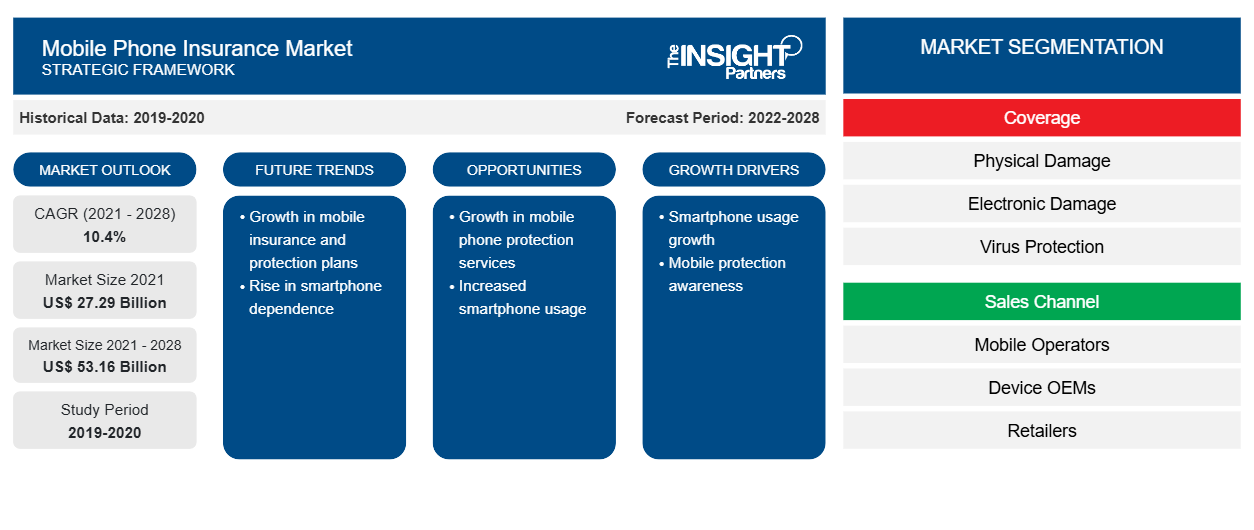

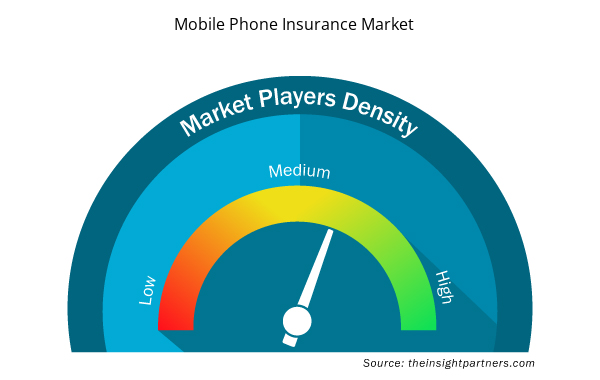

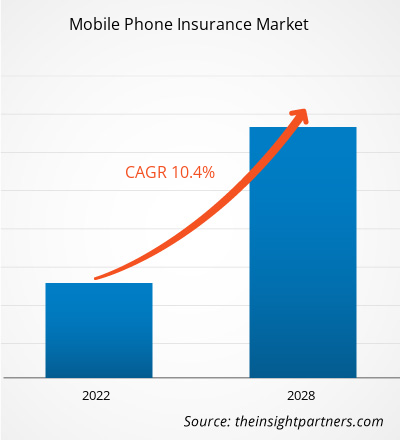

[Research Report] The mobile phone insurance market value is expected to grow from US$ 27,291.83 million in 2021 to US$ 53,161.84 million by 2028; the market is estimated to grow at a CAGR of 10.4% from 2022 to 2028.

Analyst Perspective:

Mobile phone insurance is a fast-growing market that offers coverage for lost, stolen, or damaged phones. The market is favorably competitive, with many companies providing different plans and coverage options to meet the diverse needs of consumers. The high cost of smartphones and the need for protection against damage or loss drive the growth of mobile phone insurance. These plans typically cover accidental damage, theft, and device loss. Some plans offer additional coverage for water damage, screen cracks, and other issues. The mobile phone insurance market is anticipated to grow as more people adopt smartphones and seek device protection. The trend of frequent smartphone upgrades is also expected to drive the market.

