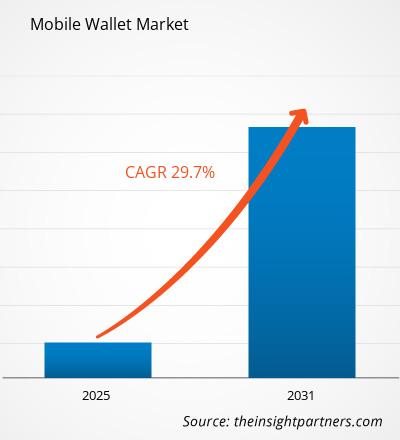

The Mobile Wallet Market is anticipated to expand at a CAGR of 29.7 % from 2025 to 2031.

The increasing adoption of digital transactions is creating a lucrative opportunity for market growth.

Mobile Wallet Market Analysis

Mobile wallets were predicted to incorporate biometric verification techniques like fingerprint, face, and even iris scanning more frequently in order to improve security and user experience. Because biometrics directly connects payment permission to each user's distinct bodily attributes, it provides an additional degree of protection. The Paris-based startup Dfns, which provides security solutions and infrastructure for cryptocurrency wallets, said in May 2023 that it will be integrating biometrics into its wallet-as-a-service offering. In addition to PIN codes, the new "Delegated Signing" functionality works with all major browsers and mobile operating systems. It leverages the WebAuthn protocol to offer authentication via native device biometrics like TouchlD and facial authentication. It is anticipated that mobile wallets will expand to include in-app purchases in addition to conventional online and offline transactions. With the help of this trend, customers may effortlessly finish purchases within mobile apps without having to go via other payment gateways. This is especially important for digital content providers, e-commerce sites, and app-based services. Thus, these factors mentioned above are essential for the Mobile Wallet Market growth.

Mobile Wallet Overview

- The ecosystem of online services and programs that let consumers use their mobile or other mobile devices to save, manage, and exchange money electronically is referred to as the mobile wallet. Compared to more conventional payment methods like cash, cheques, or actual credit/debit cards, mobile wallets provide a practical and safe substitute. They can be used by anyone at any retailer who accepts digital payments

- Consumer preference and usage of mobile wallets are on the rise as a result of the need for a quicker and more convenient method of transferring money. Users can easily make payments within other applications by integrating mobile wallets with other apps, such as those for ridesharing, online shopping, and food delivery services.

- With mobile wallets, customers can rapidly make payments in-store. They provide users with perks in addition to convenience and security. Users may store and use loyalty cards, membership cards, coupons, boarding passes, event tickets, and other stuff on their smartphones with digital wallets like Samsung, Apple, and Google.

Mobile Wallet Market Drivers and Opportunities

Increasing adoption of contactless payments

- The revenue of the market is anticipated to increase over the projected period due to the fast-increasing acceptance of contactless payments worldwide. Mobile wallet usage has increased dramatically in recent years as a result of consumers' need for speedy, secure, and touchless purchases in both real and virtual businesses. Due to customers' propensity to incorporate digital payment methods into their everyday lives, the tech-savvy culture is driving the robust expansion of the mobile wallet market. Thus, it is expected that the growing adoption of contactless payments will support market growth in the upcoming years. As a result, this is a key driver of the expansion of the Mobile Wallet Market growth.

Mobile Wallet Market Report Segmentation Analysis

- Based on technology, the proximity segment held the largest share of the mobile wallet market in 2023 and is predicted to remain in that position for the duration of the forecast. For authorization and transactions between entities that are typically physically adjacent to one another, a proximity wallet is utilized. The control or acceptance entity and the mobile wallet engage in proximity interaction. There are several other proximity-based payment options on the market today, including NFC, MST, UHF, and others. These are the top technologies driving the growth of the market. A user can quickly pay for goods and services at a physical point-of-sale terminal using proximity technology on their mobile or any other smart device.

Mobile Wallet Market Share Analysis By Geography

The scope of the Mobile Wallet Market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific (APAC) is experiencing rapid growth and is anticipated to hold a significant Mobile Wallet Market share. The region's significant economic development, growing population, and increasing focus on financial inclusion across diverse economies have contributed to this growth. Several factors have contributed to its domination, such as the Android operating system encouraging more people to use smartphones and the region's improving economic situation leading to higher disposable income, which in turn encourages greater needs and increases smartphone use.

Mobile Wallet Market Report Scope

The "Mobile Wallet Market Forecast" was carried out based on technology and applications. In terms of technology, the market is segmented into remote and proximity. Based on application, the mobile wallet market is segmented into Retail & E-commerce, Banking, Hospitality & Transportation. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Mobile Wallet Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Mobile Wallet Market. A few recent key market developments are listed below:

- In April 2023, Decentralized Finance (DeFi) exchange Uniswap launched a mobile wallet application to support on-the-go trading and promote wider DeFi wallet adoption. The Uniswap mobile wallet enables users to buy crypto, offering what the protocol says is a competitive 2.55% fiat on-ramp fee.

[Source: Decentralized Finance, Company Website]

- In October 2023, Samsung announced an investment in Skipify to expand its digital wallet.

[Source: Samsung, Company Website]

Mobile Wallet Market Report Coverage & Deliverables

The market report on “Mobile Wallet Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- A global and regional market analysis covering key Mobile Wallet Market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

Mobile Wallet Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Billion |

| Global CAGR (2025 - 2031) | 29.7 % |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Technological advancements are anticipated to play a significant role in the global mobile wallet market in the coming years.

The key players holding majority shares in the global mobile wallet market are Visa Inc., Apple Inc., Amazon Web Services Inc., Samsung, and Google Inc.

The global mobile wallet market is expected to grow at a CAGR of 29.7 % during the mobile wallet market forecast period 2024 - 2031.

Increasing adoption of contactless payments is the major factors that propel the global mobile wallet market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Visa Inc.

- Apple Inc.

- Alipay

- Amazon Web Services Inc.

- Samsung

- Google Inc.

- PayPal Holdings Inc.

- American Express

- Mastercard

- Airtel

- AT and T

Get Free Sample For

Get Free Sample For