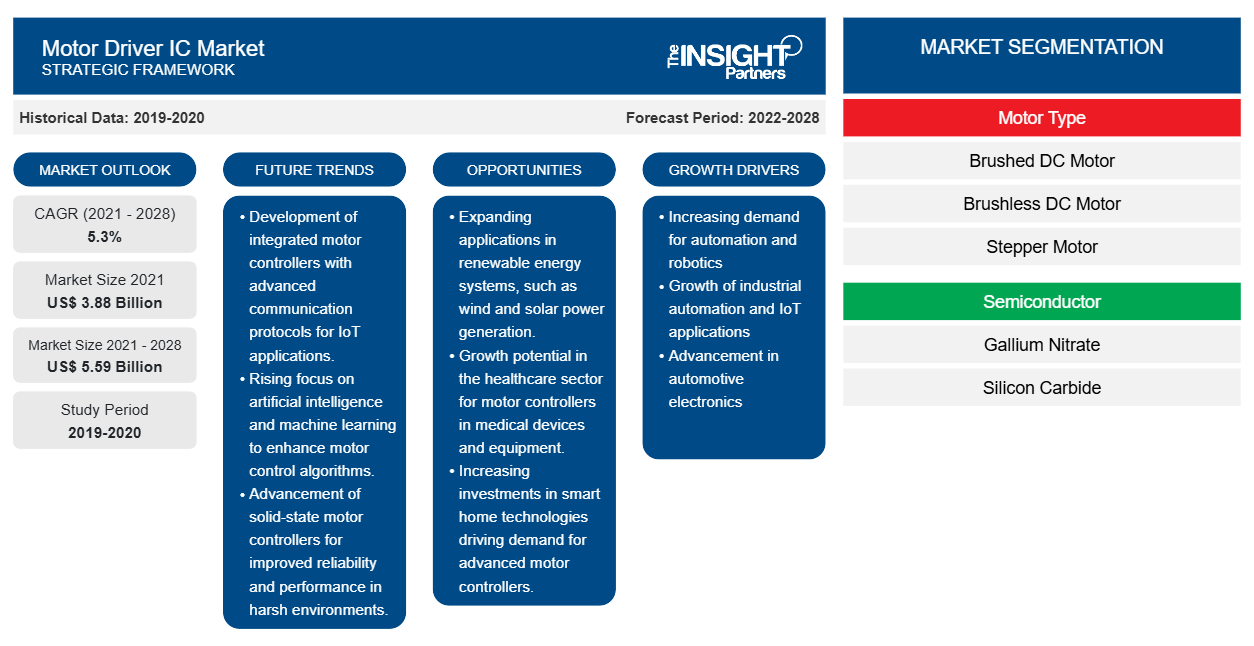

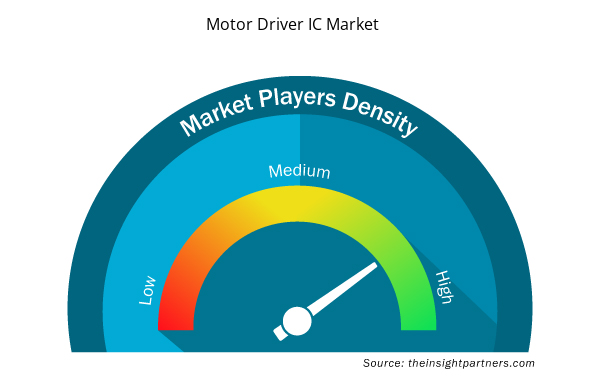

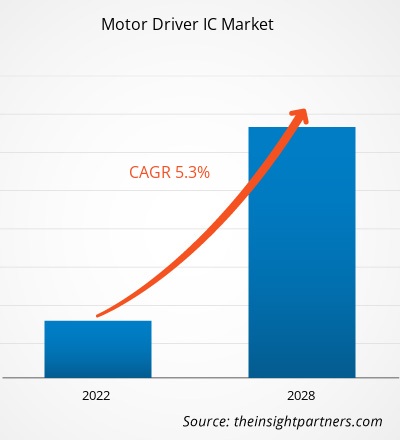

[Research Report] The motor driver IC market is expected to grow from US$ 3,882.57 million in 2021 to US$ 5,589.33 million by 2028; it is estimated to grow at a CAGR of 5.3% from 2021 to 2028.

