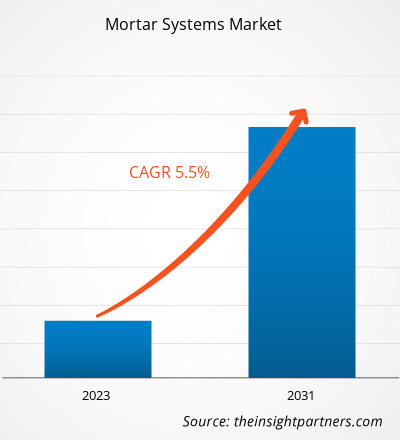

The mortar systems market size is projected to reach US$ 3.54 billion by 2031 from US$ 2.30 billion in 2023. The market is expected to register a CAGR of 5.5% during 2023–2031. Demand for self-propelled howitzers is likely to remain a key trend in the market.

Mortar Systems Market Analysis

The mortar systems market has witnessed tremendous growth in the past few years. One of the major factors driving the mortar systems market growth is the rising military expenditure for the procurement of warfare technologies across different regions. Another major factor driving the growth for mortar systems market includes the rising development of self-propelled artillery systems including mortar systems that are currently being utilized across the major countries war such as Russia-Ukraine, US-Iran, Israel-Palestine, China-Taiwan, etc. Moreover, the rising awareness to strengthen the armed forces of different countries is one of the major mortar systems market trends supporting the mortar system market growth across the world.

Mortar Systems Market Overview

The mortar systems market is likely to register a healthy growth in the coming years. However, the mortar systems market is moderately consolidated with the presence of limited number of players operating across different regions. Moreover, some of the countries have been pushing their military investments in terms of procuring vehicle mounted mortar systems for replacing their older fleet of mortars that is outdated and are operated with the higher side of the monetary sources.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mortar Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mortar Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mortar Systems Market Drivers and Opportunities

Rising Number of Contracts for Mortar Systems is Boosting the Mortar Systems Market Size

Manufacturers operating in the mortar systems market strongly focus on collaborating with different governments and armed forces to comprehend their respective demands and offer them suitable solutions. The military forces of various countries are providing numerous contracts to mortar systems manufacturers to procure different calibre of mortar systems. Moreover, the defense forces of different nations are investing substantially in procuring artillery systems such as rocket artillery, mortars, and howitzers. Artillery systems are reliable for taking down short, medium, and long-range targets. They enable armed forces to facilitate enhanced remote firing on ground or naval platforms.

The majority of the countries' armed forces have been investing heavily in the procurement of mortar systems. A few examples are mentioned below:

- In July 2023, the US Special Operations Command (USSOCOM) awarded a contract worth US$ 2 million to OKSI company for the supply of precision guidance kits for 81-millimeter mortar system rounds.

- In May 2023, Israel’s Elbit Systems Ltd won a contract worth US$ 21.8 million for the supply of mortar systems and training equipment to a Balkan Nation called Montenegro.

- In September 2022, the US army awarded an indefinite delivery/indefinite quantity (ID/IQ) contract with a maximum potential value of up to approximately US$ 49 million to Elbit Systems’ subsidiary in the North America region called Elbit Systems America LLC for the supply of 120mm mortar systems.

- In April 2023, the Swiss Federal Office of Armament (armasuisse) signed a contract with GDELS-Mowag worth of US$ 190 million for the production of a second tranche of 16 120 mm Mortar 16 systems. Under the contract, RUAG will supply its 120 mm Cobra recoiling mortar systems.

The growing number of contracts and deals to procure advanced military forces to combat the rise in ground warfare attacks is acting as a major growth factor for the mortar systems market size globally.

Rising Global Military Expsnditure

The rise in global military expenditure is one of the major factors likely to provide new opportunities for market vendors in the coming years. Majority of the countries have been pushing their respective military investments to procure different types of artillery systems market including mortar systems across different regions. For instance, according to the SIPRI data, the global military expenditure was around US$ 1981 billion, US$ 2047 billion, US$ 2070 billion, and US$ 2148 billion in the years 2019, 2020, 2021, and 2022 respectively. This shows a gradual increase in themilitary spending across different region which is further likely to drive the market for mortar systems in the coming years.

Mortar Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the mortar systems market analysis are calibre and type.

- Based on calibre, the mortar systems market report includes the segmentation such as small calibre, medium calibre, and large calibre. The medium calibre segment held a larger market share in 2022.

- Based on type, the mortar systems market is segmented into towed/hand-held and self-propelled. The self-propelled segment held a larger market share in 2022.

