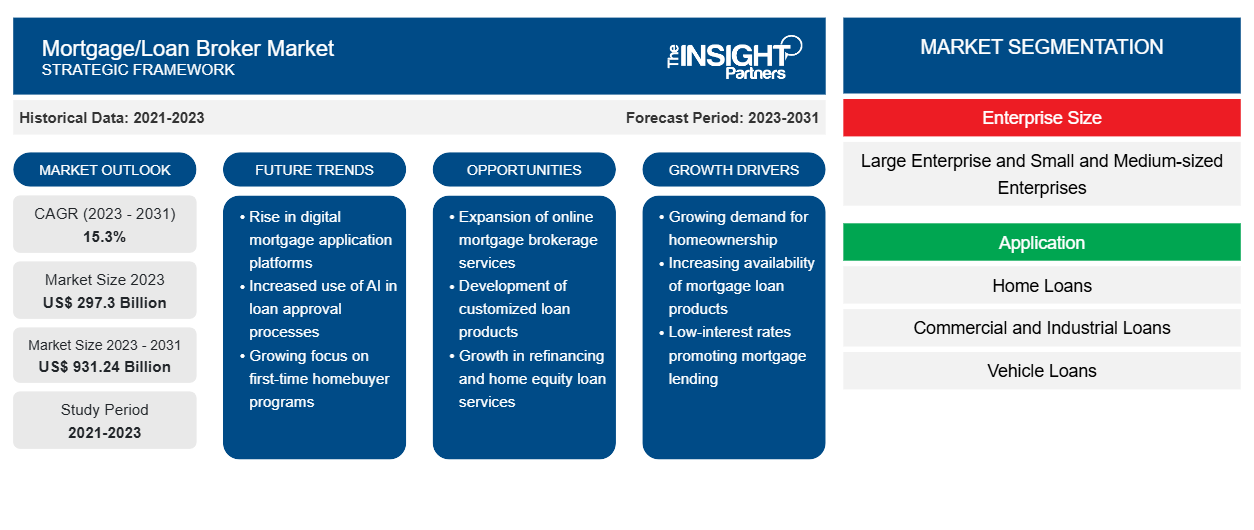

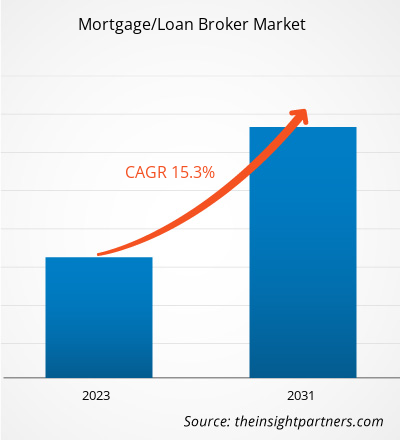

The mortgage/loan broker market size is expected to grow from US$ 297.3 billion in 2023 to US$ 931.24 billion by 2031; it is anticipated to expand at a CAGR of 15.3% from 2023 to 2031. The mortgage/loan broker market trends include favorable regulations, the busy lifestyle of customers, and the demand for cost-effective services.

Mortgage/Loan Broker Market Analysis

The mortgage/loan broker industry is embracing digitalization to enhance its customer's services and expand its global reach. This includes the loan brokers having better access to a large number of lenders, which increases customers to get good loan deals. The growing need to save time and effort is expected to drive the mortgage/loan broker market growth during the forecast period.

Mortgage/Loan Broker Industry Overview

- A mortgage/loan broker is a specialist who serves as an intermediary between lenders and companies. Lenders are the person who authorizes loans and companies are the group of persons looking to borrow money.

- A mortgage/loan broker offers a variety of loans from different lenders to borrowers. Brokers search for the best financial rates and terms demanded by their customers for new products or business launches. They bargain with lenders to secure loan approval or find other appropriate options.

- The growing need for loans among customers across the globe is driving the market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mortgage/Loan Broker Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mortgage/Loan Broker Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mortgage/Loan Broker Market Drivers and Opportunities

Mortgage/Loan Broker Save Efforts and Time of Borrowers

- Mortgage/loan brokers help customers identify the best lenders with lower interest rates, which saves time and provides a great deal to work. Mortgage/loan brokers have regular contact, and they frequently communicate with lenders related to the offers, find an ideal lender, and save time for their clients. Furthermore, they handle all loan-related documentation, which also promotes effort and time-saving. Thus, driving the market during the forecast period.