The motor driver integrated circuit (IC) is an electronic component that regulates and harnesses the electrical power sent to the motor. This IC aids in providing adequate electrical power to the motors as required. It has a wide variety of applications in the industrial, automotive, medical, and consumer electronics industries in power management and control of rotary motors. The motor driver IC is used in various sectors, including automotive and medical. A surge in demand for consumer electronics and major advancements in the semiconductor sector in terms of AI applications, device designs, chip performance, and manufacturing prices are projected to provide profitable prospects for key players operating in the motor driver IC market

Smart home gadgets are becoming increasingly popular in developed economies like the US, Japan, Italy, Germany, and France. Motor driver ICs are heavily incorporated into smart home technology products such as game consoles, robotic vacuums, and smart HVAC systems. Furthermore, integrating AI and IoT technology into smart home devices would promote market expansion throughout the projection period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Motor Driver IC Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Motor Driver IC Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

According to a survey by Care Ratings, consumer electronics and appliances manufacturers are planning to raise production by 5% to 8% in FY2022, following a drop in demand in the current fiscal. Production is predicted to climb between 5% and 8% in FY2022. The rise in demand for consumer electronics is projected to be aided by the rise in work-from-home culture. Moreover, based on increased rural earnings and government programs related to rural electrification, there is a surge in demand for consumer electronics in rural areas. Due to the growing production of consumer electronics, the demand for their basic components and devices such as motor driver ICs will also increase, resulting in market expansion.

Impact of COVID-19 Pandemic on Motor Driver IC Market

The COVID-19 pandemic had an influence on the motor driver IC business, leading to the closure of many factories, problems in supply chain, and obstacles in international trade. Several automakers have lowered their manufacturing capacity in early 2020 due to rising semiconductor shortages and reducing market potential for motor driver IC. However, the motor driver IC market gained momentum in Q3 of 2020 due to the ease of lockdown measures across the world, which led the market to witness positive outcomes at the end of 2020.

Market Insight

Increasing Adoption of Internet of Things (IoT) across Industries

Industry 4.0 is the most recent industrial revolution, introducing automation, big data, and artificial intelligence to plants and factories worldwide. The internet of things, or IoT, is one of the foundations of Industry 4.0. The industrial internet of things (IIoT) uses networked sensors and intelligent devices to collect data for artificial intelligence and predictive analytics on the production floor. The Internet of Things (IoT) has changed the way most industrial processes are carried out, including how items are created and distributed, how data is collected from areas that are too dangerous for human operators, and how product quality is maintained. Similarly, the IIoT has been a driving factor behind improved agricultural productivity at lower costs in the face of an ever-increasing population. According to several studies, the adoption of smart solutions driven by IoT in farm operations will expand in the near future. Studies claim that the agriculture business will witness a 20% compound annual growth rate in IoT device installation, with the number of connected devices (agricultural) reaching 225 million by 2024. As a result, the expanding influence of IoT across sectors bodes well for motor driver IC manufacturers, resulting in an increased customer base.

Semiconductor Segment Insights

Based on semiconductors, the motor driver IC market is bifurcated into gallium nitrate (GaN) and silicon carbide (SiC). Silicon carbide (SiC) semiconductors are more effective than ordinary semiconductors in a number of key applications. As a result, the new technology is of special interest to electric vehicle manufacturers such as enhanced battery control. Owing to which the SiC semiconductors help preserve energy, substantially improving the range of electric vehicles. Fast recharging is also possible using SiC-based semiconductors. Every electric car now contains a large number of semiconductors. With its advantages of switching speed, heat loss, and small size, the SiC type semiconductors segment would witness increased demand in the future.

Furthermore, sandblasting injectors, automobile water pump seals, bearings, pump components, and extrusion dies are all examples of SiC applications that rely on the exceptional hardness, abrasion resistance, and corrosion resistance of silicon carbide.

Motor Type Segment Insights

Based on motor type, the global motor driver IC market is segmented into brushed DC motor, brushless DC motor, and stepper motor. The adoption of brushless DC (BLDC) motors is rapidly increasing in the marketplace and across a wide range of motion control applications owing to their distinct advantages over traditional brushed DC motors, such as lower maintenance, higher operating speeds, more compactness, lower electrical noise, and better torque-to-weight ratios. Despite these advantages, BLDC motors are more expensive than ordinary DC motors since they require a motor driving controller and a rotor position sensor. In industrial positioning and actuation applications, brushless motors are employed. Brushless stepper or servo motors are utilized in assembly robots to position parts for assembly or tools for industrial processes, such as welding or painting. Linear actuators can also be driven by brushless motors. However, new trends in BLDC motor drive design are addressing the cost barrier and allowing these drivers to perform more efficiently than regular DC motors. Another key development in BLDC motor drive technology is to combine the BLDC motor and drive electronics into a single package to simplify the system, eliminate connectivity cabling, and address motor-drive compatibility difficulties.

