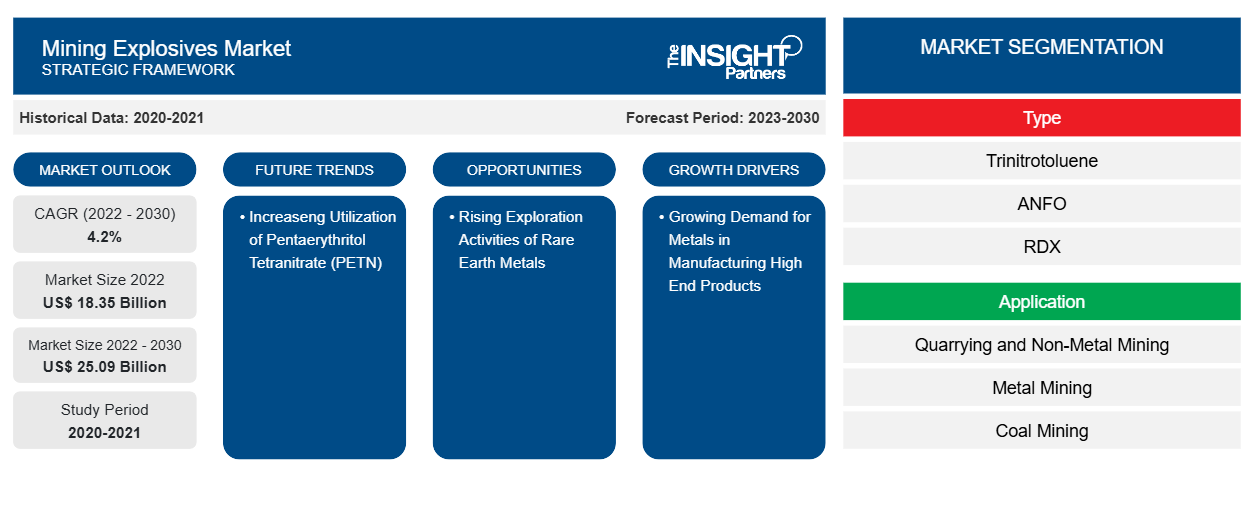

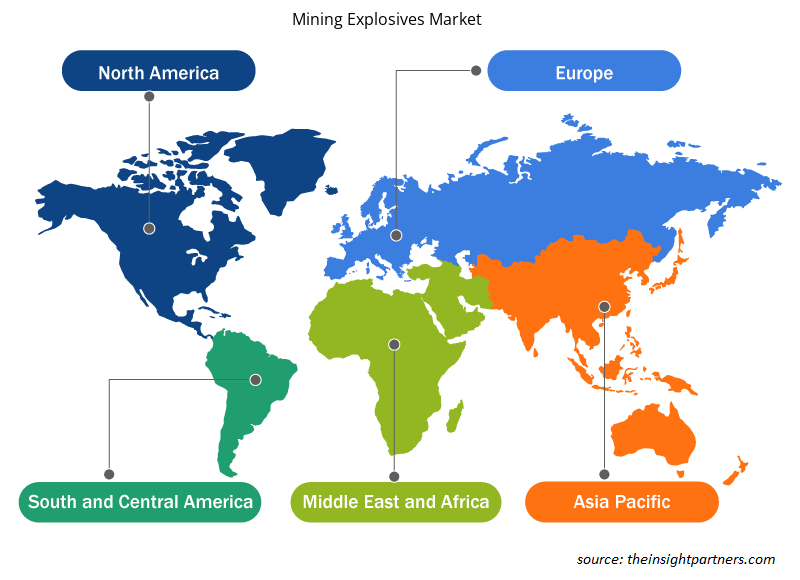

[Research Report] The mining explosives market size was valued at US$ 18,353.55 million in 2022 and is projected to reach US$ 25,092.62 million by 2030; it is expected to record a CAGR of 4.2% from 2023 to 2030.

MARKET ANALYSIS

Mining explosives are chemical compounds that react at high speed. The explosives utilized in mining are classified based on characteristics such as density, detonation velocity, explosive heat, mass strength, critical diameter, and water resistance. Explosives are produced with precise technology, high-quality raw materials, and a strong emphasis on carrying out mining operations safely. Ammonium nitrate fuel oil (ANFO) is one of the most widely used explosives in underground mining and surface hard rock quarrying operations. These explosives are highly used in the coal industry for mining and excavation.

