining Chemicals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mining Chemicals Market

Mining Chemicals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10.6 Billion |

| Market Size by 2030 | US$ 15.22 Billion |

| Global CAGR (2022 - 2030) | 4.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Mining Chemicals Market Players Density: Understanding Its Impact on Business Dynamics

The Mining Chemicals Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mining Chemicals Market are:

- Orica Ltd

- Kemira Oyj

- BASF SE

- Clariant AG

- Dow Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mining Chemicals Market top key players overview

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units of companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. The negative impact of the pandemic on the growth of the mining industry reduced the demand for mining chemicals. Mining projects and mineral exploration activities were halted and delayed due to the pandemic initially, hindering the market for mining chemicals. During the pandemic, supply chain disruptions, raw material and labor shortages, and operational difficulties created demand and supply gaps, adversely affecting the market growth.

Various industries are coming on track after supply constraints affecting these industries are resolving gradually. Moreover, the rising demand for mining chemicals is substantially promoting the growth of the mining chemicals market.

Competitive Landscape and Key Companies:

Orica Ltd, Kemira Oyj, BASF SE, Clariant AG, Dow Inc, AECI Ltd, Nouryon Chemicals Holding BV, Betachem Pty Ltd, Solvay SA, and Arkema SA are among the players operating in the global mining chemicals market. Players operating in the global market focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansion, partnerships, and collaborations to stay competitive in the market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Mineral Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The major players operating in the global mining chemicals market are Orica Ltd, BASF SE, Clariant AG, Solvay SA, and Arkema SA among others.

Based on the type, the flotation chemicals segment accounted for the largest revenue share, as it is the most flexible, effective, and convenient chemicals for controlling the flotation process. Flotation chemicals are mining chemicals used to adjust the floatability of minerals in the mineral froth flotation process.

Based on mineral type, base metal segment is the fastest-growing segment. Copper, aluminum, lead, zinc, and nickel are a few base metals., The rising demand for different metals from various industries drives the need for mining chemicals for metal processing.

Asia Pacific mining chemicals market is expected to surge due to growing mining activities and presence of mineral reserves in the region. Asia Pacific marks the presence of major mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, BHP, and others. The demand for mining chemicals is directly proportional to the mining operations and mineral exploration activities in the region.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Mining Chemicals Market

- Orica Ltd

- Kemira Oyj

- BASF SE

- Clariant AG

- Dow Inc

- AECI Ltd

- Nouryon Chemicals Holding BV

- Betachem Pty Ltd

- Solvay SA

- Arkema SA

Get Free Sample For

Get Free Sample For