Application Segment Insights

Based on application the global motor driver IC market is segmented into manufacturing, aerospace and defense, industrial automation, consumer electronics and home appliance, healthcare, and others. Manufacturing, oil & gas, energy & power, food & beverage, agriculture, and others are among the most common industries adopting the industrial automation. Industrial automation primarily relies on industrial AC drives and servo drives to meet increased expectations in terms of dynamic behavior and accuracy. The enormous demand for data in real-time, necessitating the use of a system with exceptional capabilities. Hence, these microprocessors at the heart of a high-performance motor control system can instantly calculate cascaded control tasks and detect current, position, and speed with pinpoint accuracy. Firms are offering an exclusive range of motor driver IC for industrial automation. For instance, motor control solutions from Infineon, such as our OptiMOSTM and CoolMOSTM MOSFETs, Power Control ICs, and EiceDRIVERTM Gate Driver, can help to improve the industrial automation applications.

The market players focus on new product innovations and developments by integrating advanced technologies and features to compete with the competitors. In November 2021, On Semi completed the acquisition of GT Advanced Technologies, a silicon carbide manufacturer (SiC). Onsemi's capacity to secure and grow SiC supply has improved as a result of the acquisition. Onsemi's commitment to make significant investments in disruptive, high-growth technologies to achieve differentiation and leadership, especially in the SiC ecosystem, is strengthened by the acquisition.

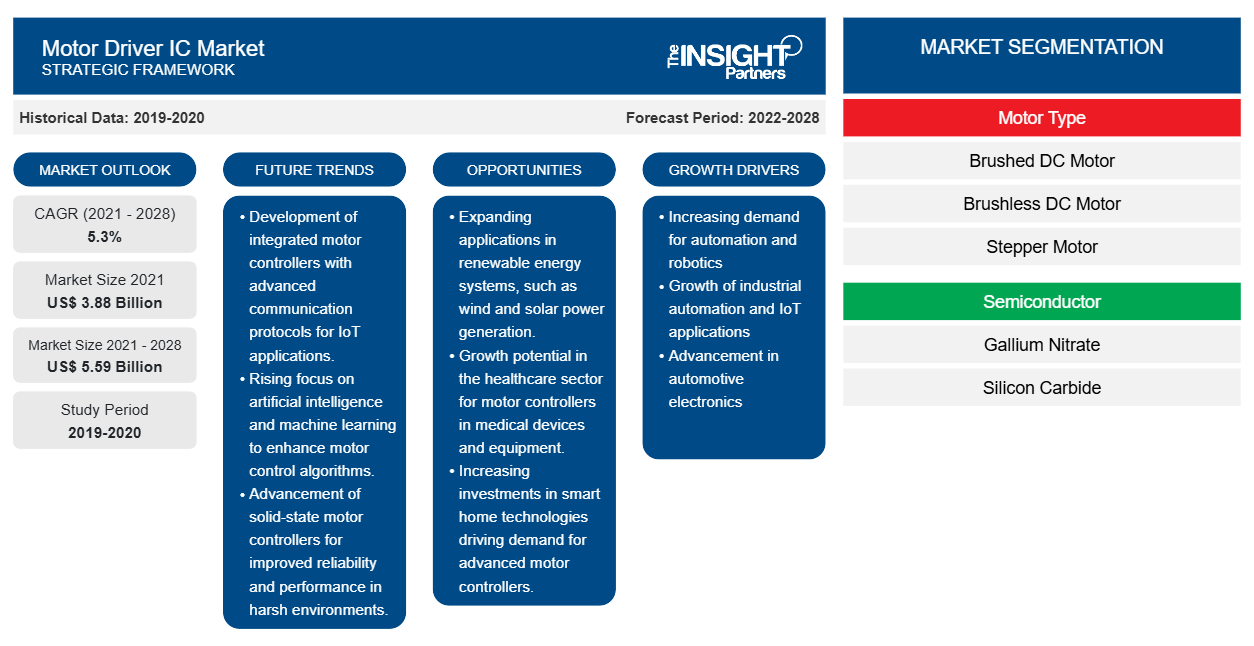

Based on semiconductors, the motor driver IC market is bifurcated into gallium nitrate (GaN) and silicon carbide (SiC). Based on motor type, the global motor driver IC market is segmented into brushed DC motor, brushless DC motor, and stepper motor. Based on application the global motor driver IC market is segmented into manufacturing, aerospace and defense, industrial automation, consumer electronics and home appliance, healthcare, and others. Based on region, the global motor driver IC market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Motor Driver IC Market Regional Insights

Motor Driver IC Market Regional Insights

The regional trends and factors influencing the Motor Driver IC Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Motor Driver IC Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Motor Driver IC Market

Motor Driver IC Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.88 Billion |

| Market Size by 2028 | US$ 5.59 Billion |

| Global CAGR (2021 - 2028) | 5.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Motor Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