Market Overview:

Mobile phone insurance is a service contract that offers component and repair services for phones sold by retailers and service providers. It frequently offers further protection for phones against theft, intentional damage, unauthorized use, and e-wallet transactions. The expense and inconvenience of mechanical and electrical problems are also covered by mobile phone insurance. One of the main causes driving the growth of the mobile phone insurance market is the rise in accidental damage, phone theft, virus infection, and device malfunction. Another important element is the rise in the adoption of high-quality smartphones. Additionally, the market for mobile phone insurance is growing because of the high cost of replacing key components. A mobile phone insurance policy usually covers physical damage, internal coverage failure, theft and loss protection, and virus and data protection.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mobile Phone Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mobile Phone Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Surge in Adoption of High Quality smartphones to Drive Growth of Mobile Phone Insurance Market

The surge in the adoption of high-quality smartphones drives the mobile phone insurance market in several ways. Firstly, high-quality smartphones are expensive, and their repair or replacement costs can be significant. Therefore, consumers increasingly seek device protection through mobile phone insurance plans. These plans typically cover accidental damage, theft, and device loss. Secondly, high-quality smartphones are more advanced and have more features than their predecessors. This means they are more susceptible to damage from drops, water, and other accidents. Mobile phone insurance plans offer coverage for such damages, essential for consumers who want to protect their investments. Thirdly, the surge in the adoption of high-quality smartphones drives the mobile phone insurance market by increasing the demand for coverage against loss or theft. High-quality smartphones are attractive targets for thieves, and the risk of loss or theft is higher than for less expensive devices. Mobile phone insurance plans offer coverage against such risks, essential for consumers who want to protect their investments. Finally, the surge in the adoption of high-quality smartphones drives the mobile phone insurance market by increasing the need for coverage against breakdowns and malfunctions. High-quality smartphones are more complex than their predecessors and have more components that can fail. Mobile phone insurance plans can offer coverage against such risks, essential for consumers who want to protect their investments.

Segmental Analysis:

Based on coverage, the market has been segmented into physical damage, electronic damage, virus protection, and theft protection. The physical damage segment held the largest share of the market in 2020. Rising awareness about STDs and HIV has led to an increase in the usage of condoms globally. The physical damage segment is the most significant mobile phone insurance market, accounting for most of the market share. This is because smartphones are fragile and expensive devices that can easily be damaged, and many consumers are willing to pay for insurance coverage that protects their devices from physical damage. The growth of this segment is also due to the increasing adoption of smartphones worldwide and the popularity of high-end smartphones. The demand for insurance coverage that protects smartphones from accidental damage will remain strong in the coming years.

Regional Analysis:

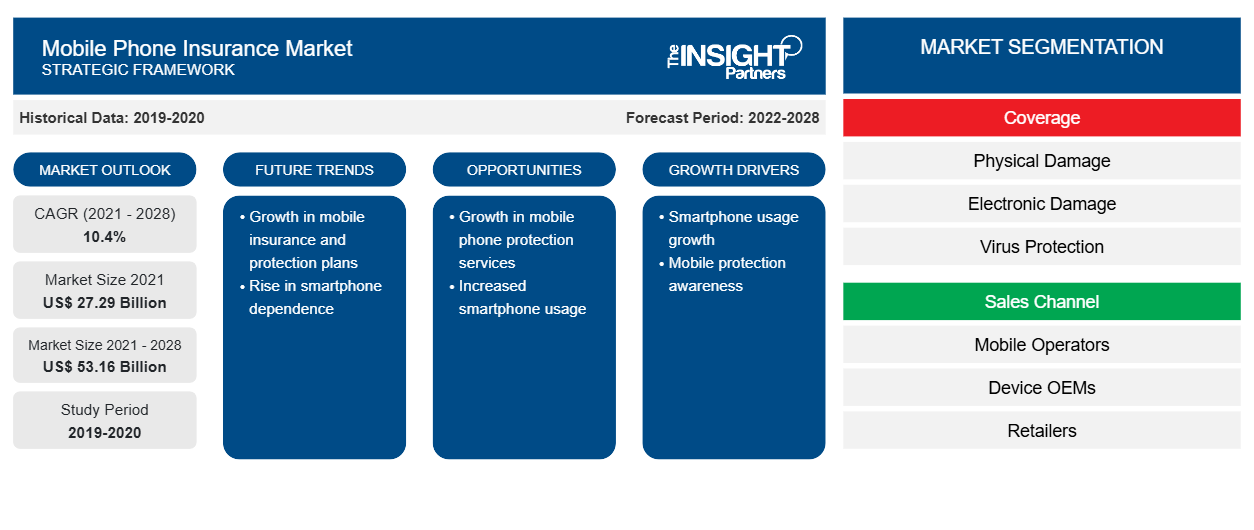

The Asia Pacific mobile phone insurance market was valued at US$ 5,407.60 million in 2021 and is projected to reach US$ 13,238.89 million by 2028; it is expected to grow at a CAGR of 14.0% during the forecast period. Due to several key factors, Asia is the fastest-growing region in the mobile phone insurance market. Firstly, the region is experiencing a rapid increase in smartphone penetration. As more and more people in Asia transition from basic mobile phones to smartphones, the potential customer base for mobile phone insurance expands significantly. This growing market of smartphone users creates a higher demand for insurance coverage to protect their valuable devices. Secondly, the rising middle class in Asia has increased disposable incomes and purchasing power. As a result, more individuals can afford to invest in smartphones, which are increasingly becoming an essential part of daily life. With smartphones' growing value and importance, consumers are recognizing the need to protect their devices against accidental damage, theft, or loss. This growing awareness of smartphone protection drives the region's demand for mobile phone insurance. Thirdly, advancements in e-commerce and digital payment systems have made it easier for consumers in Asia to access and purchase mobile phone insurance. Online platforms and mobile applications offer convenient and streamlined processes for obtaining insurance coverage, attracting a larger customer base.

