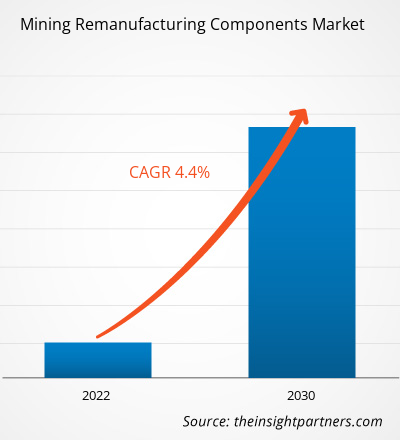

The mining remanufacturing components market was valued at US$ 4,204.56 million in 2022 and is projected to reach US$ 5,940.00 million by 2030; it is expected to register a CAGR of 4.40% from 2022 to 2030. The growing development in the mining sector is likely to remain a key trend in the market.

Mining Remanufacturing Components Market Analysis

The rising development in the mining sector and growing focus on reducing the overall lifecycle expenditure of mining equipment is projected to fuel the growth of the mining remanufacturing components market globally. The growing discoveries of new mining sites are also bolstering the demand for mining remanufacturing components worldwide. Quality issues related to remanufacturers parts or mining components might impede the growth of the mining remanufacturing components market. However, the implementation of additive manufacturing technologies in the mining sector is projected to drive market growth over the forecast period.

Mining Remanufacturing Components Market Overview

Mining is a capital-intensive sector. Expensive equipment, components, and devices are primarily integrated into the overall process. Mining companies are highly focused on increasing the lifecycle of components with periodic maintenance and remanufacturing processes to reduce the chances of system shutdown and process failure. Rising focus on technological advancement and growing emphasis on project convenience is driving the demand for mining remanufacturing components. Both dealers and dedicated remanufacturing specialists perform inspections of retrieved core components to assess whether they qualify for remanufacturing. This stage removes the need for waiting time that would otherwise be required if inspections were only performed at the core receiving facility. The high-value engineering and design step of the remanufacturing process entails the use of advanced additive manufacturing technology to restore components to original specifications and as-new condition. The dedicated remanufacturing section develops many of the technologies used during this phase. Reassembly comprises both remanufactured and new parts, as well as engineering improvements.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mining Remanufacturing Components Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mining Remanufacturing Components Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mining Remanufacturing Components Market Drivers and Opportunities

Growth in the Mining Industry in Developed Nations to Favor Market

The mining industry in the US consists of the exploration, extraction, beneficiation, and processing of naturally existing solid minerals from the earth. Coal, metals (such as iron and copper), and industrial minerals are examples of mined minerals. The US is a major producer and user of minerals and metals worldwide. Mined materials are crucial to consumer and industrial technology and define the general industrial expansion of the US. Apart from the US, China is another country where the mining industry has grown multifold in the past few years. Thus, continuous growth in the mining industry in developed nations such as the US and China. This growth in mining has directly affected the demand for equipment in the industry, such as wheel loaders and wheel dozers, ultimately driving the demand for mining remanufacturing components in developed nations.

Elevated Implementation of Electric and Autonomous Vehicles in Mining Industry

The mining sector are focusing on leveraging low-emission "driverless" mine vehicles which is a advancned move for decarbonization. Electric vehicles are combined with other fleets for leveraging both in the underground and open pit operations by procuring or revamping existing diesel engine vehicle fleets. Caterpillar company had displayed its first battery-powered vehicle prototype at the company's Tuscon, Arizona, in 2022. Furthermore, Caterpillar launched its EV mining truck with a 240-ton capacity in 2023. The mining manufacturing companies are projected to increase the adoption of electric trucks for operational convenience. The augmented demand for electric vehicles in the mining sector is expected to create high opportunities for the mining remanufacturing component market during the forecast period.

Mining Remanufacturing Components Market Report Segmentation Analysis

Key segments that contributed to the derivation of the mining remanufacturing components market analysis are component, equipment, and industry.

- Based on component, the mining remanufacturing components market is divided into engine, axle, transmission, hydraulic cylinder, and others. The engine segment held the largest share of the market in 2022.