GROWTH DRIVERS AND CHALLENGES

Manufacturing high-end products require a steady supply of raw materials such as metals and minerals. The higher demand for metals necessitates increased mining activity to extract and produce the required raw materials, ultimately leading to extensive use of mining explosives to access ore deposits, remove overburden, and fragment rocks. In addition, with the growing demand for metals, mining companies increasingly focus on improving safety measures and operational efficiency. This includes advancing mining explosive technologies and formulations that can optimize blasting operations. Mining explosives with better fragmentation capabilities, reduced vibrations, and improved safety features can help increase productivity and minimize environmental impacts. Automotive, aerospace, medical devices, electronics, defense & military, energy generation, building & construction, luxury goods, and several high-end product manufacturing industries utilize metals. In the automotive industry, luxury, sports, electronics, and other high-end vehicles are manufactured using lightweight yet strong metals such as aluminum, titanium, and high-strength steel. The growth of the high-end product manufacturing industries, such as aerospace and automotive industries, drives the demand for metals and subsequently bolsters the global mining explosives market. Further, mining operations are subject to stringent environmental and safety standards to minimize their impact on ecosystems, water resources, and communities. Compliance with these standards involves implementing mitigation measures, monitoring programs, and reporting requirements. Mining companies worldwide are required to ensure their operations meet these standards, which can involve high costs and operational adjustments. Thus, this factor may restrain the global mining explosives market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mining Explosives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mining Explosives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Mining Explosives Market Forecast to 2030" is a specialized and in-depth study with a major focus on the global mining explosives market trends and opportunities. The report aims to provide an overview of the market with detailed market segmentation based on type, application, and geography. The global mining explosives market has witnessed high growth over the recent past and is expected to continue this trend in the coming time. The report provides key statistics on the use of mining explosives worldwide and their demand in major regions and countries. In addition, it provides a qualitative assessment of various factors affecting the mining explosives market performance in major regions and countries. The report also includes a comprehensive analysis of the leading market players and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative mining explosives market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global mining explosives market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global mining explosives market is segmented based on type and application. Based on type, the market is segmented into trinitrotoluene (TNT), ANFO, RDX, pentaerythritol tetranitrate (PETN), and others. Based on application, the market is segmented into quarrying and non-metal mining, metal mining, and coal mining.

Based on type, the ANFO segment held a significant global mining explosives market share in 2022. ANFO comprises ~94% ammonium and 6% fuel oil by weight. By application, the coal mining segment led the global mining explosives market with the largest market share. Coal is the most abundant source of electricity in the world, and it generates more than 36% of global electricity. The coal reserves are huge compared to reserves of other minerals. Coal mining is an essential source of electricity generation in many developing economies.

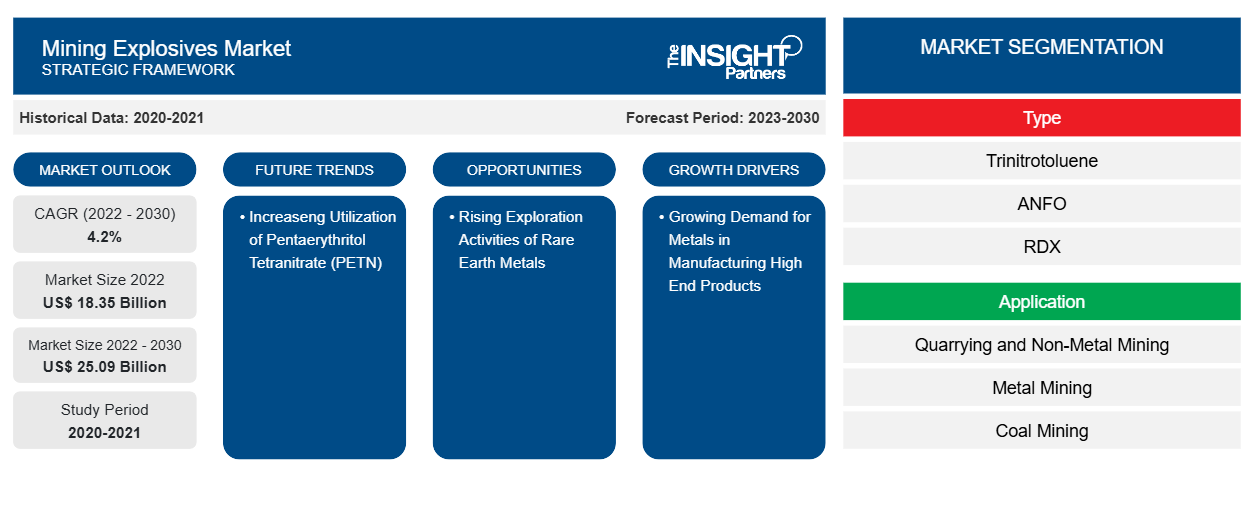

REGIONAL ANALYSIS

The report provides a detailed overview of the global mining explosives market with respect to five major regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South & Central America. Asia Pacific accounted for a large portion of the global mining explosives market share, and it was valued at ~US$ 13,500 million in 2022. Asia Pacific comprises several developing and developed economies, including China, India, Japan, Indonesia, and Australia. China, India, Indonesia, and Australia are among the major coal producers and rank in the list of top five coal-producing nations worldwide. Further, the mining explosives market in Asia Pacific reported constant demand due to increased metal mining and quarrying activities.