- Additionally, the consumers don't need to worry about any of the loan-related legal work due to the availability of the right broker, which is capable of effectively handling all the legislative documentation work.

Mortgage/Loan Broker Market Report Segmentation Analysis

- Based on application, the mortgage/loan broker market is segmented into home loans, commercial and industrial loans, vehicle loans, loans to governments, and others.

- The home loans segment is anticipated to hold a significant mortgage/loan broker market share by 2030. Home is most prominent goal for many individuals and families, which encourages individuals to save up for a down payment or qualify for a mortgage. The growing demand for homes increases the need for residential property loans among individuals worldwide is fueling the segment.

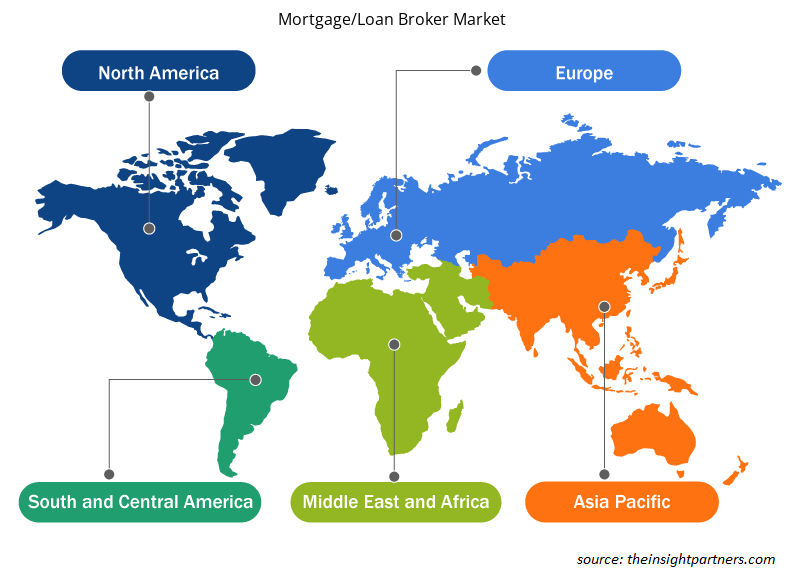

Mortgage/Loan Broker Market Share Analysis By Geography

The scope of the mortgage/loan broker market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant mortgage/loan broker market share. The presence of a large number of service providers such as Bank of America Corp; Royal Bank of Canada; Truist Financial Corp; PennyMac Loan Services, LLC; Qatar National Bank; and Standard Chartered Bank Ltd; among others. These players are continuously engaged in providing loans at low rates. Moreover, the improving macroeconomic situation and growing capital markets are fueling the market during the forecast period.

Mortgage/Loan Broker Market Regional Insights

Mortgage/Loan Broker Market Regional Insights

The regional trends and factors influencing the Mortgage/Loan Broker Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mortgage/Loan Broker Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mortgage/Loan Broker Market

Mortgage/Loan Broker Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 297.3 Billion |

| Market Size by 2031 | US$ 931.24 Billion |

| Global CAGR (2023 - 2031) | 15.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Enterprise Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

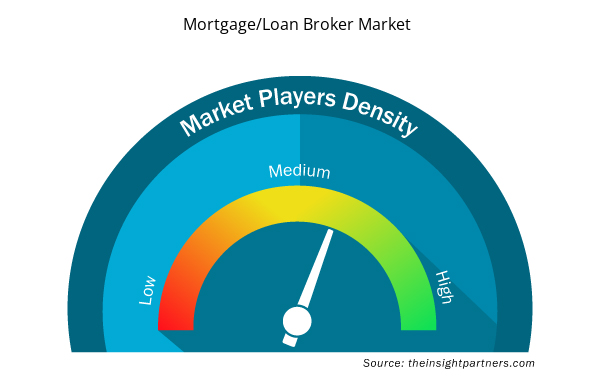

Mortgage/Loan Broker Market Players Density: Understanding Its Impact on Business Dynamics