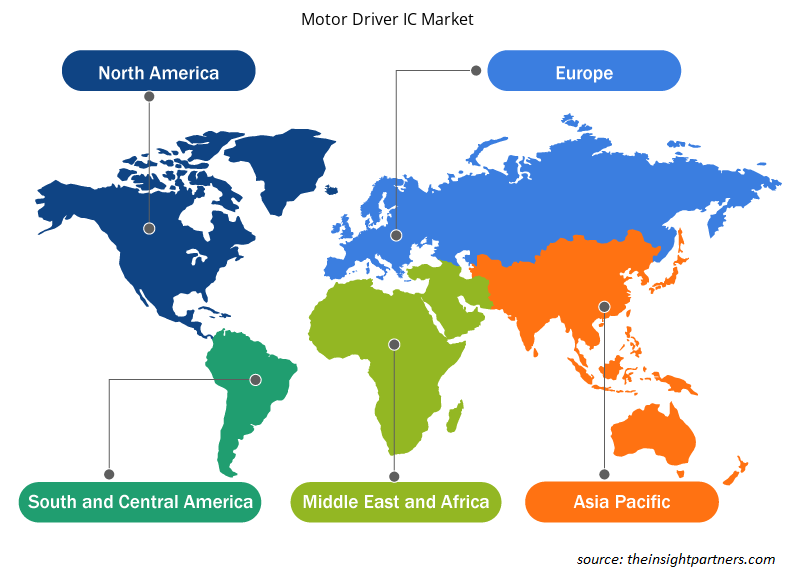

Motor Driver IC Market Players Density: Understanding Its Impact on Business Dynamics

The Motor Driver IC Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Motor Driver IC Market are:

- Allegro Microsystems

- Dialog Semiconductor PLC,

- Mitsubishi Electric Corporation

- ON Semiconductor

- Rohm Co Ltd,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Motor Driver IC Market top key players overview

Motor Driver IC Market – Company Profiles

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Texas Instrument

- Allegro Microsystems

- Dialog Semiconductor Plc

- STMicroelectronics

- ON Semiconductor

- Rohm Co., Ltd.

- Infineon Technologies AG

- Analog Devices

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Motor Type, Semiconductor, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Israel, Italy, Japan, Mexico, Russian Federation, South Africa, South Korea, United Kingdom, United States

Frequently Asked Questions

According to a survey by Care Ratings, consumer electronics and appliances manufacturers are planning to raise production by 5% to 8% in FY2022, following a drop in demand in the current fiscal. Production is predicted to climb between 5% and 8% in FY2022. The rise in demand for consumer electronics is projected to be aided by the rise in work-from-home culture. Moreover, based on increased rural earnings and government programs related to rural electrification, there is a surge in demand for consumer electronics in rural areas. Due to the growing production of consumer electronics, the demand for their basic components and devices such as motor driver ICs will also increase, resulting in market expansion.

Semiconductor firms are lobbying electric vehicle manufacturers to abandon standard silicon chips in favor of materials to improve vehicle efficiency while also easing customer concerns. Choosing the appropriate technology has never been more important than now, as the auto industry faces its most significant shift in almost a century. Manufacturers worldwide are rushing to eliminate internal combustion engines, and even gasoline-powered icons like Ford's Mustang and GMC's Hummer are receiving battery-powered versions. Hence, due to the shift, the automotive industry is likely to be the go-to-market for motor driver IC manufacturers.

The major companies in the motor driver IC and services include Texas Instruments, Analogic Devices, STMicroelectronics, Infineon Technologies AG, and Renesas Electronics.

The global motor driver IC and services market was dominated by the brushless DC motor segment in 2020, which accounted for more than 45% of the market share. Brushless DC (BLDC) motors have seen rapid adoption in the marketplace and across a wide range of motion control applications, owing to their distinct advantages over traditional brushed DC motors, which include lower maintenance, higher operating speeds, compactness, lower electrical noise, and better torque-to-weight ratios, to name a few.

The global motor driver IC and services market was dominated by the silicon carbide (SiC) segment in 2020, which accounted for a major market share. Silicon carbide (SiC) semiconductors are more effective than ordinary semiconductors in a number of key applications. As a result, the new technology is of special interest to electric vehicle manufacturers such as enhanced battery control, owing to SiC semiconductors, which helps preserve energy, substantially improving the range of electric vehicles. Faster recharging is also possible using SiC-based semiconductors.

In 2020, Asia Pacific led the market with a substantial revenue share, followed by North America and Europe. Asia Pacific is a prospective market for motor driver IC manufacturers.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Motor Driver IC Market

- Allegro Microsystems

- Dialog Semiconductor PLC,

- Mitsubishi Electric Corporation

- ON Semiconductor

- Rohm Co Ltd,

- Analog Devices

- STMicroelctronics

- Texas Instruments

- Toshiba Corporation

Get Free Sample For

Get Free Sample For