Mortar Systems Market Share Analysis by Geography

The geographic scope of the mortar systems market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2022 followed by Europe and Asia Pacific regions. Further, Asia Pacific is also likely to witness highest CAGR in the coming years. North America region some of the major mortar system manufacturers such as BAE Systems Plc, Raytheon Technologies Corporation, General Dynamics Ordnance and Tactical Systems, and Northrop Grumman Corporation that have their respective production facilities across different parts of the region and keeps generating new demand for mortar systems from their respective facilities. Such factor has been pushing the mortar systems market growth across the region. Further, the US accounted for the largest mortar systems market share in the North American market.

Mortar Systems Market Regional Insights

The regional trends and factors influencing the Mortar Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mortar Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mortar Systems Market

Mortar Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.30 Billion |

| Market Size by 2031 | US$ 3.54 Billion |

| Global CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Calibre

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

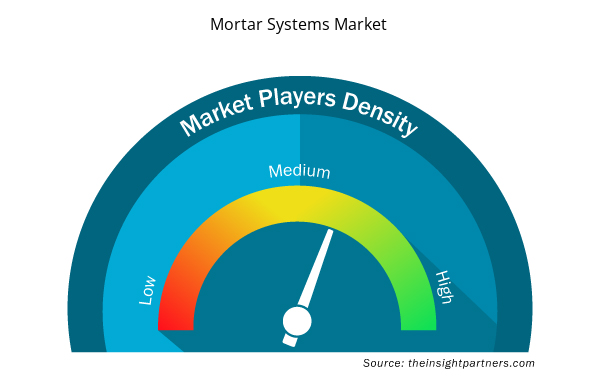

Mortar Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Mortar Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mortar Systems Market are:

- Hirtenberger Defence Systems

- General Dynamics Ordnance and Tactical Systems

- Thales

- Elbit Systems Ltd

- Rheinmetall AG

- Raytheon Technologies Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mortar Systems Market top key players overview

Mortar Systems Market News and Recent Developments

The mortar systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the mortar systems market are listed below:

- Elbit Systems Ltd. (NASDAQ: ESLT and TASE: ESLT) Elbit Systems announced today that it was awarded a contract worth approximately $53 million to supply the Crossbow Unmanned Turreted 120mm Soft Recoil Mortar Systems to General Dynamics European Land Systems (GDELS) for the installation on Pandur 6×6 APC wheeled armored vehicle for a European customer. The contract will be performed over a period of 6 years. (Source: Elbit Systems Ltd, Press Release, May 2024)

- BAE Systems has received a contract modification from the Swedish Defence Materiel Administration (FMV) to build 20 additional CV90 mortar vehicles. The approximately $30 million contract has been awarded to the BAE Systems Swedish joint venture HB Utveckling AB, which combines BAE Systems’ Hägglunds and Bofors manufacturing capabilities. Production will be performed at BAE Systems Hägglunds in Örnsköldsvik, Sweden. (Source: BAE Systems Plc, Press Release, Jan 2023)

Mortar Systems Market Report Coverage and Deliverables

The “Mortar Systems Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Mortar systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Mortar systems market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Mortar systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the mortar systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Collagen Peptides Market

- Electronic Signature Software Market

- Sports Technology Market

- Sleep Apnea Diagnostics Market

- Retinal Imaging Devices Market

- Greens Powder Market

- Lymphedema Treatment Market

- Human Microbiome Market

- Biopharmaceutical Contract Manufacturing Market

- Saudi Arabia Drywall Panels Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Caliber, and Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America region dominated the mortar systems market in 2023.

Surge in global military expenditure and rising number of contracts for mortar systems are some of the factors driving the growth for mortar systems market.

Hirtenberger Defence Systems, General Dynamics Ordnance and Tactical Systems, Thales, Elbit Systems Ltd, Rheinmetall AG, Raytheon Technologies Corporation, RUAG Group, Northrop Grumman Corporation, ST Engineering, and Arquus are some of the key players profiled under the report.

The mortar systems market is likely to register of 5.5% during 2023-2031.

The estimated value of the mortar systems market by 2031 would be around US$ 3.54 billion.

Demand for self-propelled mortar systems is one of the major trends of the market.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Mortar Systems Market

- Hirtenberger Defence Systems

- General Dynamics Ordnance and Tactical Systems

- Thales

- Elbit Systems Ltd

- Rheinmetall AG

- Raytheon Technologies Corporation

- RUAG Group

- Northrop Grumman Corporation

- ST Engineering

- Arquus

Get Free Sample For

Get Free Sample For