North America is expected to witness considerable growth and is anticipated to reach ~US$ 2,500 million in 2030. North America has a strong mining industry and several associations, including The American Exploration & Mining Association and the International Society of Explosives Engineers. In Europe, there has been a widespread use of explosives in mining activities. This is expected to create lucrative opportunities for the mining explosives market. The mining explosives market in Europe is likely to grow at a CAGR of around 3% from 2022 to 2030.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnerships, acquisitions, and new product launches are among the major strategies adopted by the players operating in the global mining explosives market.

In March 2023, Orica Ltd launched a 4D bulk explosives system, an advanced bulk system for underground, surface coal, and surface metal mining applications. The product offers a wide energy range to match varying rock properties and mine design requirements.

In March 2023, Omnia Holding Ltd's Bulk Mining Explosives signed a Conditional Sale and Purchase of Shares Agreement with PT Multi Nitrotama Kimia and formed a joint venture. The joint venture named PT Kemitraan MNK BME has integrated offering of explosives range for surface and underground mines.

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries across the globe. The crisis disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. These disruptions restricted the availability of mining explosives. It caused delays in production and increased costs, negatively impacting the overall supply of mining explosives. Many mining operations were temporarily halted or scaled back during the COVID-19 pandemic to comply with lockdown measures and ensure the safety of workers. Reduced mining activities resulted in lower demand for mining explosives. In addition, the pandemic impacted the global economy, leading to fluctuations in commodity prices and reduced demand for minerals and metals. As a result, mining companies were cautious about their investments, which influenced their demand for mining explosives.

The global marketplace is recovering from the losses as governments of different countries have announced relaxation in the restrictions. Mining activities are rebounding as countries gradually recover from the pandemic and vaccination efforts continue. Manufacturers are permitted to operate at full capacity to overcome the supply gap. Increased infrastructure investments and stimulus packages in many regions drive the demand for minerals and metals. Thus, the global mining explosives market is anticipated to grow strongly during 2022 to 2030.

Mining Explosives Market Regional Insights

Mining Explosives Market Regional Insights

The regional trends and factors influencing the Mining Explosives Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mining Explosives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mining Explosives Market

Mining Explosives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 18.35 Billion |

| Market Size by 2030 | US$ 25.09 Billion |

| Global CAGR (2022 - 2030) | 4.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Mining Explosives Market Players Density: Understanding Its Impact on Business Dynamics

The Mining Explosives Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mining Explosives Market are:

- Orica Limited

- Al Fajar Al Alamia Co SAOG

- Dyno Nobel

- China Poly Group Corporation

- NOF Corporation

- Hanwha Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mining Explosives Market top key players overview

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Orica Limited, Al Fajar Al Alamia Co SAOG, Dyno Nobel, China Poly Group Corporation, NOF Corporation, Hanwha Group, Anhui Jiangnan Chemical Co Ltd, Koryo Nobel Explosives, Solar Group, and Omnia Group Company are among the key players operating in the global mining explosives market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Mexico, Nigeria, Russian Federation, Saudi Arabia, South Africa, United Arab Emirates, United Kingdom, United States, Vietnam, Zimbabwe

Frequently Asked Questions

The major players operating in the global mining explosives market are Orica Limited, Al Fajar Al Alamia Co SAOG, Dyno Nobel, China Poly Group Corporation, NOF Corporation, Hanwha Group, Anhui Jiangnan Chemical Co Ltd, Koryo Nobel Explosives, Solar Group, and Omnia Group Company.

In 2022, Asia Pacific held the largest revenue share of the global mining explosives market. The mining explosives market growth in Australia, China, India, and Indonesia is attributed to growing mining industry in the region. The demand for mining explosives is directly proportional to the region's mining operations and mineral reserves. Therefore, the high number of potential metal and nonmetal reserves and a rise in mining operations across the region is expected to boost the demand for mining explosives during the forecast period.

The coal mining segment is estimated to register the fastest CAGR. The coal sector acts as a backbone for many emerging economies. Coal surface mines rely entirely on explosives to uncover mineral deposits.

The coal mining segment held the largest share of the market in 2022. Coal surface mines rely entirely on explosives to uncover mineral deposits. Blasting is considered an essential component for the successful extraction of coal resources from the deposits. A considerable quantity of explosives is deployed in coal mining, propelling the demand for mining explosives.

Asia Pacific is estimated to register the fastest CAGR in the global mining explosives market over the forecast period. Asia is home to leading mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, and BHP.

The ANFO segment held the largest market share. ANFO is the simplest commercial explosive and one of the most widely used explosives in the mining industry, despite other much more efficient emulsion explosives, due to its uncomplicated manufacturing technology and lower production costs than other explosives.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Mining Explosives Market

- Orica Limited

- Al Fajar Al Alamia Co SAOG

- Dyno Nobel

- China Poly Group Corporation

- NOF Corporation

- Hanwha Group

- Anhui Jiangnan Chemical Co Ltd

- Koryo Nobel Explosives

- Solar Group

- Omnia Group Company

Get Free Sample For

Get Free Sample For