The Mortgage/Loan Broker Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mortgage/Loan Broker Market are:

- Bank of America Corp

- Royal Bank of Canada

- BNP Paribas SA

- Truist Financial Corp

- Mitsubishi UFJ Financial Group Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mortgage/Loan Broker Market top key players overview

The "Mortgage/Loan Broker Market Analysis" was carried out based on enterprise size, application, end-user, and geography. In terms of enterprise size, the mortgage/loan broker market is categorized into large enterprises and small and small enterprises (SMEs). On the basis of application, the market is segregated into home loans, commercial and industrial loans, vehicle loans, loans to governments, and others. Based on end-user, the mortgage/loan broker market is segmented into businesses and individuals. By region, the mortgage/loan broker market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Mortgage/Loan Broker Market News and Recent Developments

The mortgage/loan broker market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. Companies adopt inorganic and organic strategies such as mergers and acquisitions in the mortgage/loan broker market. A few recent key market developments are listed below:

- In March 2024, BCA offers a special interest rate of 2.67% for mortgages to new families looking for a home. [Source: BCA, Company Website]

- In November 2023, China Zheshang Bank and Bank Sinopac acted as green loan coordinators on club loan facilities of US$ 1.33 (RMB 1.24) billion for Gaw Capital-managed assets. [Source: Gaw Capital Partners, Company Website]

- In May 2023, JPMorgan Chase & Co acquired assets of First Republic Bank from the Federal Deposit Insurance Corporation (FDIC) to advance their wealth strategy. JPMorgan Chase & Co acquired the substantial majority of shares of approximately US$ 173 billion of loans and approximately $30 billion of securities. [Source: JPMorgan Chase & Co, Company Website]

- February 2023, Qatar National Bank announced a commitment of US$ 3 million of first mortgage funding to low-to-moderate income individuals through its QNB Housing Opportunity Program. [Source: Qatar National Bank, Company Website]

- In August 2022, Bank of America Corp announced a new mortgage solution for first-time homebuyers that offers a bank-provided down payment and no closing costs. The Community Affordable Loan Solution is available for properties in Black/African American and Hispanic-Latino communities, as defined by the U.S. Census, in Charlotte, Dallas, Detroit, Los Angeles, and Miami. [Source: Bank of America Corp, Company Website]

- In January 2022, PennyMac Loan Services, LLC announced the changing name of its broker direct division to Pennymac TPO. The company helps its broker and non-delegated correspondent partners find new ways to grow their businesses by extending their expertise, resources, and power. The company is planning to debut POWER+, a next-generation technology platform that gives brokers more speed, control and access to expert advice, guidance, and real-time engagement that enable them to deliver a great experience to their customers and referral partners. [Source: PennyMac Loan Services, LLC, Company Website]

Mortgage/Loan Broker Market Report Coverage & Deliverables

The market report on “Mortgage/Loan Broker Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Enterprise Size, Application, End-user, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Rising demand for homeownership, complexity of mortgage products, and growing digitalization are the major factors that propel the global mortgage/loan broker market.

The key players holding majority shares in the global mortgage/loan broker market are Bank of America Corp; Royal Bank of Canada; BNP Paribas SA; Truist Financial Corp; and PennyMac Loan Services, LLC;

The global mortgage/loan broker market is expected to reach US$ 931.24 billion by 2031.

Favorable regulations and the busy lifestyle of customers are impacting the mortgage/loan broker, which is anticipated to play a significant role in the global mortgage/loan broker market in the coming years.

The global mortgage/loan broker market was estimated to be US$ 297.33 billion in 2022 and is expected to grow at a CAGR of 15.3% during the forecast period 2023 - 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Bank of America Corp

- Royal Bank of Canada

- BNP Paribas SA

- Truist Financial Corp

- Mitsubishi UFJ Financial Group Inc

- PennyMac Loan Services, LLC

- Qatar National Bank

- Standard Chartered Bank Ltd

- JPMorgan Chase & Co

- Ally Financial Inc

Get Free Sample For

Get Free Sample For