- By equipment, the market is segmented into excavators, wheel loader, wheel dozer, crawler dozer, haul trucks, and others. The crawler dozer segment held the largest share of the market in 2022.

- In terms of industry, the market is bifurcated into coal, metal, and others. The metal segment held a significant share of the market in 2022.

Mining Remanufacturing Components Market Share Analysis by Geography

The geographic scope of the mining remanufacturing components market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is leading the market. China is one of the prominent countries in the mining remanufacturing components market in the Asia Pacific. The significant financial funding from the Chinese government for the development of the mining sector and focus on product innovation create opportunities for the mining remanufacturing components market. Industrialization and an increasing number of mining projects are acting as a major driver for the market.

Mining Remanufacturing Components Market Regional Insights

The regional trends and factors influencing the Mining Remanufacturing Components Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mining Remanufacturing Components Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mining Remanufacturing Components Market

Mining Remanufacturing Components Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,204.56 Million |

| Market Size by 2030 | US$ 5,940.00 Million |

| Global CAGR (2022 - 2030) | 4.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

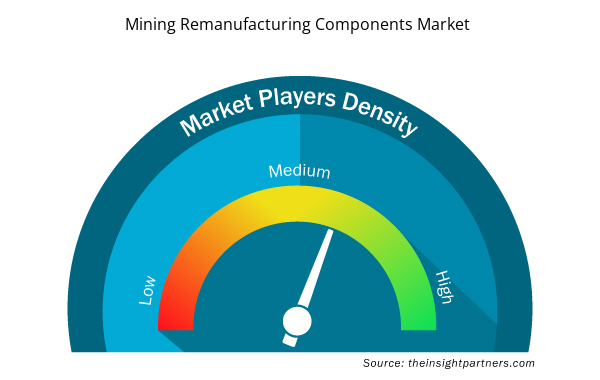

Mining Remanufacturing Components Market Players Density: Understanding Its Impact on Business Dynamics

The Mining Remanufacturing Components Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mining Remanufacturing Components Market are:

- AB Volvo

- Atlas Copco

- Caterpiller Inc

- Epiroc AB

- Hitachi Construction Machinery Co. Ltd.

- J C Komatsu Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mining Remanufacturing Components Market top key players overview

Mining Remanufacturing Components Market News and Recent Developments

The mining remanufacturing components market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Mining Remanufacturing Components market are listed below:

- SRC Holdings has completed its newest warehouse, occupied by SRC Logistics (SRCL), on North Mulroy Road in Springfield. The 413,000-square-foot facility, completed after 13 months of construction, is part of SRCL's plan to grow with current OEM partners and fulfill new business opportunities. The third expansion phase on North Mulroy Road follows the first in 2021. (Source: SRC Holdings, Press Release, May 2023)

- Komatsu Ltd. and Toyota are collaborating on a joint project to develop an Autonomous Light Vehicle (ALV) using Komatsu's Autonomous Haulage System (AHS). The aim is to enhance safety and productivity in mines by running autonomous haul trucks and automated ALVs. (Source: Komatsu Ltd, Press Release, May 2023)

Mining Remanufacturing Components Market Report Coverage and Deliverables

The “Mining Remanufacturing Components Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Mining remanufacturing components market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Mining remanufacturing components market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Mining remanufacturing components market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the mining remanufacturing components market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Equipment, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

4.8% is the expected CAGR of the mining remanufacturing components market.

US$ 6,256.31 million estimated value of the mining remanufacturing components market by 2031.

AB Volvo, Caterpiller Inc, Atlas Copco, Epiroc AB, Hitachi Construction Machinery Co. Ltd., J C Komatsu Ltd., Liebherr Group, Bamford Excavators Ltd., Swanson Industries, SRC Holding Corporation are some of the leading players in the market.

Implementation of additive manufacturing technology in the remanufacturing industry is the future trend of the mining remanufacturing components market

Asia Pacific dominated the mining remanufacturing components market in 2023.

Get Free Sample For

Get Free Sample For