Additionally, the availability of multiple payment options, including digital wallets and online banking, further facilitates the purchase of mobile phone insurance for consumers in Asia. Furthermore, the expanding network coverage and improving internet connectivity in the region have played a crucial role in driving the growth of mobile phone insurance. With improved connectivity, users rely more on smartphones for various activities such as communication, banking, shopping, and entertainment. This increased dependency on smartphones enhances the perceived value of insurance coverage, prompting more individuals to seek protection for their devices. Lastly, the growing trend of bundled insurance offerings by telecom operators and device manufacturers has contributed to the growth of the mobile phone insurance market in Asia. These bundled packages often combine mobile phone insurance with other services, such as extended warranties, data plans, or device upgrades. Such comprehensive offerings provide added convenience and value to customers, making mobile phone insurance attractive. These factors merged with the growing awareness and importance of smartphone protection, have contributed to Asia emerging as the fastest-growing region in the mobile phone insurance market.

Key Player Analysis:

The mobile phone insurance market analysis consists of the players such as Allianz; American International Group, Inc.; Apple Inc.; AT&T Inc.; Aviva; Gadget Cover; Pier Insurance Managed Services Ltd.; and Telefónica Limited. Among the players in the mobile phone insurance; Apple Inc. and AT&T Inc., Inc are the top two players owing to the diversified product portfolio offered.

Mobile Phone Insurance Market Regional Insights

Mobile Phone Insurance Market Regional Insights

The regional trends and factors influencing the Mobile Phone Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mobile Phone Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mobile Phone Insurance Market

Mobile Phone Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 27.29 Billion |

| Market Size by 2028 | US$ 53.16 Billion |

| Global CAGR (2021 - 2028) | 10.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Coverage

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Mobile Phone Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Mobile Phone Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mobile Phone Insurance Market are:

- American International Group, Inc.

- Allianz SE

- Apple Inc.

- AT&T Inc.

- Aviva insurance Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mobile Phone Insurance Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the mobile phone insurance market. A few recent key market developments are listed below:

- In October 2020, Bolttech announced its partnership with Samsung in Thailand. Through this partnership boltech provides mobile device repair services to owners of Samsung Galaxy smartphones and tablets through the Samsung Care+ programme.

- In October 2021, Assurant announced the acquisition of HYLA Mobile, a leading provider of mobile device trade-in and reuse solutions. This acquisition is expected to enhance Assurant's position in the mobile phone insurance ecosystem market by providing a more comprehensive suite of solutions to customers. HYLA Mobile's expertise in device trade-in and refurbishment will allow Assurant to offer more sustainable and cost-effective solutions to customers, while also reducing waste and supporting the circular economy.

- In March 2021, SquareTrade launched a new mobile phone insurance product that offers coverage for lost or stolen devices and the standard protection against accidental damage. The product, called "Lost and Stolen Protection," is available to both new and existing SquareTrade customers and provides up to $1,000 in coverage for lost or stolen devices. This move is aimed at addressing the growing concern among smartphone users about the risk of theft and loss and offers an additional layer of protection for customers.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Coverage, Sales Channel, Phone Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Portugal, Russian Federation, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The estimated market size for the mobile phone insurance market was US$27,291.83 million in 2021.

Surge in uptake of high-quality smartphone and increasing cases of accidental damage, phone theft, and gadget failure are the key factors driving the mobile phone insurance market over the forecast period.

Simplification of insurance claiming procedure and growing trend for insuring new phones are the key trending factors driving the market growth.

The incremental growth of the mobile phone insurance market is 10.4% during 2022 to 2028.

Canada and India are the prominent countries registered the highest growth rate of 15.5% and 19.4% respectively, during the forecast period.

The global market size for mobile phone insurance market will be US$ 53,161.84 million in 2028.

The key companies operating in the mobile phone insurance market that are profiled in the report include Allianz; American International Group, Inc.; Apple Inc.; AT&T Inc.; Aviva; Gadget Cover; Pier Insurance Managed Services Ltd.; and Telefónica Limited.

Asia Pacific region is the fastest growing region in the mobile phone insurance market.

Physical damage segment is holding larger market share during the forecast period.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies - Mobile Phone Insurance Market

- American International Group, Inc.

- Allianz SE

- Apple Inc.

- AT&T Inc.

- Aviva insurance Limited

- Better Buy Insurance

- Gadget Cover

- Insurance2go

- Telefónica Limited

- Pier Insurance Managed Services Ltd.

- AQILO Business Consulting GmbH.

- Square Trade Inc.

- Switched On Insurance

Get Free Sample For

Get Free Sample For